Get the free Form Aca-2

Get, Create, Make and Sign form aca-2

How to edit form aca-2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form aca-2

How to fill out form aca-2

Who needs form aca-2?

Your Complete Guide to the ACA-2 Form: Understanding, Completing, and Managing Your Document

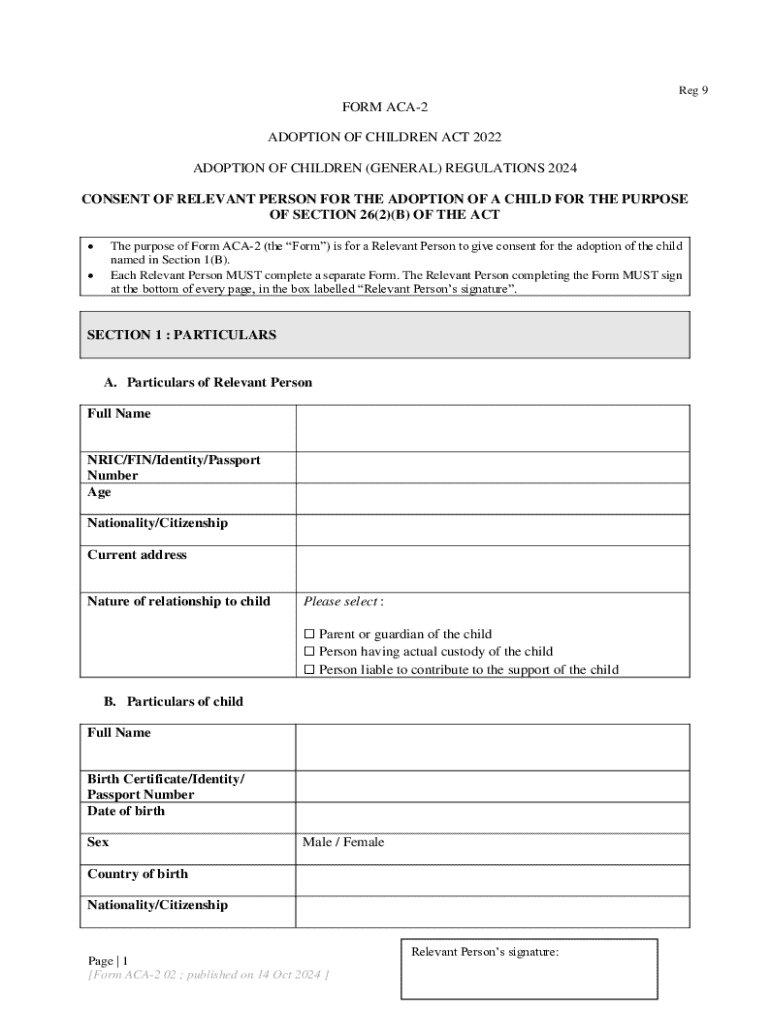

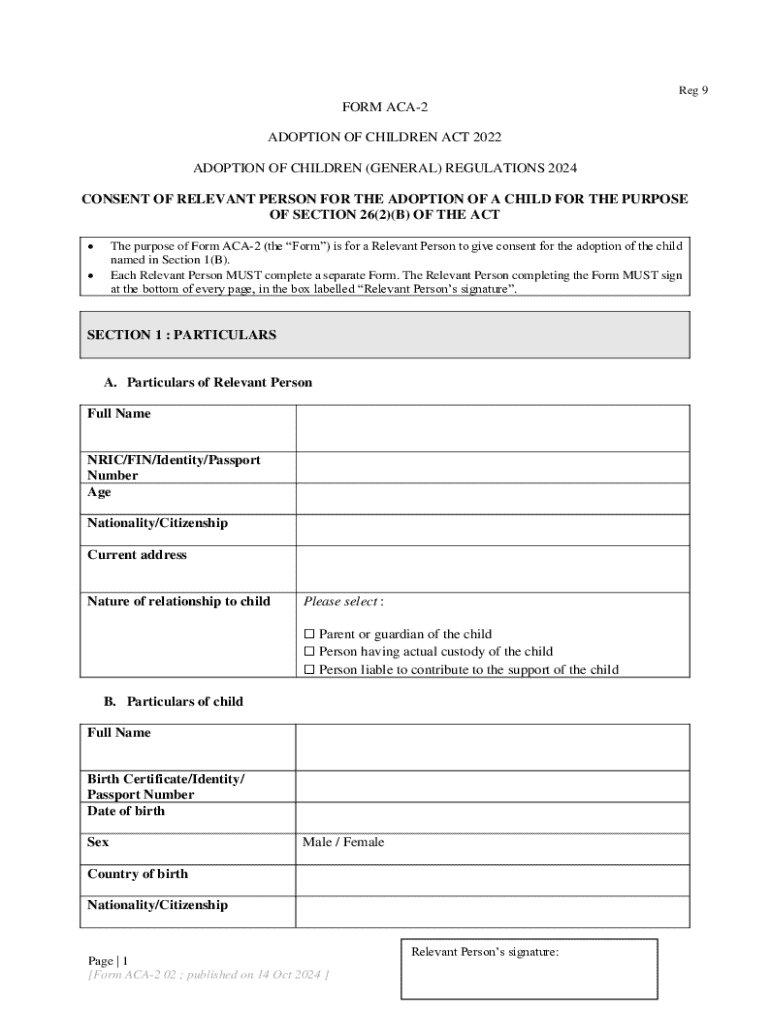

Understanding the ACA-2 form

The ACA-2 form plays a crucial role in the compliance landscape brought forth by the Affordable Care Act (ACA). It serves as an essential document used by employers to report the health coverage they provide to their employees. Essentially, the form ensures that organizations meet their obligations under the ACA and assists individuals in understanding their health insurance options.

