Get the free B52sxs

Get, Create, Make and Sign b52sxs

How to edit b52sxs online

Uncompromising security for your PDF editing and eSignature needs

How to fill out b52sxs

How to fill out b52sxs

Who needs b52sxs?

b52sxs form: A Comprehensive How-to Guide

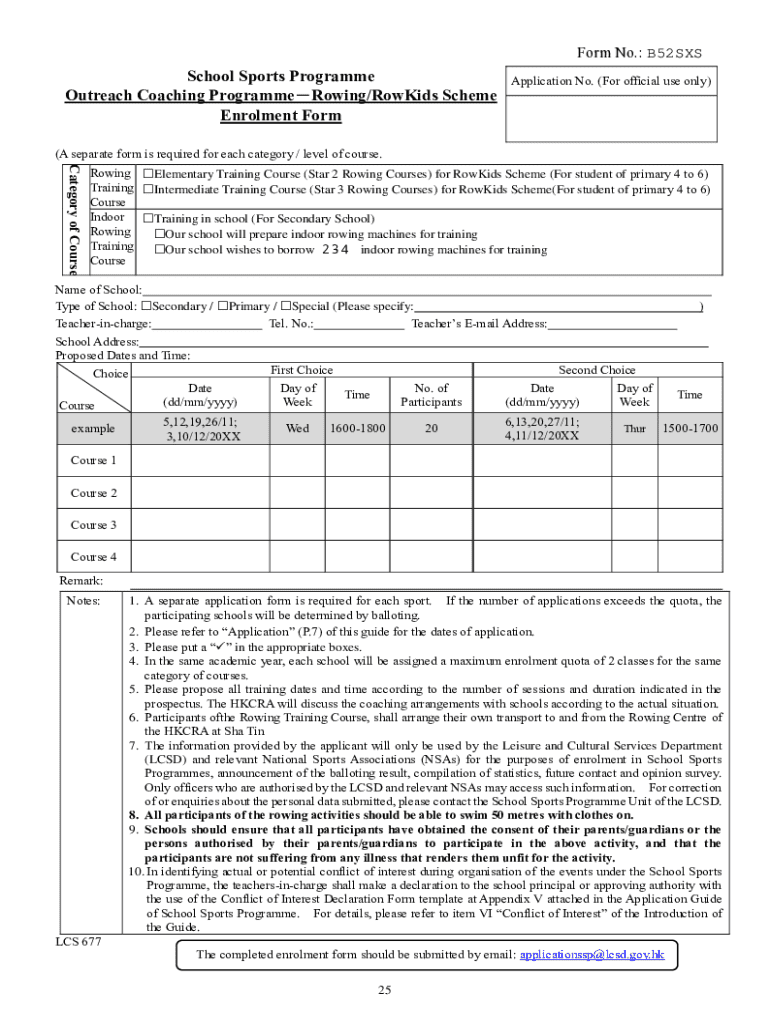

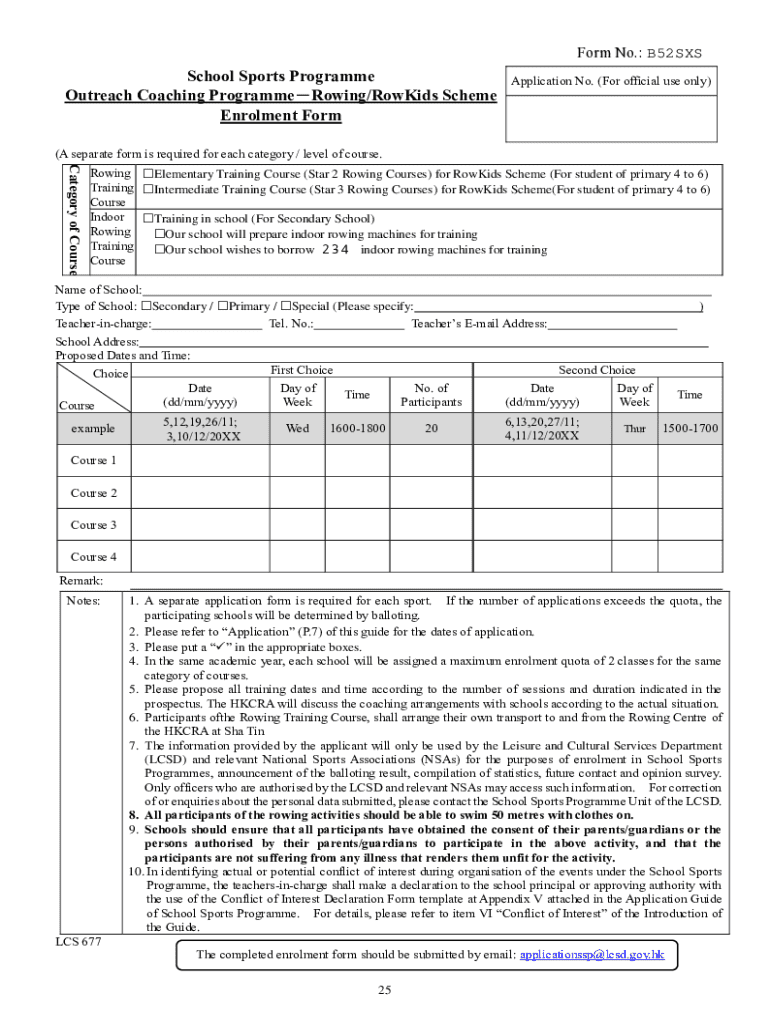

Understanding the b52sxs form

The b52sxs form is a specialized document utilized across various sectors for multiple purposes, most notably for tax documentation and employment records. Its primary function is to gather and standardize essential information that supports financial transactions and employee records. By providing a clear structure for necessary data, the b52sxs form streamlines processes that require verification or declaration of personal and financial details.

The significance of the b52sxs form extends beyond mere paperwork; it plays a crucial role in ensuring compliance with legal and financial regulations. In contexts like tax submissions and employee verification, using the correct form can make a significant difference in the efficiency and reliability of record-keeping. Common scenarios that necessitate the b52sxs form include job applications, tax filings, and even loan applications, where the clarity and completeness of the provided information are paramount.

Key features of the b52sxs form

The b52sxs form comprises several essential components that facilitate its intended use. At its core, this document includes a personal information section where individuals need to provide details like name, address, and identification numbers. This section is often required to establish identity and validate the information on the form.

The financial details segment collects relevant monetary information, including income levels, tax numbers, or other financial identifiers. Additionally, some versions of the b52sxs form may include certifications or declarations, which ensure that the information provided is accurate and compliant with regulations. Variations of the form may occur across different states or organizations, with specific adjustments reflecting local legal requirements or industry standards.

How to access the b52sxs form

Accessing the b52sxs form is straightforward, as it can typically be downloaded from official sources such as government websites or financial institutions. However, one of the most efficient ways to acquire this document is through pdfFiller’s platform, which offers a user-friendly interface for document management.

To find the b52sxs form on pdfFiller, you can follow these simple steps:

Step-by-step instructions for filling out the b52sxs form

Before filling out the b52sxs form, it's essential to prepare your information effectively. Start by gathering necessary documents, such as identification, tax records, and any financial statements that may be required. Understanding which fields are mandatory is crucial, as inaccuracies or omissions can lead to processing delays.

