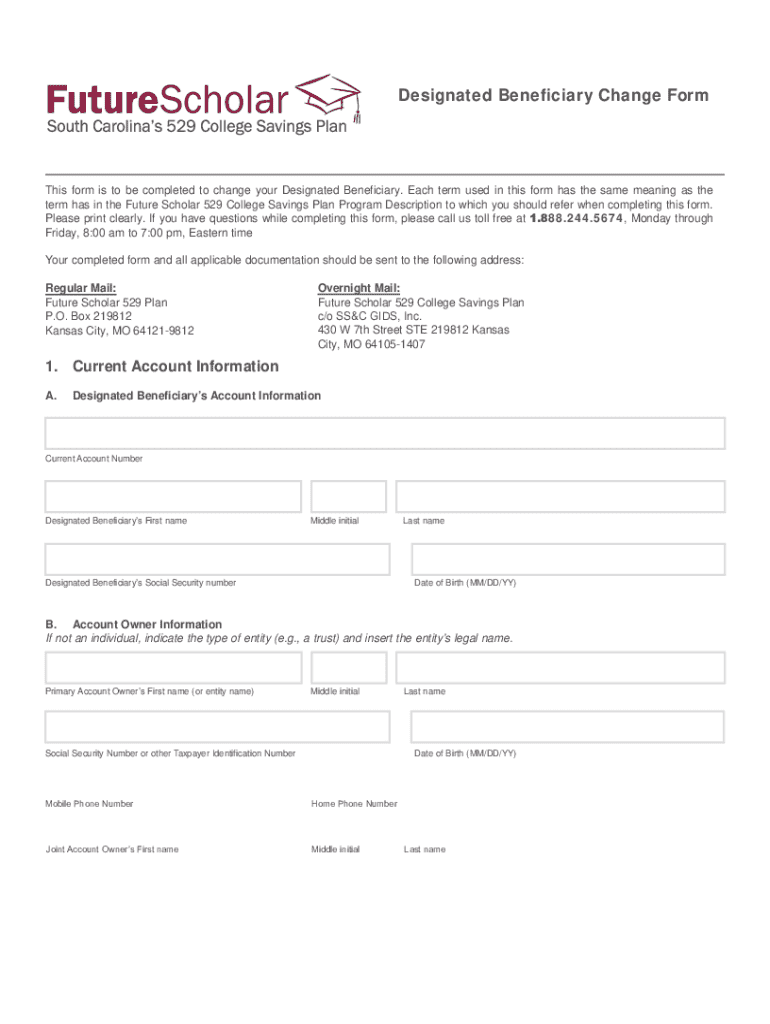

Get the free Designated Beneficiary Change Form

Get, Create, Make and Sign designated beneficiary change form

How to edit designated beneficiary change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out designated beneficiary change form

How to fill out designated beneficiary change form

Who needs designated beneficiary change form?

A comprehensive guide to the designated beneficiary change form

Understanding the designated beneficiary change form

A designated beneficiary change form is a critical document in financial planning, enabling individuals to formally designate or change their beneficiaries for various accounts, such as life insurance policies, retirement accounts, and other investment products. This form is often required by financial institutions because it serves as a legal way to ensure that the correct individuals receive benefits after the account holder passes away.

Updating beneficiary information is essential to align with life changes such as marriage, divorce, the birth of a child, or the passing of a previous beneficiary. Not only does this prevent potential disputes among heirs, but it also ensures that assets are transferred according to the individual’s wishes without unnecessary delays or legal complications.

Who needs this form?

The designated beneficiary change form is crucial for a wide array of individuals and teams. On an individual level, policyholders and account holders are the most common users. They need to take responsibility for regularly reviewing and updating their designated beneficiaries to reflect personal circumstances.

In corporate settings, teams may need this form when dealing with employee benefits programs or estate planning. It helps companies manage their financial obligations and ensures that estate distributions are handled according to the specified directives.

