Get the free Transfer on Death Registration Request

Get, Create, Make and Sign transfer on death registration

Editing transfer on death registration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer on death registration

How to fill out transfer on death registration

Who needs transfer on death registration?

A Comprehensive Guide to Transfer on Death Registration Forms

Understanding Transfer on Death (TOD) registration

A Transfer on Death (TOD) registration allows asset owners to transfer their property to designated beneficiaries upon their death, bypassing the probate process. This mechanism is becoming a popular choice for individuals looking to streamline the transfer of their estates. The importance of a TOD in estate planning cannot be understated, as it provides a clear pathway for assets to be distributed according to the owner’s wishes without delay or court intervention.

Utilizing a TOD registration form ensures that the ownership of assets such as bank accounts, stocks, and real estate directly transfers to the named beneficiaries, enhancing both efficiency and clarity in estate management. Not only does this simplify the transition for surviving family members, but it also mitigates potential disputes over asset distribution, making it a valuable tool in modern estate planning.

Eligibility for transfer on death registration

Not everyone or every asset qualifies for a Transfer on Death registration. Generally, individuals who own property or assets in their name can utilize a TOD registration form. However, specific eligibility criteria can vary by state, and it's crucial to understand local laws governing TOD registrations. Additionally, only certain types of assets can be transferred using a TOD designation, including residential properties, bank accounts, and vehicles.

It's essential to familiarize oneself with state-specific regulations. For instance, in states like California, you can transfer real estate easily, while others may impose restrictions or require specific forms to accompany the TOD registration. Checking with a legal expert can ensure compliance and aid in understanding the nuances surrounding TOD eligibility.

