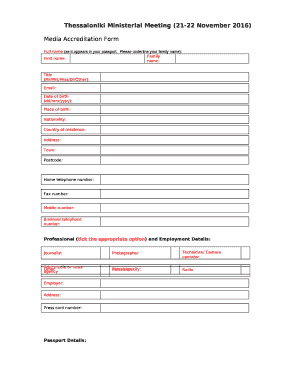

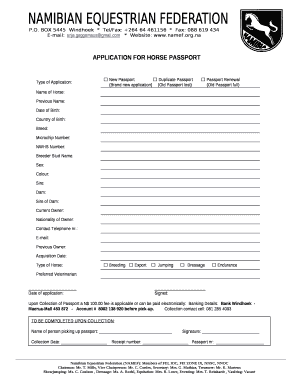

Get the free Form 990 (2019)

Get, Create, Make and Sign form 990 2019

How to edit form 990 2019 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990 2019

How to fill out form 990 2019

Who needs form 990 2019?

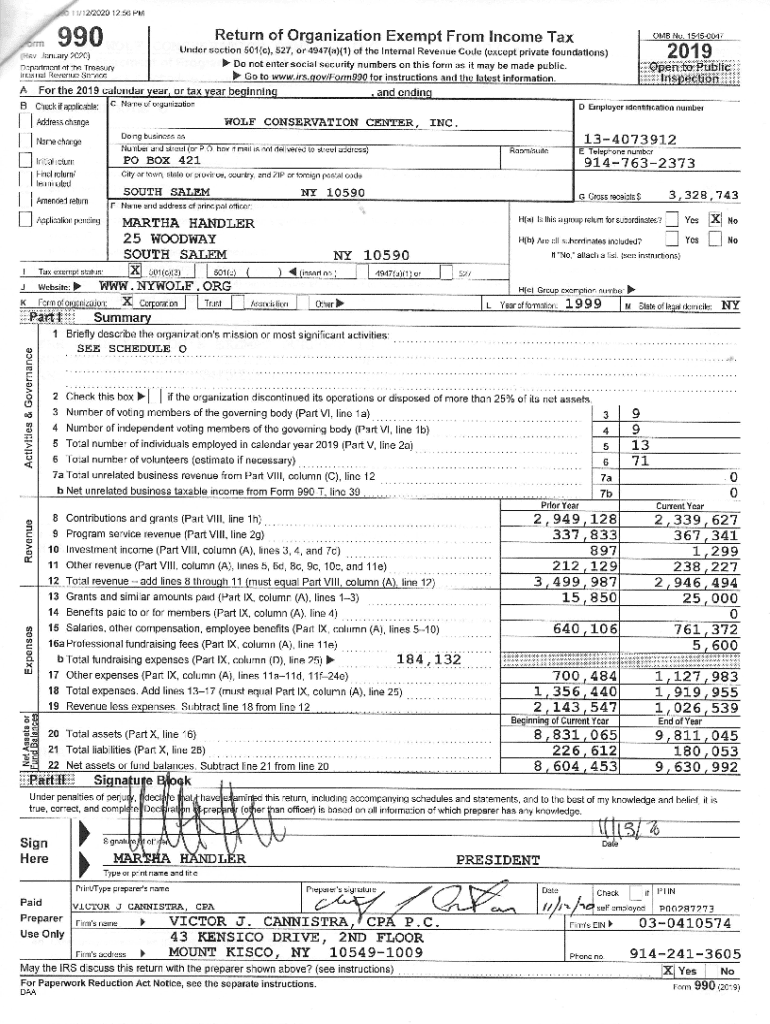

Understanding Form 990: Your Complete Guide to the 2019 Version

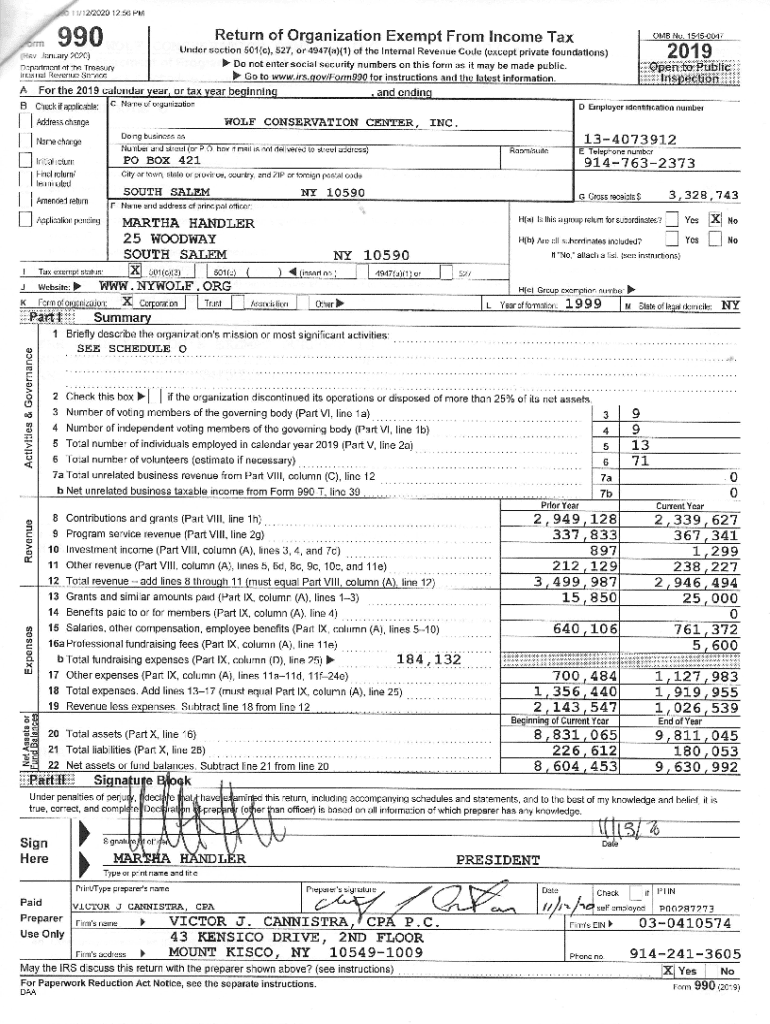

Overview of Form 990

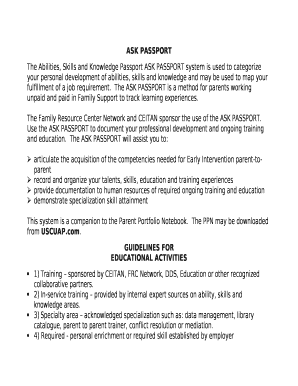

Form 990 is a crucial document for nonprofit organizations as it provides detailed insights into their financial health, governance, and operational accomplishments. Required by the Internal Revenue Service, it helps ensure transparency and accountability in the nonprofit sector. For organizations seeking tax-exempt status under section 501(c)(3) and similar provisions, finishing Form 990 isn't just a regulatory requirement, but a critical step in maintaining public trust.

The 2019 version of Form 990 introduced several changes aimed at improving clarity and reporting accuracy. These updates reflect evolving standards in financial reporting and nonprofit accountability, which are essential in encouraging donations and enhancing mission-driven effectiveness.

Key components of Form 990

Form 990 is divided into several sections, each addressing different aspects of the nonprofit's operations. Understanding these parts is crucial for accurate and effective reporting.

Moreover, the financial data within Form 990 includes vital details concerning revenue, expenses, assets, and liabilities, enabling stakeholders to evaluate the organization's financial integrity effectively.

Who needs to file Form 990?

Not all nonprofit organizations are mandated to file Form 990. Generally, the organizations required to file include 501(c)(3) charitable organizations, private foundations, and some political organizations. However, there are exceptions such as small nonprofits with gross receipts below $50,000, which may simply need to file Form 990-N (e-Postcard).

Organizations must also be aware of certain thresholds that determine the form they need to submit:

Detailed instructions for completing Form 990

Completing Form 990 can be detailed and time-consuming, but breaking it down step-by-step makes the task manageable. Start with personal organizational details, move into financial data, and complete the mission-focused narratives. A systematic approach ensures accuracy.

Common pitfalls include failing to report unrelated business income, misclassifying expenses, or not providing sufficient detail in the statement of accomplishments. Familiarity with these elements and using appropriate language helps in preventing errors.

How to download and access Form 990 (2019)

