Get the free Form Nport-p

Get, Create, Make and Sign form nport-p

How to edit form nport-p online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form nport-p

How to fill out form nport-p

Who needs form nport-p?

Form NPORT-P: A Comprehensive Guide

Overview of Form NPORT-P

Form NPORT-P is a regulatory document required by the U.S. Securities and Exchange Commission (SEC) for certain investment funds. Its primary purpose is to enhance transparency regarding fund portfolios, measuring various financial metrics that reflect investment strategies. This form is an essential tool for ensuring compliance with the SEC's rule 30e-3, as it mandates detailed reporting from funds managing over $10 million in assets.

Understanding the importance of Form NPORT-P is crucial for investment funds. Not only does it promote accountability by revealing the risk profile, asset allocations, and liquidity positions of funds, but it also helps investors make informed decisions. Compliance with the requirements of this form is not optional; failure to submit it can lead to significant penalties and sanctions from regulatory authorities.

Who needs to file Form NPORT-P?

Investment companies, including mutual funds, closed-end funds, and exchange-traded funds (ETFs) that meet the asset threshold, are required to file Form NPORT-P. These entities must diligently prepare their filings to reflect accurate fund positions, ensuring that investors and regulators have access to relevant data. Non-compliance has serious implications—including fines, restrictions on trading, or, in severe cases, legal action—which underscores the importance of timely and precise submissions.

Key sections of Form NPORT-P

Form NPORT-P is divided into several critical sections, allowing the thorough documentation of various financial metrics and fund characteristics. Each section is designed to reflect specific information about the fund's portfolio, ensuring comprehensive reporting. Below, we break down the main sections to provide clarity on their structures.

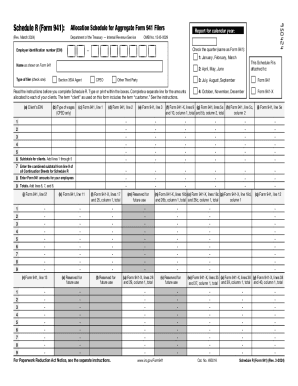

Step-by-step instructions for completing Form NPORT-P

Completing Form NPORT-P can seem daunting but breaking it down into manageable sections simplifies the process. Start by gathering all necessary documents to ensure the accuracy of the data you're submitting. This includes financial statements, investment records, and any external documents the fund might have relied upon.

Frequently asked questions

Investors and fund managers often have pressing questions regarding Form NPORT-P, particularly surrounding compliance and submission. Knowing the answers can mitigate risks associated with misreported data.

Tools and resources for managing Form NPORT-P

Utilizing digital tools can significantly ease the process of filling out Form NPORT-P. pdfFiller offers a comprehensive solution for creating, editing, and managing documents seamlessly in a cloud-based environment.

Submission guidelines

Understanding the correct methods of submission for Form NPORT-P is essential to avoid delays or rejections. The SEC mandates specific protocols for how these forms should be submitted to ensure they are considered timely and compliant.

Updates and changes to Form NPORT-P

Regulatory requirements for investment funds are not static, and Form NPORT-P has seen revisions over time. Staying informed about these changes is vital for filers to remain compliant and avoid penalties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form nport-p without leaving Google Drive?

Can I edit form nport-p on an iOS device?

How can I fill out form nport-p on an iOS device?

What is form nport-p?

Who is required to file form nport-p?

How to fill out form nport-p?

What is the purpose of form nport-p?

What information must be reported on form nport-p?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.