Get the free Cbt-160

Get, Create, Make and Sign cbt-160

How to edit cbt-160 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cbt-160

How to fill out cbt-160

Who needs cbt-160?

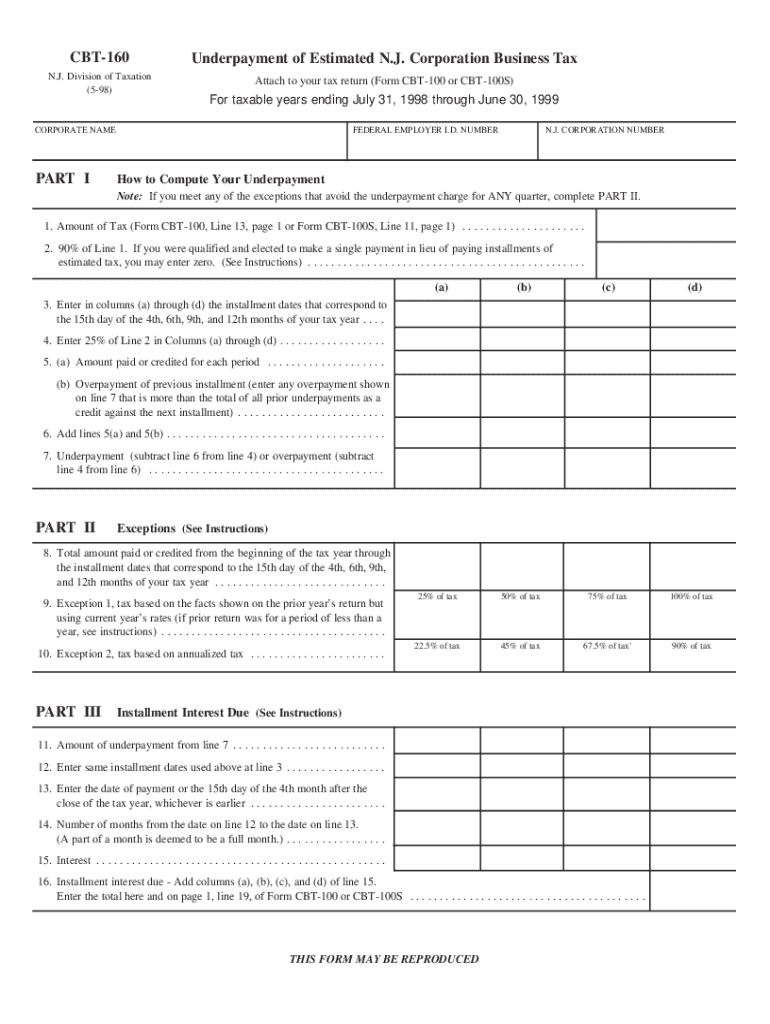

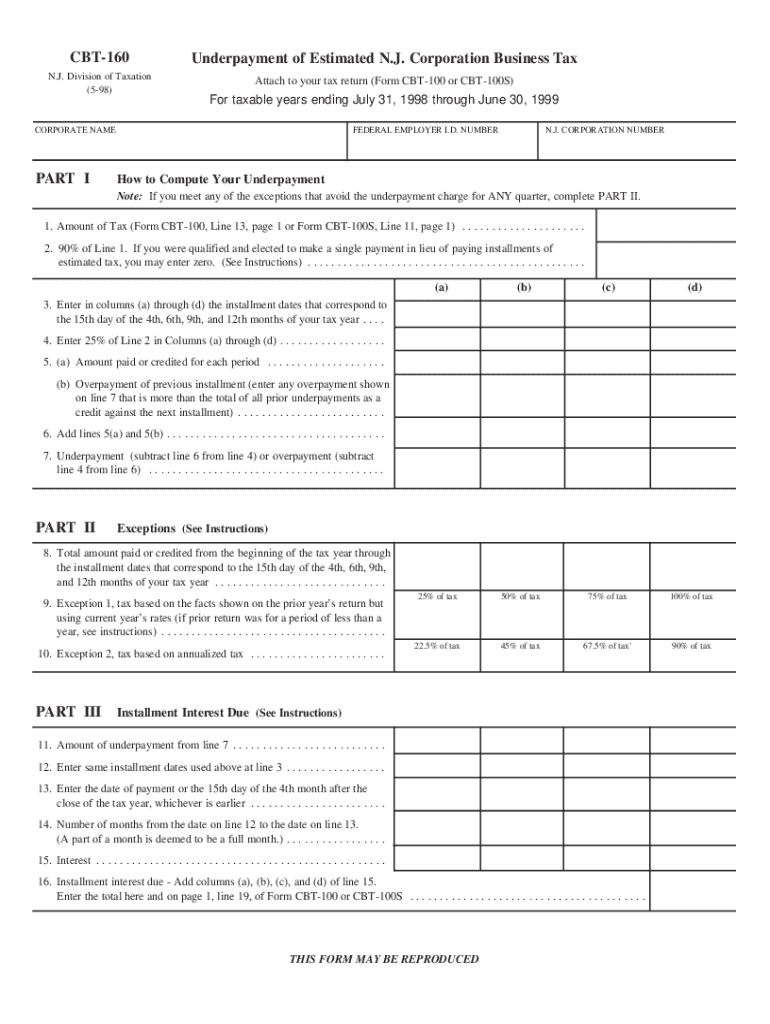

A comprehensive guide to the cbt-160 form

Understanding the cbt-160 form

The cbt-160 form is a specific document used primarily for tax-related purposes in certain jurisdictions, particularly for reporting income and business activities. Its essential purpose is to ensure compliance with local tax regulations, allowing individuals and businesses to accurately declare their financial status. The completion of this form is vital for both taxpayers and tax authorities, as it serves as a formal declaration of earnings, which can impact tax liabilities and refunds.

Individuals and businesses may find the cbt-160 form crucial, especially during tax season or when applying for loans and grants that require proof of income. This form provides a snapshot of one's financial situation, which is essential for lending institutions and government agencies.

When to use the cbt-160 form

Common scenarios where the cbt-160 form is necessary include annual income reporting, applying for tax credits, or documenting financial health for personal loans. Individuals who earn income from multiple sources or are self-employed often need to fill out this form to report their earnings accurately.

Typically, anyone who has a tax obligation in the relevant jurisdiction will need to complete the cbt-160 form, which includes self-employed individuals, freelancers, and small business owners, making it an essential document for ensuring compliance and maintaining financial integrity.

