Get the free Form 706

Get, Create, Make and Sign form 706

How to edit form 706 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 706

How to fill out form 706

Who needs form 706?

How to Fill Out Form 706: A Comprehensive Guide

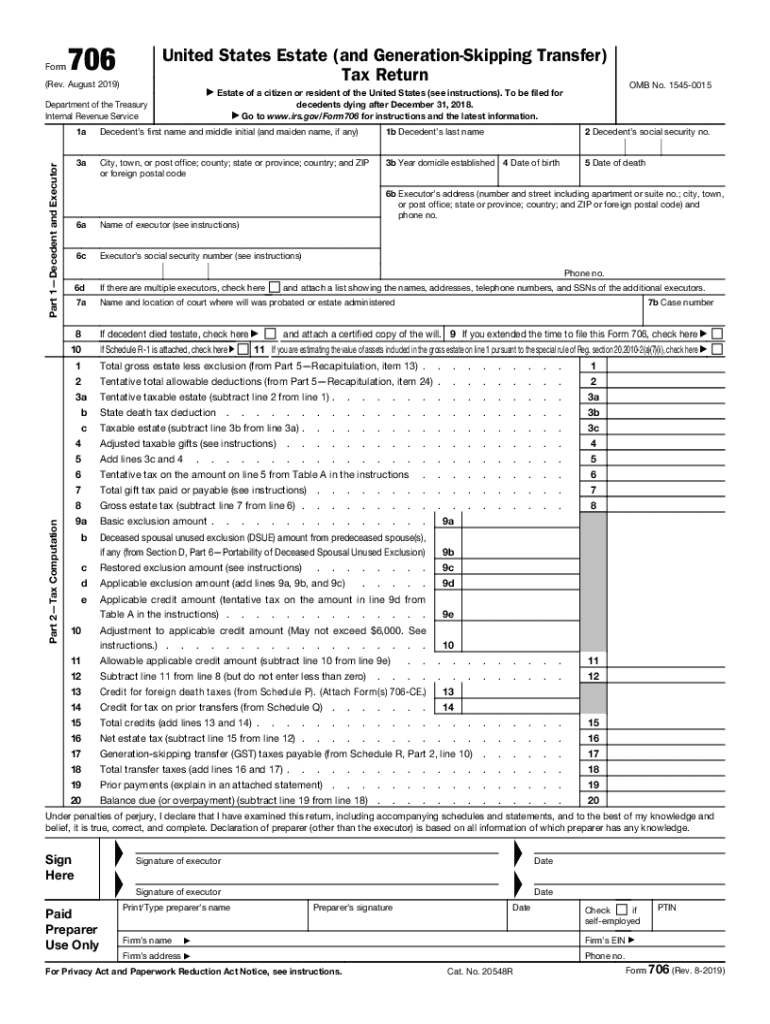

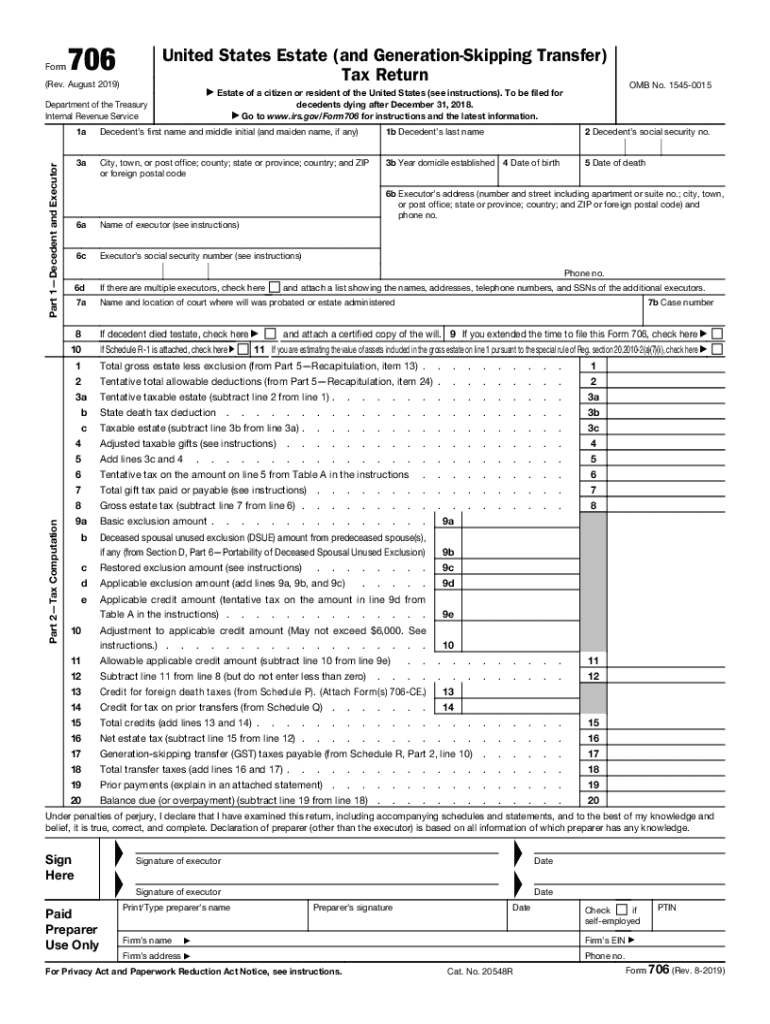

Understanding Form 706: Overview of the estate tax return

Form 706 is the United States Estate (and Generation-Skipping Transfer) Tax Return, which serves a critical role in the context of estate taxation. This form is filed by the estate of a deceased person to report their total estate value and any taxes owed, ensuring compliance with federal tax obligations. The essence of Form 706 lies in its purpose; it helps to determine whether the estate exceeds the exemption limit set by the IRS, which dictates whether any tax needs to be paid.

For U.S. citizens and residents, understanding and filing Form 706 is not just a legal obligation but a crucial step in the estate distribution process. Estate tax can significantly impact the wealth passed on to beneficiaries, making it essential to navigate this form accurately and timely. Not only does it ensure that the estate is settled in accordance with the law, but it also manages how much will ultimately be available to heirs.

Who is required to file Form 706?

Filing Form 706 is mandatory for estates that exceed the federal exemption limit, which typically changes each year. As of 2023, the exempt amount is set at $12.92 million per individual. Consequently, if the gross value of the estate surpasses this threshold, the executor or personal representative must file the form. Additionally, even if the estate value is below this limit, filing might still be beneficial in certain cases, such as when a surviving spouse is involved or to establish a tax history.

