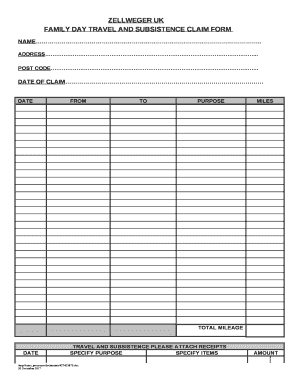

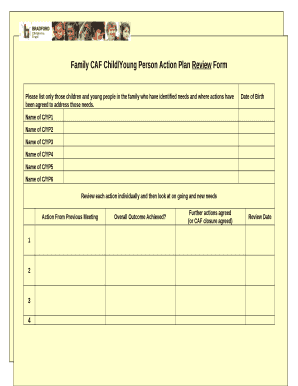

Get the free Form 10-k

Get, Create, Make and Sign form 10-k

How to edit form 10-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 10-k

How to fill out form 10-k

Who needs form 10-k?

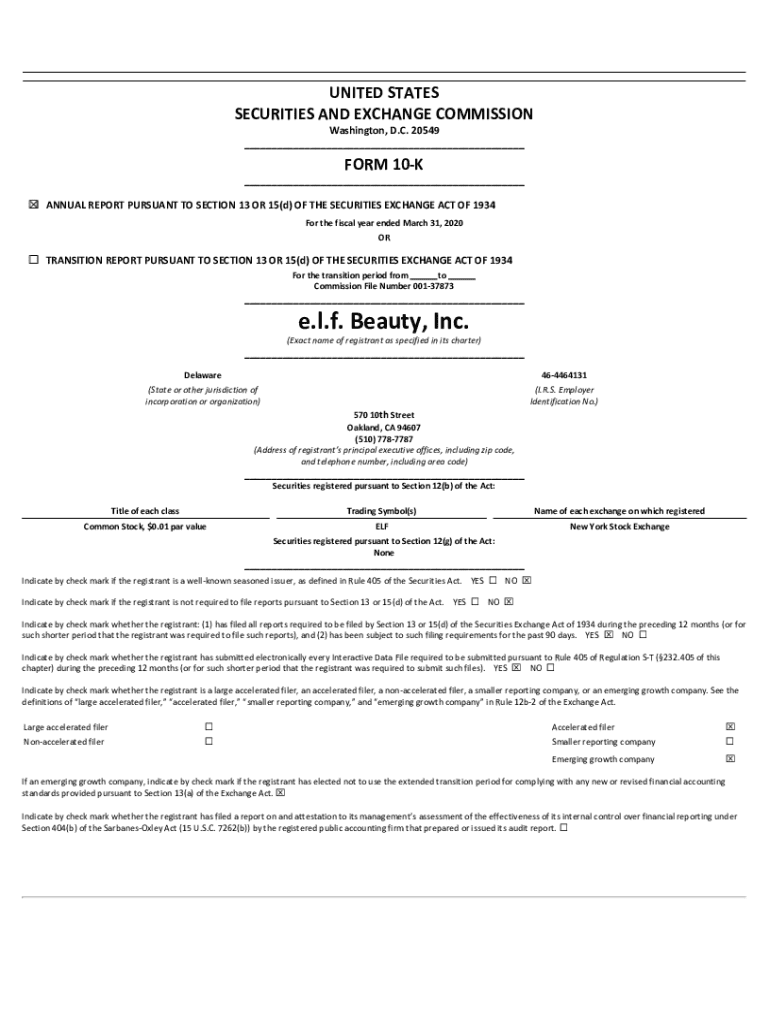

Understanding Form 10-K: A Comprehensive Guide for Investors

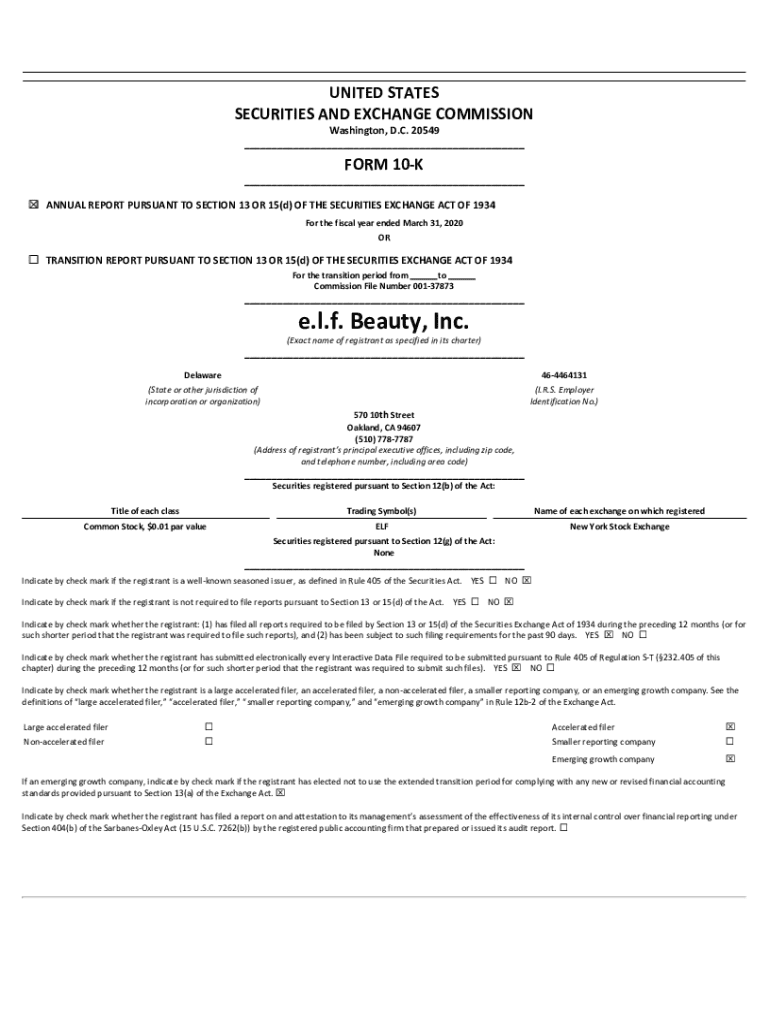

What is a Form 10-K?

A Form 10-K is a detailed annual report filed by publicly traded companies with the U.S. Securities and Exchange Commission (SEC). It provides a comprehensive overview of the company's financial performance, operations, and future prospects. This document is crucial for investors, as it includes audited financial statements, management discussions, and critical disclosures that can influence investment decisions.

For stakeholders and investors, the Form 10-K is indispensable, containing vital information that helps assess a company's health and stability. Unlike other SEC filings, such as the Form 10-Q (quarterly report) or Form 8-K (current report), the Form 10-K offers a more in-depth look at the company's overall performance over the fiscal year.

Understanding the structure of a Form 10-K

The Form 10-K is structured into four parts, each covering various aspects of the company’s performance and operations.

Key components of a Form 10-K

Among the crucial components of a Form 10-K, several sections stand out.

Forward-looking statements, which predict future operations or conditions, are also a significant portion of the Form 10-K, informing investors of planned initiatives.

Key filing deadlines for Form 10-K

Companies are required to file their Form 10-K annually within different deadlines based on their fiscal year-end. Generally, companies must file within 60 to 90 days after year-end, depending on their size and whether they are accelerated filers.

Adhering to these schedules is crucial for regulatory compliance and transparency.

How to find and access Form 10-Ks

Locating Form 10-Ks is straightforward through the SEC’s EDGAR database. To access these forms, follow these steps:

