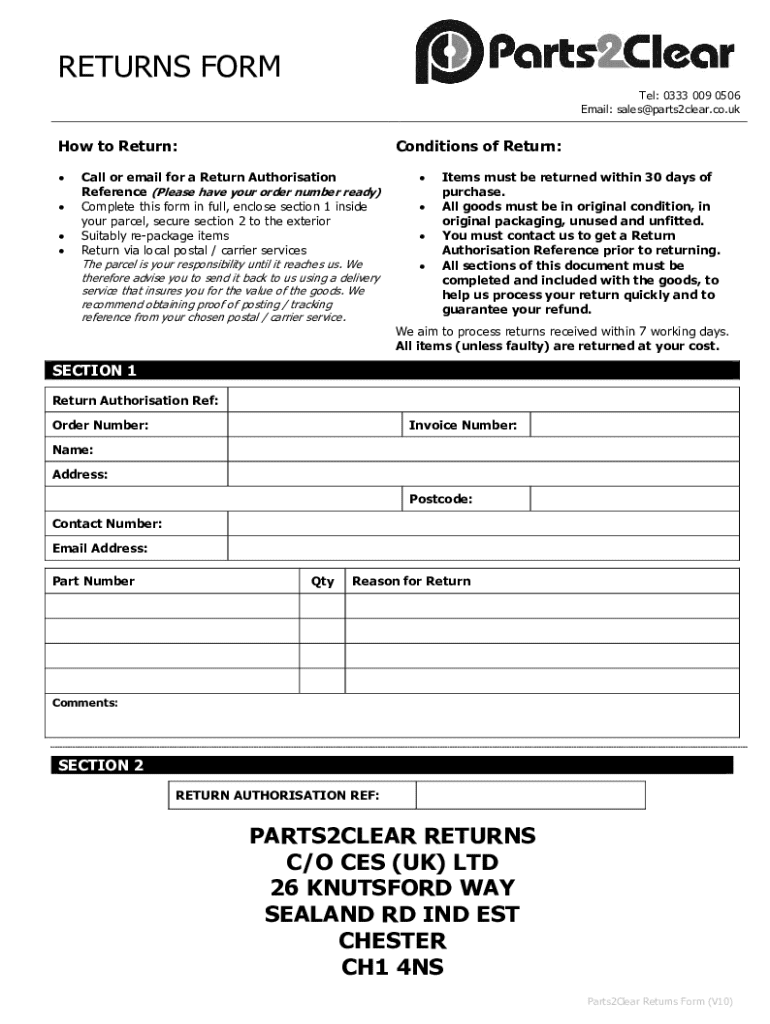

Get the free Returns Form

Get, Create, Make and Sign returns form

Editing returns form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out returns form

How to fill out returns form

Who needs returns form?

