Get the free Sbd1

Get, Create, Make and Sign sbd1

Editing sbd1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sbd1

How to fill out sbd1

Who needs sbd1?

Everything You Need to Know About the SBD1 Form

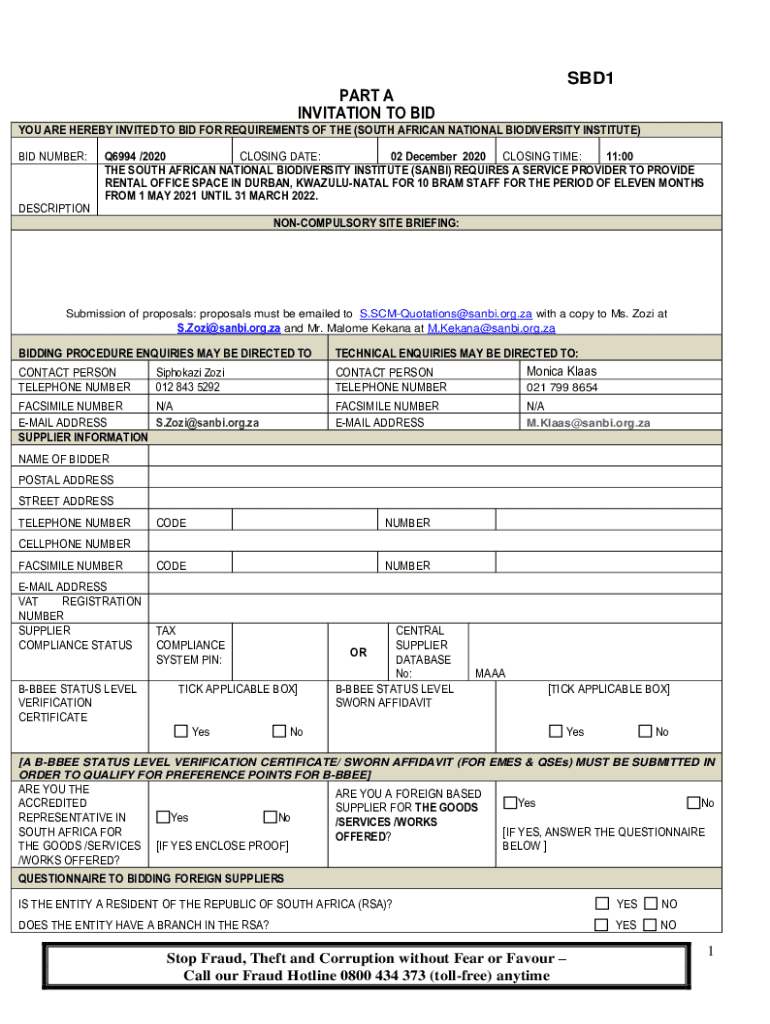

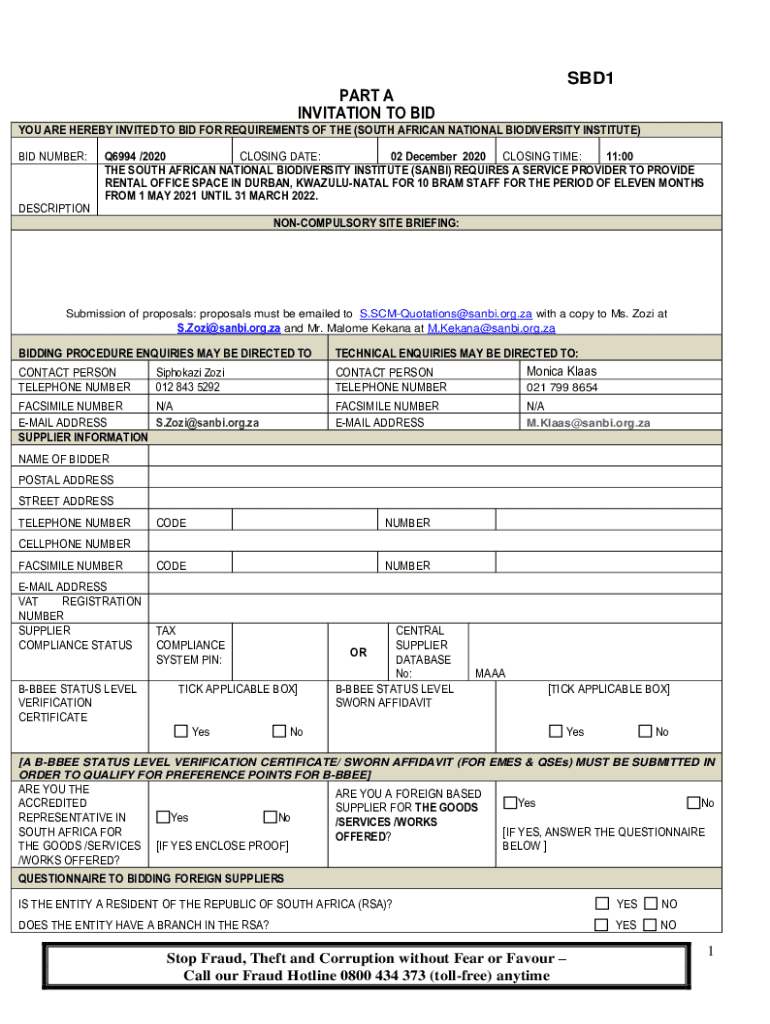

Understanding the SBD1 form

The SBD1 form is a critical document that individuals and businesses often encounter, primarily within the realms of tax and income declaration. Its primary purpose is to facilitate smooth communication between taxpayers and regulatory authorities. In various contexts, the SBD1 form serves as a declaration of personal income for self-assessment tax or similar purposes.

Filling out the SBD1 form correctly is paramount not only for compliance but also for ensuring that everyone meets their legal obligations. The accuracy of this form can significantly impact an individual’s or organization’s financial standing, making it essential to understand its nuances.

Key features of the SBD1 form

Understanding the structure of the SBD1 form is essential for successful completion. The form typically comprises several distinct sections that guide users through the necessary information required. Each section is designed to capture specific data points critical for accurate tax reporting.

These sections generally include personal identification details, income sources, deductions, and any additional financial disclosures. Each part must be filled out with meticulous attention to detail to avoid potential delays or penalties in processing.

Common terms associated with the SBD1 form include 'gross income', 'taxable income', and 'deductions'. Familiarizing yourself with these terms can greatly enhance your understanding of the entire document.

Step-by-step instructions for filling out the SBD1 form

Before diving into the completion process, it is essential to prepare adequately. This involves gathering all necessary documents and verifying you have all needed personal information at hand. Generally, you will require income statements, identification documents, and records of any deductions you intend to claim.

It's advisable to create a checklist to organize your materials, ensuring a smoother filling experience.

Now, follow these detailed steps for filling out the SBD1 form:

Editing and managing the SBD1 form

Using pdfFiller to edit your SBD1 form can significantly streamline the process. This cloud-based platform offers tools designed to enhance the completeness and accuracy of your documents. Whether you need to modify text, add signatures, or include new sections, pdfFiller provides user-friendly features to cater to these needs.

Key features of pdfFiller that can enhance your experience include:

After completing the editing process, it's crucial to securely save your finalized SBD1 form. pdfFiller allows you to easily download the document or keep it stored in your account for future access. This flexibility ensures you can retrieve and share your documents whenever necessary.