It's essential to distinguish between Form 706 and Form 706-NA, which is specifically for non-resident aliens. Form 706-NA is used when the estate includes U.S. property owned by non-resident decedents. Therefore, understanding the specific requirements and types of forms applicable to your situation can help avoid unnecessary complications in the filing process.

Key deadlines and essential filing requirements

The standard deadline for filing Form 706 is nine months after the date of the decedent's death. This deadline is crucial, as failure to file on time can lead to severe penalties and interest on owed taxes. Executors should also ensure they have gathered all necessary documents well in advance of this deadline to streamline the filing process.

When preparing to file, essential information to have includes detailed data on the decedent, including their date of birth, date of death, and the name and contact information of the executor. An accurate and complete inventory of assets must be compiled, along with valuations, which will be crucial in determining the final tax liability.

Step-by-step guide to completing Form 706

Filling out Form 706 can seem daunting, but breaking it down into manageable steps will help simplify the process.

Step 1: Gather essential documents. Executing an estate often requires a variety of documents, the most critical of which include the death certificate, prior gift tax returns, property deeds, and any relevant financial documentation of the decedent’s assets.

Step 2: Starting with Part 1 – Decedent and Executor Information. This section requests details about the decedent and the executor, including their names, addresses, and any relevant relationships. Ensure accuracy in reporting these details as they form the foundation of the tax return.

