Parent Plus Loan Adjustment Form: A How-to Guide

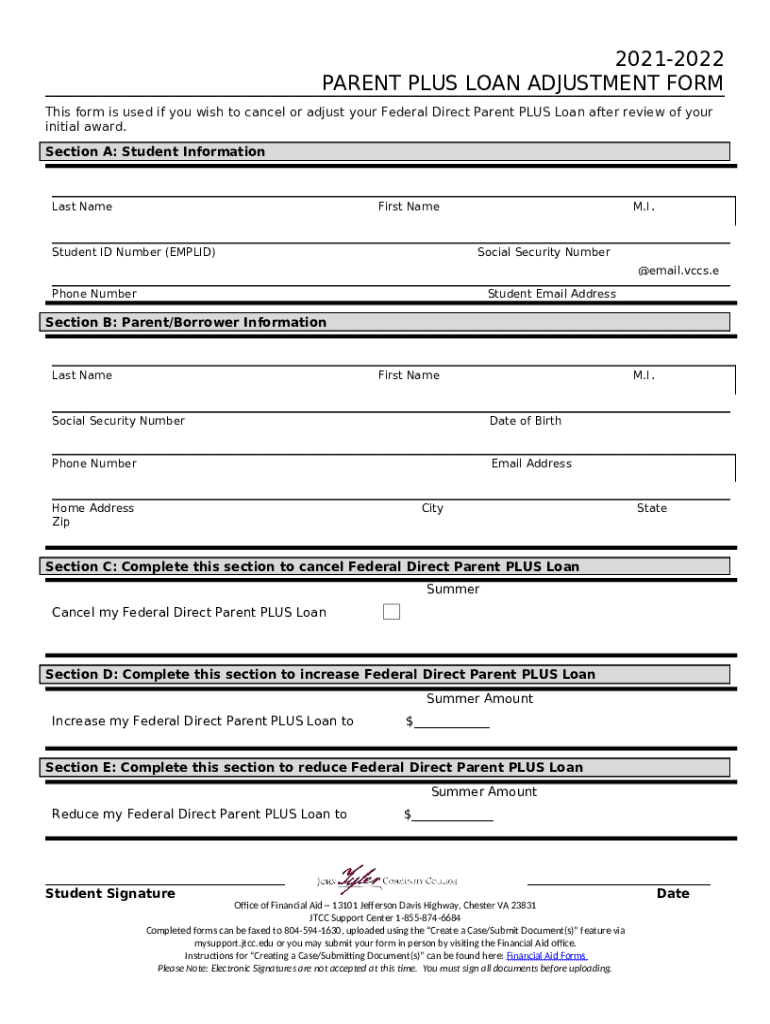

Understanding the Parent Plus Loan Adjustment

Parent Plus Loans are federal educational loans that parents can take out to help pay for their children's college expenses. Unlike traditional student loans, these loans are issued to the parents rather than the students, making parents responsible for repayment. Adjusting these loans becomes necessary for various reasons, from changing financial circumstances to correcting processing errors.

Adjusting your Parent Plus Loan can be crucial for managing repayment strategies and ensuring that the loan terms align with your financial capabilities. Common reasons for adjusting a loan include changes in family income, updates in the student’s enrollment status, or modifying the repayment plan.

Change in financial circumstances affecting repayment ability.

The student’s enrollment status changes (e.g., reducing credit hours).

Switching repayment plans for better terms.

When to use the Parent Plus Loan Adjustment Form

The Parent Plus Loan Adjustment Form should be utilized in specific situations that warrant changes to your loan agreement. For example, if you have experienced a significant decrease in income or if the student has withdrawn from school, filling out this form becomes essential. Such adjustments can have immediate effects on monthly payments and overall interest contributions, making it a critical component of loan management.

Processing times for adjustments can vary, but it is crucial to be proactive. Typically, adjustments may take anywhere from a few weeks to over a month, depending on the complexity of the change and the efficiency of the loan servicer. Understanding when and why to use this form can lead to improved financial outcomes.

You have a change in income making payments unmanageable.

