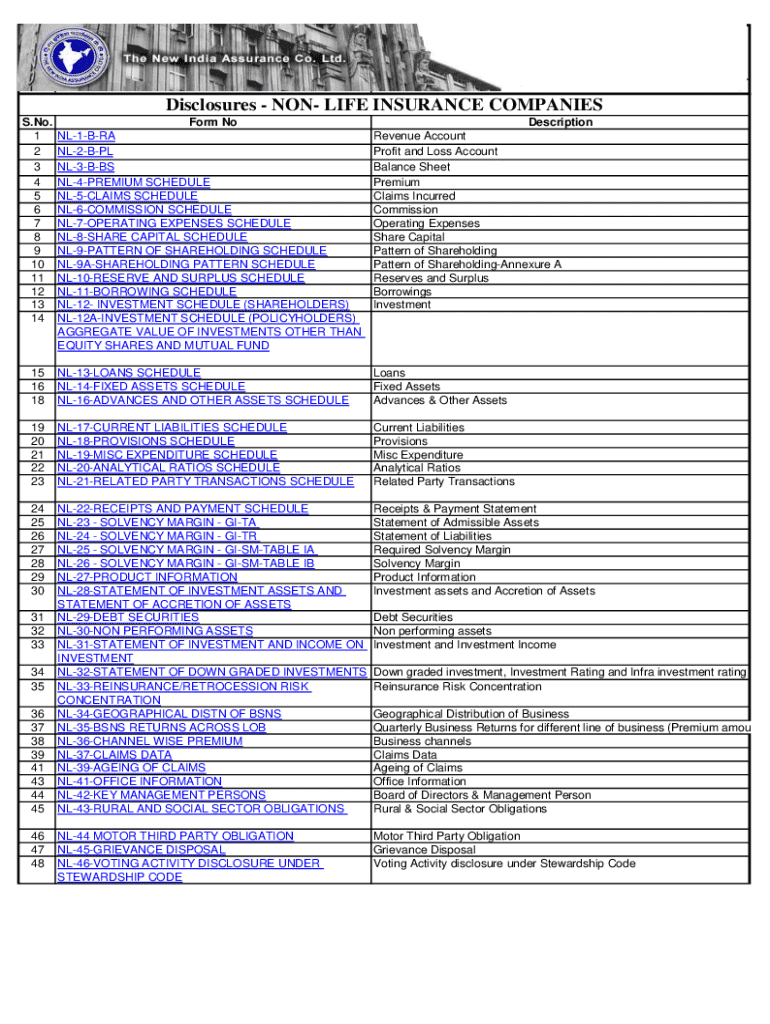

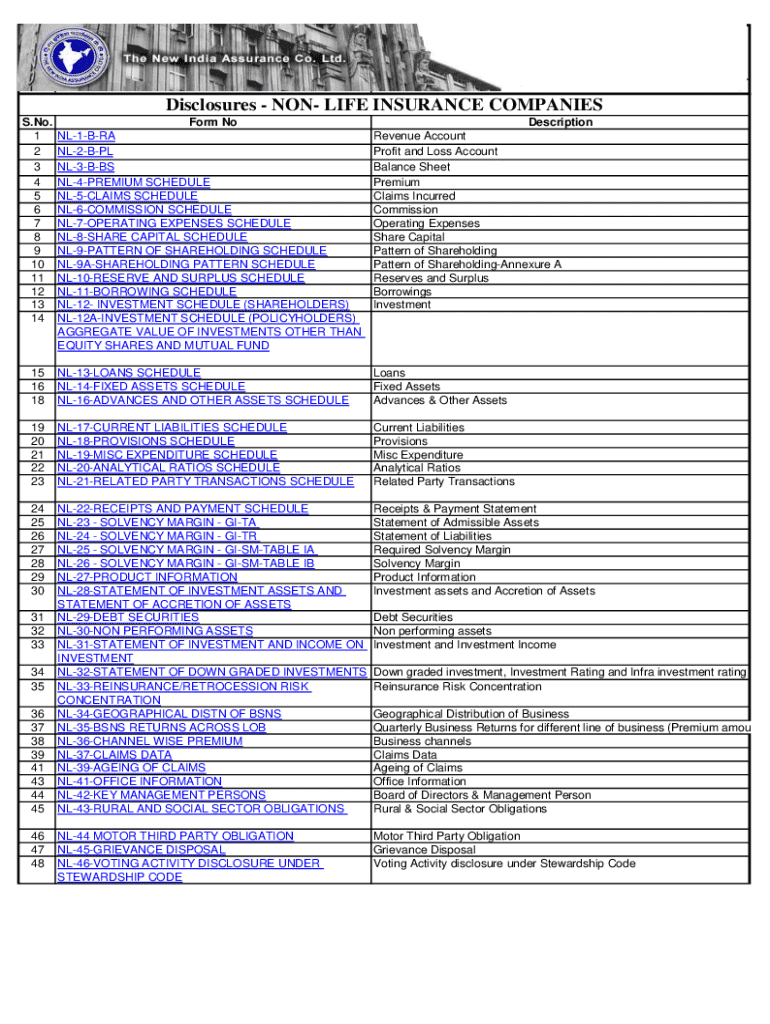

Get the free Disclosures - Non- Life Insurance Companies

Get, Create, Make and Sign disclosures - non- life

How to edit disclosures - non- life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out disclosures - non- life

How to fill out disclosures - non- life

Who needs disclosures - non- life?

Disclosures - Non-Life Form: A Comprehensive Guide

Understanding disclosures - non-life forms

Disclosures in the context of non-life forms refer to mandatory information that must be shared regarding non-life insurance policies, financial practices, and environmental impacts. These disclosures are critical as they promote transparency and accountability among companies and organizations. Accurate disclosures help stakeholders, including consumers, investors, and regulatory bodies, make informed decisions based on reliable information. The integrity of this data is paramount; it can influence market behavior and contribute to stable operational practices.

In industries such as property and casualty insurance, financial services, and environmental management, precise non-life disclosures build trust and can mitigate legal risks. Misrepresentation or lack of disclosure may lead to severe reputational damage and regulatory penalties. Therefore, organizations must prioritize developing robust disclosure practices across all operations.

Regulatory framework

Several regulations govern non-life disclosures, aimed at standardizing the information provided by companies across various sectors. For instance, in the United States, the National Association of Insurance Commissioners (NAIC) develops guidelines and recommendations that impact how disclosures are prepared in the insurance industry. Similarly, the Securities and Exchange Commission (SEC) oversees financial disclosures to ensure investors receive accurate and clear information regarding companies' economic activities.

