Get the free Title Iv Credit Balance Authorization

Get, Create, Make and Sign title iv credit balance

Editing title iv credit balance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out title iv credit balance

How to fill out title iv credit balance

Who needs title iv credit balance?

Understanding the Title Credit Balance Form: A Comprehensive Guide

Understanding Title credit balances

A Title IV credit balance arises when the financial aid received by a student exceeds the cost of their educational expenses. This surplus often results from government-funded grants, loans, or scholarships under Title IV of the Higher Education Act. Understanding Title IV credit balances is crucial for students and institutions alike, as it highlights the financial intricacies of educational funding and its implications. It directly affects financial planning, allowing students to utilize the excess funds for eligible expenses like textbooks or living costs.

Title IV funding plays a pivotal role in broadening access to higher education, ensuring that students can afford essential educational resources. Programs under Title IV include Pell Grants, Federal Student Loans, and Federal Work-Study, each designed to alleviate the financial burdens of students pursuing their academic goals.

What constitutes a Title credit balance?

A Title IV credit balance forms when the total aid awarded to a student exceeds the actual tuition and fees charged for their course enrollment. Understanding what contributes to these credit balances helps students effectively manage their financial aid. Common causes include overpayment of tuition due to adjustments or refunds, disbursements for living expenses exceeding incurred costs, and changes in enrollment status that may trigger additional aid.

Policies and procedures related to Title credit balances

The management of Title IV credit balances is subject to federal regulations set forth by the U.S. Department of Education. Institutions must adhere to these guidelines in overseeing financial aid disbursements and managing any resultant credit balances. Credit balance policies often include specific requirements regarding the timing of disbursements, how funds are applied, and what constitutes an eligible expense.

Institutions are typically required to disburse credit balances within a stipulated timeframe, usually dictated by federal law. This ensures that students receive timely access to their excess funds, which can be critical for those managing living expenses while pursuing education.

