Get the free Ftb 3500

Get, Create, Make and Sign ftb 3500

How to edit ftb 3500 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ftb 3500

How to fill out ftb 3500

Who needs ftb 3500?

Comprehensive Guide to the FTB 3500 Form

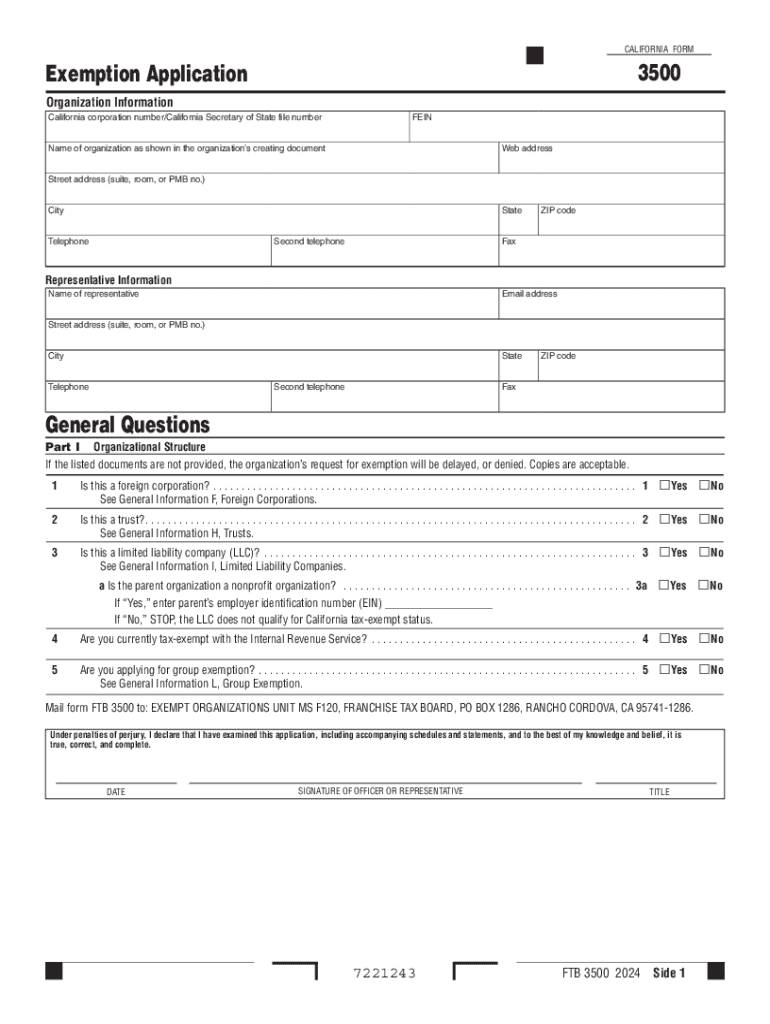

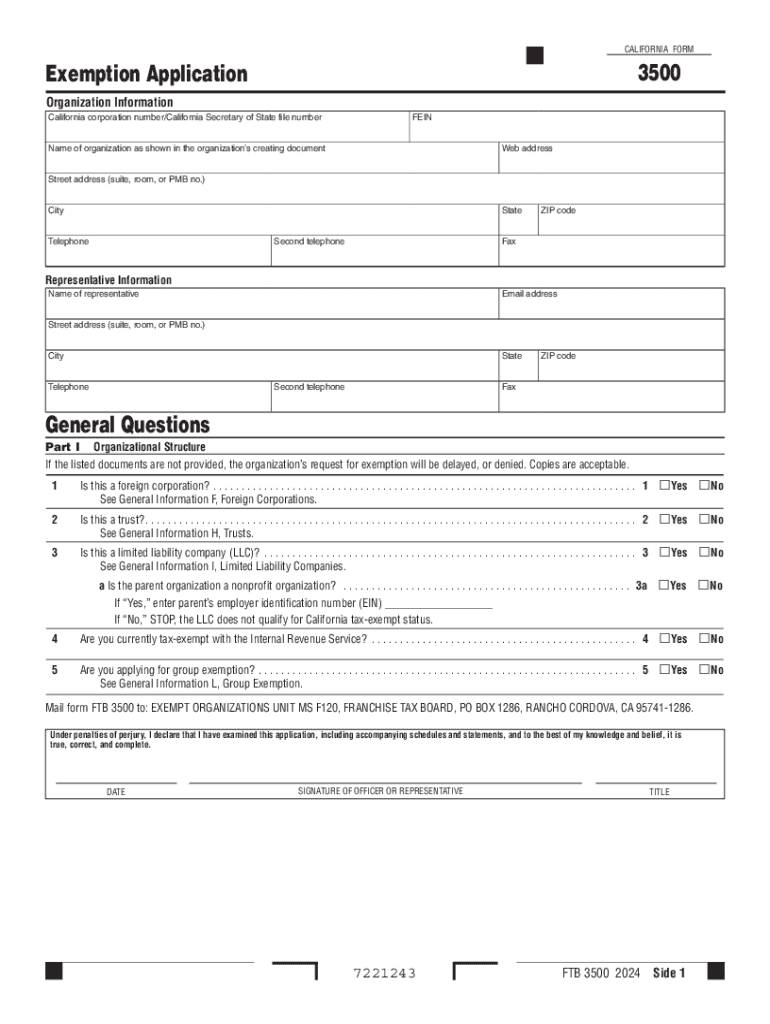

Overview of the FTB 3500 Form

The FTB 3500 form is essential for organizations in California seeking tax-exempt status. By filing this form with the California Franchise Tax Board (FTB), organizations can apply for exemption from state income tax and various other benefits. The form simplifies the process of obtaining recognition for nonprofit organizations, charitable trusts, and similar entities engaged in activities that align with public and community interests.

Organizations that need to file the FTB 3500 typically include nonprofit corporations, public charities, and private foundations. It is crucial that applicants ensure their eligibility for tax-exempt status under both state and federal laws. Accurate filing is vital; any discrepancies or incomplete information can result in delays or rejections of the application, which can impede the organization’s objectives.

Getting started with the FTB 3500 Form

To get started with the FTB 3500 form, organizations can access it directly from the California Franchise Tax Board's website. The online platform makes it easy to locate the necessary documents, ensuring you have the most up-to-date version. Users can download and print the FTB 3500, facilitating easy completion either electronically or by hand.

