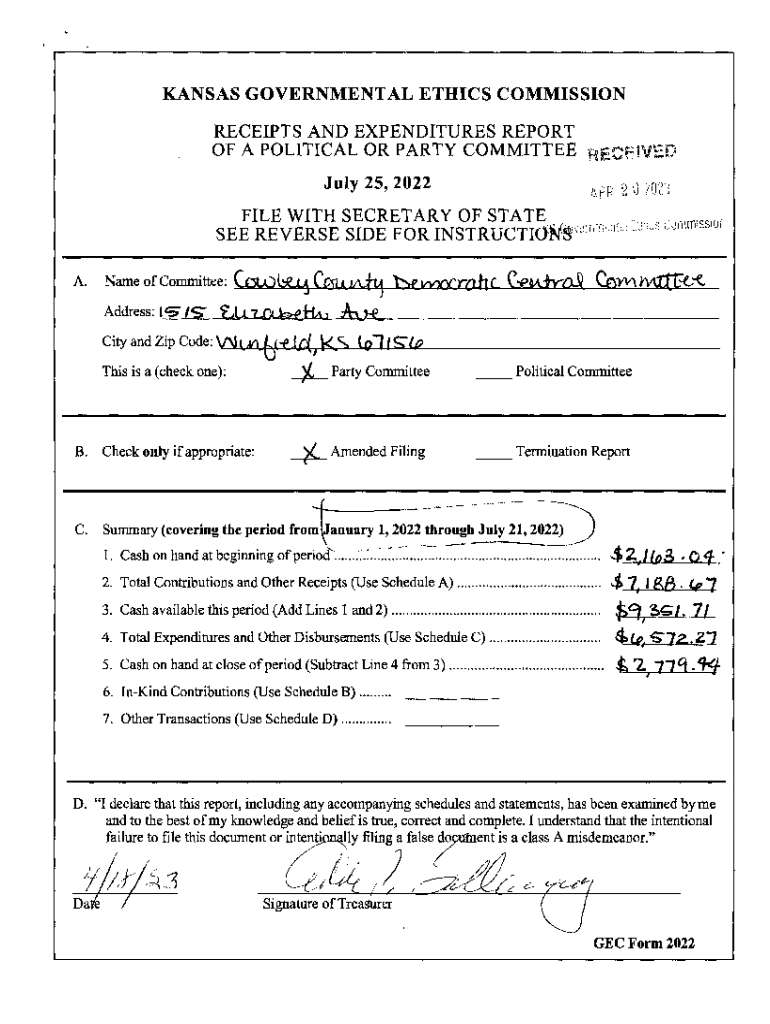

Get the free Receipts and Expenditures Report of a Political or Party Committee - ethics ks

Get, Create, Make and Sign receipts and expenditures report

How to edit receipts and expenditures report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out receipts and expenditures report

How to fill out receipts and expenditures report

Who needs receipts and expenditures report?