The student enrolls less than half-time.

You want to change repayment plans.

Step-by-step guide to completing the Parent Plus Loan Adjustment Form

Completing the Parent Plus Loan Adjustment Form requires careful preparation to ensure accuracy and compliance. Here’s a step-by-step guide to help you navigate the process efficiently.

### Step 1: Gather required information

Collect details about both the borrower (you) and the student, including names and contact information.

Prepare documentation regarding income, expenses, and any relevant financial changes that support your adjustment request.

Have your loan number and the borrower’s Social Security Number (SSN) on hand to complete the form accurately.

### Step 2: Access the Adjustment Form

To access the Parent Plus Loan Adjustment Form, navigate to pdfFiller. Ensure you are using the latest version of the form to avoid any processing delays. This can typically be done by checking the official page where the form is listed.

### Step 3: Filling out the form

Complete each section of the form carefully. Pay special attention to avoid common mistakes such as discrepancies in the borrower’s name or incorrect loan details. You can utilize pdfFiller’s editing tools for guidance, which can minimize errors and streamline the submission.

### Step 4: Review your submission

It’s indispensable to double-check all information before submission. Use pdfFiller’s built-in collaboration features to have a peer review your form, helping to catch errors you might have overlooked.

### Step 5: Submission process

Once finalized, submit the completed form. Depending on the loan servicer, you may have various submission methods, such as online or mail. Track your submission status to ensure it’s processed smoothly.

Managing your Parent Plus Loan post-adjustment

After your Parent Plus Loan Adjustment Form has been submitted, you will receive a response from your loan servicer. It is essential to understand the outcome clearly, whether it results in approval or denial. If approved, be sure to note any changes to your monthly payment amounts or interest rates.

If your request is denied, review the reasons provided by your loan servicer to identify any next steps you may take. Understanding the adjustments made to your loan will help you stay informed and manage your finances effectively moving forward.

Review adjusted repayment terms once approved.

Consult with your loan servicer if your request is denied.

Make necessary adjustments to your budget based on new payment amounts.

Using pdfFiller to manage documents effectively

pdfFiller presents several features that enhance the adjustment process for your Parent Plus Loan. One of the most significant capabilities is eSigning, allowing you to finalize documents securely without the need to print. Additionally, pdfFiller ensures secure document storage so you can access your loan documents whenever needed.

The collaboration tools available on pdfFiller allow teams to manage and edit documents effectively, facilitating better communication. Moreover, being a cloud-based platform, pdfFiller makes all adjustments manageable from anywhere with internet access, enabling real-time editing and updates for your Parent Plus Loan documents.

eSigning capabilities providing security and speed.

Document storage ensuring easy access to your loan documents.

Collaboration tools supporting team editing and document management.

Additional considerations when adjusting Parent Plus Loans

When considering adjustments to your Parent Plus Loan, it is crucial to recognize how these changes may impact your overall financial profile, including eligibility for future financial aid. Changes in repayment plans, interest rates, and overall loan terms can influence future borrowing opportunities for both you and your student.

Take advantage of resources available for ongoing loan management. This may include financial counseling services or workshops provided by educational institutions. If there are uncertainties during the adjustment process, do not hesitate to contact your loan servicer directly for assistance.

Understand the potential impact on future financial aid.

Utilize financial counseling services or workshops for guidance.

Reach out to your loan servicer for assistance with complications.

Frequently asked questions (FAQ)

Navigating the Parent Plus Loan Adjustment Form can raise various questions and concerns. Below are some common queries regarding this process, along with clarifications on eligibility and requirements.

What circumstances qualify for adjustments? Generally, financial hardship, status changes of the student, or repayment strategy modifications may qualify for adjustments.

What documentation do I need to provide? Documentation may include proof of income changes, letters addressing the student’s status, and any pertinent information related to your financial scenario.

How can I handle complications in my adjustment request? Should issues arise, contacting your loan servicer promptly is crucial for clarifying your next steps.

Clarify qualifying circumstances for adjustments.

Gather required documentation related to your financial situation.

Promptly contact your loan servicer for complications.