Get the free Wage Determinations Davis-Bacon Act WD # OH20250081

Get, Create, Make and Sign wage determinations davis-bacon act

How to edit wage determinations davis-bacon act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wage determinations davis-bacon act

How to fill out wage determinations davis-bacon act

Who needs wage determinations davis-bacon act?

Wage Determinations Davis-Bacon Act Form: A Comprehensive Guide

Understanding the Davis-Bacon Act

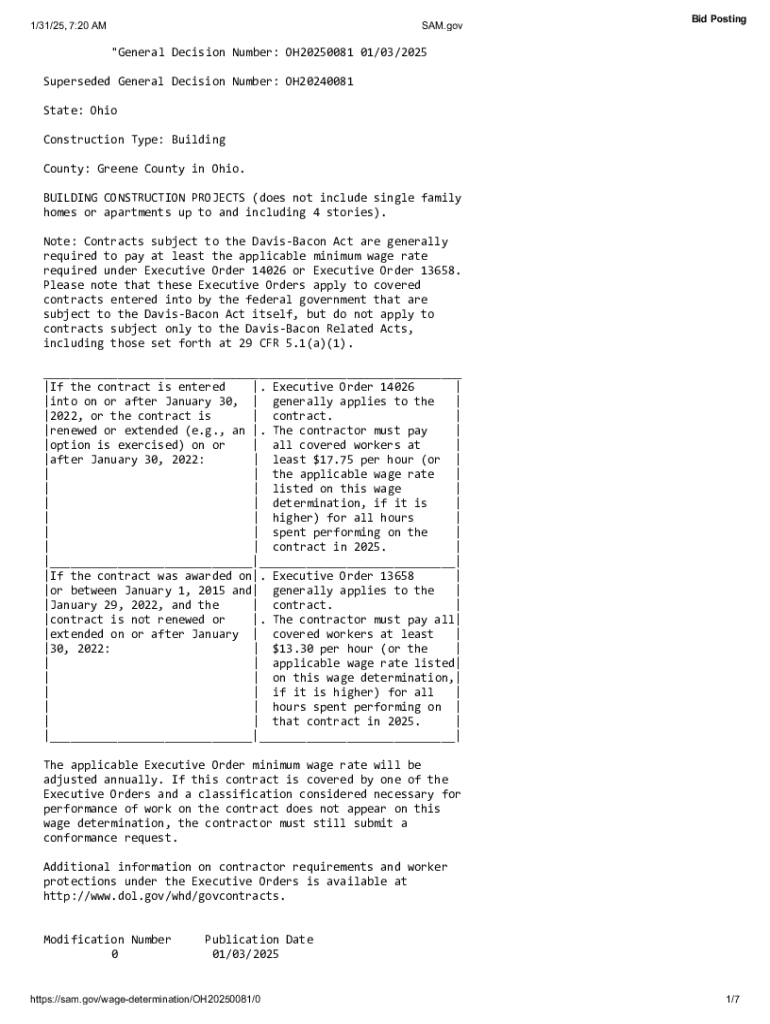

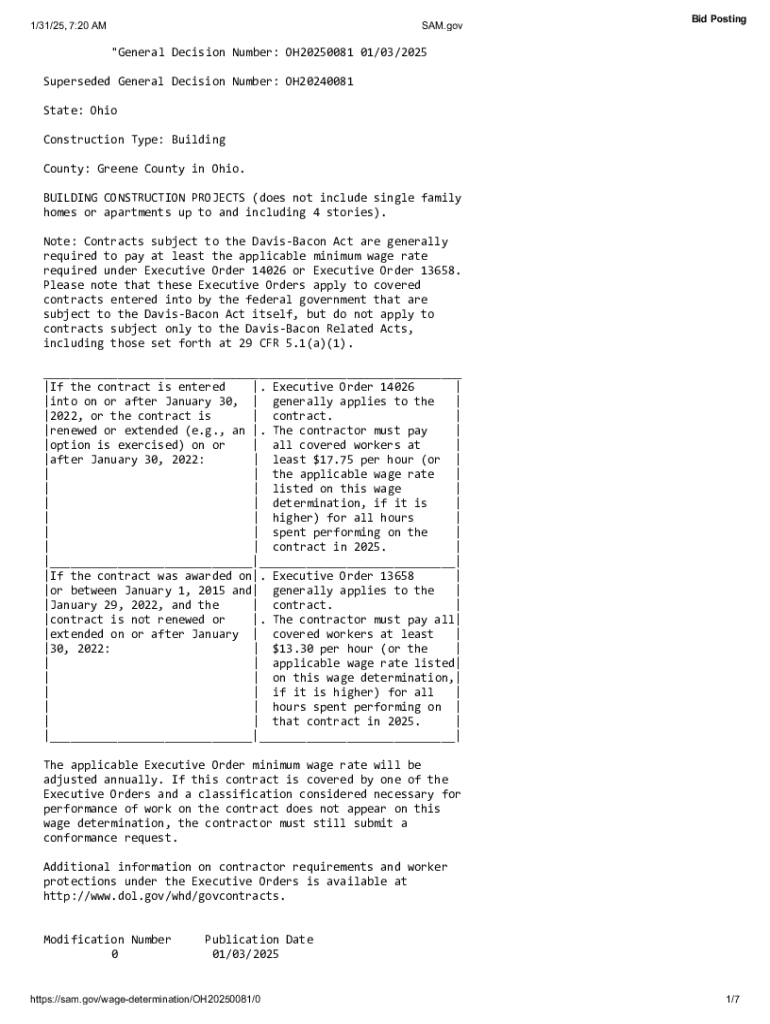

The Davis-Bacon Act, enacted in 1931, serves as a foundational piece of legislation aimed at ensuring fair wages for workers involved in federally funded or assisted construction projects. This act requires contractors and subcontractors to pay their laborers at least the locally prevailing wages for similar work. The goal is not just to protect workers but also to create a competitive environment for contractors while discouraging the underbidding that undermines local wage standards.

Understanding the significance of wage determinations becomes crucial within this context. These determinations designate the minimum wage standards for construction projects based on local data. Employers must comprehend key terminology associated with wage determinations to ensure compliance and satisfactory working conditions.

Overview of Wage Determinations

Wage determinations serve as a critical tool for ensuring fair compensation under the Davis-Bacon Act. These are official documents that specify the minimum wages and fringe benefits required for various labor classifications on federally funded projects. There are two primary types of wage determinations: general and project. General Wage Determinations (GWDs) apply broadly to a wide range of projects, whereas Project Wage Determinations (PWDs) are tailored specifically for individual projects.

Establishing wage determinations involves extensive data collection, including local wage surveys conducted by the Department of Labor. This ensures that the wages reflect the economic conditions and labor market of the area in which the construction takes place, promoting fairness and transparency in labor standards.

Physical inclusion of wage determinations in contracts

The legal framework mandates wage determinations be incorporated into contracts for applicable projects. This inclusion protects both workers and employers by clearly defining wage obligations upfront. Contractors must lack compliance to ensure they adhere to the mandated wage requirements during the bid process. Failing to include or properly reference wage determinations could lead to significant legal issues or contractual disputes.

Incorporating wage determinations requires careful documentation. Contractors should reference the specific wage determination number throughout their bids and ensure that all subcontractors are also informed of these wage obligations to maintain compliance at every project level.

Selecting the proper wage determination(s)

Correctly selecting wage determinations is vital for compliance, and several key factors should be considered. Chief among these is the location of the construction project, as wage rates can vary significantly across different regions. Additionally, the type of construction — residential, commercial, or heavy/highway — greatly influences which wage determination applies.