Effective searches often involve combining the company name with the term '10-K' to streamline results.

Navigating the forms and related filings

In addition to the Form 10-K, companies may file several other forms, such as Form 10-Q and Form 8-K. Understanding these forms is crucial for a complete picture of a company's performance.

Five percent ownership reporting

Investors owning five percent or more of a class of a company's stock are required to file reports regarding their holdings, crucial data that feeds into the Form 10-K analysis. These filings reveal ownership structure and may signal potential influences on a company's direction.

Frequently asked questions (FAQs) about Form 10-K

Many investors have common queries regarding the Form 10-K. Here are some important questions answered:

Using pdfFiller for Form 10-K management

pdfFiller offers robust solutions for managing the Form 10-K process, empowering companies and individuals to fill out, edit, sign, and manage this essential document seamlessly.

By utilizing pdfFiller, users can ensure compliance while maintaining organized records of their financial disclosures.

Conclusion

A thorough understanding of the Form 10-K is essential for any investor or stakeholder making informed business and investment decisions. By familiarizing oneself with the structure, key components, and filing procedures of the Form 10-K, users position themselves to better analyze a company's financial health and prospects.

Exploring tools like pdfFiller can enhance the process of document management and compliance, providing valuable support in navigating the responsibilities associated with filing a Form 10-K.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 10-k from Google Drive?

How can I get form 10-k?

How do I edit form 10-k on an iOS device?

What is form 10-k?

Who is required to file form 10-k?

How to fill out form 10-k?

What is the purpose of form 10-k?

What information must be reported on form 10-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.