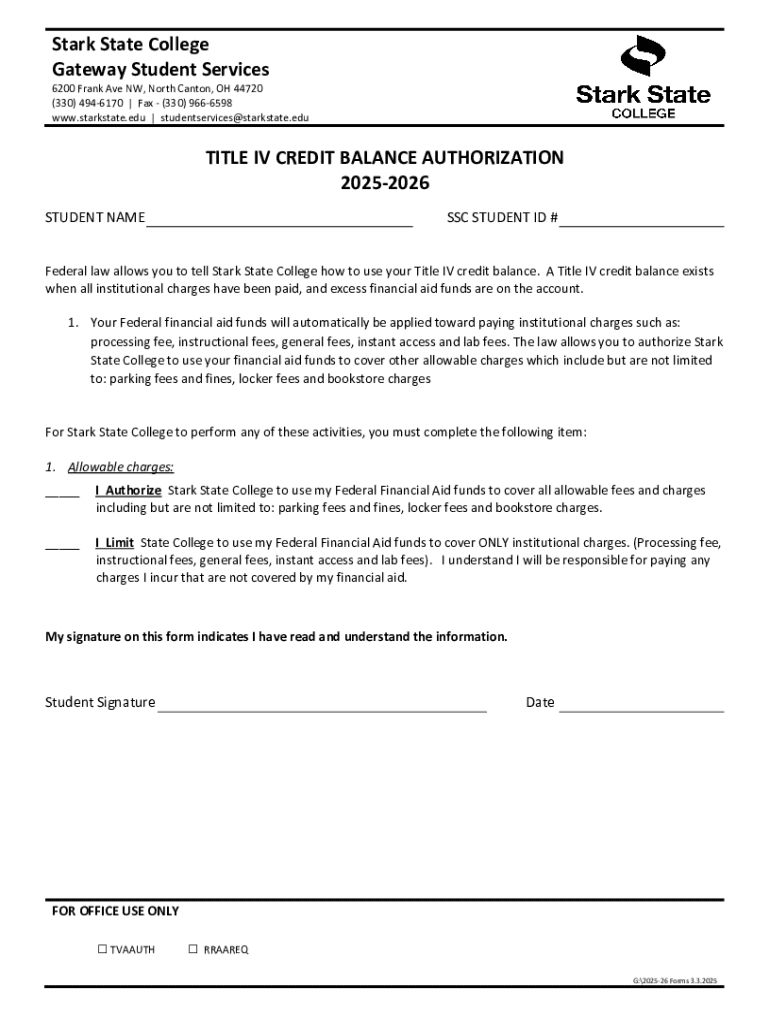

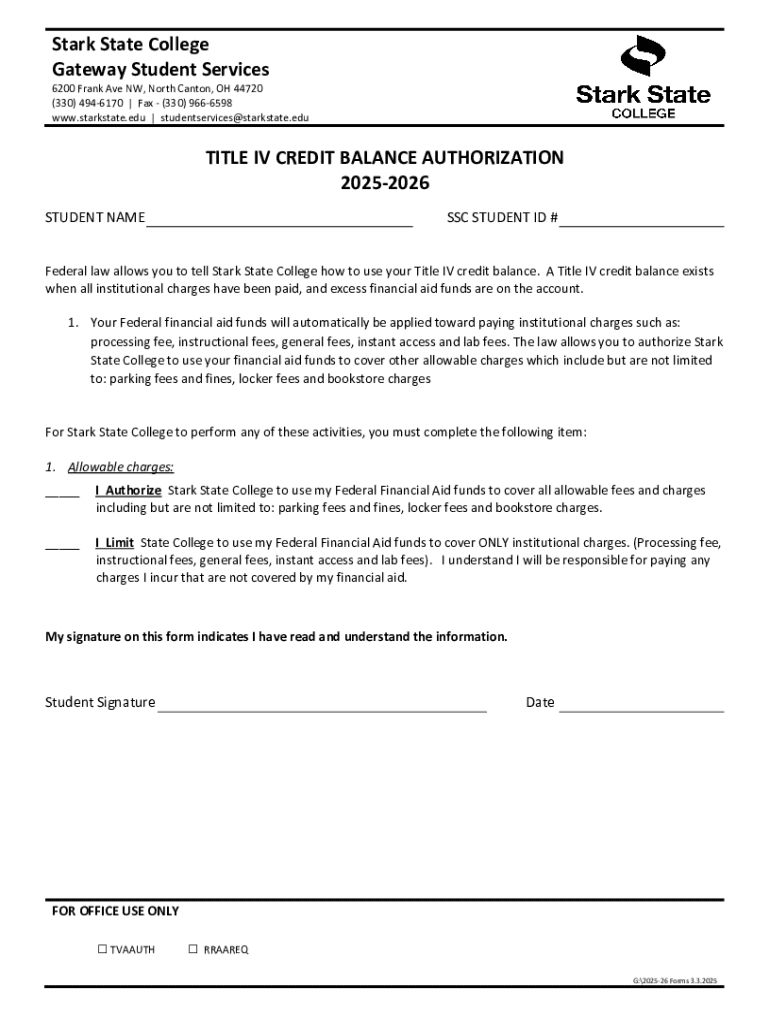

The Title credit balance authorization process

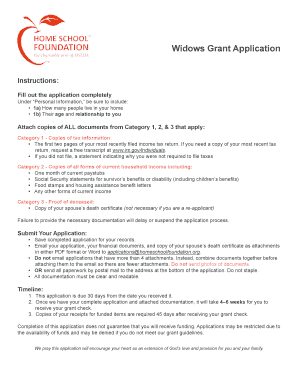

Before utilizing any Title IV credit balance, students must complete an authorization process. Authorization forms are designed to grant the institution permission to apply any excess financial aid towards allowable expenses. It's imperative to understand this process thoroughly, as improper authorization can lead to delays or misallocation of funds.

How to complete the Title credit balance form

Completing the Title IV credit balance form can seem daunting, but by following a structured approach, it can be straightforward. Start by gathering all necessary information, including your student ID, the total aid received, and intended use of the funds.

Access the form through your institution’s financial aid office or online portal. Once the form is open, carefully fill it out, ensuring accuracy in every field to avoid processing delays. Before you submit, take the time to review all your entries against your records and necessary documents. Finally, you will need to electronically sign the form before submission.

Common mistakes include miscalculations, missing signatures, and submitting outdated forms. Make sure you are aware of the specific requirements of your institution and stay updated with any changes in policy.

To ensure smooth processing, always keep a copy of your submitted form and any confirmation of your submission.

Managing your Title credit balance

Managing your Title IV credit balance is crucial for maximizing your financial aid benefits. To keep track of your credit balance effectively, start by routinely checking your account on your institution's financial portal. It's also helpful to maintain organized records of all communication regarding financial aid to ensure you are well-informed about your aid status.

Monitor any changes in your enrollment status closely, as they can directly impact your Title IV funding eligibility. Engaging regularly with your financial aid advisors can provide personalized support and guidance tailored to your situation. They can assist you in understanding the implications of credit balances and help navigate any complications.

Understanding your rights and responsibilities

As a student, understanding your rights and responsibilities in relation to Title IV funds is critical. If you do not authorize the use of any credit balances, it may delay the disbursement of these funds, making it challenging to meet financial obligations. Ensure that you are aware of the potential consequences of your choices regarding fund utilization.

Additionally, students have the right to know about their Title IV funds, including amounts, usage, and any obligations tied to these funds. If there are discrepancies or concerns regarding your credit balance, you have the right to challenge or request adjustments through your institution's financial aid office.

Frequently asked questions (FAQs)

Several common questions arise concerning Title IV credit balances. For instance, if you believe your credit balance is incorrect, contact your financial aid office immediately with any supporting documentation. Processing times for credit balance forms can vary, but generally expect a turnaround within 7-14 business days, depending on your institution’s processes.

If you wish to change your authorizations post-submission, reach out to your financial aid advisor to learn about the required steps. They can guide you on making necessary adjustments to your account. For further assistance, many institutions offer resources, including workshops, one-on-one advisement, and online tutorials.

Case studies and common scenarios

Real-life examples of Title IV credit balances shed light on the complexities students face. For instance, a student receiving a full Pell Grant may see a credit balance arise if their tuition is significantly lower than the awarded amount. In contrast, changes in enrollment status—like moving from part-time to full-time—can result in additional funds, leading to credit balances.

Throughout these scenarios, lessons emerge on the importance of proactive financial management. Understanding one’s credit balance status can empower students to leverage resources effectively while ensuring they meet all their financial responsibilities.

Accessing support and additional resources

Accessing the right support is essential for navigating Title IV credit balances effectively. Students should engage with their institution’s financial aid office, which typically offers a wealth of resources, including FAQ sections, workshops, and personal consultations. Additionally, leveraging tools like pdfFiller can streamline the completion of necessary forms and documents.

On pdfFiller, users can edit, eSign, and collaborate on documents seamlessly, making the management of credit balance forms simpler and more efficient. It’s important for students to familiarize themselves with available support options to ensure they maximize their Title IV benefits and avoid unnecessary delays in funding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit title iv credit balance online?

How do I make edits in title iv credit balance without leaving Chrome?

How do I edit title iv credit balance straight from my smartphone?

What is title iv credit balance?

Who is required to file title iv credit balance?

How to fill out title iv credit balance?

What is the purpose of title iv credit balance?

What information must be reported on title iv credit balance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.