To facilitate the selection process, contractors can utilize various online tools and databases that aggregate relevant wage data. These resources allow for speedy access to current wage determinations and ensure that bids reflect regional wage standards accurately. In instances where multiple wage determinations may apply, it’s essential to address potential complexities to maintain compliance.

Modifications and updates to wage determinations

Wage determinations are subject to updates and modifications to reflect changing market conditions or adjustments to labor standards. Understanding the modification process is essential for contractors and subcontractors as it directly impacts existing contracts. Anytime a wage determination is reissued, it may come with changes to wage rates or classifications that could affect project compliance.

To stay informed, contractors should regularly check for updates to wage determinations through official channels like the Department of Labor’s website. Knowledge of key updates is especially critical in pre-contract award situations, where changes in wage determinations could impact the competitiveness of bids.

How to interpret general wage determinations

Interpreting wage determinations correctly is essential for compliance and proper budgeting. Each wage determination typically includes classifications, basic hourly rates, and fringe benefits. The classifications delineate specific job functions and roles, providing clarity on which rates apply based on the work performed.

Understanding classification identifiers and union codes is also critical. Each classification has a unique identifier that signals to contractors and workers the specific roles covered under that determination. Survey and average rate identifiers provide additional contextual information, highlighting how rates are derived and standardized across the board.

Practical steps for obtaining wage determinations

Obtaining the right wage determinations involves knowing where to look and how to properly file for project-specific determinations. The primary source for accessing Davis-Bacon wage determinations is through official online resources provided by the U.S. Department of Labor, which maintains a comprehensive database of current wage rates.

Additionally, contractors can file for Project Wage Determinations if a specific project requires rates tailored to unique conditions. Accessing previous Federal Wage Determinations allows for historical context, guiding current bidding practices and ensuring compliance with past wage standards where applicable.

Common issues and resolution strategies

As with any regulatory framework, challenges may arise during the wage determination process. Common issues include clerical errors in wage determination documents, which can lead to confusion and unintended contractual violations. Contractors must know how to address such issues proactively to avoid significant fallout.

In addition, issues regarding wage determination extensions can emerge; therefore, understanding the procedures for seeking clarity or requesting amendments is critical. Navigating conflicts during the bidding process requires strategic resolution and partnership with legal counsel to safeguard compliance, ensuring all parties understand their obligations and rights under the Davis-Bacon Act.

Help and support

Navigating wage determinations can be daunting without adequate support. Contractors should know where to seek assistance for compliance-related inquiries, especially through government resources dedicated to the discussion of the Davis-Bacon Act. Engaging with dedicated support teams helps to clarify legal obligations and promote adherence to both state and federal laws. Resources like the Office of Construction & Facilities Management can provide guidance and clarity.

Furthermore, veterans and workers facing personal challenges can tap into resources like the Veterans Crisis Line, offering emotional and mental health support. Engaging professional legal assistance can also contribute significantly to resolving potential conflicts or misunderstandings related to wage determinations.

pdfFiller’s solutions for managing wage determinations

For individuals and teams managing wage determinations, pdfFiller offers a robust cloud-based platform that simplifies document management. From editing to eSigning, pdfFiller empowers users to easily edit documents, ensuring your wage determination forms are up-to-date and compliant before submission. The platform also enables seamless collaboration, allowing multiple team members to work on documents simultaneously while maintaining version control.

Accessing and managing forms from anywhere increases efficiency in construction project management, allowing users to focus on compliance without the hassle of paperwork delays. With pdfFiller, you can tackle wage determinations efficiently, ensuring accurate and timely submissions while adhering to labor laws.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit wage determinations davis-bacon act from Google Drive?

How can I send wage determinations davis-bacon act for eSignature?

How do I fill out the wage determinations davis-bacon act form on my smartphone?

What is wage determinations davis-bacon act?

Who is required to file wage determinations davis-bacon act?

How to fill out wage determinations davis-bacon act?

What is the purpose of wage determinations davis-bacon act?

What information must be reported on wage determinations davis-bacon act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.