Key elements of the form

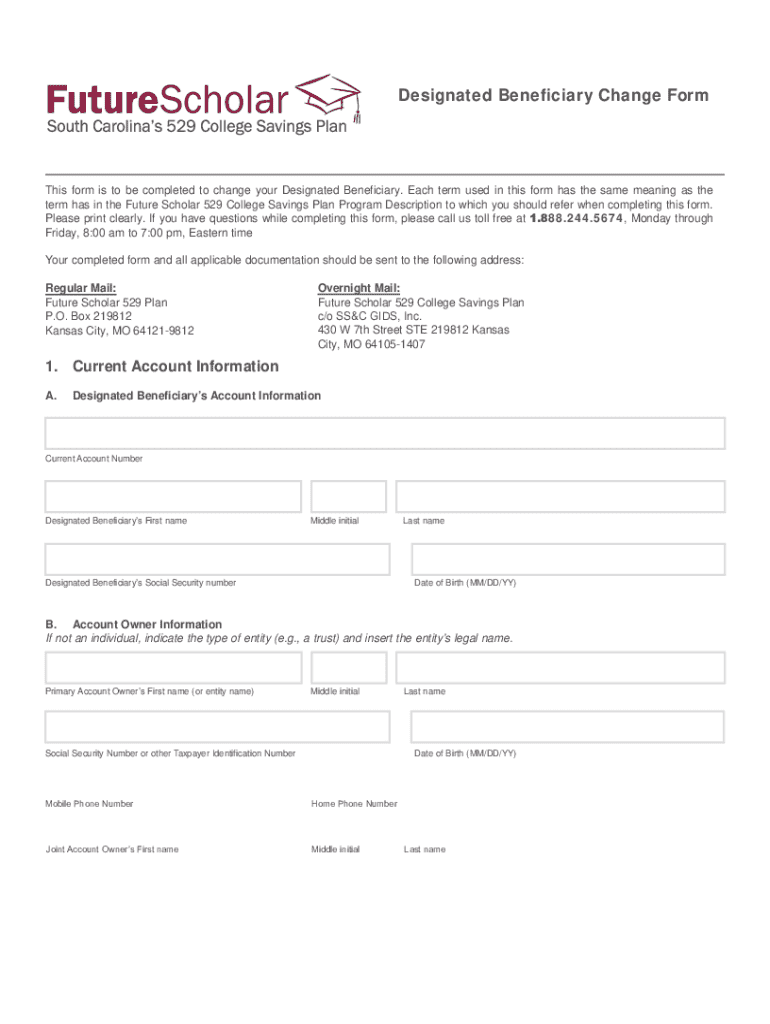

The designated beneficiary change form encapsulates several important components that must be accurately completed. Fundamental fields in this form typically require personal information, including the account holder’s name, address, and social security number to prevent any confusion regarding identity.

Another critical aspect includes beneficiary details where users can specify primary and secondary beneficiaries. Primary beneficiaries are the first in line to receive benefits, while secondary beneficiaries get the assets if the primary beneficiaries predecease the account holder.

Various types of beneficiaries can be designated. Individuals, such as relatives or partners, can be named alongside trusts or organizations, which can also be designated as beneficiaries, allowing for more complex estate planning.

Step-by-step instructions for completing the form

Completing the designated beneficiary change form may seem daunting, but following a structured approach can simplify the process considerably. Start by gathering all required information related to both the account holder and the beneficiaries.

It's vital to understand the implications of your choices, as they will impact who receives your assets after you are gone. Once prepared, follow these detailed instructions for each section of the form:

Editing and customizing your form

Once you have completed the designated beneficiary change form, editing and customizing it for further alignment with your needs is crucial. This is where tools like pdfFiller can significantly streamline the process. By utilizing pdfFiller’s editing tools, you can easily add or remove fields as required, ensuring that no pertinent information is left out.

Moreover, modifying content is simple, allowing you to tailor your document further. You can also incorporate digital signatures, which are becoming increasingly accepted in legal processes, facilitating easier submission.

To incorporate a digital signature using pdfFiller, follow the steps provided on the platform, ensuring a legally binding agreement without the need for printing, signing, and scanning.

Managing your completed designated beneficiary change form

After successfully filling out the designated beneficiary change form, the next step is effective document management. Saving and storing your completed form securely is of utmost importance. Utilizing cloud storage solutions offered by pdfFiller can protect your document from physical loss and provide access from anywhere.

Additionally, taking advantage of version tracking and document history features helps maintain clarity on any changes made over time, ensuring you are always aware of the current state of your beneficiary designations. This feature can be a lifesaver during estate management.

Submitting the designated beneficiary change form

Submission of your completed designated beneficiary change form is the final step in this process. Ensure that all information is thoroughly verified before making your submission. The way you choose to submit—by mail, email, or fax—can vary based on institutional requirements.

When submitting by mail, ensure that you follow addressing and stamp requirements. In contrast, submitting via email may require specific formats, and when using fax, it's essential to have access to the necessary equipment.

After submission, always confirm receipt, as it's important to follow up to ensure your changes have been processed properly.

What happens after submission?

After you submit your designated beneficiary change form, processing can take some time depending on the institution. It's wise to ask how long you should expect for changes to take effect. Additionally, keeping track of your beneficiaries regularly is a recommended best practice to ensure that your asset distribution remains aligned with your current wishes.

This may involve setting calendar reminders for annual reviews or life milestones that might necessitate another beneficiary change.

Common pitfalls and FAQs

When completing the designated beneficiary change form, there are common pitfalls to avoid. One frequent mistake includes leaving sections incomplete, leading to confusion or rejection of the form altogether. Another common issue arises from misunderstandings surrounding beneficiary types, such as the differences between primary and contingent beneficiaries.

Frequently asked questions center around how often one can change beneficiaries, and what actions to take if the form is found to be incorrect or misplaced. Addressing these questions can provide clarity.

Legal considerations and tips

Adjusting beneficiary designations is not merely procedural; it carries legal implications that could affect your estate. Understanding the laws surrounding beneficiary changes is essential. When in doubt, consulting with a legal professional can provide the necessary guidance to navigate this complex area.

Taking the time to comprehend these legal considerations will ensure that your final wishes are respected and that you manage your estate effectively.

Additional features of using pdfFiller for your forms

Utilizing pdfFiller offers more than just a platform for completing your designated beneficiary change form. It also provides various additional tools that enhance collaboration and make document management a breeze. The ability to share documents securely and manage privacy settings means that sensitive information remains protected.

Additionally, being cloud-based means that you can access your documents from anywhere at any time. This flexibility, combined with enhanced security features, underscores pdfFiller as an optimal choice for managing your important financial documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit designated beneficiary change form from Google Drive?

How do I make changes in designated beneficiary change form?

Can I create an electronic signature for the designated beneficiary change form in Chrome?

What is designated beneficiary change form?

Who is required to file designated beneficiary change form?

How to fill out designated beneficiary change form?

What is the purpose of designated beneficiary change form?

What information must be reported on designated beneficiary change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.