eSigning the SBD1 form

In many cases, the SBD1 form requires a signature to verify the information provided. eSigning is increasingly important in today's digital environment. It not only enhances security but also expedites the administrative process.

Using pdfFiller to eSign your SBD1 form follows a straightforward process. Here’s how you can do it:

Following these steps ensures your eSignature is legally binding, making your SBD1 form ready for submission.

Collaborating on the SBD1 form

Often, filling out the SBD1 form may require input from multiple stakeholders, particularly in organizational contexts. Collaborating using tools like pdfFiller can significantly enhance this process. pdfFiller enables easy sharing and collaboration on documents, allowing team members to provide feedback and make necessary revisions.

To share your SBD1 form using pdfFiller, follow these steps:

Utilizing features such as comments and markup within pdfFiller allows you to gather feedback effectively and incorporate necessary changes, making the entire collaborative experience seamless.

Troubleshooting common issues with the SBD1 form

Even with diligent efforts, mistakes can occur when completing the SBD1 form. Being aware of common errors can help you avoid pitfalls that may delay processing or lead to rejected claims. Some typical mistakes include incorrect personal information, missing signatures, or wrongly calculated income.

To resolve these issues, it is essential to identify errors promptly. If you notice a mistake post-submission, contact the relevant authority to rectify the error as soon as possible. Many jurisdictions have specific procedures for amending submitted forms, which can prevent complications.

If you encounter persistent issues, reaching out to support services associated with your local tax authority can provide further assistance and guidance.

Conclusion and next steps

Completing the SBD1 form is a crucial process requiring careful attention and accuracy. By following the outlined steps, you can ensure your submission is appropriate, thereby safeguarding against potential issues. Using a platform like pdfFiller to edit, eSign, and collaborate reinforces your efficiency and effectiveness during the process.

In addition, don’t hesitate to explore other features offered by pdfFiller, from advanced document management to templates that simplify your work. These tools not only streamline your SBD1 form experience but also enhance your overall document handling capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit sbd1 on an iOS device?

How can I fill out sbd1 on an iOS device?

How do I fill out sbd1 on an Android device?

What is sbd1?

Who is required to file sbd1?

How to fill out sbd1?

What is the purpose of sbd1?

What information must be reported on sbd1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.