Get the free Summary Plan Description

Get, Create, Make and Sign summary plan description

Editing summary plan description online

Uncompromising security for your PDF editing and eSignature needs

How to fill out summary plan description

How to fill out summary plan description

Who needs summary plan description?

A comprehensive guide to the summary plan description form

Understanding the summary plan description (SPD)

A Summary Plan Description (SPD) serves as a crucial document that outlines the details of employee benefit plans provided by an employer. It comprehensively describes the rights and obligations of both the employer and the employee concerning health plans, pension plans, and other welfare benefits. The SPD serves as a roadmap for employees to understand their benefits.

The SPD is not just a formality but a legal requirement under the Employee Retirement Income Security Act (ERISA). It is intended to ensure that participants receive essential information in a straightforward manner. The clarity offered by the SPD helps in minimizing confusion and disputes about plan offerings.

Who can request a summary plan description?

The SPD is accessible to various stakeholders within the benefits ecosystem. Generally, the following individuals can request an SPD:

Requesters must be aware of their roles and responsibilities when requesting the SPD. Employees should know that they are entitled to receive a copy of the SPD free of charge upon request, helping them make informed decisions about their benefits.

Types of plans that may require an SPD

Multiple types of plans are required to have an SPD, ensuring transparency and communication of benefits to employees. Some common ones include:

These plans must provide clear details to help members navigate benefits effectively.

Essential information needed to request an SPD

To request a Summary Plan Description, specific information is crucial. This not only ensures the correct SPD is provided but also speeds up the request process. Key data includes:

Incomplete information may lead to unnecessary delays in obtaining your SPD, so it’s crucial to double-check your request submission.

The request process for summary plan description

Requesting your SPD can seem daunting, but it can be straightforward if you follow a structured process. Here are the steps to take:

After submitting your request, it’s important to know how to verify its status. You could contact HR via multiple channels, including email, phone, or online portals, to get updates on your request.

Timeline expectations

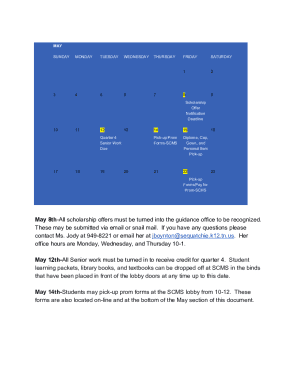

Understanding the timeline for receiving your SPD can help manage expectations effectively. Typically, you should receive your SPD within 30 days of your request, barring any unexpected delays.

Being informed about possible delays, and taking proactive steps to follow up, can be beneficial.

Follow-up procedures

If you haven’t received your SPD after the expected timeline, it’s sensible to follow up on your request. This can be done through a polite email or a phone call to HR.

Taking these proactive steps can enhance your chances of receiving the SPD promptly.

Plan information and resources

Once you receive your SPD, accessing and managing it effectively is vital. Most SPDs will provide various sections, helping you understand your benefits better.

Keeping your SPD accessible can be invaluable, especially during critical times when you need quick reference.

FAQs about summary plan descriptions

Many questions arise concerning SPDs and their functionalities. Common queries include what to do if your SPD is inaccurate or incomplete, and how often updates occur.

Clarifying these FAQs can equip you with the knowledge necessary to navigate your benefits.

Popular resources and webpages on SPDs

Numerous resources exist both online and offline to help you understand the importance of SPDs and the laws governing them. Government agencies often provide robust guidance.

Utilizing these resources can enhance your understanding and ensure that you're informed about your employee benefits.

Useful tools on pdfFiller for managing your SPDs

Managing your SPDs effectively is essential. pdfFiller provides unique tools to streamline the process. Here are some essential functions:

Harnessing these tools can greatly facilitate the management of your benefit plan descriptions, making your workflow more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit summary plan description online?

Can I create an eSignature for the summary plan description in Gmail?

How do I fill out summary plan description using my mobile device?

What is summary plan description?

Who is required to file summary plan description?

How to fill out summary plan description?

What is the purpose of summary plan description?

What information must be reported on summary plan description?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.