Get the free Wv/cst-280

Get, Create, Make and Sign wvcst-280

How to edit wvcst-280 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out wvcst-280

How to fill out wvcst-280

Who needs wvcst-280?

Understanding the WVCST-280 Form: A Comprehensive Guide

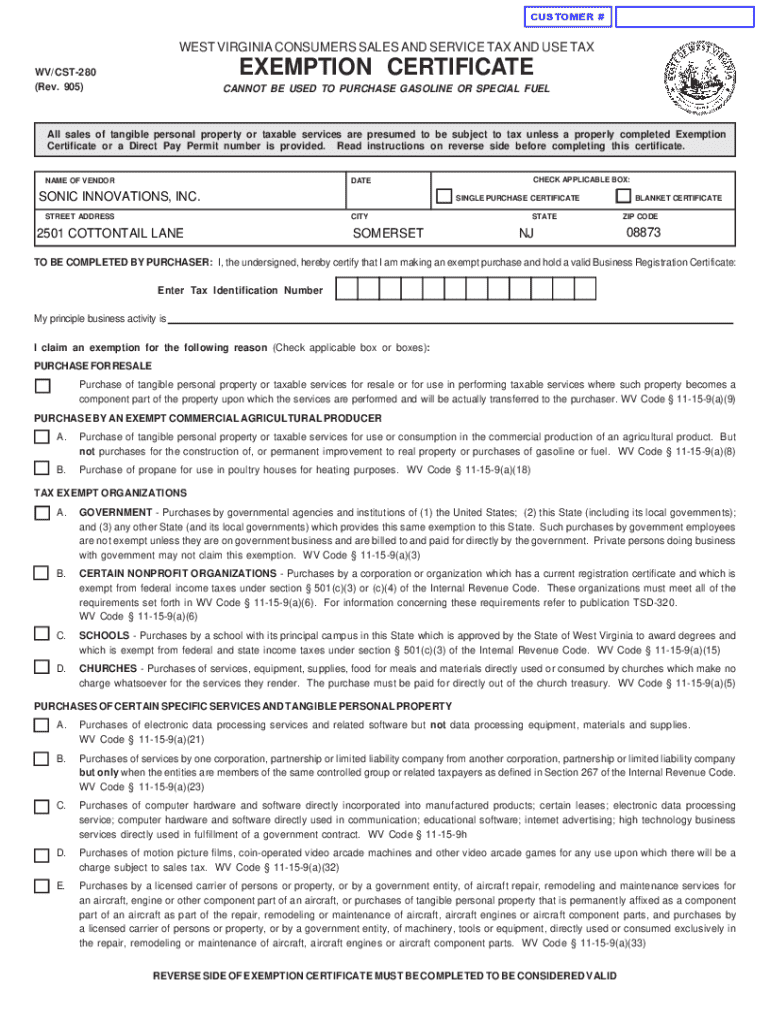

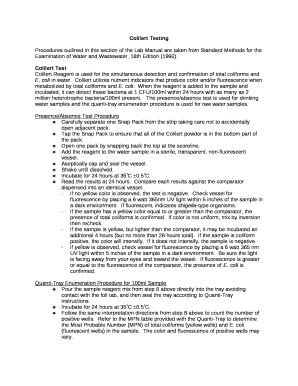

Overview of form WVCST-280

Form WVCST-280 is a crucial document for compliance with sales and use tax regulations in West Virginia. It serves businesses and individuals in accurately reporting sales data to ensure proper tax payment, thus maintaining legal and financial integrity. This form is instrumental in helping taxpayers navigate the complexities of tax compliance efficiently.

Understanding the purpose of the WVCST-280 is vital for anyone involved in sales tax transactions within the state. It allows for reporting sales, calculating taxes due, and claiming exemptions, which can directly impact the financial standing of businesses and individuals alike.

Key features of the WVCST-280

The WVCST-280 form incorporates key features that cater directly to the needs of taxpayers. This document is designed to streamline the process of tax calculation, documentation, and submission. It includes specific sections focused on identifying taxpayer information, tax computations, and eligibility for any exemptions.

The required information typically includes the taxpayer's name, address, and identification numbers, as well as details pertaining to sales transactions and any applicable tax breaks. Accurate completion of these fields is essential for compliance.

Detailed breakdown of form sections

Form WVCST-280 is segmented into intuitive sections, each designed to gather specific information. Section 1 focuses on identifying information. This part identifies the taxpayer and the nature of the transactions involved, ensuring the submission is correctly attributed.

