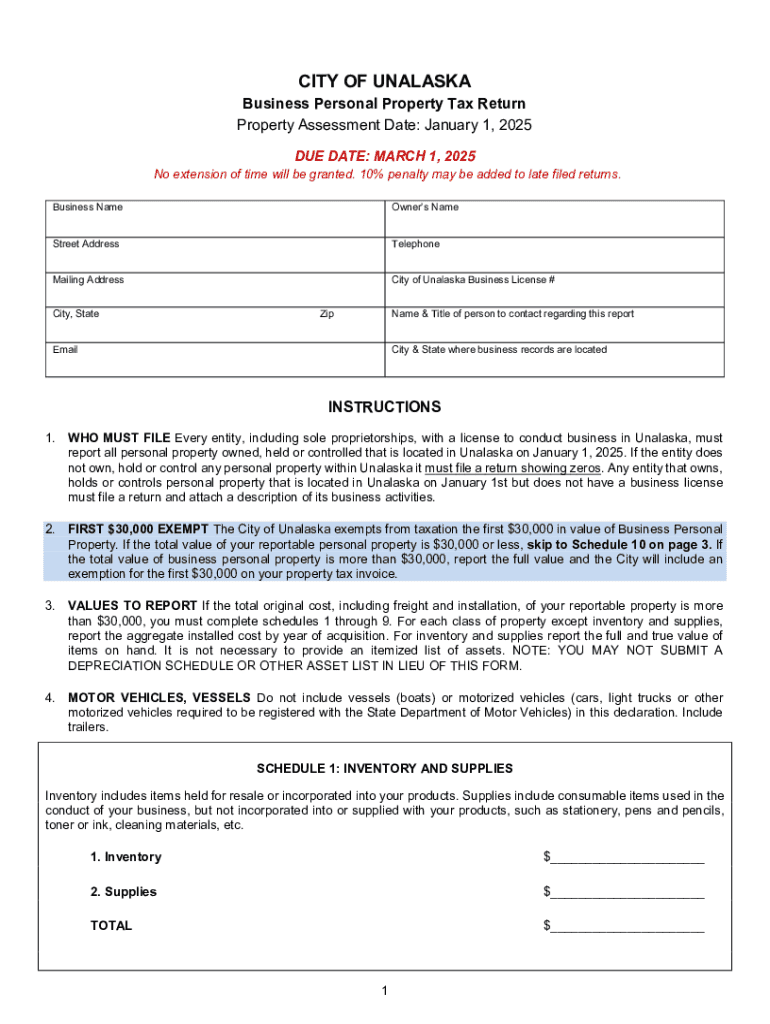

Get the free Business Personal Property Tax Return

Get, Create, Make and Sign business personal property tax

How to edit business personal property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business personal property tax

How to fill out business personal property tax

Who needs business personal property tax?