The layout of the form is straightforward, consisting of clearly marked sections to guide users through the necessary input. Understanding this layout is crucial, as each section contains specific information required for processing the application. When starting, carefully review the instructions provided on the form to avoid common mistakes.

Step-by-step instructions for filling out the FTB 3500

Filling out the FTB 3500 requires careful attention to detail, organized into several key sections. Section A captures basic information such as the organization’s name, address, and its primary purpose. This initial section sets the tone for the entire application and should be completed with accuracy to ensure clear identification of the organization.

In Section B, organizations must outline their eligibility for exempt status. This section highlights common exempt categories, enabling applicants to identify which exemptions apply to them. For instance, educational nonprofits may fall under one category, while charitable foundations may qualify under another. Each category has specific requirements, so it's essential to be thorough.

Guidelines for completing your FTB 3500

When completing the FTB 3500, it's crucial to avoid common pitfalls that often lead to application delays. Many applicants mistakenly provide incomplete information or fail to include necessary documentation. Carefully reviewing the requirements prior to submission can significantly mitigate these risks.

Additionally, establishing a clear data entry process can enhance accuracy. Use templates for financial documents, cross-check names and figures, and ensure consistency in terminology. Legal considerations play a significant role; understanding the IRS regulations alongside state requirements ensures your organization remains compliant in both respects.