Detailed instructions for completing the cbt-160 form

Completing the cbt-160 form may seem daunting, but with the right approach, it can be manageable and straightforward. Here’s a step-by-step guide to help you fill out this form correctly.

Step 1: Gathering necessary information

Start by collecting all necessary documents that pertain to your income, expenses, and other financial information.

Step 2: Filling out the personal information section

Accurately enter your personal details, including full name, address, and social security number. Double-check for any typos, as inaccuracies can lead to delays or rejections of your submission.

Step 3: Completing the financial information section

This section requires you to report all earnings, income sources, and any liabilities accurately. Break down your income by source and be transparent about your financial situation. It's essential to include all information, as omissions can lead to audits or penalties.

Step 4: Reviewing additional sections

Pay careful attention to additional sections that require disclosures, such as investments or rental income. These sections are commonly overlooked but are critical for a complete submission.

Step 5: Final review and verification

Once you have filled out all sections, conduct a final review. Verify all entries for accuracy, as even minor mistakes can hinder processing. Consider having someone else review your form for a fresh perspective.

Visual aids and examples

To help with clarity, consider using annotated screenshots of a filled-out cbt-160 form. Visual aids can enhance understanding, showing the correct way to fill in each field. Some common errors include misreporting of income or not following formatting rules — ensure that you're aware of these to avoid pitfalls.

