Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form How-to Guide

Understanding Form 990: A Comprehensive Overview

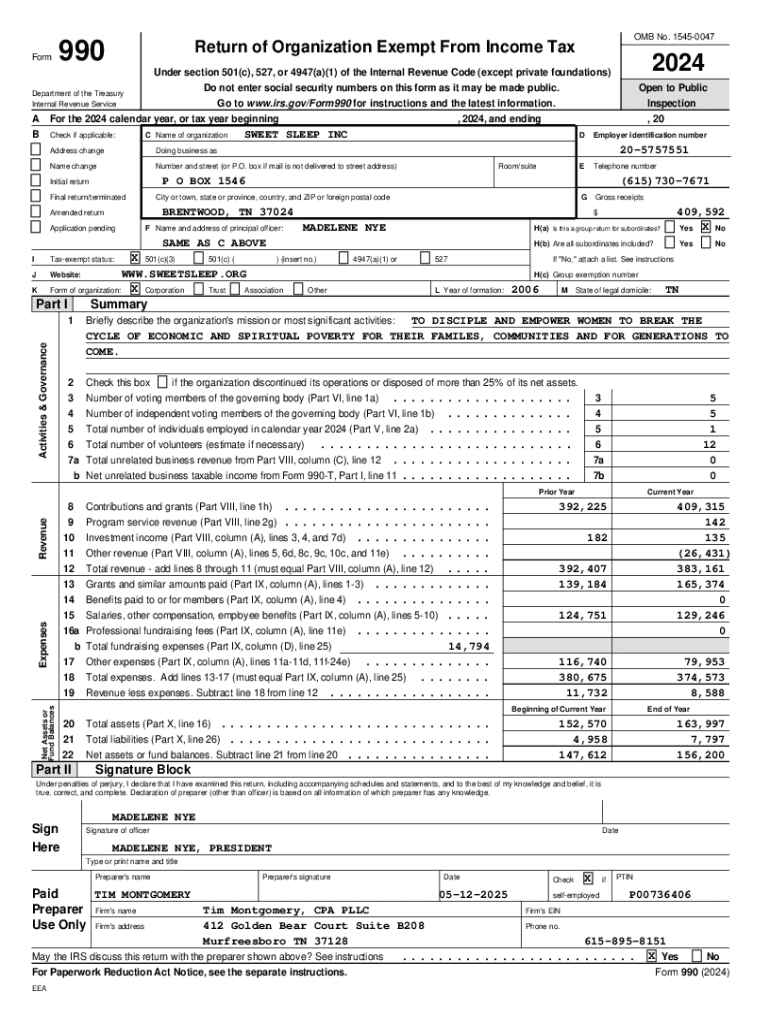

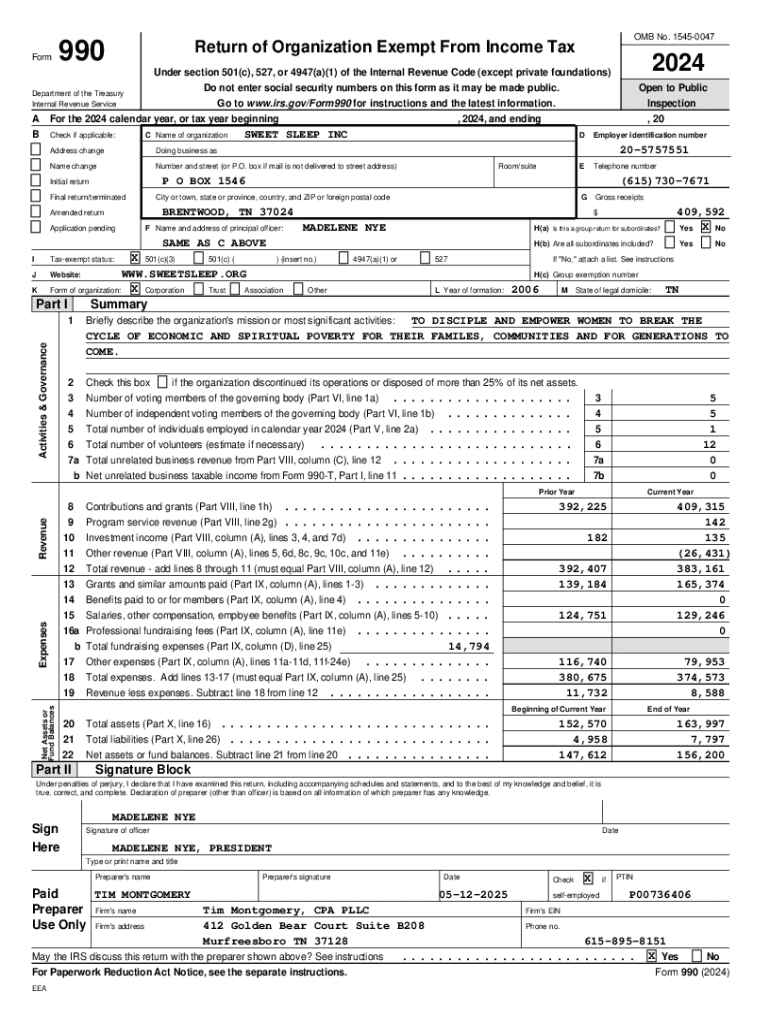

Form 990 is a crucial document that nonprofit organizations in the United States are required to file with the Internal Revenue Service (IRS). This form serves multiple purposes, primarily to ensure transparency in the operations of charitable organizations. By disclosing financial and programmatic information, Form 990 allows the IRS and the public to gauge the organization’s financial health and compliance with tax regulations.

The importance of Form 990 cannot be overstated. It plays a vital role in maintaining public trust, as it informs donors, grant makers, and the general public about how organizations use their funding. Additionally, the key components of this form include financial statements, governance practices, and details about programs and services, all of which contribute to understanding an organization’s impact.

Who needs to file Form 990?

Most tax-exempt organizations must file Form 990, with specific criteria dependent on the organization's income and type. Generally, organizations with gross receipts exceeding $200,000 or total assets over $500,000 must file the standard Form 990. Smaller organizations may be eligible to use Form 990-EZ or Form 990-N, also known as the e-Postcard, which simplifies the process.

However, some organizations are exempt from filing, including churches, certain governmental entities, and organizations that are classified as private foundations. For those who do not meet the mandatory filing requirements, voluntary filing can enhance credibility and provide a clearer picture of their activities, attracting potential donors and fostering trust.

Filing modalities for Form 990

Organizations have several options for filing Form 990, including paper and electronic submissions. However, eFiling is increasingly becoming the preferred method due to its efficiency and the instantaneous nature of electronic systems. The IRS offers an online submission portal for eFiling, simplifying what can otherwise be a cumbersome process.

