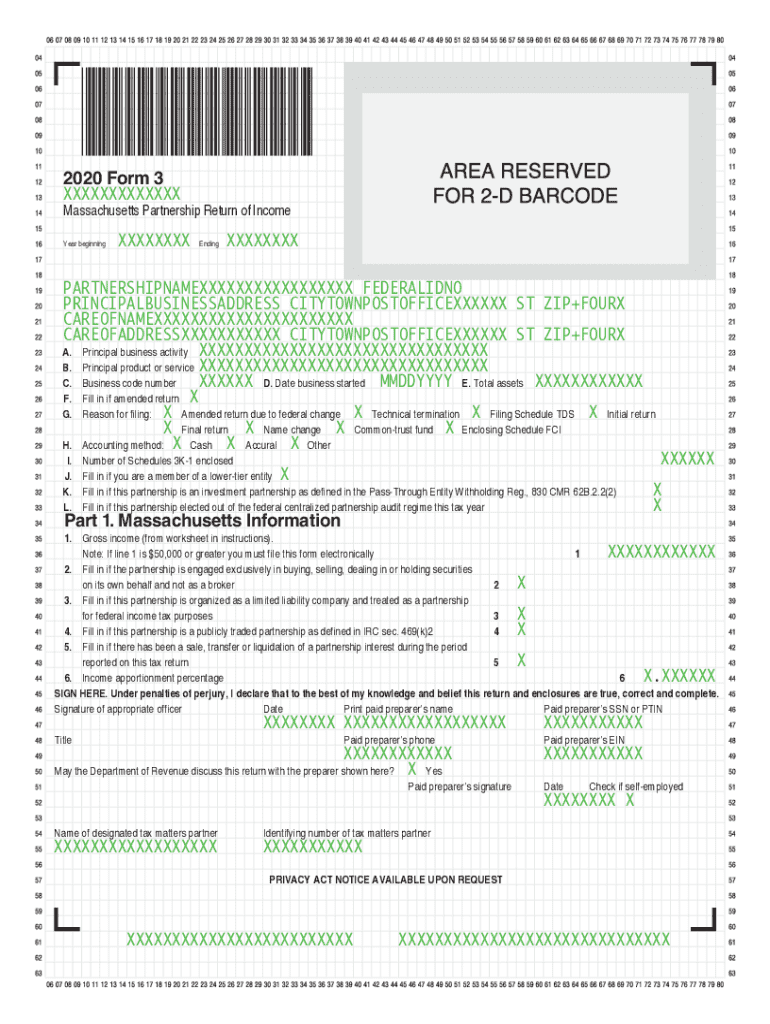

Get the free 2020 Form 3

Get, Create, Make and Sign 2020 form 3

Editing 2020 form 3 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2020 form 3

How to fill out 2020 form 3

Who needs 2020 form 3?

Comprehensive Guide to the 2020 Form 3 Form

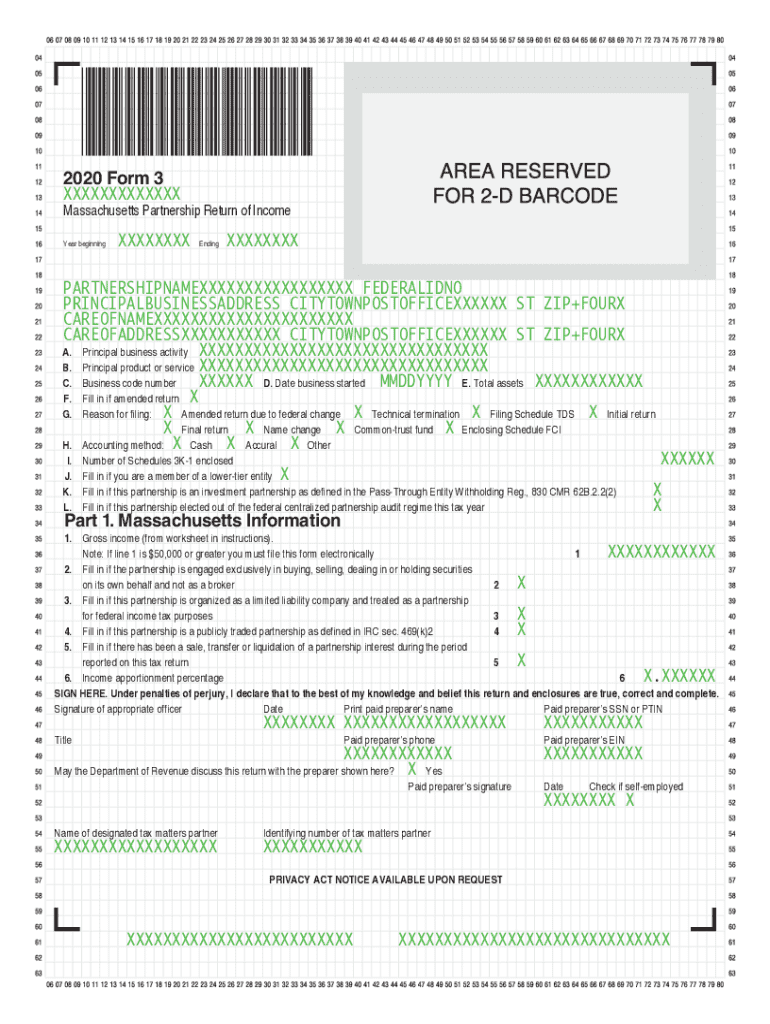

Understanding the 2020 Form 3 Form

The 2020 Form 3 Form is a critical document that serves specific functions across various sectors, including taxation, compliance, and organizational reporting. This form is designed to gather essential information that helps facilitate processes such as tax filing, financial audits, or regulatory compliance. Proper completion is not just a matter of formality; it can significantly impact your financial and legal obligations.