Key regulatory bodies include the Financial Accounting Standards Board (FASB) and the International Financial Reporting Standards (IFRS) Foundation, which help shape the landscape of financial reporting globally. Each body plays a unique role, ensuring that disclosures fulfill their objective of informing stakeholders while protecting consumer interests.

Types of non-life disclosures

Non-life disclosures encompass several essential categories, each with specific requirements. Insurance disclosures involve revealing pertinent information about policies, including coverage limits, exclusions, and premium costs. It is crucial to adhere to the guidelines laid out by regulatory authorities to avoid pitfalls such as non-compliance, which can lead to legal repercussions and loss of credibility.

Another important type includes financial disclosures, particularly for publicly traded companies. These disclosures provide insights into the company's financial health, including income statements, balance sheets, and cash flow statements. Transparent financial reporting positively affects stakeholder trust and can influence investment decisions. Additionally, environmental and social disclosures are increasingly mandatory across various sectors to reflect a company's commitment to sustainability and social responsibility, particularly in industries such as manufacturing and energy.

Essential components of non-life disclosures

The specific data required in non-life disclosures varies depending on industry requirements but typically includes critical information that stakeholders need to understand the nature of the disclosures. In insurance, for example, essential data points often include policyholder names, coverage types, premium amounts, and claimants' histories. For financial disclosures, details like revenue figures, expenditures, and profit margins are paramount. Each of these components serves an essential role in portraying a clear picture of a company's operations and risks.

