Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990 Form: A Comprehensive How-to Guide

Understanding Form 990

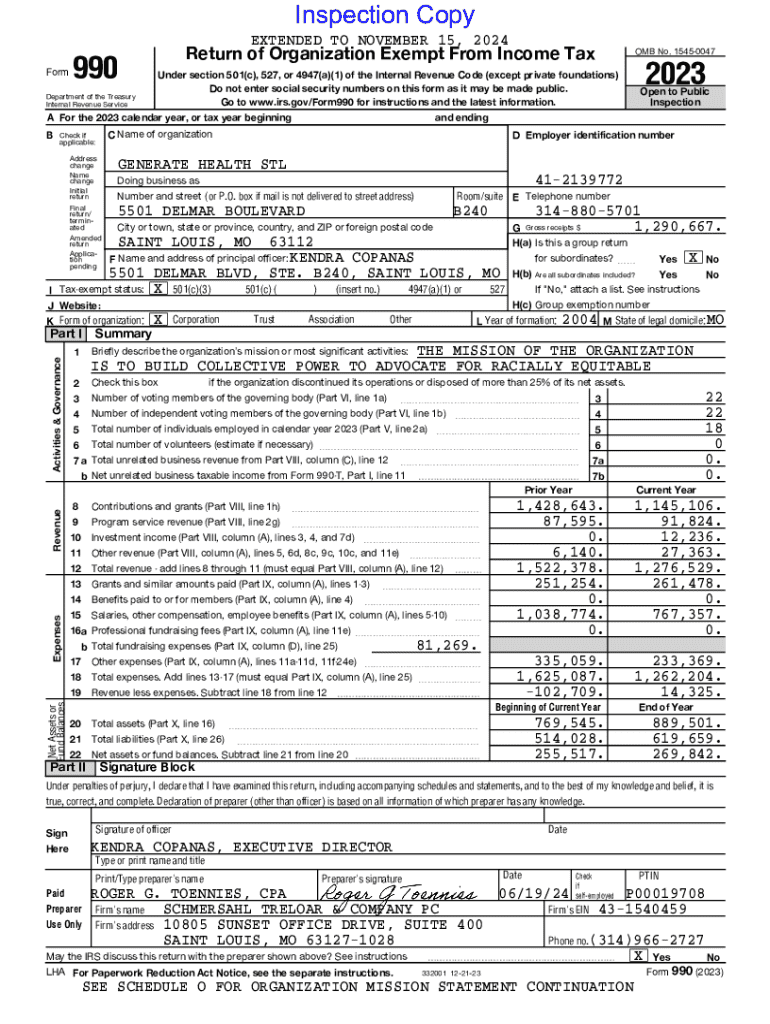

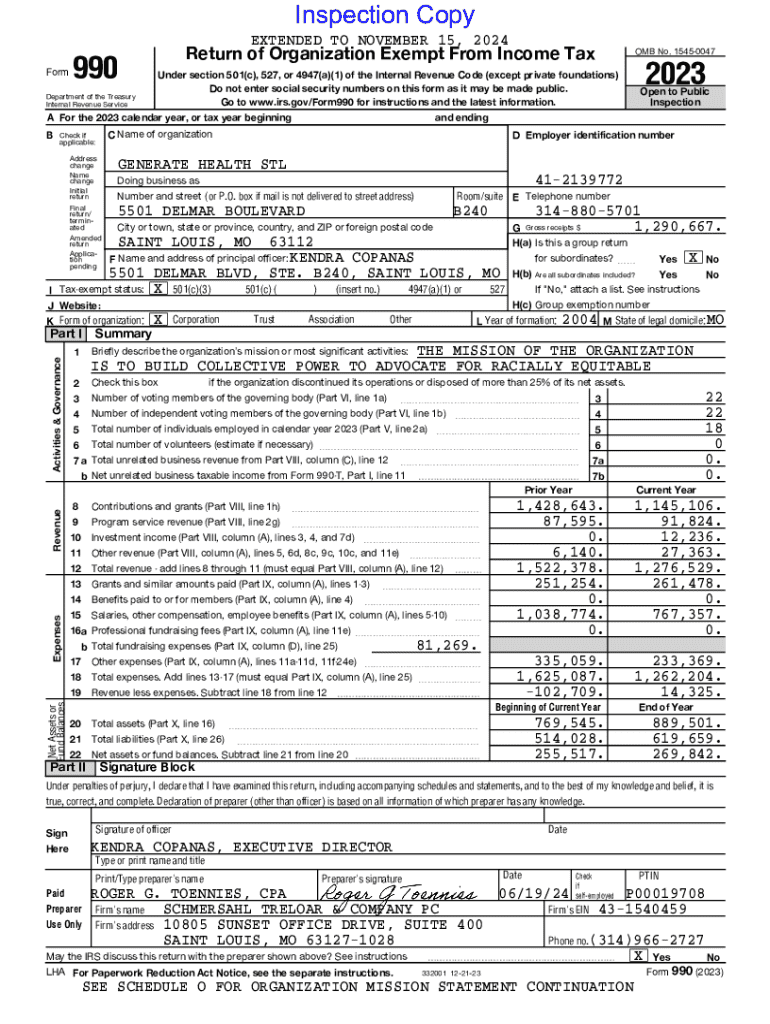

Form 990 is a crucial tax document for nonprofits, providing the Internal Revenue Service (IRS) with essential information about the organization's mission, governance, and financial health. This form serves as a tool for transparency and accountability, ensuring that nonprofits operate in the public interest and adhere to legal requirements. Nonprofit organizations, including charities, cultural organizations, and educational institutions, are typically required to file Form 990 if their gross receipts exceed $200,000 or total assets exceed $500,000.

