Get the free Unsubsidized Loan Only Authorization Form

Get, Create, Make and Sign unsubsidized loan only authorization

How to edit unsubsidized loan only authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unsubsidized loan only authorization

How to fill out unsubsidized loan only authorization

Who needs unsubsidized loan only authorization?

Navigating the Unsubsidized Loan Only Authorization Form

Understanding unsubsidized loans

Unsubsidized loans are a type of federal financial aid that allows students to borrow money to cover educational expenses. Unlike subsidized loans, where the government covers interest while you’re in school, unsubsidized loans accrue interest from the moment the funds are disbursed. This means borrowers are responsible for paying the interest, whether or not they are enrolled in school.

The key differences between subsidized and unsubsidized loans lie primarily in how interest is managed and eligibility criteria. Subsidized loans are based on financial need and are typically awarded to undergraduate students, whereas unsubsidized loans are available to both undergraduate and graduate students, regardless of financial need.

One of the notable benefits of unsubsidized loans is that they provide a larger borrowing limit compared to subsidized options. Additionally, they offer flexibility in repayment, including options for deferment and income-driven repayment plans, making them an attractive option for many students.

The importance of the authorization form

The unsubsidized loan only authorization form is a critical component of the loan application process. It serves as a formal request for the specific type of loan and outlines the terms associated with it. Failing to complete this form accurately can lead to delays in funding or a denial of your loan request.

Legal implications are also associated with signing this form. By signing it, borrowers confirm that the information provided is true and agree to the terms and conditions set by the lender. Common reasons for requiring authorization include the need for consent to share personal and financial information among relevant parties throughout the loan process.

Preparing to complete the unsubsidized loan authorization form

Before diving into filling out the unsubsidized loan only authorization form, ensure you have all the necessary documents and information at hand. Key identification documents include your driver's license, Social Security card, or passport, which verifies your identity.

You'll also need to gather financial information such as your family’s income, assets, and any existing debts. Educational records, including your school’s enrollment status, will confirm your eligibility. Organizing this information can streamline the application process; consider creating a checklist to ensure nothing is overlooked.

Step-by-step guide to completing the unsubsidized loan only authorization form

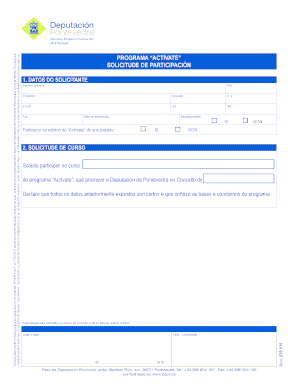

Completing the form can seem daunting, but breaking it down into sections makes it manageable. The first section typically asks for personal information. This includes your full name, Social Security number, and contact info such as your address and phone number.

Next, you will need to specify loan details, including the type of loan you are applying for—unsubsidized—and the desired loan amounts and periods. It's essential to understand your financial needs to make accurate selections.

The third section covers consent for disclosure, where you will grant permission to share your information for processing the loan. Understanding this part ensures that your privacy is safeguarded, and you’re aware of how your data is being used.

Finally, the certification and signature section is where you verify that all the information provided is accurate to the best of your knowledge. You’ll sign the form either electronically or manually, depending on your method of submission.

Editing and customizing the authorization form

Once you have accessed the unsubsidized loan only authorization form, consider utilizing pdfFiller's editing tools. These features allow you to make any necessary changes, such as adding or removing text that pertains specifically to your situation.

You can also include digital signatures that comply with e-signature laws. Ensuring compliance with both federal and state guidelines during this editing phase is crucial, as it authenticates your submission.

Submitting your authorization form

The submission process for the completed form is critical. Typically, forms can be submitted directly through your school's financial aid portal. However, mail submission is also an option, especially if you're submitting additional documentation.

Online submissions tend to be faster, but ensure you follow the specific instructions provided by your institution as processes may vary. After submission, it's wise to keep track of the status of your application, which can usually be done through your school's online system.

Managing your unsubsidized loan documentation

After submission, keeping your documents organized is essential. Store copies of your authorization form along with any other related paperwork securely. Using digital solutions like pdfFiller can help you maintain access to your documents from anywhere, simplifying the retrieval process.

Best practices for maintaining your financial records include regularly updating your documents, backing them up in a secure location, and being proactive about monitoring any emails or notifications from your financial aid office regarding your loan status.

Frequently asked questions (FAQs)

You may wonder what to do if your form is rejected. Typically, financial aid offices will contact you with reasons for rejection and steps to correct the issues. It’s essential to act promptly to rectify any discrepancies.

Understanding loan processing timelines can help manage expectations. Usually, processing can take several weeks depending on the institution. Finally, if there’s a need to adjust your authorization after submission, contact your financial aid office as soon as possible to discuss potential changes.

Additional considerations in applying for unsubsidized loans

While completing the unsubsidized loan only authorization form is a significant step, it's also essential to be aware of how your credit score can impact your loan application. Although federal loans typically don't require credit checks, your score can affect private loan options.

Moreover, understanding your repayment options will enable you to make informed choices once you graduate. Unsubsidized loans offer various repayment plans, including income-driven repayment options that can ease the burden after graduation.

Connecting with financial aid resources

Engaging with financial aid resources can empower you throughout your education financing journey. Your school’s financial aid office is an excellent first point of contact for inquiries or assistance with forms like the unsubsidized loan only authorization form.

Consider also checking local nonprofit organizations or online resources that specialize in financial literacy. Staying informed about changes in loan policies, interest rates, and available programs can further enhance your ability to navigate student loans efficiently.

Interactive tools for loan management

pdfFiller offers a robust suite of tools designed for effective loan management. Features such as document collaboration, real-time updates, and easy access to templates can significantly ease the administrative burden of tracking multiple financial documents.

User testimonials demonstrate the efficacy of utilizing pdfFiller in managing financial documents. Real-life case studies show how users have streamlined their processes, eliminated paperwork chaos, and maintained organized records, making the entire loan experience less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute unsubsidized loan only authorization online?

How do I make edits in unsubsidized loan only authorization without leaving Chrome?

Can I sign the unsubsidized loan only authorization electronically in Chrome?

What is unsubsidized loan only authorization?

Who is required to file unsubsidized loan only authorization?

How to fill out unsubsidized loan only authorization?

What is the purpose of unsubsidized loan only authorization?

What information must be reported on unsubsidized loan only authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.