Get the free Credit Application for a Business Account

Get, Create, Make and Sign credit application for a

How to edit credit application for a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit application for a

How to fill out credit application for a

Who needs credit application for a?

Credit application for a form - How-to guide

Understanding the credit application process

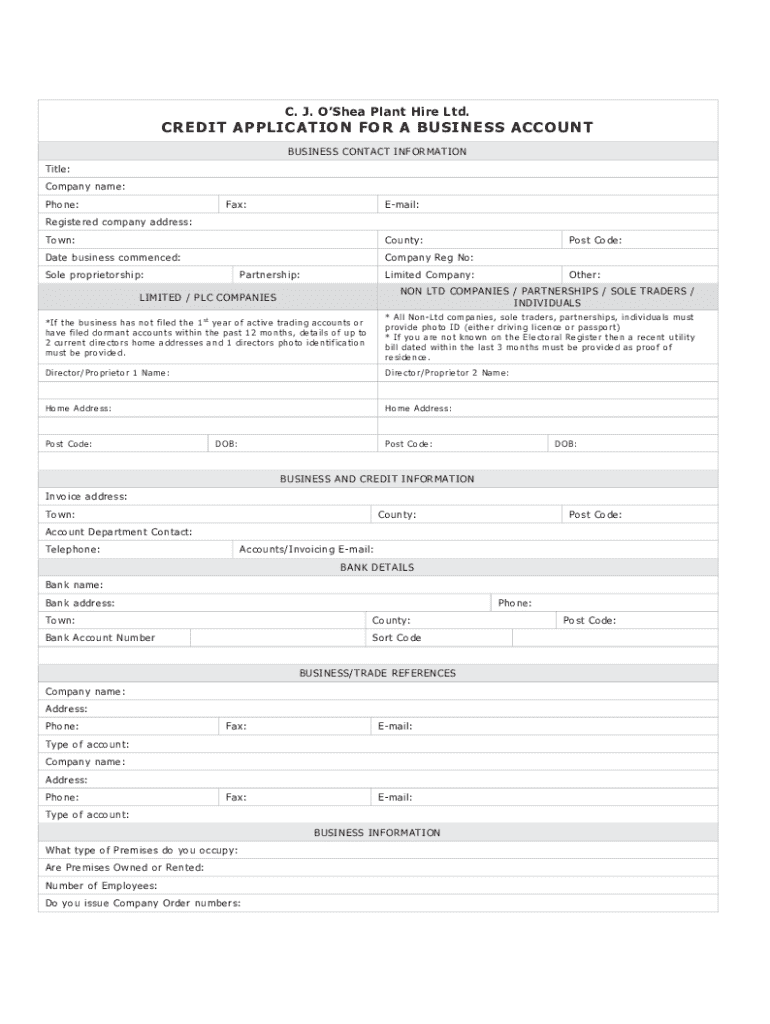

Credit applications are forms that individuals and businesses use to request credit from lenders. They encompass a variety of financial products, such as loans, credit cards, and mortgages. By filling out these applications, applicants provide information that lenders assess to determine creditworthiness.

The accuracy of the information in a credit application is crucial. Every detail provided helps establish trustworthiness and financial reliability. Incorrect or misleading information can lead to application denial or even legal consequences, such as charges of fraud.

Types of credit applications

There are primarily two types of credit applications: personal and business. Personal credit applications typically cater to individual needs, such as personal loans or credit cards. Within this category, applications focus mainly on the borrower's income, credit history, and personal identification.

In contrast, business credit applications evaluate the financial health of a company. They often require detailed financial statements, projections, and additional documents to provide a clearer picture of the business's operational capacity and creditworthiness.

Preparing to complete the credit application

Before starting a credit application, it’s essential to gather necessary documents. This preparation will not only facilitate a smoother application process, but it also helps in ensuring accuracy and transparency, leading to a higher likelihood of approval.

Key documents include identification, financial statements, and employment verification. Identification can include a driver’s license or passport, while financial statements should provide proof of income, like pay stubs or tax returns. Employment verification confirms stable income, which is crucial for lenders.

Step-by-step guide to filling out the credit application form

Section 1: Personal information

The first section typically requires personal information, including your full name, current address, and Social Security Number. Accuracy is vital here to ensure background checks can be completed seamlessly.

Section 2: Employment details

Provide a detailed account of your employment history, including the names of your employers, job titles, and the duration of employment. This helps lenders assess your ability to repay the credit.

Section 3: Financial information

In this section, you'll be expected to report your current assets, liabilities, and net worth. Reporting accurately is critical as it dictates your financial stability. Include all income streams and fixed and variable expenses.

Section 4: Consent and signature

At the end of the form, you’ll find a consent statement that gives the lender permission to check your credit history. Signing this section validates the application and affirms the accuracy of the information provided.

Editing and reviewing the credit application

Once you have filled out the credit application form, reviewing it thoroughly is necessary. Using tools like pdfFiller can streamline the editing process, allowing you to easily make corrections or add information.

Common mistakes applicants make include typos, missing information, or providing inconsistent data. Taking the time to double-check your application can prevent delays and increase the chances of approval.

Submitting the credit application

Credit applications can be submitted through various methods, with online and paper submissions being the most common. Online submissions are often quicker, allowing borrowers to receive instant notifications, whereas paper submissions may take longer for processing but can still be necessary for certain lenders.

Lenders will review your application after submission to determine whether to approve or deny your request. The timeframe for this review process can vary, but applicants can typically expect feedback within a few days to a week.

Managing your credit application after submission

After submitting your application, it's vital to track its status. Many lenders provide portals where you can view updates on your application progress, ensuring you stay informed about any required actions or additional information needed.

In case your application is denied, understanding the reasons can provide vital insights for future applications. It's essential to request feedback and work on addressing any issues related to your credit profile or documentation.

Frequently asked questions (FAQs) about credit applications

Many potential borrowers have questions surrounding the credit application process. Addressing common queries can help mitigate concerns and prepare applicants for such experiences.

For instance, if your information changes after submission (like employment status), contact your lender immediately. Additionally, applicants often wonder about ways to improve approval chances. One key way is to ensure comprehensive and accurate documentation, alongside maintaining a good credit score.

Interactive tools and resources

Leveraging interactive tools can significantly enhance the credit application experience. Creditworthiness calculators, for example, can help prospective borrowers estimate their eligibility for different credit products based on income and debt levels.

Additionally, user testimonials shed light on successful applications and can guide new applicants in navigating the process. Accessing support through platforms like pdfFiller ensures you have assistance readily available if you encounter challenges when filling out forms.

Conclusion on effective credit application practices

A well-completed credit application is critical in securing the necessary funds for personal or business needs. Adhering to best practices, such as being thorough, accurate, and using resourceful tools like pdfFiller, increases the likelihood of approval.

Remember, the application is not merely a formality. It is a critical step toward achieving financial goals, whether you are looking to purchase a home, acquire a new vehicle, or expand your business operation. With the right approach and resources, you can navigate this process smoothly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit credit application for a online?

How do I complete credit application for a on an iOS device?

Can I edit credit application for a on an Android device?

What is credit application for a?

Who is required to file credit application for a?

How to fill out credit application for a?

What is the purpose of credit application for a?

What information must be reported on credit application for a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.