Initially introduced in the 1940s, Form 990 has undergone numerous revisions to enhance transparency. Today, it plays an integral role in maintaining public trust in the nonprofit sector by allowing individuals, researchers, and other stakeholders to access vital information about nonprofit operations. Organizations that file this form demonstrate their commitment to ethical fundraising and responsible expenditure of resources.

Components of Form 990

Form 990 consists of several sections, each designed to provide comprehensive insights into the organization's activities and financial standing. Below is a breakdown of key sections:

Understanding the financial information in Form 990 is key for both nonprofits and their stakeholders. Key metrics such as total revenue, program expenses, and the ratio of program expenses to total expenses can indicate the financial health of an organization. Stakeholders are encouraged to analyze these metrics to gauge the effectiveness and sustainability of nonprofit operations.

Filing requirements for Form 990

Not all nonprofits are required to file Form 990, but those that meet specific criteria must comply with filing regulations. Organizations that typically need to file include public charities, private foundations, and some government entities. However, smaller organizations with gross receipts below $200,000 or total assets below $500,000 may file Form 990-EZ, a simplified variant.

Form 990 must be filed either electronically or on paper, but e-filing is increasingly encouraged to facilitate swift processing. Organizations are subject to different deadlines depending on their fiscal year end. Generally, Form 990 must be filed by the 15th day of the 5th month after the end of the fiscal year. Failure to file on time can result in penalties, making punctuality crucial for compliance.

Interactive tools for managing Form 990

pdfFiller can significantly streamline the process of completing Form 990. Here's a step-by-step guide to using pdfFiller for this essential task:

Moreover, pdfFiller features collaborative tools, allowing team members to work together effectively on Form 990. This is especially valuable for larger organizations where multiple stakeholders are involved in the filing process. By tracking changes and managing document versions, organizational teams can ensure that all aspects of the filing are reviewed and approved.

Public inspection regulations

Form 990 plays a critical role in promoting transparency within the nonprofit sector. The IRS mandates that nonprofit organizations make their Form 990 accessible to the public, typically by providing them upon request or by posting them on their websites. This accessibility allows potential donors, researchers, and watchdog organizations to evaluate how funds are being utilized and assess the organization’s fiscal health.

Public inspection of Form 990 not only fosters trust but also encourages nonprofits to maintain ethical practices. Stakeholders can analyze this data, ensuring accountability and helping them make informed decisions regarding donations and support.

Best practices for Form 990 preparation

Preparing Form 990 can be complex, and there are several common pitfalls organizations should avoid. Frequent errors include inaccuracies in reporting revenue or expenses, failing to provide required information, and omitting important schedules. Such inaccuracies can lead to penalties or damage to the organization's reputation.

To enhance the likelihood of a successful filing, nonprofits should organize their data in advance. Keeping up-to-date records of financial transactions and program activities is critical. Utilizing detailed checklists can help ensure that all necessary information is included, facilitating a more manageable filing process. Additionally, reviewing previous year’s Form 990 can provide valuable insights into what has been filed and what improvements can be made.

Form 990 for evaluation and research

Form 990 serves as a vital resource for donors and researchers interested in nonprofit evaluation. By using the data provided in Form 990, they can assess the financial stability and operational effectiveness of nonprofits. Indicators such as fund distribution to program services, levels of fundraising expenses, and administrative costs can inform stakeholders about the organization’s performance.

To interpret the financial health of nonprofits accurately, evaluators should focus on ratios and comparative benchmarks. Understanding these financial dynamics allows donors to make informed decisions and helps raise the accountability standards across the nonprofit sector.

Variants of Form 990 and their use

To accommodate organizations of various sizes and structures, the IRS provides several variants of Form 990. The main versions include:

Understanding which version to file is essential for compliance. Improper filing can result in penalties or losing tax-exempt status, impacting the organization profoundly.

Recent changes and future outlook

The landscape surrounding Form 990 continues to evolve, reflecting the changing needs of the nonprofit sector. Recent regulatory updates aim to streamline the filing process and enhance the data collection requirements to offer more transparency. Such changes signal an increasing emphasis on accountability, especially amid heightened scrutiny on nonprofit operations from both regulators and the public.

Looking ahead, technological advancements, including cloud-based solutions, will play a pivotal role in simplifying document management. Continued enhancements to digital platforms like pdfFiller will empower organizations to adapt to new filing requirements efficiently and improve overall compliance.

Engaging with the nonprofit community

Being part of the nonprofit community entails staying informed about best practices and compliance requirements regarding Form 990. Engaging in forums, webinars, and industry associations can provide invaluable networking opportunities and insights into effective filing strategies.

Subscribing to publications and blogs dedicated to nonprofit management can also enhance one’s understanding of Form 990. Leveraging these resources helps organizations stay updated on trends, regulatory changes, and effective operational practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 990?

Can I create an electronic signature for the form 990 in Chrome?

How do I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.