Accessing Form 990 is straightforward through the IRS website, where organizations can find the necessary documentation. Users may download a PDF version directly for completion.

Best practices for filing Form 990

Timeliness and transparency are essential when submitting Form 990. It's crucial to adhere to filing deadlines to avoid penalties. Organizations should set deadlines for themselves well ahead of the IRS's established due date to facilitate thorough review and corrections.

These best practices establish not only procedural efficiency but also strengthen the organization's credibility and accountability in the eyes of stakeholders.

Using pdfFiller for Form 990

pdfFiller offers a user-friendly platform that significantly simplifies the process of filling out Form 990. With its interactive editing features, users can easily populate the form fields digitally without needing to print and manually fill them out.

The ease of use associated with pdfFiller enhances the filing process, streamlining both the completion and management of Form 990, enabling organizations to focus on their missions rather than paperwork.

Common questions about Form 990

Many organizations have questions when it comes to the specifics of Form 990, including filing requirements, deadlines, and penalties for late submissions. Common inquiries often center around amendment procedures for corrections and whether extensions for filing are possible.

Case studies and examples

Exploring real-life examples of Form 990 submissions allows organizations to learn from others. Case studies demonstrate how certain non-profits leveraged their completed Form 990 to exhibit transparency and secure increased funding from stakeholders.

For instance, organizations that accurately report revenue and clearly describe program purposes often attract more support. Moreover, examining what common mistakes and procedural failures have cost others serves as a valuable learning opportunity.

Additional tools and resources

For organizations preparing to file Form 990, a wealth of resources is available. The IRS website provides extensive guidelines directly related to filing procedures, penalty structures, and instructions for every part of the form.

Leveraging these resources empowers organizations to approach Form 990 preparation with confidence and clarity, ensuring compliance and financial integrity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990 2019 to be eSigned by others?

How do I make changes in form 990 2019?

Can I create an electronic signature for signing my form 990 2019 in Gmail?

What is form 990 2019?

Who is required to file form 990 2019?

How to fill out form 990 2019?

What is the purpose of form 990 2019?

What information must be reported on form 990 2019?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.