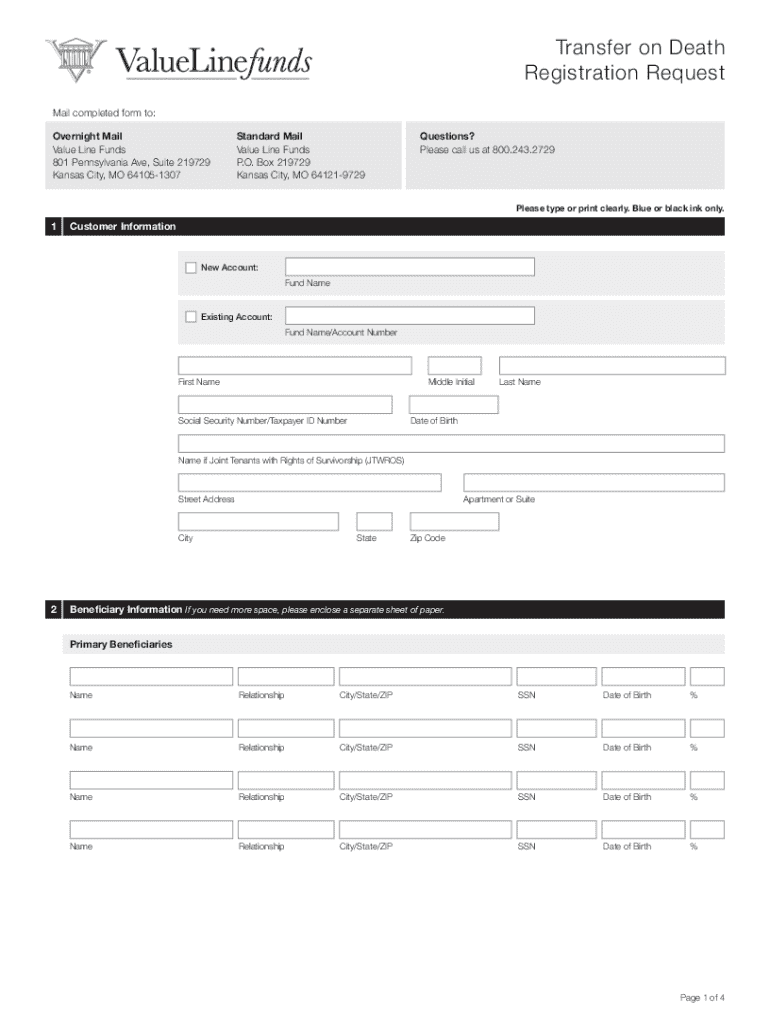

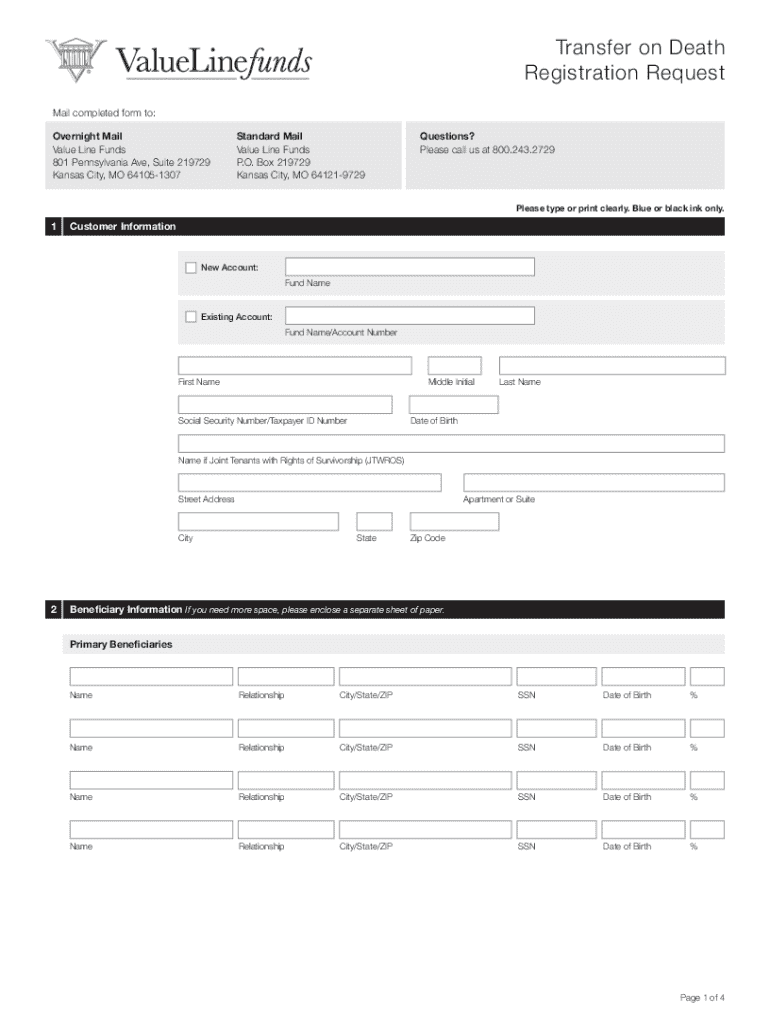

Preparing to complete the transfer on death registration form

Completing the transfer on death registration form requires careful preparation. Start by gathering all necessary information and documentation relevant to the assets you wish to transfer. This includes personal identification details, such as your full name, address, and date of birth, which validate your identity and ownership.

You'll also need to gather detailed information about the asset(s) to be transferred. This could include property addresses, account numbers, or descriptions of personal belongings. Additionally, beneficiary information is crucial; ensure that names, relationships, and contact information are accurately detailed.

Step-by-step guide to filling out the transfer on death registration form

Once you have gathered all necessary information, you can begin filling out the transfer on death registration form. Begin by accessing the appropriate template on pdfFiller, which provides an easy-to-navigate platform for document management. Once you have the form ready, you will encounter several sections.

Each section plays a critical role in ensuring clarity and compliance. The first section typically requires the owner's personal information, including their name and address. In the second section, you will list the beneficiaries who will receive the assets upon the owner's passing. The third section necessitates a description of the assets in question.

Finally, ensure to include signatures where required and any notarization that may be necessary based on your state’s laws.

Editing and customizing your transfer on death registration form

After you draft your transfer on death registration form, you may need to edit or customize it to better fit your needs. pdfFiller provides tools to easily add or remove sections as necessary. This flexibility allows you to adjust beneficiary designations or include additional specifications about your assets.

To ensure clarity and compliance, leverage the editing tools available to enhance your document’s accuracy. Make sure any changes reflect your intentions and comply with legal standards to avoid future disputes or issues.