Section 1: Identifying information

Proper completion of Section 1 is enough to prevent delays in processing. Common mistakes include incorrect identification numbers or omitting necessary fields, which can lead to rejections or audit triggers. Thus, it’s critical to double-check all entries to ensure accuracy.

Section 2: Taxpayer information

Moving on to Section 2, taxpayers must provide detailed instructions for filling out their information. This section is generally straightforward but demands attention to detail. The inclusion of business entity types, revenue categories, and tax identification numbers is vital.

Section 3: Calculation of taxes

The third section, designed for tax calculations, contains a worksheet to guide taxpayers through the process. This section breaks down tax obligations based on sales, ensuring all calculations conform to state taxation principles. An example scenario could involve a business selling goods worth $10,000 at a tax rate of 6%. Hence, the tax amount would be calculated as $10,000 x 6% = $600.

Tips for filling out the WVCST-280 form

Completing the WVCST-280 form accurately is paramount. Adopting a systematic approach can significantly enhance your accuracy. Preparation begins with gathering all necessary documents and understanding any specific nuances related to sales and tax rates applicable to your transactions.

Tools to assist in form completion

The right tools can simplify your completion of the WVCST-280 form. Online tax calculators can help you estimate your sales tax obligations efficiently. Platforms like pdfFiller provide interactive tools that make filling out forms straightforward and highlight areas needing attention, thus ensuring a smooth filing experience.

How to edit and sign your WVCST-280 form

Once you have completed the WVCST-280 form, it’s crucial to incorporate any necessary changes or sign it properly to ensure validity. Utilizing pdfFiller can significantly streamline these processes.

Using pdfFiller to edit your form

To edit your WVCST-280 form using pdfFiller, simply upload your completed document to the platform. From there, you can make adjustments, correct any mistakes, or add additional information as required.

Adding eSignatures to your WVCST-280

Adding a valid signature is essential for authenticity. With pdfFiller, you can easily create and insert your eSignature into the WVCST-280 form by following their straightforward setup process. This feature is particularly beneficial for quickly finalizing documents without printing.

Saving and storing your completed form

After completing and signing your form, the next logical step is to save it securely. pdfFiller offers cloud-based storage that allows for easy access, sharing, and protection of your sensitive tax documents. Ensure you back up your files and consider organizing them in specific folders for easy retrieval.

Common questions about form WVCST-280

As with any tax-related document, questions often arise surrounding the WVCST-280 form, especially regarding submission and possible errors. Understanding and anticipating these inquiries can smoothen the process.

Understanding tax exemptions and variances

Tax exemptions can vary significantly based on business type and products sold. Recognizing when and how to claim these exemptions can lead to considerable savings. It’s beneficial to consult state resources or tax professionals to tap into all available options.

Related forms and documents

In addition to the WVCST-280 form, there are several other related documents necessary for comprehensive sales tax filing. Familiarizing yourself with these forms can enhance your overall tax strategy.

Differences between WVCST-280 and other forms

Understanding the differences between the WVCST-280 and other tax-related forms is important for accurate compliance. Each form has its own specific purpose, and mixing them up may lead to errors in reporting sales tax. Therefore, it's vital to familiarize yourself with the nuances of each document.

Troubleshooting common issues

Navigating tax forms can be complex, and various issues can arise while filling out the WVCST-280. Recognizing these pitfalls in advance can help mitigate their impacts.

Contact information for support

If you encounter issues while filling out the WVCST-280, contacting the West Virginia State Tax Department is your best course of action. They offer support and guidance for taxpayers and can assist in resolving common challenges.

Conclusion of form WVCST-280 guide

Successfully completing the WVCST-280 form is an essential step in maintaining compliance with West Virginia’s sales tax regulations. By following this guide, taxpayers can ensure accuracy, efficiency, and peace of mind when submitting their tax forms.

Recap: Completing your form minute-by-minute

Key points from this guide include thorough preparation, careful attention to detail, and leveraging available tools like pdfFiller for efficient form management.

Final thoughts on efficient document management

The use of pdfFiller’s comprehensive platform for managing forms, including the WVCST-280, empowers users to handle their documentation seamlessly. From editing to storing completed documents, integrating technology into your tax preparation process can save time and reduce stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wvcst-280 for eSignature?

How do I complete wvcst-280 online?

How do I fill out wvcst-280 on an Android device?

What is wvcst-280?

Who is required to file wvcst-280?

How to fill out wvcst-280?

What is the purpose of wvcst-280?

What information must be reported on wvcst-280?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.