Get the free Sbd1

Get, Create, Make and Sign sbd1

How to edit sbd1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sbd1

How to fill out sbd1

Who needs sbd1?

The Complete Guide to Completing the sbd1 Form

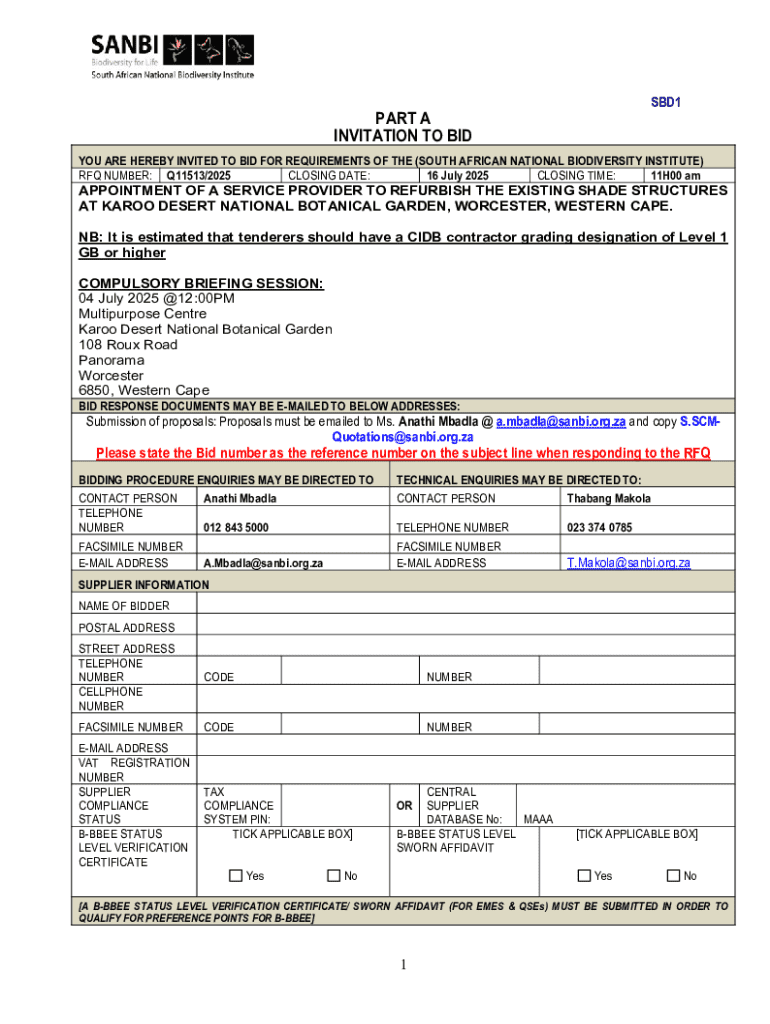

Understanding the sbd1 form

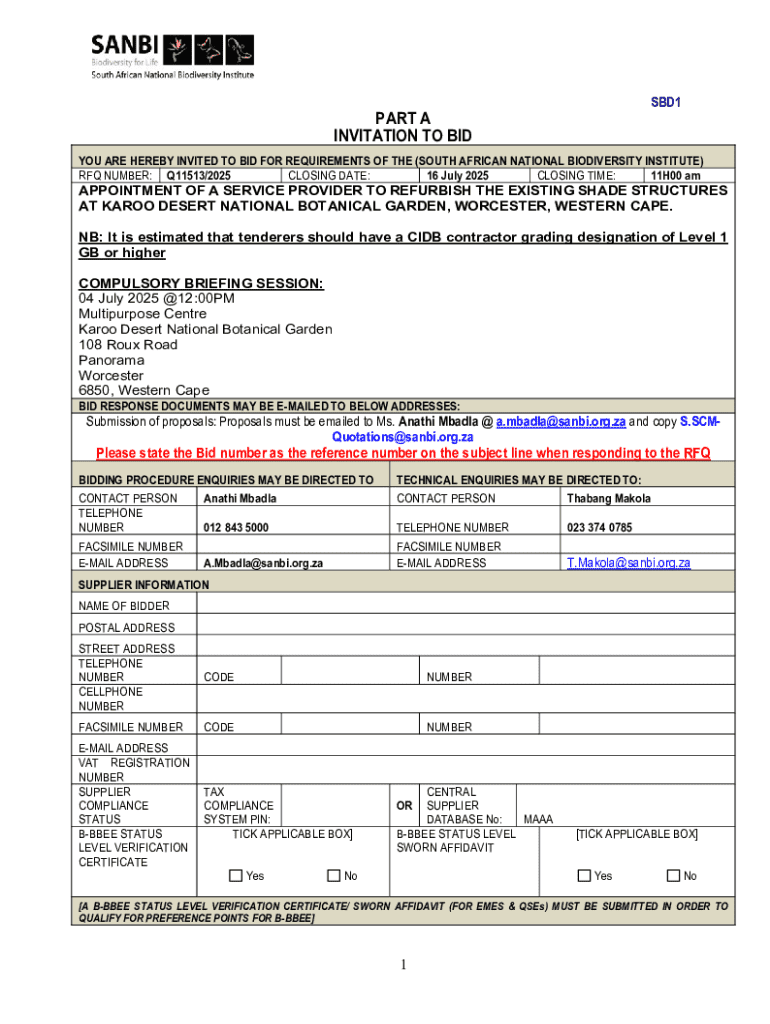

The sbd1 form is a critical document used in various contexts, primarily for tax-related submissions and documentation management. It serves to collect specific information required by regulatory agencies and organizations to process claims, applications, or detailed records. Understanding the purpose and common uses of the sbd1 form is crucial for ensuring compliance and correct data submission.

