Get the free When the Empire State Building Was New

Get, Create, Make and Sign when form empire state

Editing when form empire state online

Uncompromising security for your PDF editing and eSignature needs

How to fill out when form empire state

How to fill out when form empire state

Who needs when form empire state?

When Form Empire State Form: A Comprehensive How-To Guide

Overview of the Empire State Form

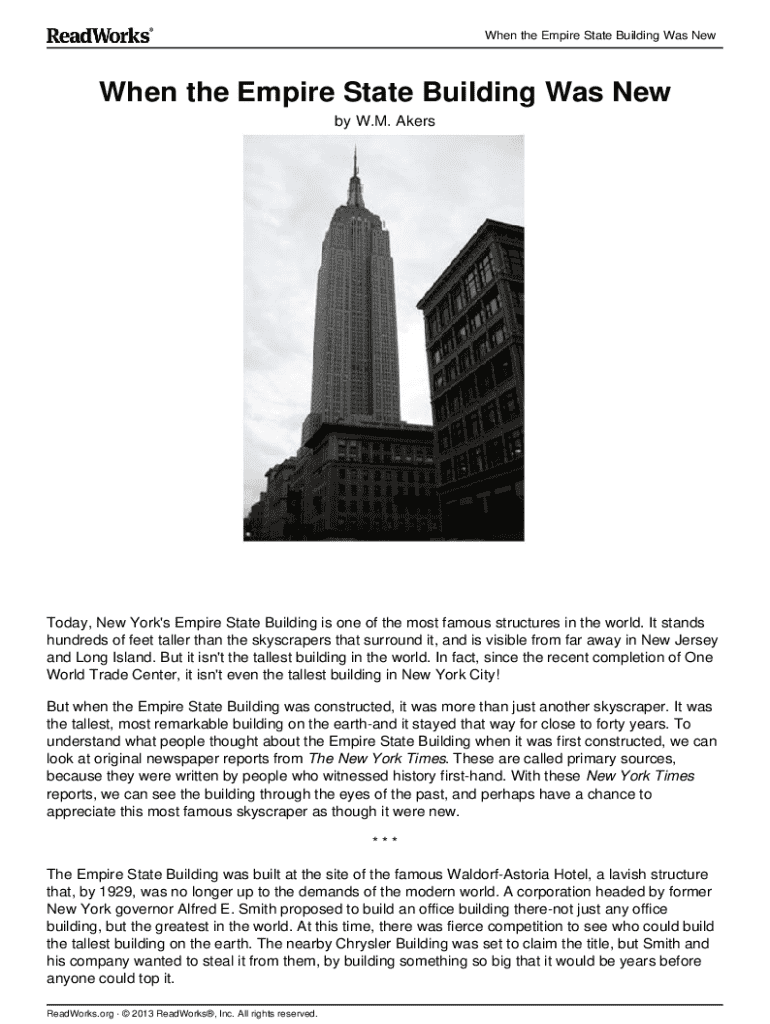

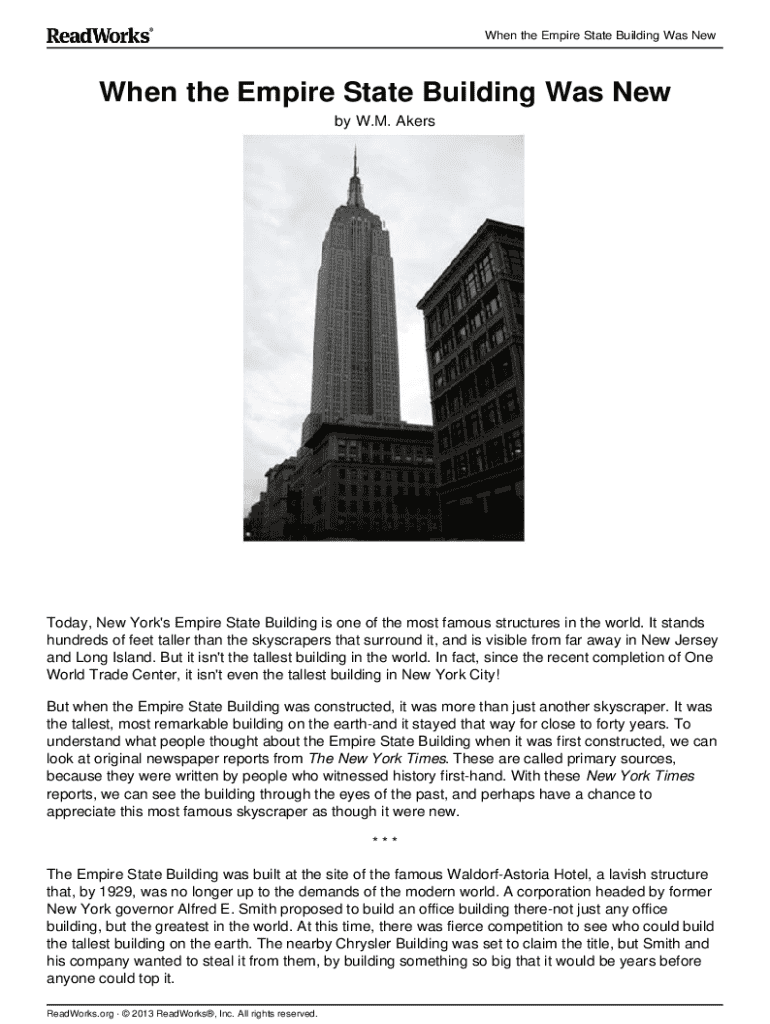

The Empire State Form serves a critical role in various administrative processes within New York, allowing individuals and organizations to submit necessary information for tax, legal, or regulatory purposes. Understanding its significance is essential for compliance with state requirements. Essentially, this form acts as a standardized method to gather specific data required by New York state agencies, making it easier for both the filer and the agency to manage information effectively.

Individuals, businesses, and organizations all play key roles in the need for this form, often needing it for purposes such as reporting income, filing for business licenses, or adhering to various regulations. Key features of the Empire State Form include its straightforward structure, which organizes information logically, and its accessibility for different users. Whether you’re an individual taxpayer or a corporate entity, knowing how and when to utilize the Empire State Form can save you time and potential legal hurdles.

Understanding the Empire State Form requirements

To properly utilize the Empire State Form, it’s crucial to understand its eligibility criteria. Generally, anyone engaging with state taxes, including individuals, partnerships, and corporations, may need to fill it out. Specific situations that necessitate using this form can include changes in business structure, claiming tax credits, or compliance with state regulations.

