Get the free Annual Return

Get, Create, Make and Sign annual return

How to edit annual return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual return

How to fill out annual return

Who needs annual return?

Your Comprehensive Guide to the Annual Return Form on pdfFiller

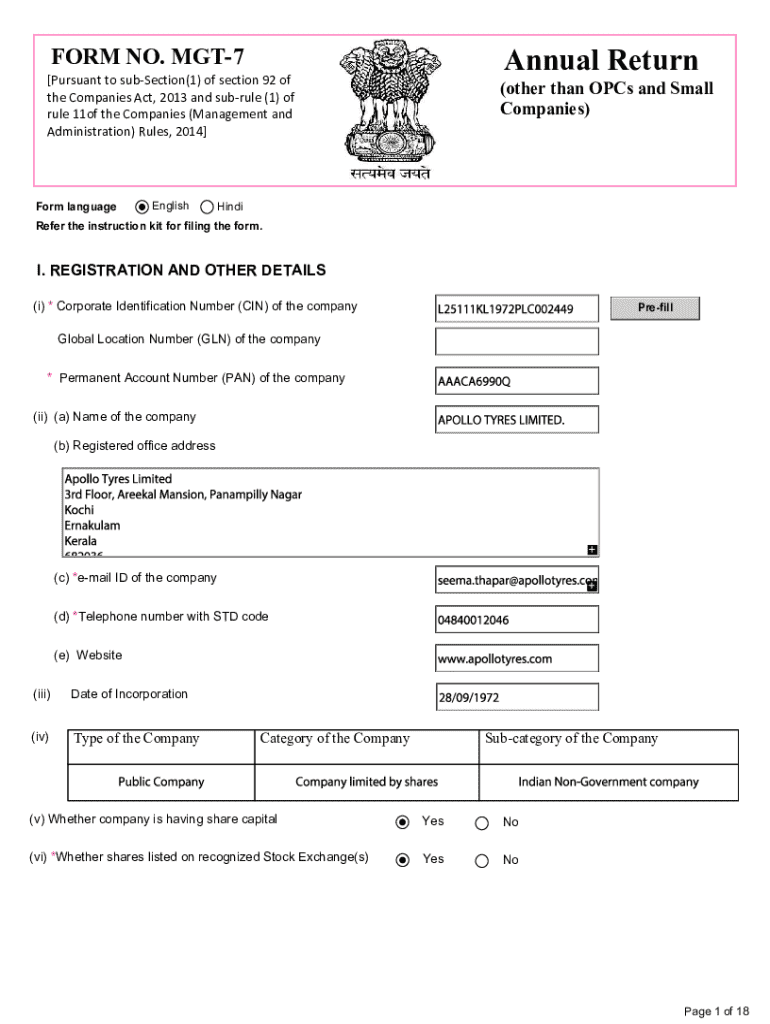

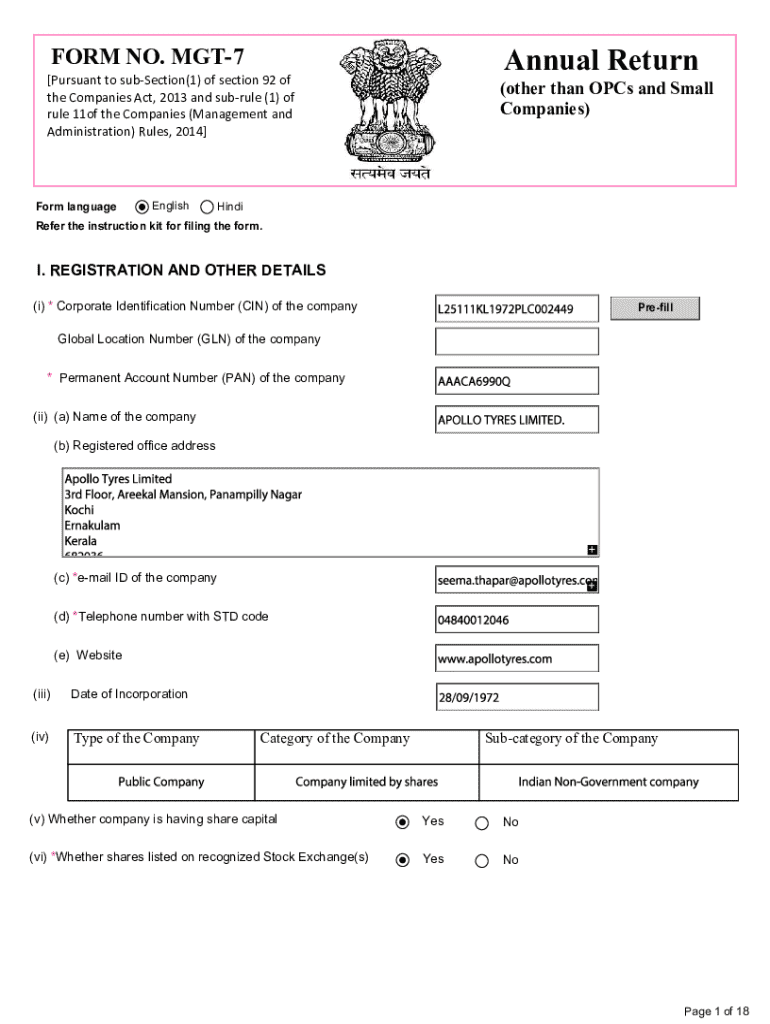

Understanding the annual return form

The annual return form is a crucial document that corporations must file with their local regulatory authority. It provides a snapshot of the company's financial health and governance structure. This form is distinct from the annual financial statements and often includes key data points that regulators use to ensure compliance with corporate laws.