To start eFiling, organizations must select a compatible software provider approved by the IRS. The key deadlines to remember include the due date of the 15th day of the 5th month after the end of the organization's accounting period. Organizations can also apply for an extension using Form 8868 if they need additional time to prepare their filings.

Detailed breakdown of Form 990 sections

Form 990 consists of several parts, each serving distinct purposes, starting with Part I, which provides an overview of the organization's mission and key operations. Accurate summaries are critical here, as they set the stage for the more detailed information that follows, allowing reviewers to quickly grasp essential aspects of your nonprofit.

Part II covers the Signature Block, which requires the signature of an authorized representative. It's imperative to ensure that this section complies with IRS requirements, including the use of e-signatures where applicable. In Part III, organizations detail their program accomplishments, which is an excellent opportunity to craft a narrative that resonates with stakeholders, showcasing your mission's impact.

Parts IV-VI delve into financial information, where organizations report income, expenses, and net assets. Accurate reporting in this domain cannot be underestimated, as financial integrity is paramount. Finally, Part VII addresses governance and management, encouraging nonprofits to adopt best practices in reporting their leadership structures, thereby reinforcing accountability.

Responsibilities of Form 990 signers

The signing of Form 990 is not merely a formality; it carries significant legal implications. Authorized individuals, typically board members or executives, must ensure the accuracy and completeness of the information provided. Misrepresentation can lead to severe penalties and loss of tax-exempt status.

