Get the free Policyowner/annuitant Service Request

Get, Create, Make and Sign policyownerannuitant service request

How to edit policyownerannuitant service request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out policyownerannuitant service request

How to fill out policyownerannuitant service request

Who needs policyownerannuitant service request?

Understanding the Policyowner Annuitant Service Request Form

Understanding the Policyowner Annuitant Service Request Form

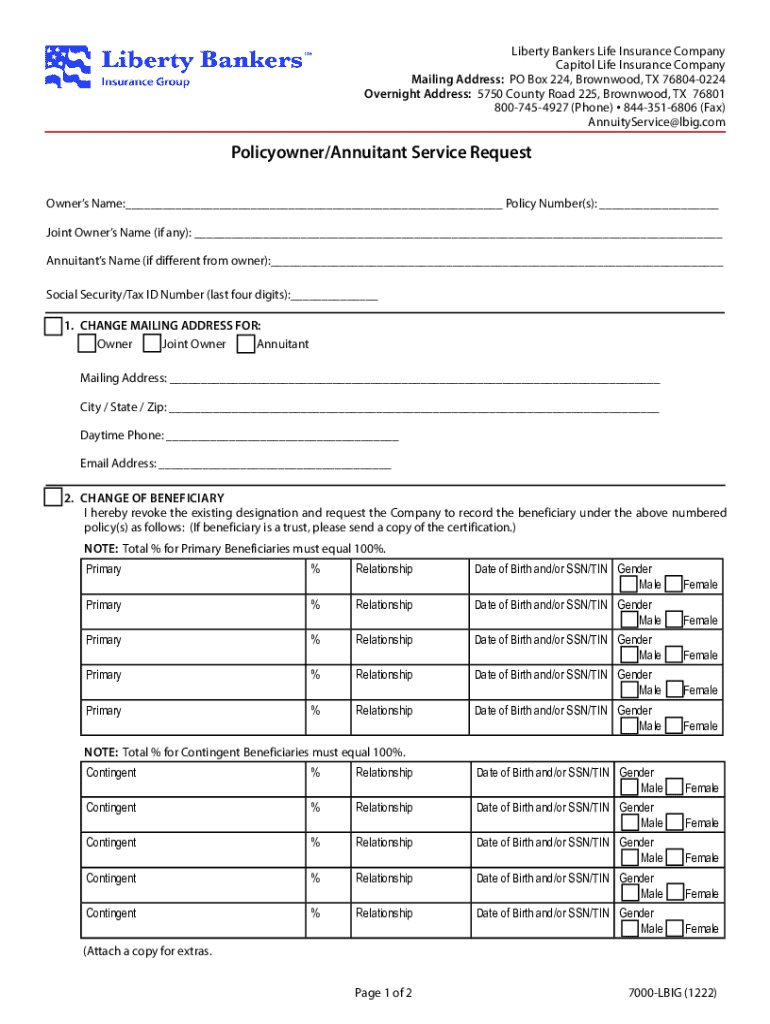

The policyowner annuitant service request form is a crucial document designed to facilitate specific requests related to annuity contracts. This form allows policyowners to manage their annuities effectively, making it essential for anyone holding such contracts. The primary purpose of this form is to ensure that the policyowner's requests regarding their annuity can be processed in a systematic and organized manner.

Importance cannot be overstated when it comes to managing annuity contracts. Not only does it help keep track of beneficiary changes, payment adjustments, and withdrawal requests, but it also serves to provide clarity and transparency in the transaction processes. The key stakeholders involved typically include the policyowner, the annuity issuer (insurance company), and sometimes, legal or financial advisers acting on behalf of the policyowner.

Components of the Service Request Form

There are several essential components that comprise the policyowner annuitant service request form, and understanding these is vital for successful completion. The first component involves the required information. This section typically collects personal details such as the policyowner's name, address, and social security number, which are necessary for identification and verification purposes.

Another critical component is the annuity information section where policyowners specify their policy number and type of annuity. Additionally, the form presents various options available to policyowners, allowing them to change the beneficiary designation, adjust premium payments, or submit withdrawal requests. Lastly, the signatures and declarations section emphasizes the importance of authorization, ensuring all submissions are legally binding and formally recognized.

