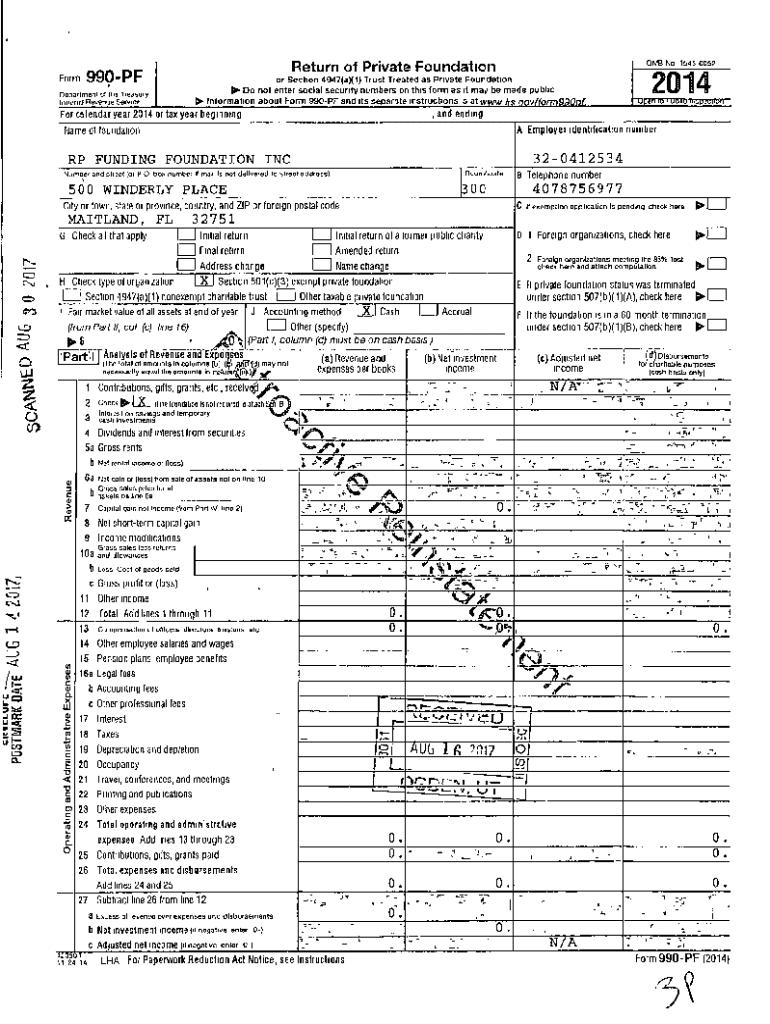

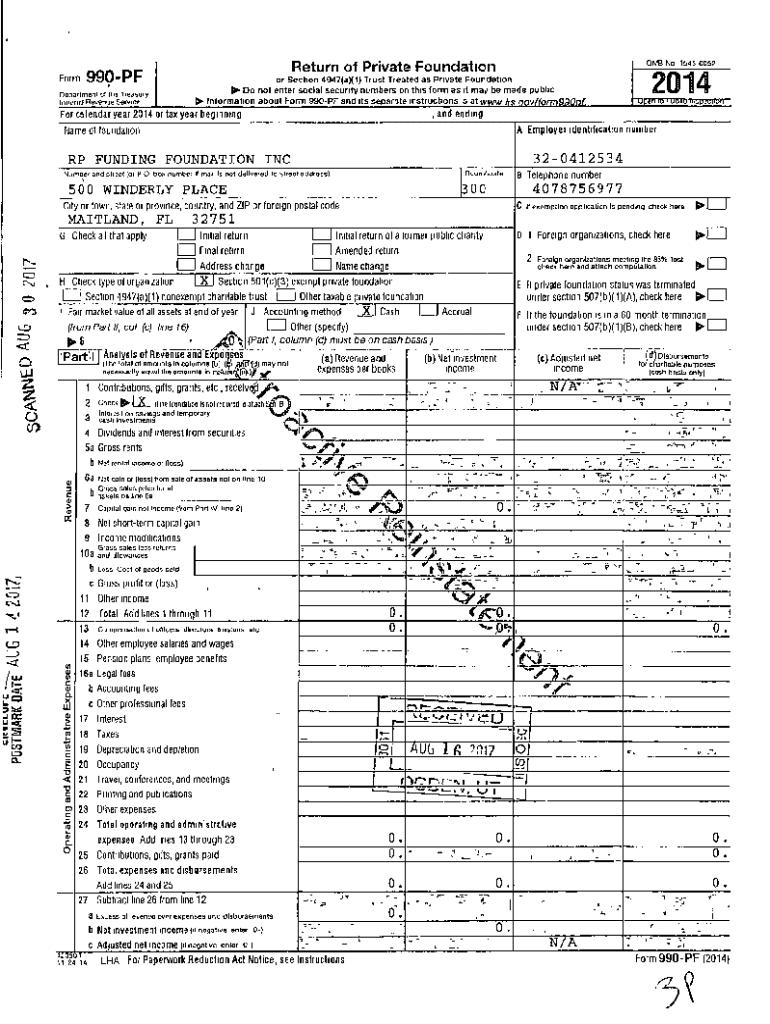

Get the free Form 990-pf

Get, Create, Make and Sign form 990-pf

Editing form 990-pf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-pf

How to fill out form 990-pf

Who needs form 990-pf?

Form 990-PF: How-to Guide

Understanding Form 990-PF

Form 990-PF is a U.S. Internal Revenue Service (IRS) document specifically designed for private foundations. Unlike public charities, which file Form 990 or Form 990-EZ, private foundations must comply with unique reporting requirements stipulated in Form 990-PF. This form provides the IRS with comprehensive financial data, operational details, and a complete account of the foundation's charitable activities.

Filing Form 990-PF is a crucial obligation for private foundations that fall under section 501(c)(3) of the Internal Revenue Code. It serves to ensure transparency and accountability in the foundation's operations. The primary purpose of this form is to disclose the foundation's income, expenses, and grants awarded, along with details about its governance and investment activities.

Importance of filing Form 990-PF

Filing Form 990-PF is not just a regulatory requirement; it is integral to the responsibilities of private foundations. This form presents an opportunity for foundations to demonstrate their commitment to transparency, making their financial and operational activities accessible to the public. This act of openness fosters trust and accountability among donors, beneficiaries, and the general public.

Failing to file can have severe repercussions, including incurring IRS penalties, losing tax-exempt status, and facing increased scrutiny from federal regulators. Moreover, non-filing may hinder the foundation's ability to attract new donors and grantors, as potential supporters often look for transparency in charitable organizations.

Preparing to file Form 990-PF

Before diving into the actual filing of Form 990-PF, organizations must gather essential information and documentation. Key data points include organizational identification, financial data, and details about the foundation's operational activities. This preparation phase is critical to ensure a smooth and efficient filing process.

In terms of information, organizations need to provide basic identifying details such as their name, address, and Employer Identification Number (EIN). Furthermore, they should compile all financial data for the year, including income, expenses, and assets. Operational details may include descriptions of grant-making activities, governance structures, and program evaluations.

Don't forget to note the filing deadlines and potential extensions. Typically, Form 990-PF must be filed by the 15th day of the fifth month after the end of the foundation's fiscal year. However, extensions can be requested, allowing organizations additional time to compile their information.

Step-by-step guide to completing Form 990-PF

Filling out Form 990-PF can be straightforward with a systematic approach. This step-by-step guide will walk you through the process, from basic identification to the final submission.

Filing Form 990-PF electronically

The IRS encourages the electronic filing of Form 990-PF, offering several benefits to organizations. E-filing is not only faster but also reduces the likelihood of errors compared to paper filing. By utilizing electronic platforms like pdfFiller, organizations can streamline the filing process, ensuring timely submission and compliance.