Step 3: Reporting the Gross Estate in Part 2. Here, you'll enter the values of all assets owned by the decedent at the time of death. Items such as real estate, bank accounts, stocks, and business interests must be included. Accurate property appraisals and documentation of ownership are critical in ensuring that valuations are correct.

Step 4: Deductions in Part 5. This section allows for various deductions that can lower the taxable estate. Common deductions include debts owed by the decedent, funeral expenses, and taxes due at the time of death. Understanding what qualifies as deductions can significantly mitigate tax liability.

Step 5: Credits and Exemptions in Part 6. Here, refer to any credits applicable to the estate, including the estate tax exemption amount. Knowing how to properly apply these credits can help reduce potential tax obligations.

Step 6: Calculation of the estate tax. Finally, calculating the total estate tax owed is crucial. This can be complex, as it requires taking the total gross estate, subtracting allowable deductions, and applying tax rates to ascertain the final tax due. Example calculations can assist in clarifying this often-confusing step.

Common mistakes to avoid when filing Form 706

Mistakes in filing Form 706 can lead to delays or penalties, so knowing common pitfalls to avoid is paramount. One prevalent error is misreporting asset values or failing to include certain assets altogether. Executors should ensure that every ounce of the estate is accurately reported and valued to avoid inconsistencies.

Another common mistake involves forgetting to consider allowable deductions. Executors often overlook debts or expenses incurred by the estate, which can lead to paying unnecessary taxes. Best practices include double-checking all information—especially numbers—and consulting with a tax professional or estate attorney if there are uncertainties regarding asset valuations or deductions.

Frequently asked questions (FAQs)

Curiosity regarding Form 706 often brings several questions. Here are some frequently asked questions to clarify common concerns.

Managing estate and trust planning with Form 706 and related forms

Form 706 has significant implications for managing estates and trusts. It interacts directly with Form 1041, the income tax return for estates and trusts, which may also be required for generating income after the decedent's passing. Filing Form 706 accurately ensures that all tax obligations are appropriately met, paving the way for correct filings on Form 1041 moving forward.

Additionally, Form 709, which covers gift taxes, may also come into play in trust planning. Understanding your filing requirements across different forms is essential in holistic estate management, ensuring that all aspects of tax liability are evaluated and addressed.

Calculating the value of an estate

Estimating estate values correctly is crucial when completing Form 706. Various methods for valuation must be considered, including market approaches for real estate, income approaches for investments, and cost approaches for personal property. Each asset type may require different valuation methodologies, and distinguishing between these will enhance accuracy.

Professional appraisal assistance is invaluable in these situations. Appraisers can provide not only reputable assessments of property but also help with documentation that supports the values reported on the tax return, thereby reducing the likelihood of IRS scrutiny.

Strategies for reducing estate taxes and GSTs

Reducing estate taxes involves proactive planning strategies. Establishing irrevocable trusts or utilizing life insurance policies can safeguard portions of the estate from taxation. By placing assets in trust, an individual effectively removes them from their taxable estate, potentially lowering the overall tax liability.

Moreover, gifting assets during one’s lifetime allows individuals to effectively manage exposure to estate taxes. The annual gift tax exclusion allows individuals to transfer certain amounts without incurring gift taxes, which assists in reducing the estate value over time.

Navigating payments and filing processes

When it comes to estate tax payments, various methods are available. Executors can either pay via the IRS website or send a check directly. Understanding the electronic payment system can simplify the process and ensure timely payments to avoid penalties.

Filing Form 706 can be done electronically through certain tax software or by submitting a paper form through the mail. Executors should also be aware that extensions can be requested if additional time is needed to complete the necessary paperwork. Knowing how to apply for these extensions well in advance can prevent unnecessary stress as deadlines approach.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 706 without leaving Chrome?

How can I edit form 706 on a smartphone?

How can I fill out form 706 on an iOS device?

What is form 706?

Who is required to file form 706?

How to fill out form 706?

What is the purpose of form 706?

What information must be reported on form 706?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.