Mastering Your Returns Form: A Comprehensive Guide

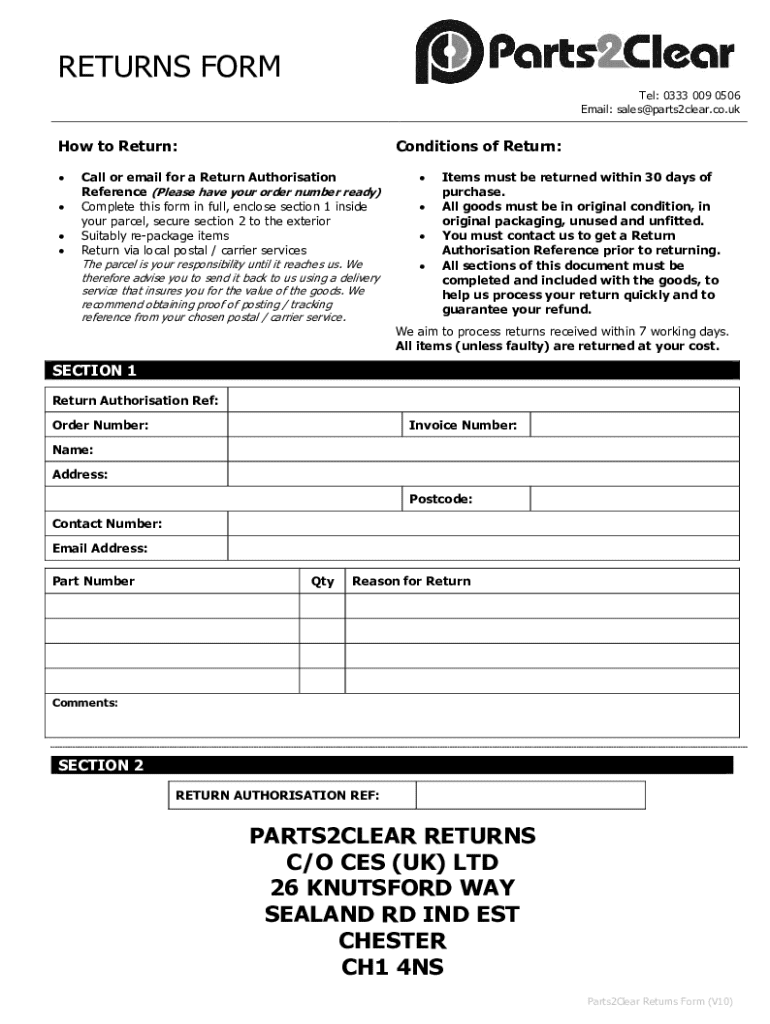

Understanding the returns form

Returns are an integral part of the retail ecosystem, allowing customers to return purchased items for various reasons. Understanding why returns are important not only underscores their necessity but also helps businesses maintain customer satisfaction and loyalty. Common scenarios requiring returns include defective products, incorrect items shipped, or simply a change of mind.

The returns form plays a crucial role in streamlining the returns process. This document aids in recording the transaction details pertinent to the return, providing vital information to both customers and retailers. Additionally, it carries legal implications, since a properly filled returns form serves as proof of the transaction and can help resolve future disputes.

Types of returns forms

Various returns forms cater to different situations, each designed to meet specific needs. Here are the common types of returns forms:

Essential elements of a returns form

An effective returns form must include several key elements to ensure both the retailer and customer are protected and informed. These essential components include the following:

Step-by-step guide to filling out a returns form

Filling out a returns form can be straightforward if you follow a structured approach. Here’s a detailed, step-by-step guide:

Interacting with the returns process

Once you have submitted your returns form, staying apprised of your return status becomes vital. Different retailers may have unique systems for tracking your return, and understanding these can help alleviate concerns about unresolved returns.

It’s also important to familiarize yourself with the retailer's return policies before submitting a return. Key factors to look out for include time frames for return eligibility and specific requirements for outright returns versus exchanges. Expectation setting can significantly enhance your experience with returned goods.

Utilizing pdfFiller for returns forms

pdfFiller is an invaluable resource when it comes to managing returns forms efficiently. It offers features that simplify the process of customizing and managing these documents. Here’s how pdfFiller can enhance your returns experience:

FAQs about returns forms

Many customers have questions surrounding the completion and submission of returns forms. Some common queries involve how to handle issues when returns submissions do not go as planned. Being aware of troubleshooting tips can save time and frustration.

Additionally, understanding the process for dealing with unsatisfactory return experiences—such as needing additional assistance—can empower customers, making them feel more equipped to navigate returns.

Conclusion: Mastering your returns form usage

By adhering to best practices in filling out and submitting your returns form, you're more likely to enjoy a smooth returns experience. Utilize pdfFiller to further enhance efficiency and ease in managing your documentation. Simplifying your returns process ensures you can focus on what really matters—satisfied customers and a seamless retail environment.

Whether it's customizing forms or tracking submissions, pdfFiller empowers users to seamlessly manage their returns forms from anywhere, significantly improving the returns process for both individuals and teams.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute returns form online?

How do I edit returns form in Chrome?

How do I complete returns form on an Android device?

What is returns form?

Who is required to file returns form?

How to fill out returns form?

What is the purpose of returns form?

What information must be reported on returns form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.