Understanding the purpose of the 2020 Form 3 Form is crucial. It ensures that individuals, professionals, and organizations can efficiently communicate their financial status or operational transparency to the requisite authorities. Inaccuracies or incomplete submissions can lead to delays, penalties, or even legal consequences.

Key elements of the 2020 Form 3 Form

To successfully complete the 2020 Form 3 Form, familiarity with its key elements is essential. The form contains sections that require your personal, business, or operational information, depending on who you are. From basic identification details to specific numeric data concerning income or expenditures, each section plays a vital role in accurately conveying the relevant information.

Certain sections might be universally required, while others can vary based on your profile as an individual or as an organization. Each section must be carefully reviewed and completed to ensure all necessary data is submitted. The layout and design of the form also guide you as you enter your information, making it imperative to follow the prescribed format for each segment.

Step-by-step instructions for filling out the 2020 Form 3 Form

Filling out the 2020 Form 3 Form begins with meticulous preparation. Gathering all necessary documents such as identification, financial records, and other pertinent information can save you time and reduce errors. Understanding the submission deadlines is also vital, as they determine the urgency of your preparations.

Begin with your personal information, ensuring that every detail is accurate and up-to-date. Next, proceed to the relevant sections tailored to your profile, whether you're an individual, a small business, or a larger organization. After completing all sections, it is critical to review the form for accuracy, checking for any discrepancies that could cause issues during processing.

Interactive tools for completing the 2020 Form 3 Form

Utilizing online tools can significantly streamline the process of completing the 2020 Form 3 Form. For instance, pdfFiller provides a robust platform that allows users to effortlessly fill out, edit, and manage their documents online. These tools not only simplify the user experience but also prevent the errors that may arise from manual filling.

With pdfFiller, you can use its interactive features to collaborate in real-time with team members, enabling easier input and feedback. To utilize pdfFiller effectively for the 2020 Form 3 Form, start by importing your document into the platform. From there, follow the guided interface to input your required information accurately and efficiently.

Signing and submitting the 2020 Form 3 Form

After completing the 2020 Form 3 Form, signing it correctly is essential to validate your submission. eSignatures are legally recognized in many jurisdictions, making them a convenient method for signing documents online. pdfFiller provides an intuitive interface where you can easily add your eSignature to the form.

Once the form is signed, it is crucial to choose an appropriate submission method. This could be via online submission, mailing the document, or delivering it in person, depending on the requirements set forth by the receiving authority. Tracking your submission status can also be handled through pdfFiller, ensuring that you are aware of any updates or necessary follow-ups.

Common mistakes to avoid

Mistakes in filling out the 2020 Form 3 Form can have significant consequences. Common errors include failing to complete required sections, misinterpreting questions, or providing inaccurate information. Individuals often overlook sections, especially in comprehensive forms, leading to incomplete submissions that can result in penalties or delays.

In terms of submission, pitfalls like late submissions can lead to fines, loss of benefits, or additional scrutiny from regulatory authorities. Making it a habit to double-check for confirmations upon submitting can save you from future complications.

Frequently asked questions about the 2020 Form 3 Form

Many users have questions regarding the 2020 Form 3 Form, particularly its requirements and submission processes. Common queries include, 'What if I make a mistake on the form?', 'When is the submission deadline?' and 'How do I track my submitted form?' Addressing these questions can alleviate confusion and streamline the process.

Troubleshooting tips involve ensuring you maintain digital copies of all submissions for your records and staying informed about updates to submission processes to avoid any last-minute issues.

Tips for managing and storing your 2020 Form 3 Form

Organizing your documents digitally is vital for easy access and future reference. Using tools like pdfFiller not only allows you to manage your 2020 Form 3 Form efficiently but also ensures that your sensitive information remains secure. Establishing a systematic way of storing documents can help you retrieve them better when needed.

Utilizing pdfFiller’s features allows users to save, share, and manage their forms securely in a cloud environment. By categorizing documents and labeling them appropriately, you can streamline your workflow and reduce time spent searching for forms.

Resources for further assistance

When navigating the complexities of the 2020 Form 3 Form, accessing help centers or support services can be invaluable. Many platforms, including pdfFiller, offer dedicated support to cater to your needs while filling out forms. Utilizing these resources ensures that you can get expert opinions when you encounter difficulties.

Moreover, pdfFiller’s knowledge base serves as a robust repository of tutorials and guides, helping users maximize their document handling abilities. This access to real-time help enhances your confidence and accuracy when dealing with important forms.

Staying informed about changes to the 2020 Form 3 Form

Changes to the 2020 Form 3 Form can occur, and staying up-to-date is essential to ensure compliance. Regularly checking for updates to the form requirements is a best practice for anyone who regularly fills it out. PdfFiller makes it easy to access the latest versions of forms, ensuring you are always using the correct document.

With rapid changes in regulations and requirements, leveraging tools that provide alerts or notifications about updates can simplify the process of keeping your information current. Being proactive minimizes the risk of compliance issues and helps maintain your financial clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2020 form 3 for eSignature?

How can I edit 2020 form 3 on a smartphone?

How do I complete 2020 form 3 on an Android device?

What is 2020 form 3?

Who is required to file 2020 form 3?

How to fill out 2020 form 3?

What is the purpose of 2020 form 3?

What information must be reported on 2020 form 3?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.