Comprehensive Guide to the Business Personal Property Tax Form

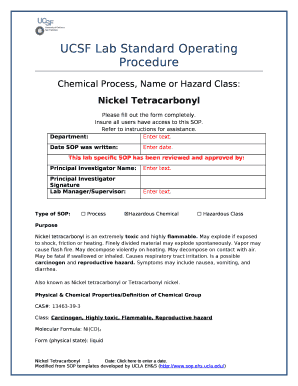

Overview of business personal property tax

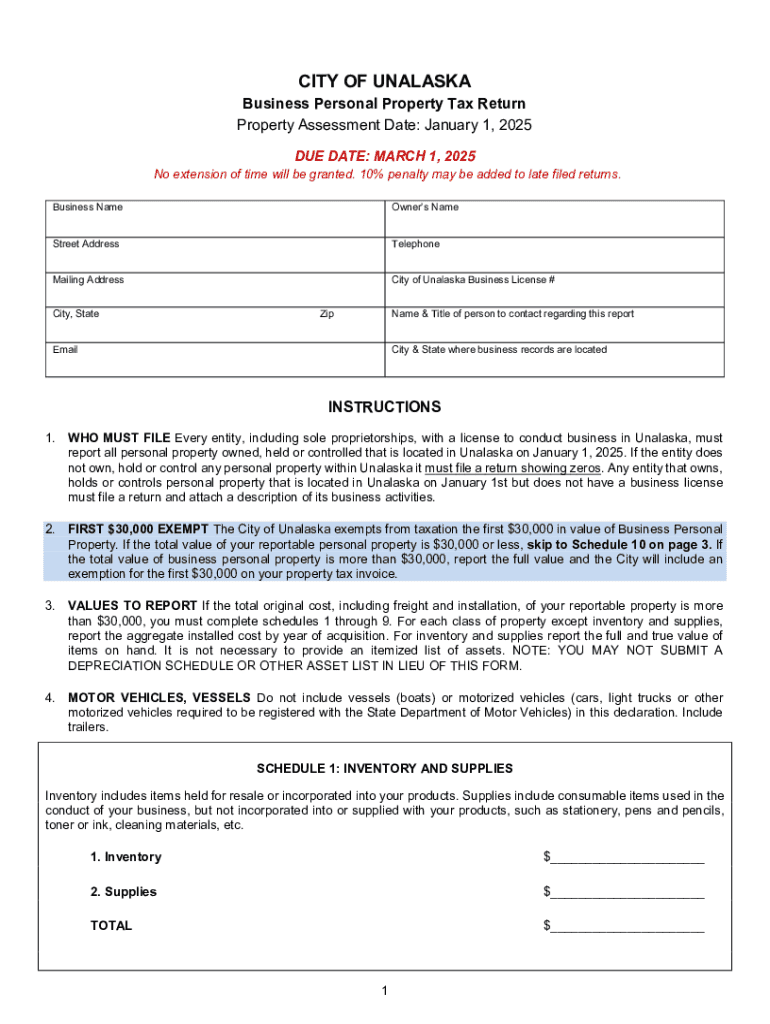

Business personal property tax is an essential part of local taxation systems, applied to the tangible assets that businesses own and utilize. This type of tax is generally levied on items such as machinery, equipment, furniture, and inventory that are not tied to real estate. Understanding and filing the business personal property tax form is critical, as it impacts your business operations and profitability.

Businesses of all sizes need to file this form, including corporations, partnerships, and sole proprietorships. Local jurisdictions typically require businesses to report their owned assets annually to assess appropriate tax charges. Key deadlines for filing often fall on specific dates, commonly aligning with the tax year and determined by local legislation.

Understanding the business personal property tax form

The business personal property tax form serves a mandatory role in reporting business-owned tangible assets. This form is utilized by tax assessors to calculate the tax liability for a business, making it critical for maintaining compliance and avoiding penalties.

Typically, the form is divided into several sections, including the Identifying Information Section, Asset Details Section, and Valuation Section. Each section must be carefully completed to ensure accurate reporting.

Steps to fill out the business personal property tax form

Filling out the business personal property tax form involves several key steps to ensure accuracy and compliance. Start by gathering all required documentation that will support your asset claims.

Next, accurately complete the identifying information section, ensuring all business details are correctly listed. Following that, report the asset details, listing items such as office furniture, computers, and machinery. It's vital to assess and report their values accurately, which may require referencing financial statements and market conditions.

Review your completed form thoroughly, making sure to correct common mistakes such as incorrect asset valuations or typos in identifying information. Finalize the form by confirming all entries are correct and complete.

Submitting your business personal property tax form

Once your business personal property tax form is completed, the next step involves submission. Depending on your local regulations, forms may need to be sent to a specific tax office or department.

Payment of business personal property tax

Upon successful filing, businesses must then address payment of the assessed personal property tax. Payment options can vary based on jurisdiction and may include several methods.

Failure to meet payment deadlines can result in penalties, which may escalate quickly. Businesses facing difficulties should inquire about potential payment plans offered by local tax authorities to ease financial burdens.

Managing ongoing business personal property tax responsibilities

Once filed and paid, businesses have ongoing responsibilities to maintain compliance with personal property tax laws. This includes knowing that businesses typically must re-file annually or as asset changes occur.

FAQs on business personal property tax form

The following addresses common questions that arise regarding the business personal property tax form and its responsibilities. If you miss the filing deadline, be aware of the procedures to request an extension or file late without incurring steep penalties.

Additional tools and resources from pdfFiller

pdfFiller facilitates the completion of your business personal property tax form with a variety of interactive tools. With pdfFiller, you can edit, eSign, and securely share your documents from any location, ensuring ease of access and efficient management.

Support and assistance

For additional support with your business personal property tax form, pdfFiller offers various resources. Customer support teams are readily available to assist with specific questions regarding form completion and submission.

Related forms and applications

Besides the business personal property tax form, numerous other business tax forms may be relevant depending on your state's requirements. Familiarizing yourself with these forms can streamline your overall tax management process.

Conclusion

Properly managing the business personal property tax form is crucial for ensuring your business remains compliant and avoids any unnecessary penalties. Taking the time to understand filing requirements, keep thorough records, and utilize helpful tools like pdfFiller can significantly ease the burden of tax responsibilities, promoting the continued success of your business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business personal property tax without leaving Google Drive?

How do I execute business personal property tax online?

Can I create an eSignature for the business personal property tax in Gmail?

What is business personal property tax?

Who is required to file business personal property tax?

How to fill out business personal property tax?

What is the purpose of business personal property tax?

What information must be reported on business personal property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.