To e-file, begin by preparing your data in the supported format. The IRS accepts various file formats, including XML and other standardized data formats. Once your data is prepared, follow the platform's instructions to upload your document. Platforms like pdfFiller also simplify the e-signing process, allowing for a seamless submission experience.

Managing and editing your Form 990-PF

Once your Form 990-PF has been completed, managing and editing it is critical for maintaining accuracy and compliance. Utilizing tools from pdfFiller can enhance your workflow considerably. For instance, you can add annotations, attach necessary documents, and make real-time edits.

Besides editing features, pdfFiller also supports collaboration among team members. Easily share the document with stakeholders for approval or feedback, enabling real-time collaboration. Furthermore, you can track version changes, ensuring everyone is on the same page throughout the preparation process.

Common questions and challenges

Navigating IRS forms can be daunting, and many organizations have questions regarding Form 990-PF. Understanding the nuances of this form can help alleviate common challenges faced by private foundations.

For instance, are there additional filing requirements for Form 990-PF? The answer is yes. Depending on your foundation's activities, you may be required to attach additional schedules or documents. Furthermore, can you file Form 990 or Form 990-EZ instead of Form 990-PF? Generally, no, as these forms are intended for different types of organizations. Lastly, late filing can result in penalties, which underscores the importance of adhering to deadlines.

Cost considerations

Understanding the financial aspects associated with filing Form 990-PF can help organizations plan their budget effectively. While the IRS does not charge a fee to file Form 990-PF, organizations may incur costs related to using online filing services or hiring tax professionals to assist in the process. It's crucial to explore various options to ensure value for money.

pdfFiller offers affordable pricing models tailored specifically for nonprofit organizations, enabling easy access to document management solutions without breaking the bank. By utilizing pdfFiller, organizations can save on filing costs while benefiting from a plethora of features designed to streamline the entire process.

Utilizing pdfFiller for superior document management

pdfFiller is a cloud-based platform that empowers organizations to manage their Form 990-PF-related documents with impeccable ease and efficiency. This platform offers extensive document editing capabilities, allowing users to make real-time changes, e-sign documents, and collaborate seamlessly with teams.

Additional features tailored specifically for nonprofits include an easy signature process and built-in audit checks to ensure compliance with IRS guidelines. Furthermore, pdfFiller provides robust customer support and resources, making it an ideal partner for organizations seeking to navigate the complexities of nonprofit documentation.

Helpful tools and resources

Preparation is key when approaching Form 990-PF. Organizations can leverage various tools and resources to ensure they are ready for a successful filing experience. Checklists are particularly helpful, offering a practical overview of everything needed when filling out the form.

Moreover, the IRS provides comprehensive guidelines that organizations must adhere to when completing Form 990-PF. Additionally, organizations can enhance their understanding through educational webinars and videos that provide insights into best practices and common pitfalls.

Additional forms related to Form 990-PF

Understanding the landscape of IRS filing forms is important for private foundations. While Form 990-PF is tailored specifically for private foundations, related forms such as Form 990 and Form 990-EZ serve different organizational needs.

Certain situations warrant filing these forms in conjunction with Form 990-PF. For instance, if your private foundation has substantial revenue or is engaged in specific activities, you may need to also submit Schedule A, Schedule B, or other additional schedules to report detailed information.

Next steps

Once you feel prepared to file Form 990-PF, implement efficient submission strategies to ensure that your organization meets all deadlines. Developing a filing calendar can be beneficial in keeping your team on track and ensuring timely submissions.

Additionally, managing follow-up requirements is essential for maintaining compliance throughout the year. Review your organization’s operations regularly, adjust strategies as needed, and stay informed on IRS updates to ensure compliance remains a priority year-round.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find form 990-pf?

How do I make edits in form 990-pf without leaving Chrome?

How do I edit form 990-pf straight from my smartphone?

What is form 990-pf?

Who is required to file form 990-pf?

How to fill out form 990-pf?

What is the purpose of form 990-pf?

What information must be reported on form 990-pf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.