Employers and employees alike should recognize the importance of the ACA-2 form. For employers, completing it accurately can help avoid penalties associated with non-compliance. On the other hand, employees utilize this form to verify their coverage and receive necessary tax documentation when filing their returns.

Key requirements for completing the ACA-2 form

To accurately fill out the ACA-2 form, collecting pertinent information is essential. Firstly, personal details like the individual's name, Social Security Number (SSN), and contact information are crucial. Additionally, employers must ensure they include their Employer Identification Number (EIN) for accurate reporting.

Alongside this information, supporting documents are required for accurate completion. This includes health plan documents as well as any records indicating prior healthcare coverage. These documents help validate the information reported on the ACA-2 form.

Step-by-step instructions for filling out the ACA-2 form

Completing the ACA-2 form may seem daunting, but breaking it down into sections simplifies the process. The form consists of several parts, each requiring specific information. In the first section, personal information must be input accurately to reflect the employee's details.

Next, employers need to provide their information, including the EIN and contact details. This section is vital as it links the coverage provided with the employer's identity. Following this, accurately reporting healthcare coverage is essential; this includes listing the health plans offered, the duration of coverage, and which employees are covered.

Finally, before submission, verifying all information for accuracy is crucial. This can help prevent errors that might lead to compliance issues. Double-checking each section ensures that the data aligns with the documentation gathered earlier.

Common mistakes to avoid while completing the ACA-2 form

Filling out the ACA-2 form can lead to several common mistakes. One frequently made error includes incorrect personal information, such as misspellings in names or transposed numbers in SSNs. Such inaccuracies can complicate compliance processes and create delays.

Inaccuracy may lead to IRS penalties, making it essential to pay close attention to detail when filling out the ACA-2 form. Timeliness is equally important, as late submissions can attract fines and further compliance issues.

Editing and managing your ACA-2 form

Using document management tools can significantly streamline the process of editing and managing the ACA-2 form. pdfFiller is one such platform that provides efficient tools for creating and modifying documents. With pdfFiller, users can easily make changes to their form, ensuring accuracy and compliance.

Additionally, adding electronic signatures and comments is straightforward. With the integrated eSigning feature, signatories can quickly add their signatures directly on the document, facilitating smooth workflows. This is especially useful for employers needing to secure signatures from multiple parties before final submission.

Interactive tools for ACA-2 form preparation

Using templates can significantly speed up the completion of the ACA-2 form. pdfFiller offers a range of customizable templates that allow users to fill out their forms quickly and efficiently. These templates are designed to ensure that all necessary fields are addressed, reducing the risk of omissions.

Alongside templates, pdfFiller features filling assistants that provide on-screen guidance. This interactive support can help clarify any uncertainties about each section of the form, showing users where they need to input specific information. Such tools are especially beneficial for those unfamiliar with ACA regulations or form requirements.

Troubleshooting common issues with ACA-2 form submission

In some cases, issues may arise after submitting the ACA-2 form. These can range from inquiries from the IRS regarding discrepancies in reported data to notifications about late submissions. If a user encounters such problems, it’s essential to address them promptly.

Users can benefit from pdfFiller’s support resources, which help troubleshoot common submission issues and ensure compliance with ACA regulations.

Managing ACA compliance beyond the ACA-2 form

ACA compliance isn't solely addressed through the ACA-2 form; employers must also stay informed about ongoing reporting requirements. This includes keeping track of employee coverage and ensuring consistent communication regarding health plan offerings.

pdfFiller can assist in this ongoing compliance by providing a comprehensive document management system. This enables businesses to maintain updated records, create necessary forms, and streamline their workflows, ensuring they remain compliant with ACA rules at all times.

Frequently asked questions (FAQs) about the ACA-2 form

Employers and employees alike often have questions regarding the ACA-2 form. Common queries include uncertainties about the specifics needed to complete the form, such as the required documentation and deadlines for submission. Other questions might focus on consequences for inaccuracies on the form.

It's vital for both employers and employees to understand these FAQs to navigate the ACA landscape successfully. Addressing common concerns effectively makes the completion and submission of the ACA-2 form a much smoother process, ultimately ensuring better compliance.

Final tips for success with the ACA-2 form

To ensure successful completion of the ACA-2 form, focus on accuracy in every section. Gathering all necessary documents beforehand can streamline the process, minimizing the time spent on filling out the form. Moreover, utilizing pdfFiller’s tools can enhance collaboration and reduce risk.

Following these best practices will not only simplify the ACA-2 form process but also contribute to broader ACA compliance objectives.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form aca-2 online?

How do I edit form aca-2 in Chrome?

Can I edit form aca-2 on an iOS device?

What is form aca-2?

Who is required to file form aca-2?

How to fill out form aca-2?

What is the purpose of form aca-2?

What information must be reported on form aca-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.