Get the free Form 10-k

Get, Create, Make and Sign form 10-k

Editing form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

Understanding Form 10-K: A Comprehensive Guide

Understanding Form 10-K

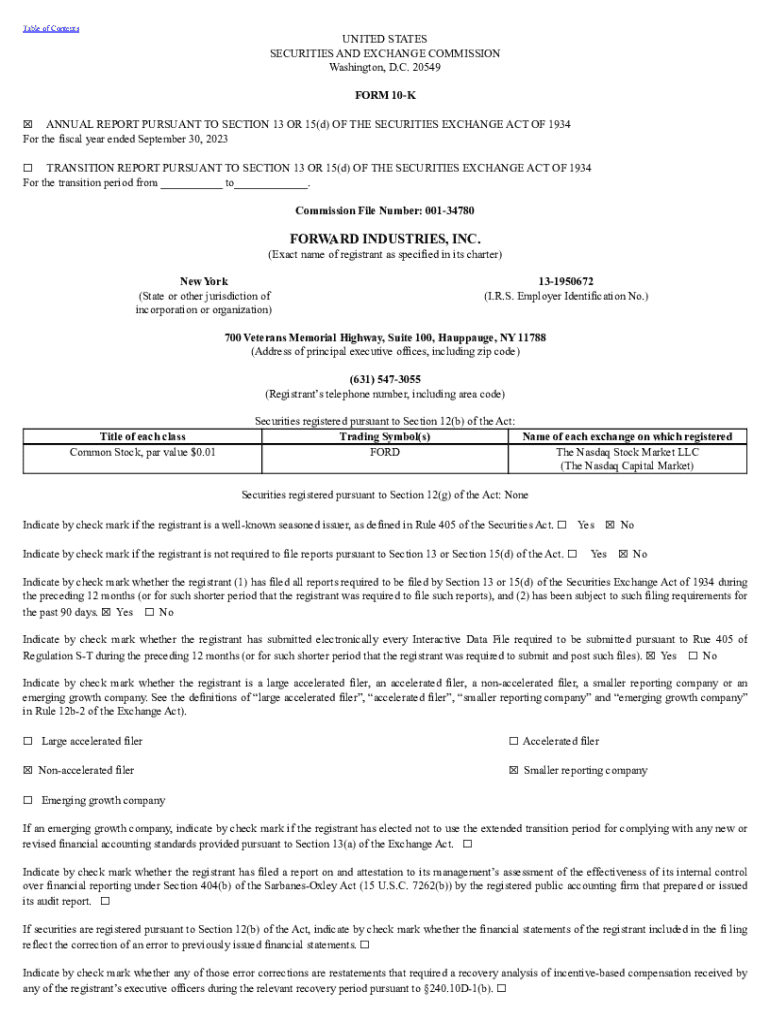

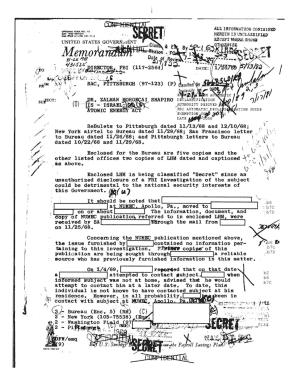

The Form 10-K is a comprehensive report filed annually by publicly traded companies to provide a detailed overview of their financial performance. This document showcases a company's financial condition, operations, risks, and broader business strategy. Unlike the quarterly Form 10-Q, the Form 10-K includes extensive detail that is crucial for investors and analysts looking to evaluate a company’s overall performance.

The historical significance of the Form 10-K dates back to its introduction in the Securities Exchange Act of 1934. Initially intended to increase transparency in the securities market, the 10-K has evolved over the decades to include additional sections focusing on risk factors and management’s discussion, offering insights critical to assessing a business’s future prospects.

For investors, the Form 10-K is an invaluable tool. It provides not only a snapshot of current financial health but also essential insights into potential future performance. Analysts rely heavily on this filing to conduct thorough valuations and make recommendations to clients.

