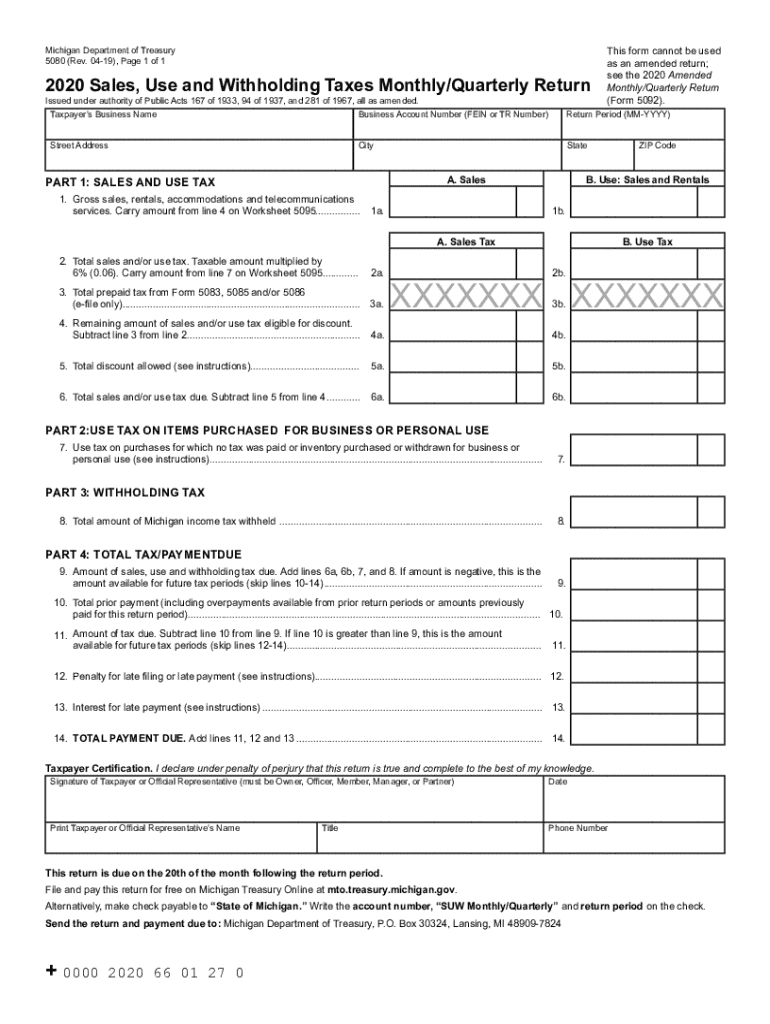

Get the free 2020 Sales, Use and Withholding Taxes Monthly/quarterly Return

Get, Create, Make and Sign 2020 sales use and

Editing 2020 sales use and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2020 sales use and

How to fill out 2020 sales use and

Who needs 2020 sales use and?

