Get the free Special Audit Procedures for Maryland Hospitals

Get, Create, Make and Sign special audit procedures for

How to edit special audit procedures for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out special audit procedures for

How to fill out special audit procedures for

Who needs special audit procedures for?

Special Audit Procedures for Form: A Comprehensive Guide

Understanding special audit procedures

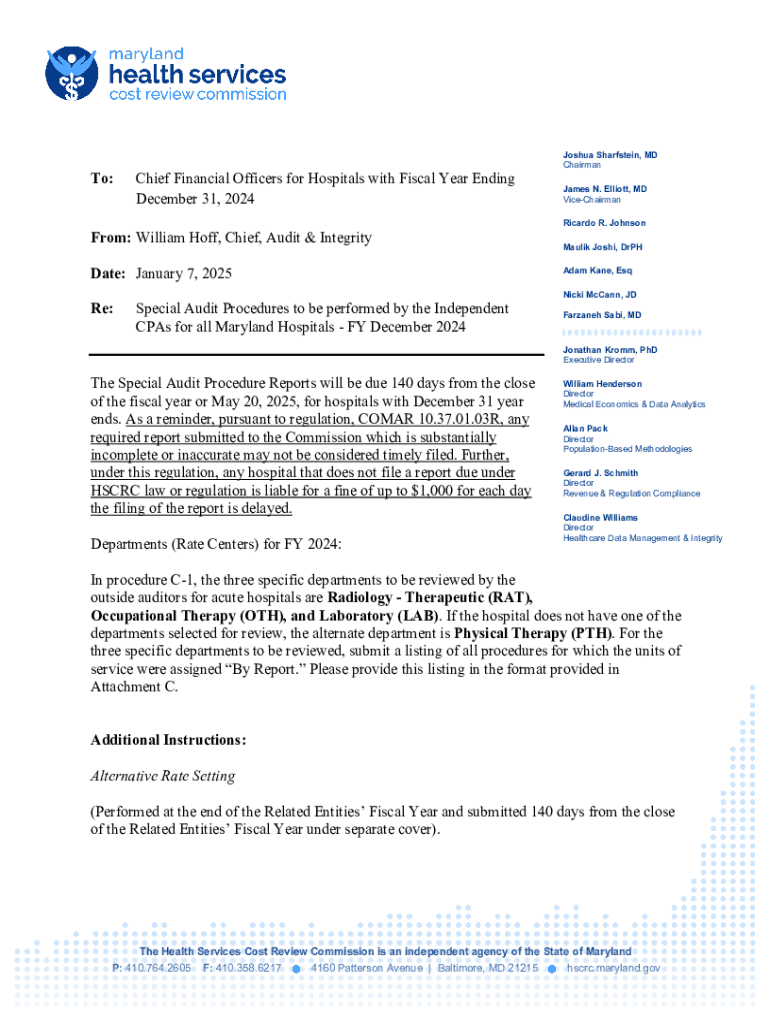

Special audit procedures refer to tailored audit approaches designed to address specific audit objectives that standard audits may not completely satisfy. These procedures are vital in ensuring compliance with legal, regulatory, or internal requirements, particularly when the organization faces complex scenarios. Special audits vary in type and intensity based on the peculiar needs of the organization, ranging from internal investigations to compliance audits mandated by various regulatory bodies.

Types of special audits include forensic audits, compliance audits, and operational audits, among others. For instance, a forensic audit may be necessary in cases of suspected fraud, while a compliance audit ensures that specific regulations or policies are being adhered to. The legal and regulatory framework governing special audits can vary significantly depending on jurisdiction and industry, necessitating a thorough understanding of applicable laws and standards.

Preparing for a special audit

Preparation is crucial for an effective special audit. Identifying the audit's purpose forms the foundation of this process. Organizations must clearly outline compliance requirements, especially for audits driven by external regulations. This step often involves evaluating risk factors that may affect the organization, such as previous audit findings or changes in relevant laws. A targeted approach enhances the likelihood of meeting the audit objectives.

Gathering necessary documentation is equally essential. A comprehensive list of essential documents should be compiled, including financial records, operational documents, and evidence of compliance with regulations. Maintaining accurate record-keeping practices not only prepares the organization for the audit but also bolsters the credibility of the documentation presented to auditors.

Engaging with auditors

Selecting the right auditor is a critical step in the process. The ideal auditor should have expertise relevant to the specifications of the special audit. They should possess a strong understanding of the industry's best practices and the regulatory landscape surrounding the particular audit's focus. Once an auditor is selected, establishing clear communication channels becomes paramount to facilitate a smooth audit process.

Setting clear expectations regarding the audit process is vital. Both the auditors and the organization should agree on the scope and timeline of the audit, including deliverables and reporting structures. Transparent communication helps foster a collaborative environment, reducing misunderstandings that can arise during the audit.

Executing the special audit procedures

Executing special audit procedures involves a systematic, step-by-step approach. Initially, auditors engage in planning and risk assessment to strategize the best methods for obtaining necessary information. This includes identifying high-risk areas requiring more extensive examination. During fieldwork, auditors gather credible evidence through interviews and document reviews.