Here’s a detailed walkthrough of each section of the b52sxs form:

To avoid common mistakes, double-check all entries for accuracy and consistency, ensuring that names and numbers match existing documentation.

Editing the b52sxs form using pdfFiller

Once you’ve filled out your b52sxs form, you may find the need to edit it. pdfFiller makes this process seamless. You can add text, images, and even signatures with just a few clicks. The platform’s intuitive design allows you to adjust formatting easily, helping you ensure that your document looks professional.

Here are some key features of pdfFiller that enhance your experience:

eSigning the b52sxs form

Digital signatures are increasingly important in today’s document management landscape, presenting a secure way for you to authenticate your b52sxs form electronically. pdfFiller simplifies this process, streamlining the signing experience.

Here’s how to eSign using pdfFiller:

Collaborating on the b52sxs form

When working on the b52sxs form as part of a team, collaboration tools become essential. pdfFiller offers features that allow for real-time collaboration, enabling multiple users to edit, comment, and review the document simultaneously.

You can make use of team collaboration tools with the following steps:

Managing and storing your b52sxs form

Efficient document management is vital for maintaining a comprehensive understanding of your records. pdfFiller provides robust options for storing and managing your b52sxs form securely in the cloud.

Best practices for document management include:

Common FAQs about the b52sxs form

As users engage with the b52sxs form, several frequently asked questions arise. Addressing these can help streamline the process for new users.

Common issues and their solutions include:

Final thoughts and best practices for using the b52sxs form

Accuracy in document submission cannot be overstated. The implications of erroneous information can be far-reaching, affecting not only personal records but also legal standing. It's advisable to keep a comprehensive record of all your forms and their submissions as a reference.

By leveraging pdfFiller's vast capabilities, from document creation to signature management, users can ensure their experience with the b52sxs form is effective and efficient. As you navigate through this process, remember to regularly review your documents for compliance with any regulatory changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find b52sxs?

Can I sign the b52sxs electronically in Chrome?

How do I fill out the b52sxs form on my smartphone?

What is b52sxs?

Who is required to file b52sxs?

How to fill out b52sxs?

What is the purpose of b52sxs?

What information must be reported on b52sxs?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.