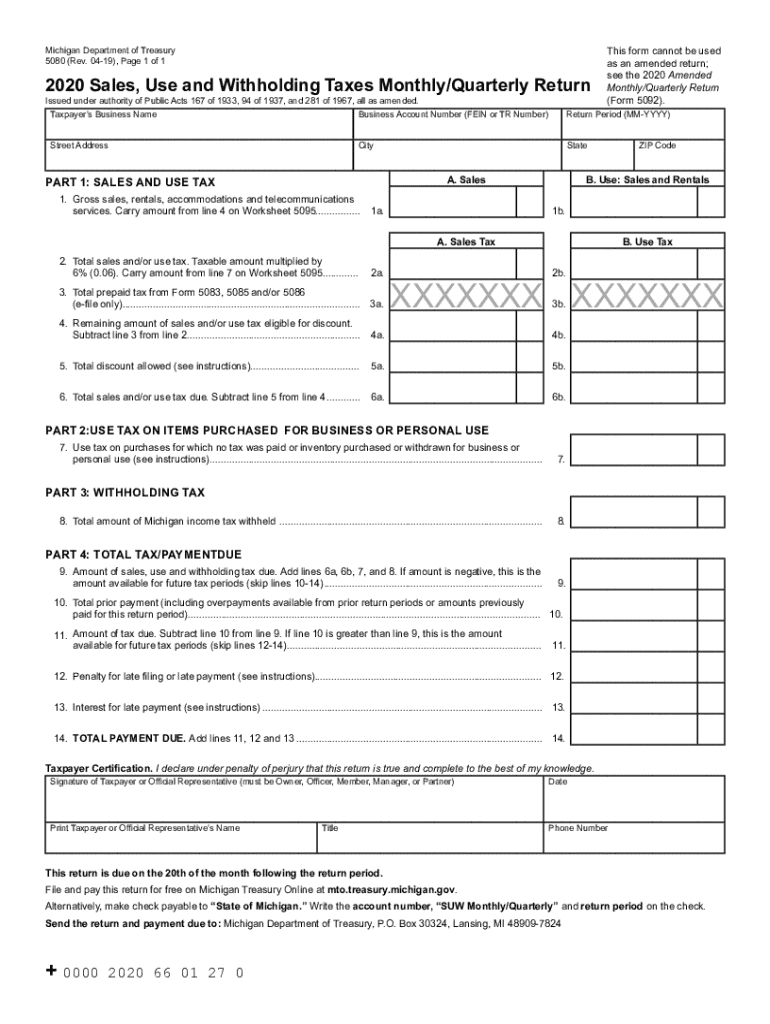

2020 Sales Use Tax and Form – A Comprehensive Guide

Understanding the 2020 sales use tax

Sales use tax is a consumption tax imposed on sales of goods and services. In essence, it ensures that consumers pay a tax when they purchase items, and businesses are responsible for collecting and remitting this tax to state authorities.

For individuals and businesses alike, understanding sales use tax is crucial. It impacts every retail transaction, meaning compliance is essential to avoid penalties. Additionally, knowledge of the tax ensures that from budgeting to accounting practices, there are no hidden costs.

In 2020, there were notable changes in the sales use tax landscape, particularly due to shifts in legislation and economic conditions resulting from the pandemic. Various states adapted their policies, prompting a need for individuals and businesses to review their compliance obligations.

Eligibility criteria for sales use tax

Not everyone has the obligation to file sales use tax returns. Eligibility largely hinges on the types of purchases and the nature of the entities involved. Generally, any business making taxable sales or purchases must file.

However, exemptions apply in specific scenarios:

Required forms for 2020 sales use tax

Navigating the paperwork for sales use tax in 2020 involved several essential forms. Each form serves a unique purpose in the compliance process, and understanding them can help streamline filing.

The key forms include:

Forms can generally be found via two primary avenues: online resources, such as state tax authority websites, or through local tax offices where physical copies may be available.

Step-by-step instructions for filling out the forms

Filling out the proper forms correctly is crucial to avoid delays or penalties. Let’s break down the process for the most common forms.

Sales tax return form

1. Gather Necessary Information: Before beginning, have your sales records, tax rates, and exemption documentation on hand.

2. Detailed Instructions for Each Section: The forms usually have divided sections for gross sales, taxable sales, and exemptions claimed.

3. Common Mistakes to Avoid: Watch out for miscalculating tax owed or misreporting sales figures, as these are common pitfalls.

Exemption certificate

1. Eligibility Verification: Ensure that you qualify for an exemption before filing this form.

2. Completed Example: Consider using templates available from pdfFiller that provide a clear structure for your entries.

Use tax form

1. Understanding Use Tax Calculations: This tax applies to purchases made out-of-state; ensure proper calculation of the equivalent in-state tax.

2. Filling Out the Form Accurately: Be clear about the specific purchases and tax rates, avoiding errors that could lead to compliance issues.