To ensure compliance, organizations may leverage pdfFiller’s eSign feature. This streamlines the signature process, allowing for quicker approvals without compromising on legal validity. Ensuring that the signers understand their responsibilities is essential for maintaining organizational integrity and compliance.

Common mistakes to avoid when filing Form 990

Filing Form 990 can be complex, and many organizations make avoidable mistakes. One common error is overlooking deadlines, which can result in penalties. Additionally, misreporting financial data, whether due to simple errors or misleading data, can have severe consequences and damage the organization’s reputation.

Another critical mistake is neglecting to disclose required information, particularly regarding compensation for board members and executives. Ensuring that all necessary documentation is in order and verified can prevent many issues from arising down the line.

Public inspection regulations and compliance

One of the key aspects of Form 990 is its requirement for public inspection. The IRS mandates that organizations make their Form 990 available to the public, either on their website or upon request. Understanding this regulation is crucial for nonprofits, as it invites public scrutiny and requires a proactive approach to transparency.

To prepare for this public inspection, nonprofits should ensure that the information presented is clear, accurate, and aligned with organizational goals. Leveraging Form 990 for trust-building with donors enhances the organization's credibility, allowing potential funders to see firsthand how their contributions create meaningful impacts.

The role of Form 990 in charity evaluation and research

Form 990 serves as a critical resource for assessing nonprofit effectiveness. Researchers, grant makers, and donors utilize this form to evaluate how well organizations align with their missions and to analyze financial health. Understanding donor patterns, program effectiveness, and overall organizational sustainability are achievable through a careful examination of Form 990 data.

For researchers and evaluators, having practical tips can streamline the use of this information. Analyzing trends through different fiscal years can reveal insights about growth, funding shifts, and impact, thus enhancing their understanding and decision-making capabilities.

Navigating other variants of Form 990

In addition to the standard Form 990, there are several variants tailored to different types of organizations. For smaller nonprofits, Form 990-EZ provides a simplified filing procedure, making it easier to adhere to IRS requirements while maintaining compliance. This variant is particularly valuable for organizations with less financial complexity.

For very small organizations, Form 990-N, or the e-Postcard, is an accessible option that requires minimal information. It allows small nonprofits to maintain their tax-exempt status without the burden of extensive reporting. Additionally, the Form 990-PF is designed specifically for private foundations, addressing their unique reporting needs.

Utilizing technology for Form 990 management

Technology, particularly platforms like pdfFiller, significantly improves document management for organizations filing Form 990. From document creation to eSignatures, pdfFiller enables nonprofits to manage their filings efficiently within a cloud-based environment, reducing paperwork and enhancing accessibility.

Interactive tools available through pdfFiller facilitate easy editing and collaboration, making it simple for teams to work together on their Form 990 filings. Incorporating digital signatures streamlines the signing process, thus ensuring compliance while reducing time and effort.

Third-party resources for completing Form 990

Nonprofits can benefit from numerous third-party resources when completing Form 990. Several professional services specialize in assisting nonprofit organizations with their filings, ensuring accuracy and compliance with IRS regulations. Additionally, many online communities and forums provide a space for organizations to seek advice and share best practices.

Furthermore, continuing education blogs and articles can offer valuable insights into best practices, recent changes in tax laws affecting nonprofits, and tips for effective financial reporting. Engaging with these resources can foster a culture of learning within organizations, enabling them to leverage the insights gleaned from their Form 990 filings.

Seeking help with Form 990 filing

While filling out Form 990 may seem manageable, there are situations when it is prudent to consult a tax professional or legal expert. Complex financial scenarios or unique organizational structures may necessitate expert guidance to navigate the intricacies of tax compliance effectively.

Organizations facing troubleshooting issues with Form 990 can utilize pdfFiller support for prompt assistance. They also provide a FAQ section to help users address common inquiries related to filing, ensuring that nonprofits stay informed and well-prepared.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 990 in Gmail?

Can I create an electronic signature for the form 990 in Chrome?

How can I edit form 990 on a smartphone?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.