Key components of Form 10-K

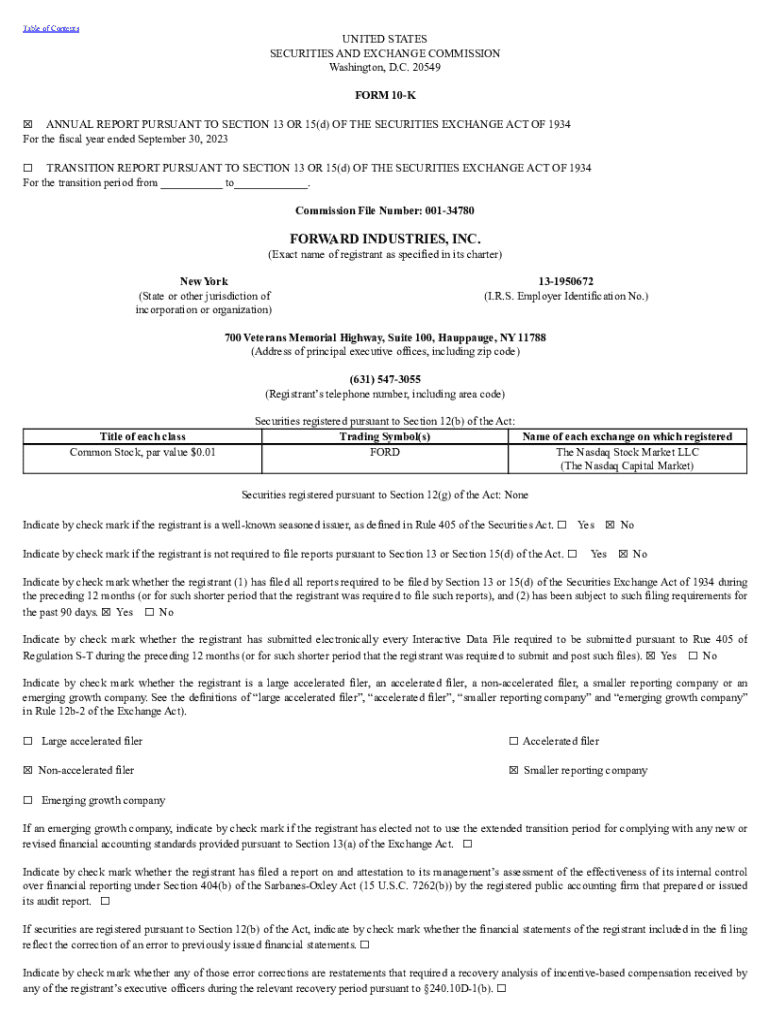

The Form 10-K is divided into four primary parts, each detailing crucial aspects of the company’s business, finances, and relevant disclosures.

Navigating the 10-K filing process

Accessing the Form 10-K is straightforward through the SEC’s EDGAR database, which allows users to search for documents by company name or ticker symbol. The filings are publicly available and can typically be obtained within a few clicks.

To find a specific company’s Form 10-K, follow these steps: First, go to the SEC EDGAR website. Next, utilize the search bar to enter the company’s name or ticker symbol. After locating the company in the search results, navigate to the 'Filings' section where you can filter for the most recent Form 10-K.

It’s crucial to be aware of filing deadlines as companies are required to submit their 10-K within a specific time frame post the fiscal year-end. Generally, larger companies must file within 60 days, while smaller reporting companies have a 90-day deadline.

Analyzing and interpreting Form 10-K

When interpreting the Form 10-K, several key metrics should be monitored, including revenue growth rate, profit margins, and return on equity. These indicators provide insight into how well a company is performing relative to its competitors.

Reading between the lines is important, especially in sections discussing risk factors or management's personal analysis of financial performance. Look for language that indicates optimism or caution, which can affect stock performance.

It’s best to conduct a thorough review using real-life examples. For instance, examining case studies of companies before and after major announcements can highlight how well the information within the Form 10-K forecasts trends.

Related forms and additional filings

The SEC requires various forms in addition to the Form 10-K to ensure comprehensive disclosures. The Form 10-Q provides quarterly updates, while the Form 8-K is used for unscheduled significant events. Understanding these can create a fuller picture of a company’s operational and financial health.

The Form 10-K is more detailed and expansive than both the 10-Q and the 8-K. This makes it critical for annual assessments while the other filings serve to update stakeholders throughout the year. Notably, investors should look at these related forms to have a continuous view of the company’s condition.

Preparing your own 10-K filing

For companies looking to prepare their own Form 10-K, there are best practices that should be followed. Start by gathering comprehensive data from all departments within the organization. Ensure all information is accurate and aligned with the Financial Accounting Standards Board (FASB) guidelines.

Common sections include the business overview, risk factors, MD&A, and financial statements. An organized checklist can help streamline the process, preventing omissions or errors that could harm the company’s credibility.

Common questions and misconceptions about Form 10-K

The Form 10-K often raises questions, with many individuals uncertain about its contents, purpose, and implications. One common misconception is that the 10-K is mainly for investors; in reality, it serves various stakeholders, including creditors and regulatory bodies.

Addressing frequently asked questions can demystify the 10-K filing process. For example, many wonder how to effectively interpret risk factors. Understanding that these disclosures represent management's identification of potential challenges can give readers a vital understanding of a company's risk appetite.

Forward-looking statements and risk management

Forward-looking statements found in the Form 10-K can provide insight into management’s projections about future performance and operational strategies. These statements are often accompanied by disclaimers, highlighting the uncertainty associated with such forecasts.

Risk management is a vital aspect detailed within the Form 10-K. Understanding how a company identifies and mitigates risks offers investors a better grasp of its overall strategy and operational longevity. A thorough analysis of risk factors allows stakeholders to assess the viability of the company’s business model critically.

Enhancing your 10-K skills

Improving your ability to navigate and analyze the Form 10-K is a strategic advantage. Utilize premium templates available on platforms like pdfFiller, which not only simplify the document creation process but also ensure adherence to regulatory standards.

Creating an account allows users access to interactive tools essential for document management. These tools foster collaboration within teams, making the overall filing experience seamless and efficient, while enhancing the quality of the final document.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 10-k without leaving Google Drive?

How do I fill out the form 10-k form on my smartphone?

How do I complete form 10-k on an Android device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.