Necessary documents typically include identification numbers, financial records, and prior submissions related to state activities. Preparing to fill out the form involves gathering supporting documents, ensuring all relevant information is readily available. This helps uphold accuracy, reducing the risk of delays or rejections. Below is a concise step-by-step guide to getting started:

Step-by-step instructions for completing the Empire State Form

Completing the Empire State Form involves carefully navigating each section to ensure all required information is entered accurately. The form is divided into several sections, each focusing on different aspects of your submission. A common pitfall during the process is misunderstanding the instructions provided in each section. It’s essential to read these instructions thoroughly before proceeding.

To aid accuracy during this process, it's important to gather information in advance. For example, ensure you have your Social Security number, employer identification number (EIN), and any relevant documentation to back up your claims. Always remember to double-check each entry to avoid simple mistakes that can lead to processing delays. Here’s a section breakdown to guide you:

Editing and managing the Empire State Form with pdfFiller

Utilizing pdfFiller for managing the Empire State Form streamlines the completion and editing process significantly. First, upload your version of the form to pdfFiller’s platform. The interface is user-friendly, allowing you to navigate smoothly through the options available for document editing. With tools for adjusting text, adding notes, or even rearranging sections, pdfFiller gives users flexibility in customizing their forms.

In addition, eSigning your form is straightforward within pdfFiller. To add your electronic signature, simply click the designated area in the form after you've completed it. Remember that electronic signatures, recognized legally within New York state, enable a completely digital workflow, providing a convenient alternative to traditional pen-and-paper methods. Keep in mind, though, that these electronic signatures must align with certain legal requirements under e-signature laws.