Submission process for the FTB 3500 form

Once the FTB 3500 form is meticulously completed, it’s time to submit. The completed form can typically be sent by mail to the appropriate address listed on the California FTB website. For added convenience, many users may also choose to file their application electronically, depending on the specific guidelines provided by the FTB.

Timing is also critical. Applications are best submitted well in advance of any expected deadlines or fiscal year starts to allow for processing time. Following submission, tracking your application status is advisable; keeping a record of the submission can expedite any queries you may have regarding the approval process.

Post-submission considerations

After submitting the FTB 3500, organizations will typically await a response from the California Franchise Tax Board. Understanding the standard response time can help organizations manage expectations while preparing for potential follow-up inquiries. The FTB may request additional information or clarifications depending on the complexity of the application.

Organizations should be prepared for this process by maintaining organized records of all submitted materials, as well as any communications with the FTB. This can ensure a smoother experience when responding to any additional requests or clarifications that may arise.

Special cases and FAQs related to the FTB 3500 form

Certain organizations may face unique challenges while filling out the FTB 3500 form. For example, incorporated organizations need to provide additional documentation demonstrating compliance with both state and federal statutes. Conversely, foreign corporations seeking tax-exempt status in California may have specific legal requirements, including a thorough explanation of activities and how they align with local interests.

By compiling a list of frequently asked questions regarding the common issues that arise, organizations can better prepare themselves. Issues may range from misclassification of exempt status to missing documentation deadline errors. Offering clarity on these matters can save time and increase the likelihood of a smooth application process.

Tools to help manage the FTB 3500 process with pdfFiller

pdfFiller offers seamless solutions for managing the FTB 3500 form, making it easier for individuals and teams to collaborate. The platform allows users to edit the PDF directly within an intuitive online interface, ensuring documents are accurate and up-to-date. Additional features, such as electronic signing, streamline the process for faster submission.

Collaborative features of pdfFiller allow teams to work simultaneously on the same document, adding comments and suggestions in real-time. This cooperation minimizes errors and enhances the quality of the submission, ultimately improving the chances of a successful filing.

Troubleshooting and support

Addressing common issues during the preparation of the FTB 3500 is vital for ensuring a smooth filing experience. Errors in filing often stem from misunderstanding requirements or failing to provide adequate documentation. If issues arise, pdfFiller provides robust customer support to help guide users through the process, offering expertise and solutions as needed.

Additionally, the help center on pdfFiller offers comprehensive, step-by-step guidance on document preparation and submission, addressing a range of problems that organizations may encounter. Utilizing these resources can enhance your filing experience and expedite the recognition process.

Long-term management of tax-exempt status

Achieving tax-exempt status through the FTB 3500 is just the beginning. Organizations must continue to stay compliant with both state and federal regulations to maintain their favorable status. Regular updates to the franchise tax board and timely re-filing can ensure that the organization remains in good standing.

Additionally, organizations should keep abreast of any changes in laws that could impact their tax-exempt status. By staying informed and proactive, organizations can prevent lapses in compliance and ensure that they continue to serve their communities effectively.

Related document management resources on pdfFiller

Beyond the FTB 3500 form, there are several related tax documents that organizations may encounter. Familiarizing yourself with these forms can further streamline the overall tax and compliance process. pdfFiller allows users to create custom templates, enabling organizations to manage multiple forms with ease, from the initial filing through periodic updates.

Using a cloud-based document platform like pdfFiller offers additional benefits such as easy access from anywhere, automated reminders for re-filing, and simplified collaborative editing features. These tools empower organizations to focus on their mission while ensuring compliance in their tax matters.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ftb 3500 for eSignature?

Can I create an electronic signature for the ftb 3500 in Chrome?

Can I edit ftb 3500 on an Android device?

What is ftb 3500?

Who is required to file ftb 3500?

How to fill out ftb 3500?

What is the purpose of ftb 3500?

What information must be reported on ftb 3500?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.