Get the free 2025 Residential & Income Qualified Solutions Programs

Get, Create, Make and Sign 2025 residential income qualified

Editing 2025 residential income qualified online

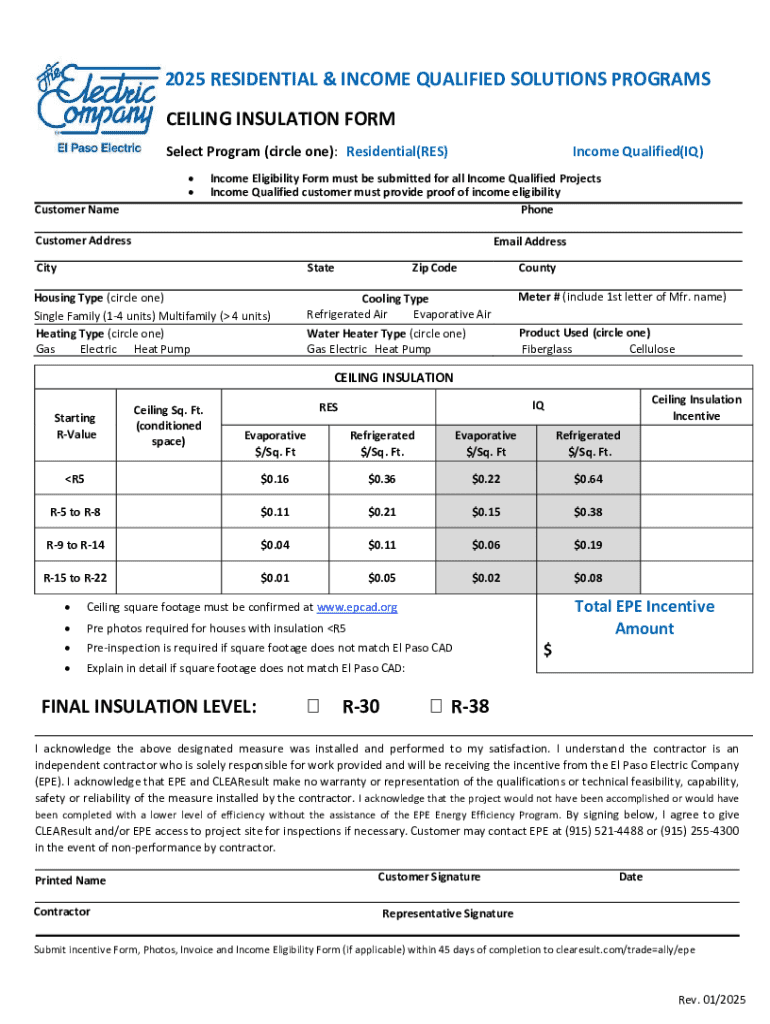

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 residential income qualified

How to fill out 2025 residential income qualified

Who needs 2025 residential income qualified?