Signing your transfer on death registration form

Once you have completed your transfer on death registration form, signing it is the next crucial step. Understanding the eSign process can help streamline the completion. pdfFiller offers various options for electronic signatures, making it convenient to finalize your document. It's vital to comply with any state requirements regarding witnessing or notarization, which may add an extra layer of validation to your form.

Ensure that all signatures are properly executed and, if required, witnessed in accordance with your state’s laws. This can prevent potential complications when the time comes to transfer the assets.

Managing your transfer on death registration form

Storage and management of your completed transfer on death registration form are essential to ensure its accessibility when needed. Utilize cloud-based solutions like pdfFiller for secure storage options, allowing easy access from anywhere and on any device. Keeping your document organized is paramount for ensuring beneficiaries and legal representatives can access it without delay.

As your circumstances may change, it’s wise to make updates and changes over time to accurately reflect your current wishes. Regularly sharing your completed form with relevant parties can also help in maintaining clear communication regarding your estate plans.

Common mistakes to avoid when filling out TOD registration forms

Despite the straightforward nature of the transfer on death registration form, various common mistakes can lead to issues down the line. One frequent error occurs when beneficiaries' details are incomplete or inaccurate, which could hinder the transfer process. Another common pitfall is failing to comply with state notarization or witnessing requirements, making the form potentially invalid.

Best practices include double-checking all information before submission, ensuring clarity in beneficiary designations and asset descriptions, and maintaining an open line of communication with those involved in the process. Taking these precautions mitigates risks and supports a smoother asset transition.

FAQs about transfer on death registration

Understanding how the transfer on death registration operates involves addressing common queries that often arise. For instance, what happens if a beneficiary predeceases the owner? In such cases, most states permit the transfer to alternate beneficiaries or may allow the remaining beneficiaries to inherit equally, depending on specific laws in place.

Can a TOD form be revoked or changed? Yes, in most cases, you can revoke or amend your TOD registration by completing a new form or expressly stating your intention through legally acceptable means. Determining the validity of a TOD registration often requires consulting state-specific resources, but it typically revolves around ensuring compliance with signing and witnessing rules.

Interactive tools and resources on pdfFiller

pdfFiller provides users with various interactive tools and resources to aid in the management of their transfer on death registration forms. The platform hosts an array of tutorials and webinars designed to facilitate a deeper understanding of the document creation and management process. These resources can be invaluable for both individuals and teams looking to maximize their experience with estate planning documentation.

Utilizing these tools effectively can significantly enhance knowledge of how to handle forms, alter designs, and engage with electronic signature processes. By embracing these resources, you can ensure that your estate planning remains organized and accessible.

Final considerations for using TOD registration forms

While using a transfer on death registration form can greatly simplify the process of asset distribution, there are scenarios in which seeking legal advice is prudent. For individuals with complex estates or unique circumstances, consulting with an estate planning attorney can provide tailored guidance that safeguards against potential pitfalls.

Recognizing the role of estate planning within broader financial management is key. Effective planning not only aids in the smooth transfer of assets but also plays a crucial role in fulfilling your financial goals and ensuring peace of mind for you and your loved ones.

Understanding the broader impact of transfer on death registrations

Transfer on Death registrations offer insights into an individual's broader estate strategy. By leveraging this tool, owners can reflect their personal and financial philosophies in their estate planning effectively. Furthermore, as legal scenarios evolve, the implications of TOD registrations may adjust, potentially influencing how future estate cases are interpreted in the legal system.

Establishing clear and concise intentions through your TOD designations contributes significantly to a well-rounded estate strategy. This not only benefits the immediate transfer process but also sets a precedent for how future estate-related matters might be legislated or adjudicated.

pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform. With tools at your disposal for easy document management, utilizing a transfer on death registration form can be an efficient and effective way to ensure that your assets are passed on as intended. Explore what pdfFiller has to offer to enhance your document experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit transfer on death registration from Google Drive?

Can I sign the transfer on death registration electronically in Chrome?

Can I edit transfer on death registration on an iOS device?

What is transfer on death registration?

Who is required to file transfer on death registration?

How to fill out transfer on death registration?

What is the purpose of transfer on death registration?

What information must be reported on transfer on death registration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.