Get the free Form 1120-s

Get, Create, Make and Sign form 1120-s

Editing form 1120-s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 1120-s

How to fill out form 1120-s

Who needs form 1120-s?

A Comprehensive Guide to Filling Out Form 1120-S

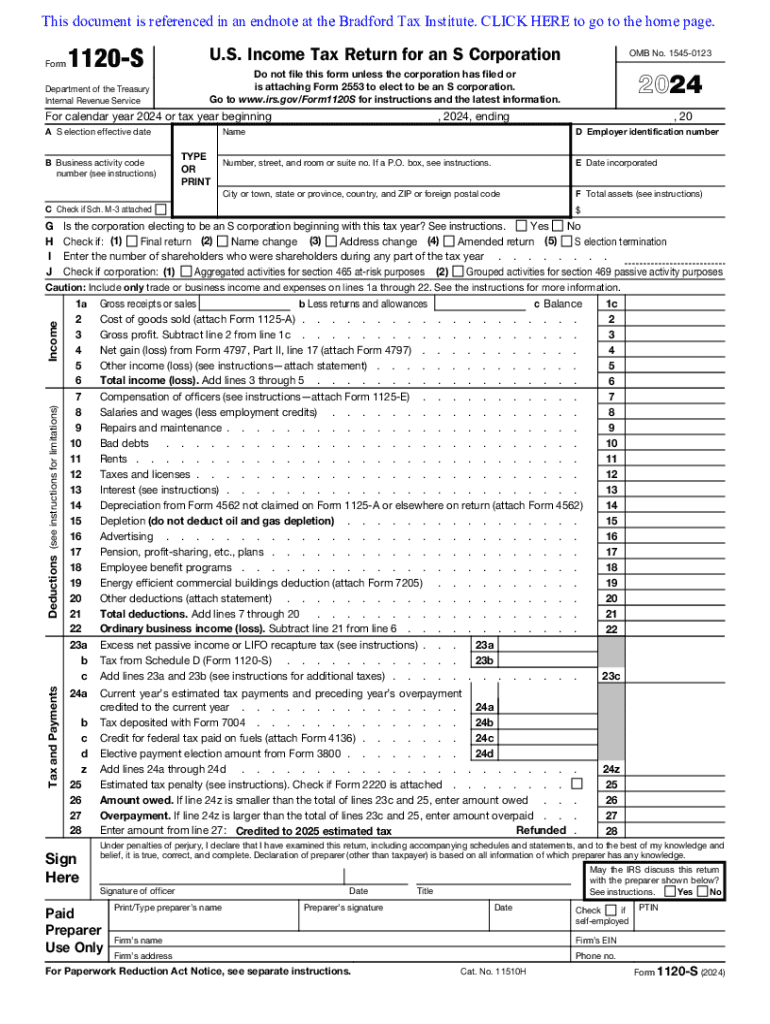

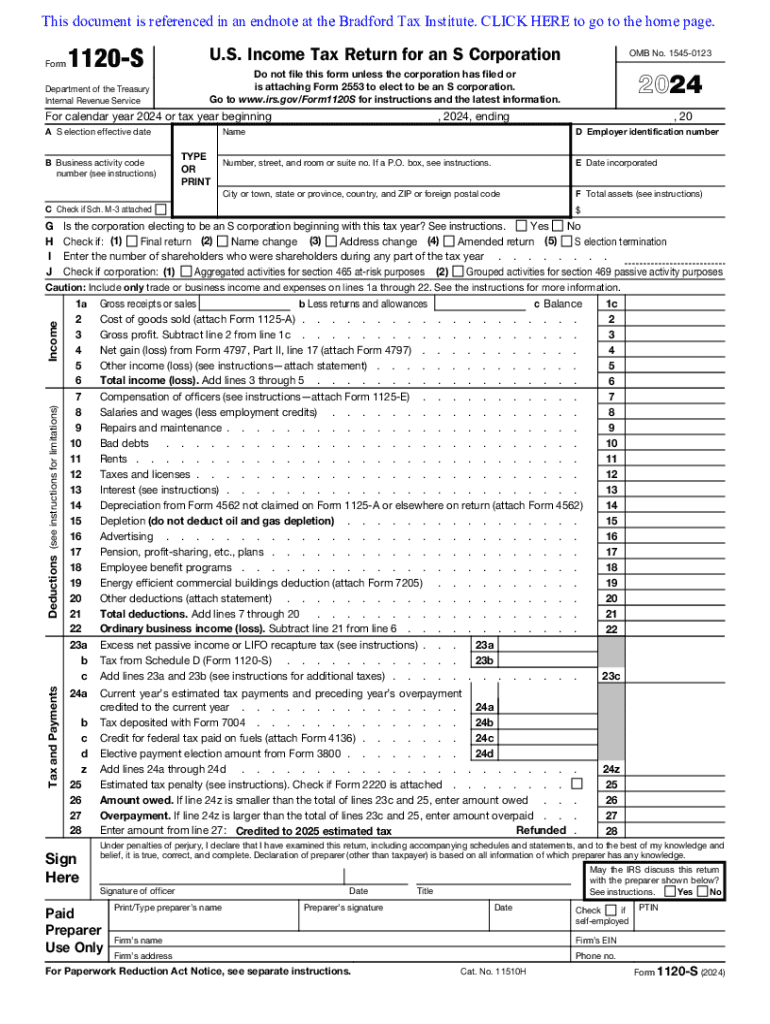

Overview of Form 1120-S

IRS Form 1120-S is a crucial document filed by an S Corporation to report income, gains, losses, deductions, and credits. This form is significant because it allows the corporation to maintain its status as an S Corporation, which provides tax advantages including pass-through taxation to shareholders.