Comprehensive Guide to the 2025 Residential Income Qualified Form

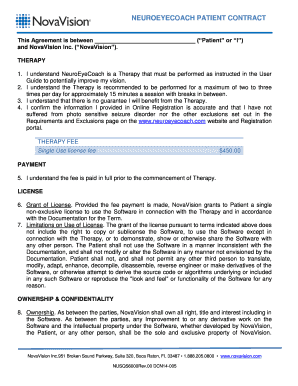

Understanding the 2025 residential income qualified form

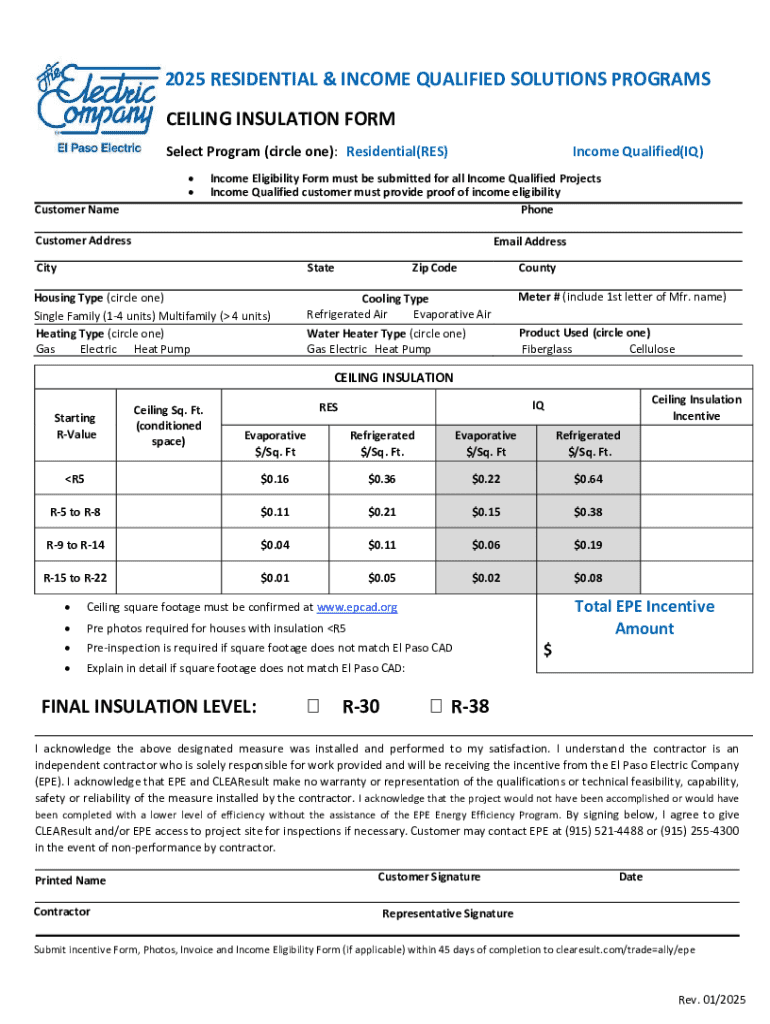

The 2025 Residential Income Qualified Form is an essential document for individuals and businesses involved in the management of residential income properties. This form serves as a formal declaration of income derived from rental activities and is necessary for various financial assessments, including loan applications and tax filings.

Its importance cannot be overstated as it allows landlords, property managers, and investors to demonstrate their income stability, which is crucial for obtaining financing or confirming eligibility for specific programs. Understanding who qualifies to use this form in 2025 is vital, as this dictates how income can be reported for tax purposes and potential benefits.

Key features of the 2025 residential income qualified form

The 2025 Residential Income Qualified Form boasts several key functionalities tailored to meet the needs of renters and landlords. One of its most valuable features is the comprehensive income assessment section, which allows for detailed reporting of all income sources, including rent, lease agreements, and additional revenue from ancillary services.

Managing residential income documentation has unique challenges; however, utilizing digital tools can ease this burden significantly. The integration of platforms like pdfFiller enhances the process of filling out this form through cloud-based editing, straightforward collaboration capabilities, and eSignature functionalities, which all contribute to expedited approvals.

How to fill out the 2025 residential income qualified form

Pre-requisites: What you need to get started

Before embarking on filling out the 2025 Residential Income Qualified Form, gather necessary personal and financial information. This typically includes identification details, proof of income, and documentation supporting housing status, such as leases or rent rolls. Ensuring all this information is on hand can streamline the process.

Step-by-step instructions for completion

Breaking the form down into sections can help clarify the required information: - Personal Information Entries: Provide basic details such as your name, address, and contact information. - Income Assessment Details: This section details all rental income, including monthly rent per unit and any additional sources of income derived from the property. - Property Ownership Disclosures: A clear statement of how many properties you own is necessary.

For accurate completion, pay close attention to ensuring that all information is current and correct. A common pitfall is neglecting to update rental incomes or failing to report all properties owned.