Comprehensive Guide to Receipts and Expenditures Report Form

Understanding the receipts and expenditures report form

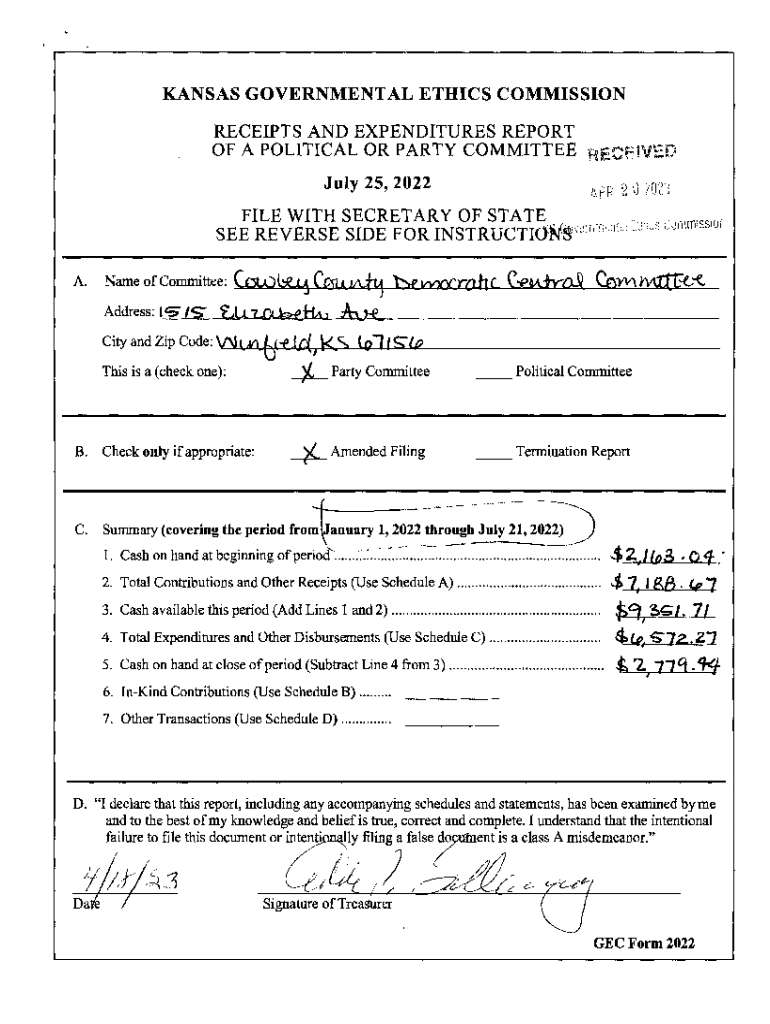

The receipts and expenditures report form is an essential tool for financial transparency in various organizations, including nonprofits, businesses, and governmental bodies. This form documents all incoming funds (receipts) and outgoing funds (expenditures) over a specified period. Proper filling out and submission of this report is crucial, as it helps maintain accountability and provides a clear financial picture of any organization.

Reporting requirements typically include adherence to local regulations and guidelines, specifying who is required to submit these forms, the reporting periods they must cover, and the ramifications of non-compliance which can include penalties or reduced funding opportunities.

The structure of the receipts and expenditures report form

The receipts and expenditures report form is structured to facilitate organization and clarity in reporting financial activities. Typically, it comprises several key sections designed to capture both receipts and expenditures effectively. Understanding these sections is paramount for accurate completion.

The receipts section includes detailed information regarding the incoming funds, while the expenditures section categorizes outgoing funds to track spending accurately.

Step-by-step instructions for completing the form

To successfully complete the receipts and expenditures report form, follow these step-by-step instructions. Accessing the form is straightforward through pdfFiller's cloud-based tools. Once logged in, navigate to the specific report section.

After obtaining the form, begin with filling out the receipts section, ensuring each source of income is properly documented. Elaborate on the source details, specifying amounts received and attaching any acceptable documentation, such as bank statements or donation slips.

Editing and modifying the report form in pdfFiller

Utilizing pdfFiller's advanced editing tools can significantly improve the ease of completing your receipts and expenditures report form. By accessing features like text editing and annotations, you have the power to tailor the form to fit your specific needs.

After finalizing your entries, pdfFiller also allows for the preparation of the document for eSignatures, simplifying the process of obtaining necessary approvals.

Collaborating on the report with teams

Effective teamwork is crucial when it comes to preparing the receipts and expenditures report. pdfFiller’s collaboration features empower multiple users to contribute to the report, ensuring that all perspectives are taken into account.

Real-time feedback can tremendously improve document accuracy. By inviting team members to review and edit the document, organizations can leverage diverse viewpoints and expertise.

Submitting your completed report

Once you have completed the receipts and expenditures report form, it's important to follow a systematic approach for submission. A thorough review is critical to catch any errors or omissions that may lead to compliance issues.

Before hitting send, ensure that every section of the form is accurately filled out and that all necessary supporting documents are attached.

Troubleshooting common issues

Even with thorough preparation, issues may arise during the reporting process. It is crucial to address any potential errors promptly and understand the correct protocols if anything goes awry.

If you find yourself missing a submission deadline, knowing your options going forward can help mitigate negative consequences.

Maintaining records

After submitting the receipts and expenditures report form, keeping copies of all financial documentation is imperative for future reference. This prevents loss of important information and aids in audits or further reporting.

Additionally, using pdfFiller's ongoing document management features enables you to organize and retrieve all relevant reports and receipts efficiently.

Additional tools and resources from pdfFiller

pdfFiller offers a range of additional tools and resources that can enhance your work with the receipts and expenditures report form. Whether it's finding related report templates or accessing interactive document tools, users have everything they need at their fingertips.

Furthermore, pdfFiller provides extensive training materials and support resources for new users to familiarize themselves with the platform seamlessly.

Best practices for future reporting

Establishing a workflow dedicated to efficient reporting is critical for each subsequent reporting cycle. Learning from past experiences leads to greatly improved processes and outcomes.

Continuous education on current requirements and trends will further ensure compliance and maximize the effective use of resources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send receipts and expenditures report for eSignature?

How do I edit receipts and expenditures report on an iOS device?

How do I complete receipts and expenditures report on an Android device?

What is receipts and expenditures report?

Who is required to file receipts and expenditures report?

How to fill out receipts and expenditures report?

What is the purpose of receipts and expenditures report?

What information must be reported on receipts and expenditures report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.