Filing and payment procedures

Once the forms are completed, the next step involves filing and payment. Depending on your preference and the guidelines from your state, there are various options available.

Electronic filing options

Using platforms like pdfFiller can enhance the efficiency of your submissions. They provide tools for seamless electronic filing, enabling faster processing.

Checkpoints Before Submission: Always double-check your entries, ensure all required attachments are included, and confirm compliance with state-specific regulations.

Payment methods available

1. Online Payment Systems: Many states offer robust online payment systems, allowing for quick and secure transactions.

2. Mail-in Payments: If preferred, payments can still be mailed; however, ensure they're sent far enough ahead of deadlines to avoid late fees.

Key deadlines and important dates

The timeline for filing and payment in 2020 was critical. Familiarizing yourself with these dates aids in avoiding penalties.

Filing Deadlines for 2020: Generally, forms must be submitted by quarterly or annual deadlines, which can vary from state to state.

Payment Due Dates: Align payment dates with filing deadlines to streamline the process and avoid penalties.

Penalties for Late Filing or Payment: These can include fines, interest on unpaid taxes, and additional fees for noncompliance.

Managing documents and records

Organizing your financial records effectively is essential for compliance and future audits. Implementing best practices ensures you stay prepared.

Best practices for document management

1. Storing Your Tax Documents: Keep all filings and supporting documents in an organized physical or digital location.

2. Organizing Digital Files: Utilize cloud-based solutions, like pdfFiller, to store and easily retrieve important documents.

Using pdfFiller for document collaboration and eSigning

1. Benefits of Cloud-Based Document Solutions: Access files from anywhere, minimizing risks of loss or damage.

2. Interactive Tools for Team Collaboration: Features within pdfFiller allow for real-time collaboration, reducing turnaround time for approvals and revisions.

Common questions and troubleshooting

Filing taxes can prompt numerous questions. Here, we address some frequently asked queries surrounding sales use tax.

Frequently Asked Questions about Sales Use Tax Filing: Many individuals wonder about the scope of taxable items, residency implications, or reporting errors.

What to Do If You Make an Error on Your Form: Mistakes are common; however, promptly addressing them through amended forms can mitigate penalties.

Contacting Tax Authorities for Assistance: Don't hesitate to reach out to local tax offices for guidance or clarification on specific situations.

Future considerations and preparation for upcoming tax years

Looking ahead, staying informed about tax legislation changes is crucial for compliance and strategic planning.

Anticipating changes in tax legislation

Tax laws frequently evolve. Engage with professional tax advisors or current news sources to remain aware of impending changes that could affect sales use tax.

Tools and resources for ongoing tax compliance

Utilize platforms that provide ongoing tax resources, such as pdfFiller, which can offer updates on legal changes and enhanced filing solutions.

How to stay informed

Regularly check state and federal tax websites, engage with tax professionals, and subscribe to taxation blogs to ensure ongoing compliance.

pdfFiller's comprehensive document solutions

pdfFiller stands out as a premier choice for managing tax documents efficiently, offering features tailored for document creation and submission.

Overview of pdfFiller's features and benefits

1. Seamless Editing and Signing: Users can edit PDFs, fill forms, and eSign documents intuitively without needing extensive training.

2. Collaboration Tools for Teams: Team members can collaborate in real-time, facilitating smooth workflows and accurate document handling.

Future innovations and what’s next for pdfFiller

As pdfFiller evolves, users can expect innovative features that improve functionality and user experience, ensuring continued relevance in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2020 sales use and straight from my smartphone?

How can I fill out 2020 sales use and on an iOS device?

How do I edit 2020 sales use and on an Android device?

What is 2020 sales use and?

Who is required to file 2020 sales use and?

How to fill out 2020 sales use and?

What is the purpose of 2020 sales use and?

What information must be reported on 2020 sales use and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.