Using pdfFiller tools to enhance your submission

pdfFiller offers a host of tools that can streamline the process of filling out the 2025 Residential Income Qualified Form. Features like interactive editing tools allow users to easily incorporate changes without starting from scratch. Using the autofill function can significantly reduce the time spent on repetitive data entry, while templates can provide a robust starting point tailored for residential income documentation.

Important deadlines for 2025 residential income reporting

Being aware of key submission dates is crucial to ensure compliance when filing the 2025 Residential Income Qualified Form. This typically involves specific deadlines around tax reporting periods and may coincide with financial year ends, depending on your situation. Missing these deadlines can lead to penalties, reduced eligibility for benefits, or complications during audits.

Utilizing the reminder and alert features on pdfFiller can help keep these important dates on your radar and assist you in effectively managing your documentation timeline, reinforcing your ability to stay compliant.

Reviewing and editing your submission

Once the 2025 Residential Income Qualified Form is completed, reviewing it for accuracy is imperative. pdfFiller facilitates this process through collaborative features, allowing others on your team to provide feedback before the final submission. Utilize commenting tools to gather insights and ensure every piece of information is correctly represented.

Adopting best practices for revisions can prevent the need to redo entire sections. Instead of starting over, make targeted edits and run checks on specific data points to maintain the integrity of the completed form.

Frequently asked questions about the 2025 residential income qualified form

Encountering issues while completing the 2025 Residential Income Qualified Form is not uncommon. If you find yourself stuck, check with your financial advisor or consult resources available directly through pdfFiller, which often provides comprehensive support for using their tools. If discrepancies arise post-submission, be proactive about disputing them through the appropriate channels outlined in your submission confirmation.

Electronic submissions are permitted in many jurisdictions, and pdfFiller simplifies this process further. By securely submitting your completed form through their platform, you can ensure that your documentation is delivered timely and accurately.

Common mistakes to avoid with the 2025 residential income qualified form

To expedite the processing of the 2025 Residential Income Qualified Form, awareness of common errors is essential. Incomplete information often leads to significant delays, with many individuals forgetting crucial details such as additional income or rental properties owned. Incorrect income declarations can also complicate matters, especially when it comes to W-2s or unreported income.

Moreover, timing issues related to documentation—like submitting backdated paperwork—can result in rejection or audit triggers. Being diligent in reviewing before submission can help catch these pitfalls early on.

Special considerations for unique situations

Handling mixed-use properties presents specific challenges when filing the 2025 Residential Income Qualified Form. Distinguishing between residential and commercial income streams is paramount. Additionally, if there are changes in residency or income status throughout 2025, applicants must remain vigilant and adjust their reporting accordingly to reflect their true financial situation.

It’s essential to document any changes promptly and revisit the form as needed to ensure compliance with the latest regulations. Relying on tools like pdfFiller can help maintain accurate and up-to-date records.

Leveraging pdfFiller for better document management in 2025

pdfFiller provides a wide array of tools to assist in managing residential income documentation throughout 2025 and beyond. From comprehensive templates that include all necessary fields to interactive editing options, users can easily keep their forms organized and accessible. Keeping records secure yet easily retrievable is essential in today’s fast-paced environment.

Using a cloud-based solution ensures that all documents are available remotely, facilitating collaboration with team members regardless of their location. Features like version control preserve the integrity of documents while allowing teams to work together seamlessly.

Enable secured sharing and collaboration

Sharing your completed 2025 Residential Income Qualified Form effectively with stakeholders is crucial for transparency and accountability. pdfFiller allows users to securely share documents while managing permissions to control who can view or edit them. Being able to track changes and comments in real-time enhances trust among collaborators.

When sharing sensitive financial documents, security is of utmost importance. pdfFiller adheres to data protection protocols, ensuring that your information remains safe while still being accessible to necessary parties.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025 residential income qualified online?

Can I create an eSignature for the 2025 residential income qualified in Gmail?

How can I edit 2025 residential income qualified on a smartphone?

What is 2025 residential income qualified?

Who is required to file 2025 residential income qualified?

How to fill out 2025 residential income qualified?

What is the purpose of 2025 residential income qualified?

What information must be reported on 2025 residential income qualified?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.