Get the free Ct401

Get, Create, Make and Sign ct401

Editing ct401 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct401

How to fill out ct401

Who needs ct401?

CT401 Form: A Comprehensive How-To Guide on pdfFiller

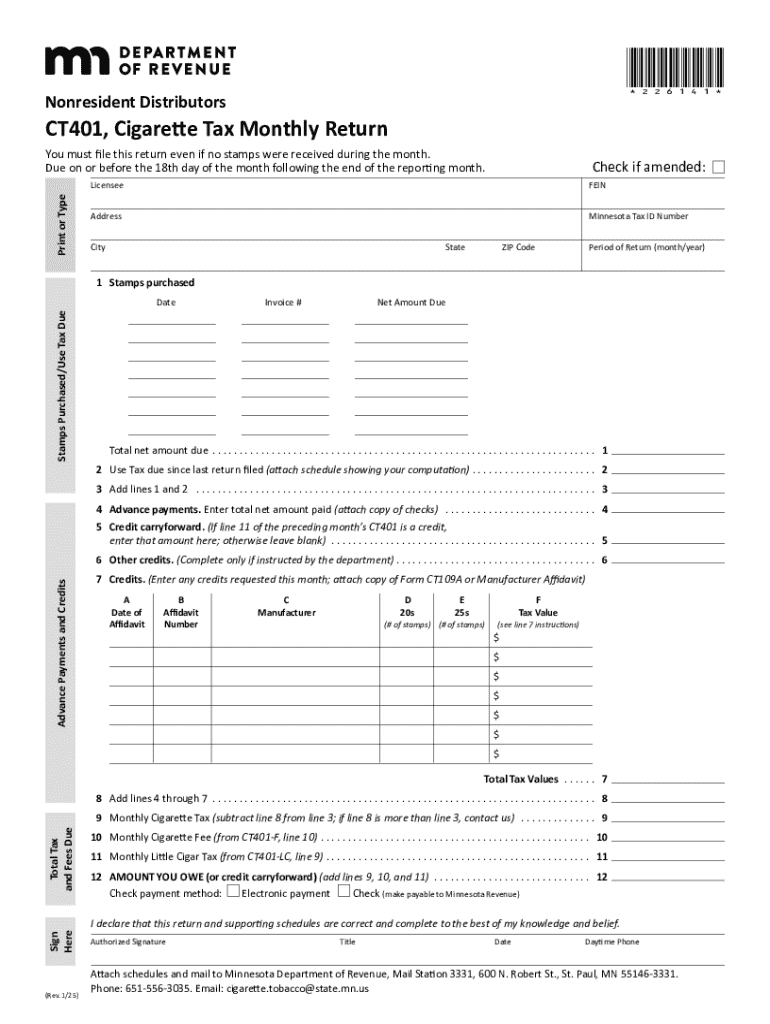

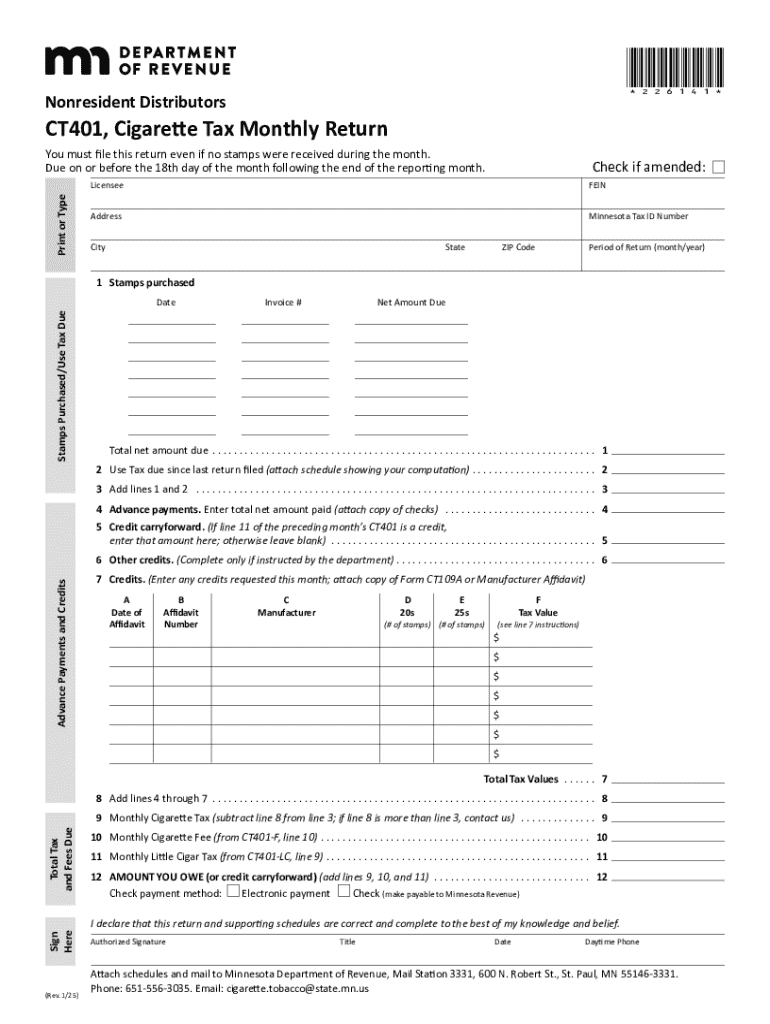

Understanding the CT401 Form

The CT401 form is a crucial document often associated with certain tax obligations in the state of Connecticut. Primarily, it serves as a means for taxpayers to report and remit taxes owed to the state, including issues related to business income or other taxable entities. Accurate completion of this form is essential, as it ensures compliance with state tax laws, and helps avoid potential penalties.