Analytical review procedures often complement fieldwork to assess financial information against expectations or historical data. Throughout the audit process, documenting findings is crucial. Accurate documentation not only supports conclusions drawn during the audit but also provides a basis for future assessments. Techniques such as utilizing audit software or checklists can streamline this documentation process, making it both efficient and comprehensive.

Special considerations in auditing

Certain special considerations must be acknowledged when planning and executing audits. Organizations with complex financial structures may present unique challenges, necessitating tailored audit strategies. Compliance with accounting standards like GAAP or IFRS must be maintained throughout, ensuring that all financial reporting aligns with accepted practices. Auditors must also be mindful of sensitive data and privacy concerns, particularly when dealing with personal data under laws like GDPR.

Moreover, evaluating and ensuring robust internal controls is crucial during a special audit. Auditors often assess these controls to determine their effectiveness in preventing or detecting errors and fraud. Recommendations may arise from these evaluations, guiding organizations toward enhancing their internal control systems for future audits.

Utilizing technology in special audits

In today's fast-paced business environment, leveraging technology can significantly enhance the audit process. One prominent benefit of using a cloud-based document management system is improved accessibility. Solutions like pdfFiller allow teams to collaborate seamlessly, edit documents in real-time, and securely manage files from anywhere. This technology not only streamlines the audit but also contributes to increased efficiency and accuracy.

Tools offered by platforms like pdfFiller, including templates and custom forms for document organization, facilitate the audit process by offering structured formats to gather and analyze data. Features such as e-signatures and workflow automation further augment efficiency, ensuring that documents can be promptly edited and approved without delays that often occur in traditional workflows.

Filling out and managing audit forms

Filling out audit forms accurately is crucial for maintaining the integrity of the auditing process. To complete audit forms effectively, focus on key sections that require your specific input. Concentrating on areas where you can provide meaningful documentation minimizes errors that may lead to compliance issues. Common mistakes to avoid include overlooking mandatory fields and failing to adhere to formatting requirements.

For best practices in form management, create an organized filing system that allows for easy access and retrieval of documents. Options include using digital solutions to store forms and records securely. Implementing strategies around document review schedules can further enhance the management process, ensuring that forms remain current and accurate.

Post-audit actions

Analyzing audit findings is an important post-audit action. Organizations should prioritize recommendations made by auditors, implementing actionable steps to address identified issues. Follow-up procedures often involve verifying that recommendations have been effectively integrated into the organization's operations and that any risks highlighted during the audit are being managed appropriately.

Crafting a comprehensive audit report is also essential. This report should communicate findings clearly to stakeholders, summarizing audit objectives, methodologies, and outcomes. Effectively communicating these results fosters a culture of transparency and accountability within the organization, reinforcing trust among stakeholders.

Case studies: Success stories in special audits

Examining real-world examples of successful special audits can provide valuable learning experiences. For instance, a company facing regulatory challenges implemented a compliance audit that not only identified areas of non-compliance but also helped streamline their operations, ultimately leading to a favorable legal standing and improved financial health. Lessons learned from such case studies emphasize the importance of thorough planning, clear communication, and utilizing the right tools for audit success.

Key takeaways from these examples underline the necessity of engaging skilled auditors who understand the unique challenges posed by the organization’s circumstances while reinforcing the significance of proactive risk assessment and documentation.

Interactive tools and resources available

Utilizing interactive tools can enhance the special audit experience, making the process more efficient. pdfFiller provides unique features catering specifically to audit needs, such as interactive templates that allow users to fill out, edit, and sign forms effectively. By offering access to online support and FAQs, pdfFiller ensures that users can quickly resolve any questions or challenges that arise during the audit process.

Integration with other tools enhances audit efficiency, allowing for seamless data transfer and communication across various platforms. By optimizing workflows to include features useful for audits, organizations demonstrate a commitment to continuous improvement and the thorough execution of special audit procedures.

FAQs about special audit procedures

Addressing common concerns about special audit procedures is important for organizations preparing for an audit. Questions often arise regarding the types of audits available, their purposes, and how to adequately prepare. Organizations may also seek clarification on the legal aspects, including what documentation is necessary and how to engage with auditors effectively.

By providing detailed answers to these questions, organizations can empower their teams to approach the audit process with greater confidence, ensuring a clearer understanding of the requirements and expectations associated with special audits.

Feedback and performance monitoring

Continuously improving audit processes requires a mechanism for performance monitoring and feedback. Organizations should establish a culture that encourages feedback from all parties involved in the audit process, creating an environment of openness and constructive criticism. This feedback loop serves to enhance future audits by identifying strengths and areas for improvement based on real experiences.

By implementing changes based on audit feedback, organizations can refine their processes, ensuring they remain compliant with regulations, improve internal controls, and streamline operations. This proactive approach ultimately leads to more effective special audits and contributes to the overall sustainability and growth of the organization.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit special audit procedures for from Google Drive?

How can I fill out special audit procedures for on an iOS device?

How do I complete special audit procedures for on an Android device?

What is special audit procedures for?

Who is required to file special audit procedures for?

How to fill out special audit procedures for?

What is the purpose of special audit procedures for?

What information must be reported on special audit procedures for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.