S Corporations are typically small to medium-sized entities where shareholders benefit from limited liability while avoiding the double taxation often applied to traditional corporations. Companies that choose this structure must file Form 1120-S annually, making it essential for those interested in this business model.

Key features of Form 1120-S

Form 1120-S consists of several sections and key fields designed to collect necessary information about the corporation's financial performance. The structure typically includes spaces for basic identification details, income, deductions, and a tax computation section.

Additionally, important attachments such as Schedule K-1 must accompany Form 1120-S to report each shareholder's share of income, deductions, and credits. Understanding common terms like 'pass-through income' and 'distributions' is essential to accurately complete the form and avoid costly mistakes.

Filling out Form 1120-S: Step-by-step instructions

Completing Form 1120-S requires methodical attention to detail across several steps, ensuring that every aspect of the corporation's finances is represented accurately.

Step 1: Basic information and identification

Begin by entering the company name, address, and Employer Identification Number (EIN). Providing accurate shareholder details, including names and stock ownership percentages, is essential as these determine the distribution of income on Schedule K-1.

Step 2: Income and deductions

Next, report all sources of income the S Corporation earned throughout the year. Common types include gross receipts, sales, and dividends. It’s crucial to ensure all income aligns with prior financial records and business activities.

Following income, list your deductions. Common deductions include salaries and wages, rent, utilities, and any necessary business expenses. Adequate documentation is vital to substantiate these claims.

Step 3: Tax computation

After income and deductions are determined, use this information to calculate the tax owed. Unlike C Corporations, S Corporations typically do not pay federal income tax directly. This pass-through taxation means that shareholders will report S Corporation income on their personal tax returns.

Step 4: Completing additional schedules

Finally, complete any additional schedules as required. Schedule M-1 reconciles income (or loss) per books with what is reported, while Schedule M-2 analyzes retained earnings. Both schedules help clarify any discrepancies and ensure the accuracy of the submitted information.

Form 1120-S examples

To enhance your understanding of Form 1120-S, here are a couple of illustrative examples showing key sections of the form completed.

For instance, a digital marketing S Corporation reporting $200,000 in revenue could enter its total income and identify deductions such as $50,000 for salaries and $30,000 for advertising expenses. Another example is a consultancy firm that has $150,000 in revenue with $40,000 in operating expenses, thus reporting these in their respective sections.

These examples demonstrate how various types of S Corporations might report distinctly based on their service offerings and financial structures.

Frequently asked questions about Form 1120-S

Several common questions arise when filing Form 1120-S, many of which revolve around deadlines and penalties.

Common mistakes to avoid when filling out Form 1120-S

Common pitfalls exist when completing Form 1120-S that could lead to serious consequences, including financial penalties. One key area is the inaccuracy in financial reporting, which constituents could easily fall victim to due to oversight.

Another mistake is missing filing deadlines; thorough planning can prevent unintentional delays. Furthermore, omitting necessary attachments and documentation can lead to rejection or inquiries from the IRS, underscoring the importance of diligent preparation.

Utilizing pdfFiller for Form 1120-S

pdfFiller offers an efficient platform for managing Form 1120-S with interactive tools for filling, editing, and signing. Users can easily access the Form 1120-S template directly from the platform, helping to ensure they are using the most up-to-date version, compliant with the latest IRS guidelines.

The platform allows for seamless collaboration, making it convenient for teams to work together on completing the form. Users can take advantage of electronic signatures and cloud storage, ensuring that all documents are easily accessible from anywhere. These features simplify the filing process dramatically and reduce the room for errors.

Resources for S Corporations

A wealth of resources is available to assist S Corporations in navigating the complexities of filing Form 1120-S. The IRS website provides comprehensive guidelines and FAQs that have been specifically designed for S Corporations.

Apart from IRS resources, consulting tax professionals can provide tailored advice that fits the specific needs of your business. Tracking compliance updates and tax law changes is also vital in maintaining good standing with the IRS as an S Corporation.

Key takeaways

Filing Form 1120-S is essential for S Corporations to ensure compliance with IRS regulations. Properly completing this form allows shareholders to enjoy the tax advantages provided under the S Corporation structure. Moreover, utilizing tools like pdfFiller streamlines the process, making form completion, submission, and management a hassle-free experience.

By adhering to the guidelines and recommendations outlined, S Corporations can minimize errors, avoid penalties, and focus on their business growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 1120-s?

Can I create an eSignature for the form 1120-s in Gmail?

Can I edit form 1120-s on an Android device?

What is form 1120-s?

Who is required to file form 1120-s?

How to fill out form 1120-s?

What is the purpose of form 1120-s?

What information must be reported on form 1120-s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.