The importance of this form cannot be overstated. It not only serves as a declaration of one’s tax liability but also maintains transparency in financial dealings with the state. Moreover, the CT401 form is commonly utilized by various entities, including individuals, corporations, and partnerships, making it vital to understand for anyone who is required to report financial data to state authorities.

Who needs to file the CT401 form?

Understanding the eligibility criteria for filing the CT401 form is pivotal. Generally, anyone with taxable income earned within Connecticut—including businesses and individuals—may need to file. Key stakeholders include small business owners, freelancers, and any organizations that generate taxable revenue within the state’s jurisdiction.

Specific scenarios warrant the filing of the CT401 form. For instance, if you have made significant earnings, reported a business profit, or are required to meet regulatory tax obligations in Connecticut, completing this form is necessary. Not only does it keep you compliant, but it also enables you to unlock business credits and deductions that can alleviate tax burdens.

Preparing to fill out the CT401 form

Before diving into the completion of the CT401 form, gathering the required information and documentation is imperative. This includes your personal identification details such as your name, address, and social security number. Additionally, you’ll need financial data regarding your earnings, deductions, and any relevant tax credits.

Utilizing tools like pdfFiller can simplify this preparatory stage. The platform offers user-friendly templates and resources specially tailored for document management. This can streamline the process, allowing you to efficiently gather and input the necessary information.

Step-by-step instructions to complete the CT401 form

Completing the CT401 form involves several crucial sections that require your attention and accuracy. Beginning with Section 1, you will need to fill out your personal information thoroughly. It’s important to ensure all details are correct to prevent issues later on.

Pay special attention to the signature section; without it, your form may be deemed invalid. On pdfFiller, you can conveniently use the eSign feature, making it easy to add your electronic signature.

Editing the CT401 form using pdfFiller

Editing your CT401 form is made simple with pdfFiller's array of editing tools. Once you've entered your initial information, the platform provides straightforward options to modify text, add new fields, or remove unnecessary sections.

This level of flexibility ensures that your CT401 form is not only accurate but also tailored to your precise needs.

Collaborating on the CT401 form

Collaboration is key when preparing your CT401 form, especially if you are working within a team. pdfFiller allows you to invite colleagues to review and comment on your submission. This functionality enhances the accuracy of your filings and fosters a collective approach to compliance.

This collaborative environment not only enhances the quality of your document but also promotes better communication among team members.

Managing your CT401 form after completion

Once your CT401 form is finalized, effective management of your document is crucial. Utilizing pdfFiller allows for cloud storage, meaning you can save and store your document securely without worrying about physical paperwork. This feature offers significant advantages, including access to your documents from anywhere and the peace of mind that they’re safely stored.

Setting up reminders for key dates ensures that you never miss an important deadline, keeping you compliant and organized.

Common mistakes to avoid when filling the CT401 form

Filing the CT401 form can be straightforward, but common mistakes can lead to delays or penalties. It's essential to review your form for frequent errors, such as incorrect personal information or inaccurate financial reporting.

Utilizing pdfFiller’s error-check features can aid in identifying potential issues before submission, significantly reducing the risk of errors and enhancing efficiency.

FAQs about the CT401 form

Navigating the nuances of the CT401 form can lead to many questions. Common queries often revolve around eligibility, the filing process, and what happens if mistakes occur. Addressing these concerns promptly is key to ensuring a smooth filing experience.

By providing quick answers to these frequent concerns, you can instill confidence in your preparatory process and facilitate understanding of any complexities involved.

Related forms and templates

Along with the CT401 form, there are several other forms and templates that you may find beneficial. Forms such as the CT1040 or CT1065 closely relate to individual and business tax reporting in Connecticut. Having access to these documents through pdfFiller enhances your document management experience.

This comprehensive accessibility allows for streamlined preparation of related documents, making large filing tasks manageable.

Contacting support for help with the CT401 form

If you encounter any challenges while filling out your CT401 form, reaching out for support is essential. pdfFiller offers multiple avenues for user assistance, helping guide you through the process.

Having these resources at your disposal ensures that you can effectively navigate the requirements of the CT401 form with knowledgeable assistance.

User experiences and case studies

Learning from others' experiences can greatly enhance your understanding of how to effectively manage your CT401 form. Many users have shared success stories about how utilizing pdfFiller streamlined their tax preparation processes and improved compliance.

Testimonials such as these highlight the value pdfFiller brings to document management and underscore its capabilities in dealing with forms like the CT401.

Legal considerations surrounding the CT401 form

Filing the CT401 form carries legal implications that can affect both individuals and businesses. Understanding these responsibilities is key to avoiding potential compliance issues and adhering to state regulations. It’s essential to maintain the security of your information during the filing process to prevent data misuse or breaches.

Taking these legal aspects into account when preparing your CT401 ensures that you navigate the process responsibly and with full awareness.

Exploring more features of pdfFiller

Beyond basic document management, pdfFiller offers advanced features that can enhance your filing experience. These include integrations with various platforms and additional tools that further ease the process of preparing forms like the CT401.

Utilizing these enhanced functionalities allows users to maintain high levels of efficiency in documents management and encourages effective tax preparation.

Engaging with pdfFiller community

Becoming part of the pdfFiller community enriches your experience and opens avenues for knowledge sharing. Joining user groups and forums allows individuals to share experiences and best practices related to filling out forms like the CT401.

This community engagement not only boosts individual confidence but also solidifies a collective knowledge base that can benefit all users navigating the CT401 form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ct401 from Google Drive?

How do I edit ct401 on an Android device?

How do I complete ct401 on an Android device?

What is ct401?

Who is required to file ct401?

How to fill out ct401?

What is the purpose of ct401?

What information must be reported on ct401?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.