Filing annual returns is essential because it allows companies to maintain good standing in their jurisdiction. It reflects transparency in business operations and helps in building trust with shareholders, investors, and other stakeholders. Without this filing, companies may face penalties or lose their rights to operate.

Who needs to file an annual return?

Every registered company is required to file an annual return form within the stipulated timeframe established by regulatory bodies. This includes public companies, private limited companies, and certain not-for-profit entities. It is imperative for corporations to know their specific obligations, as they vary based on jurisdiction.

Certain exemptions may apply to specific types of organizations, especially those that have been inactive or dissolved. Smaller companies may also enjoy relaxed filing requirements depending on local regulations. However, it’s essential to seek advice or conduct thorough research to understand these nuances.

Preparing to complete your annual return form

Before diving into the process of filling out the annual return form, it’s vital to gather all necessary information. This includes precise company registration details such as your business number or tax identification number, up-to-date financial data, and relevant governance documents.

It’s equally important to be well aware of the deadlines associated with your filing. Many jurisdictions have specific periods within which companies are required to submit their annual return, usually tied to the financial year-end. Understanding these timelines ensures that businesses avoid late fees and maintain their good standing.

Step-by-step guide to filling out the annual return form

Completing the annual return form accurately is vital for compliance and future company stability. Start by accurately entering your company details in the designated section. This includes the registered office address, contact numbers, and other identifying information necessary for the regulatory authorities.

Next, input the shareholder information, including names and shares owned. This transparency is essential for regulatory checks and ensuring shareholder rights are respected. After that, complete the financial statements section, which should reflect the financial standing of the company and align with submitted financial documents.

Lastly, provide the date of the annual general meeting. This date is critical for compliance and informs investors when the company shares its performance and future direction with its stakeholders.

Submitting your annual return form

After completing your annual return form, the next step is submission. Businesses typically have the option to file their documents electronically or via hard copy. Electronic submissions are encouraged due to their speed and efficiency, as they often allow for quicker processing and feedback.

While both submission methods are valid, electronic filing may require you to be familiar with the specific online platforms or portals used by your regulatory body. Ensure you understand the submission process thoroughly and follow all required steps for a successful filing.

Managing and storing your annual return form

Effective document management is critical for any business, particularly concerning legal and compliance documents like your annual return form. Keeping a well-organized archive of past returns can be beneficial for future reference and audits.

pdfFiller offers powerful tools to manage your documents seamlessly. With features for editing and signing, cloud storage solutions, and collaborative options for team members, managing your annual return becomes less daunting.

FAQs on annual returns

After submitting your annual return, the next steps may involve waiting for confirmation from the regulatory authority. They may take some time to process submissions, and it’s paramount to keep track of any received notifications.

Updating your annual return information after submission can be possible depending on the specific regulations of your jurisdiction. Businesses must follow the guidelines to make amendments correctly and timely.

Missing a filing deadline can have serious repercussions, including fines or penalties. Organizations should have measures in place to alert them of upcoming deadlines to mitigate risks.

Conclusion: Empowering your document management with pdfFiller

Utilizing pdfFiller for your annual return filing can significantly ease the burden of managing corporate documentation. With its comprehensive range of interactive tools, businesses can navigate the complexities of annual return forms more efficiently.

From easy editing to cloud storage and team collaboration features, pdfFiller empowers companies to stay organized and compliant. Leveraging these tools can lead to streamlined processes and enhance the overall integrity of corporate governance.

Related topics to explore

Understanding the broader context of corporate filings is crucial for business success. Companies should explore other necessary corporate documents and the process of updating company registration details, as this knowledge can contribute to better governance and compliance.

Legal and compliance aspects

Filing annual returns is not solely a matter of bureaucratic necessity but is governed by specific laws that vary by jurisdiction. Compliance with these laws ensures that companies operate within legal frameworks, thereby protecting their interests and those of their stakeholders.

Understanding the implications of non-compliance is equally important. Companies can face significant penalties, including fines, restrictions, or even dissolution. Staying informed about the legislative landscape surrounding annual returns helps businesses to avoid pitfalls associated with non-compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my annual return directly from Gmail?

How can I edit annual return on a smartphone?

How do I fill out the annual return form on my smartphone?

What is annual return?

Who is required to file annual return?

How to fill out annual return?

What is the purpose of annual return?

What information must be reported on annual return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.