Editing and managing your cbt-160 form

Once you've completed the cbt-160 form, you may need to make alterations or updates. This is where pdfFiller’s editing tools come into play, offering an efficient way to modify your document without hassle.

Using pdfFiller’s editing tools

With pdfFiller, you can easily edit existing entries directly on your cbt-160 form. This feature allows you to rectify any errors or update your financial particulars as needed.

Additionally, you can enhance your document with annotations, highlights, or comments, which can be particularly useful if you’re collaborating with others on your submission.

Saving and storing your form

It’s important to save your filled-out cbt-160 form securely. Utilize cloud storage solutions to back up your documents, ensuring they are protected and easily accessible when necessary. Remember to adopt best practices for electronic storage to avoid any potential data loss.

eSigning the cbt-160 form

In today’s digital environment, eSigning your cbt-160 form is both convenient and legally binding. This process eliminates the need for physical paper trails and promotes efficiency, particularly when time is of the essence.

Steps to electronically sign your cbt-160 form

First, ensure that you are using a platform that supports eSigning, such as pdfFiller. The steps to eSign can typically be followed as:

Once completed, your eSignature confirms your consent and acknowledgment of the information contained within the document.

Collaborating with teams on the cbt-160 form

When working as part of a team, sharing the cbt-160 form for review becomes crucial. pdfFiller facilitates this collaboration, allowing multiple users to access and edit the document securely.

Sharing the cbt-160 form for team review

You can share the cbt-160 form easily within pdfFiller by sending it directly to team members. This feature allows for real-time collaboration, where team members can leave comments and make suggestions, thereby enriching the content and ensuring accuracy.

Tracking changes and feedback from multiple users

Using pdfFiller, you can track changes made by each user, which is essential for maintaining the integrity of the document. This functionality also helps manage feedback effectively, ensuring that every input is considered and addressed before final submission.

Troubleshooting common issues

Even with careful preparation, issues may arise during the form submission process. Understanding how to troubleshoot these common problems can save you considerable time and stress.

What to do if your cbt-160 form is rejected

If your cbt-160 form gets rejected, determine the root cause. Some common reasons include inaccuracies in personal or financial data or failure to provide necessary documentation. Address these issues promptly, and resubmit your form with the corrected information.

Contacting support for assistance

Should you encounter persistent issues, reaching out to pdfFiller support is advisable. Their team can assist you in troubleshooting problems related to the cbt-160 form and guide you through the resolution process, ensuring you can complete your submission efficiently.

Policies related to the cbt-160 form

Being aware of the policies surrounding the cbt-160 form is vital to ensure compliance and safeguard your personal information.

Confidentiality and privacy concerns

Handling the personal data required on the cbt-160 form necessitates a heightened sense of privacy and confidentiality. Always ensure that you are using secure methods to transmit and store your form, particularly if it contains sensitive financial information.

Document retention policies

It's recommended to keep your cbt-160 form and any related documents for at least three to seven years, depending on local regulations. This ensures that you have access to your financial records for reference, audits, or disputes.

Additional tools and features within pdfFiller

pdfFiller offers a suite of tools to enhance your document management experience, particularly when dealing with the cbt-160 form.

Leveraging interactive tools for enhanced document management

With interactive tools such as templates, forms, and automated workflows, users can significantly streamline their document management process. These features not only save time but also enhance accuracy in filling out forms like the cbt-160.

Integrating third-party applications

Integrating pdfFiller with other third-party applications can further optimize your workflow, allowing you to manage documents from various sources conveniently. This seamless integration can enhance productivity by centralizing your document management tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete cbt-160 online?

How can I edit cbt-160 on a smartphone?

How do I edit cbt-160 on an Android device?

What is cbt-160?

Who is required to file cbt-160?

How to fill out cbt-160?

What is the purpose of cbt-160?

What information must be reported on cbt-160?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.