Typically, the sbd1 form is employed by individuals and businesses alike, appealing to audiences that include tax professionals, accountants, and entrepreneurs seeking tax deductions or credits. While its primary focus is on financial matters, the form's significance extends to numerous administrative and compliance needs.

Completing the sbd1 form properly is not merely a administrative task; it carries legal implications. Submitting incomplete or incorrect forms can lead not only to delays in processing but also potential penalties during audits. Ensuring that every field is filled accurately accelerates processing times and enhances the accuracy of records.

Preparing to fill out the sbd1 form

Effective preparation before filling out the sbd1 form is pivotal. Begin by gathering all necessary information, which typically includes personal details such as your full name, address, and tax identification numbers. Depending on the context, you may also need supporting documents like receipts, other tax documents, or legal identifications.

For those working digitally, pdfFiller is recommended for editing and filling out PDFs. This software supports easy form completion and allows for modifications, annotations, and the safe handling of sensitive information.

Step-by-step instructions for completing the sbd1 form

Navigating the layout of the sbd1 form is straightforward with an overview of each section. Familiarize yourself with the document's structure to ensure efficient completion. Key fields include your personal information, tax year, and specific claims or deduction requests.

When filling each section, be aware of common mistakes such as miscalculating numbers or leaving mandatory fields blank. Using pdfFiller’s tools can help confirm all entries are accurate, and their e-signature capabilities streamline the signature process.

Tips for editing and formatting the sbd1 form

Editing a PDF can pose challenges, but best practices can lead to a polished final product. Focus on ensuring readability and compliance while making any necessary edits. Consider reviewing the font and size, as well as ensuring consistency in spacing within the document.

Annotations can enhance your form, whether for personal notes or to highlight specific areas for review by others. Utilizing pdfFiller’s editing features can make this process seamless, allowing you to maintain organization and professionalism.

Signing and submitting the sbd1 form

When it comes to signing the sbd1 form, understanding the requirements is vital. For forms that allow e-signatures, pdfFiller provides a secure platform to eSign documents effortlessly. This method is not only convenient but also expedites the overall submission process.

Regardless of the submission method, it’s crucial to follow best practices like confirming addresses and sending via tracked services to ensure the safe arrival of your form.

Managing your sbd1 form after submission

Post-submission, managing your sbd1 form effectively can save time and hassle. First, track your submission status by following up with the respective agency or entity utilizing their tracking system. Keeping a record of your submission date and any confirmation receipt is beneficial.

Utilizing pdfFiller allows for easy file retrieval and enhances collaboration, leading to better management of important forms and documents.

Troubleshooting common issues with the sbd1 form

Even seasoned professionals encounter issues when completing the sbd1 form. The most common challenges arise from providing incomplete information or experiencing technical difficulties during uploads or e-signatures. Addressing these hurdles swiftly can prevent delays or rejections.

Utilizing available resources efficiently can save you from making preventable mistakes. pdfFiller remains committed to ensuring users can overcome these challenges while filling out their forms.

Real-life examples of successful sbd1 form submissions

Real-life examples illuminate the practical applications of effectively completing the sbd1 form. For instance, several entrepreneurs reported successfully claiming tax credits after utilizing their tax professional's guidance with the sbd1.

These testimonials not only underscore the importance of accurate submissions but also highlight the enhanced efficiency when utilizing platforms like pdfFiller.

Exploring advanced features of pdfFiller for form management

pdfFiller hosts an array of advanced features that enhance user experience beyond just filling out forms. For instance, collaboration tools enable teams to work together on document management seamlessly. These capabilities streamline workflows, ensuring that information is shared, revised, and approved within one convenient platform.

Additionally, integrating pdfFiller with other applications such as CRM or accounting software can yield robust document management solutions that save significant time and resources.

Conclusion

The sbd1 form is an essential document that requires careful consideration and correct completion. By leveraging tools like pdfFiller, users can optimize their form management strategies, improving compliance and efficiency significantly. Embrace these digital tools to streamline your workflow and ensure you handle all your documentation with precision.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete sbd1 online?

How do I fill out sbd1 using my mobile device?

Can I edit sbd1 on an Android device?

What is sbd1?

Who is required to file sbd1?

How to fill out sbd1?

What is the purpose of sbd1?

What information must be reported on sbd1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.