Furthermore, the formatting and presentation of non-life disclosures are equally important. Clarity and accessibility can enhance understanding and compliance. Companies are encouraged to follow established guidelines to ensure that the information is presented in an organized, readable manner. Tools like pdfFiller provide features that enable users to format and edit disclosures efficiently, facilitating a seamless process.

Step-by-step guide to completing non-life disclosures

Completing non-life disclosures entails a structured approach to gathering and presenting information accurately. Initially, organizations should enter the preparation stage, which involves compiling all necessary documents and data. This may require gathering insurance policy files, financial records, or environmental assessments. It's crucial to understand the compliance requirements as set forth by regulatory bodies, ensuring that all relevant information is included.

Next, when filling out the non-life disclosure form, users must be methodical in addressing each section of the document. Critical sections to fill include:

Finally, reviewing and finalizing the disclosure is crucial. Thorough proofreading and cross-checking information can prevent errors and ensure compliance. Tools like pdfFiller make it easier to check for accuracy and provide a streamlined way to collaborate and finalize documents before submission.

Electronic signing and submission procedures

In today's digital environment, electronic signing (eSigning) has become a vital part of completing non-life disclosures. eSignatures not only enhance the efficiency of the disclosure process but also hold legal standing similar to traditional handwritten signatures. Using eSigning can expedite approvals and facilitate a smoother workflow, which is especially crucial for businesses managing multiple disclosures.

When using pdfFiller for eSigning, follow these simple step-by-step instructions: First, upload your disclosure document onto the platform. Next, select the option to eSign, and add your signature either by drawing it, uploading a scanned image, or typing your name using a customizable font. Ensure to save the document securely. Be aware of the security measures and compliance checks that pdfFiller implements to protect sensitive information during the signing process.

Common challenges in non-life disclosures

Filling out non-life disclosures can pose challenges for organizations, especially for those unfamiliar with regulatory requirements. Some common mistakes include inaccuracies in data entry, omitting required information, or misinterpreting compliance guidelines. These errors amplify risks of penalties and might lead to significant delays in the disclosure process.

Moreover, managing revisions and updates is essential as regulations and policies change. Organizations must establish a system to keep track of changes in disclosure requirements proactively. Utilizing tools like pdfFiller can ease the burden of managing these updates, providing efficient methods for revising documents and ensuring that the latest information is always at hand.

Best practices for managing non-life disclosures

Developing a robust disclosure management system is essential for organizations. This involves determining key components such as clear roles and responsibilities, up-to-date templates for disclosures, and regular training sessions for team members. An effective system allows for efficient tracking and management of disclosures, ensuring that documents are completed accurately and submitted on time.

Additionally, providing training and resources for teams can significantly impact the quality of non-life disclosures. Teams should familiarize themselves with specific requirements and utilize available tools for collaboration and compliance. Platforms like pdfFiller offer a variety of resources and collaborative features that aid in enhancing the overall disclosure process from creation to submission.

Conclusion on the importance of accurate non-life disclosures

Accurate non-life disclosures are vital for promoting transparency and accountability in various sectors. From insurance to finance, the integrity of disclosure practices directly affects stakeholder trust and ultimate business success. Organizations must invest in robust systems and utilize tools, such as pdfFiller, to effectively manage disclosures and adapt to changing regulations. By prioritizing accurate and timely disclosures, companies can significantly enhance their reputations and operational integrity.

As organizations strive to navigate the complexities surrounding non-life disclosures, they can turn to pdfFiller for seamless document management solutions. By empowering users to edit, eSign, collaborate, and manage documents effortlessly from a single, cloud-based platform, pdfFiller stands out as a practical resource for anyone looking to optimize their non-life disclosure processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete disclosures - non- life online?

Can I create an electronic signature for signing my disclosures - non- life in Gmail?

How do I fill out disclosures - non- life using my mobile device?

What is disclosures - non- life?

Who is required to file disclosures - non- life?

How to fill out disclosures - non- life?

What is the purpose of disclosures - non- life?

What information must be reported on disclosures - non- life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.