Collaborating with teams on the Empire State Form

Collaboration is essential when multiple team members are involved in filling out the Empire State Form. PdfFiller offers robust sharing capabilities that allow you to send and receive feedback in real time. You can invite colleagues to view or edit the form, ensuring everyone's input is captured without confusion. The comments and annotations tools further enhance communication, enabling users to ask specific questions or clarify details on the form itself.

One of the major concerns in collaborative efforts is tracking changes made by different users. PdfFiller accommodates this need through a version history feature that logs all modifications. This transparency helps maintain integrity in the submission process and provides a trail for auditing purposes. Leveraging these tools effectively can significantly enhance team efficiency and accuracy.

Submission process for the Empire State Form

Once your Empire State Form is complete and has undergone necessary reviews, the next step is submission. It's important to understand where and how to submit the completed form. Depending on the type of form, submissions may vary between online portals, mail, or in-person delivery to the appropriate state office. Always check for the most current guidelines on the New York State website.

Key deadlines often accompany submission of the Empire State Form. For tax-related forms, ensure compliance with state tax deadlines to avoid penalties. After your submission, it can be beneficial to follow up to confirm that your form has been received and is being processed. This proactive approach can prevent issues that might arise from lost paperwork or misunderstandings about requirements.

Troubleshooting common issues with the Empire State Form

Even with careful preparation, issues may arise when dealing with the Empire State Form. Common errors often include incomplete information or mismatched data. To troubleshoot effectively, revisit each section of your form to ensure consistency and completeness. If problems persist, reach out to knowledgeable contacts for clarification, such as your tax advisor or state office.

For further assistance, utilize FAQs provided on the official New York State website or contact their support services directly. They will typically help clarify complex processes and resolve ongoing challenges you face while completing the form.

Benefits of using pdfFiller for the Empire State Form

PdfFiller offers numerous advantages that enhance the overall management of the Empire State Form. An online document management system is instrumental for anyone handling multiple forms, allowing for ease of accessibility from any location. This flexibility is especially beneficial for teams needing to collaborate across various states or offices. Further, the cost-effectiveness of pdfFiller allows users to save on printing and mailing costs, making it an attractive option for budget-conscious individuals and businesses.

Security is paramount when managing sensitive documents. PdfFiller adheres to stringent compliance standards, ensuring that user data and submitted documents remain secure. The platform encrypts data, and with comprehensive permission controls, users can determine who can view or edit the documents. This focus on security protects users while empowering them to manage documents efficiently.

Real-world examples and case studies

Success stories illuminate the effective use of the Empire State Form via pdfFiller, showcasing how both individuals and companies have streamlined their reporting processes. One small business owner highlighted their experience with using pdfFiller to complete their annual tax submissions, sharing how the platform’s collaborative features enabled their accountant to review documents seamlessly before filing.

Testimonials indicate that users appreciate the secure access to their documents while still allowing others to provide insights. These streamlined workflows significantly reduce the chances of errors while increasing efficiency in document management. The ease with which users could transition to electronic submissions underscored the advantages of utilizing cloud-based solutions like pdfFiller.

Additional considerations for the Empire State Form

The impact of government changes can significantly influence the requirements or processes surrounding the Empire State Form. It's essential for users to stay informed about potential legislative or regulatory updates that may alter compliance requirements. Continuous education through resources provided by the New York State government or reliable online platforms like pdfFiller keeps individuals and teams ahead of requirements.

As the landscape of form submissions evolves, trends such as increased digitization and integration with financial software tools are becoming prominent. Future integrations with pdfFiller will further enhance usability and automation, creating a seamless experience for users. Adapting to these changes can position individuals and organizations as forward-thinking, effectively managing their filing responsibilities with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send when form empire state to be eSigned by others?

Where do I find when form empire state?

Can I sign the when form empire state electronically in Chrome?

What is when form empire state?

Who is required to file when form empire state?

How to fill out when form empire state?

What is the purpose of when form empire state?

What information must be reported on when form empire state?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.