Step-by-step guide to completing the form

Filling out the policyowner annuitant service request form may seem daunting, but with a structured approach, it can be done smoothly. The first step is preparing to fill out the form, which involves gathering the necessary documents such as the annuity contract, identification documents, and any prior communications from the annuity provider. Ensuring that the information is accurate is crucial to avoid delays.

Next, detailed instructions for each section should be followed closely. Start by filling out personal information accurately, ensuring names and addresses are clear and correct. Specify the annuity details by providing the policy number and the type of annuity. Don’t forget to check the options that apply to your situation and make selections as needed. Finally, reviewing your submission is essential to ensure completeness and to understand the available submission channels, including mail and online options.

How to submit your service request form

Once your policyowner annuitant service request form is completed, the next step is submission. There are different methods available, starting with online submission, which is usually the most efficient. Follow the specific steps on your annuity provider’s website for online submissions, ensuring that you have all required documents ready for uploading. For mailing the form, utilize secure delivery options, such as certified mail, to ensure that it reaches the designated office.

After you submit your form, you should receive confirmation of receipt, either via email or postal service, depending on your method of submission. It’s important to inquire about the expected timeframes for processing requests, as this can vary typically between a few days to several weeks based on the complexity of the request and the company’s processing times.

FAQs about the policyowner annuitant service request form

Frequently Asked Questions (FAQs) about the policyowner annuitant service request form can help clarify concerns you might have. For instance, if you make a mistake on your form, it's important to contact the customer service department immediately to seek guidance on how to correct it without impacting your requests.

To check if your service request has been processed, you can usually call the customer service line or check your online account. Some companies may charge fees associated with specific requests, such as withdrawals; it is essential to familiarize yourself with these potential costs. Lastly, if you miss the deadline for submission, reach out to your annuity provider as soon as possible to explore available options.

Common challenges and solutions

While completing the policyowner annuitant service request form, you may encounter common challenges. Frequent errors include providing incorrect personal information or failing to include necessary signatures, which can lead to rejection of your request. To mitigate these issues, double-check all information before submission.

If you're unsure about specific sections of the form, don’t hesitate to seek assistance. Your annuity provider typically has supportive resources, including customer support lines and online resources to guide you through the process.

Additional options for policyowners

As a policyowner, it is important to understand your rights. You have the right to manage and make changes to your annuity as necessary. Besides the service request form, alternative communication options exist, such as contacting customer support directly or utilizing chat and email services for inquiries.

Additionally, leveraging services like pdfFiller can be beneficial, as it provides access to templates and editing tools specifically designed for annuity forms. Navigating through the platform can allow you to collaborate with others effectively, ensuring that all involved parties can review and sign necessary documents seamlessly.

Tools and resources for managing annuities

Managing annuities efficiently requires access to reliable tools and resources. Online resources can provide further information about annuity education, including updates on regulations and best practices. Moreover, pdfFiller's interactive tools can enhance your document management processes, offering features like document editing and eSignature solutions for quicker processing.

By utilizing these resources, you can remain informed and ready to navigate any changes or required modifications to your annuity contracts. Staying up to date can empower policyowners to manage their investments better and ensure their financial security.

Importance of document management for policyowners

For anyone holding annuities, keeping track of all submitted forms is imperative. Document management provides a clear snapshot of your transactions, making it easier to reference past submissions or agreements with your annuity provider when necessary. Moreover, utilizing cloud-based solutions, such as those offered by pdfFiller, can enhance organization and reduce the risk of losing important documents.

Regularly reviewing annuity documents ensures that you remain aware of your policy status, benefits, and any potential adjustments that may be required. This proactive approach contributes to better financial planning, ensuring that you can make informed decisions regarding your future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send policyownerannuitant service request to be eSigned by others?

How do I execute policyownerannuitant service request online?

How do I edit policyownerannuitant service request on an Android device?

What is policyownerannuitant service request?

Who is required to file policyownerannuitant service request?

How to fill out policyownerannuitant service request?

What is the purpose of policyownerannuitant service request?

What information must be reported on policyownerannuitant service request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.