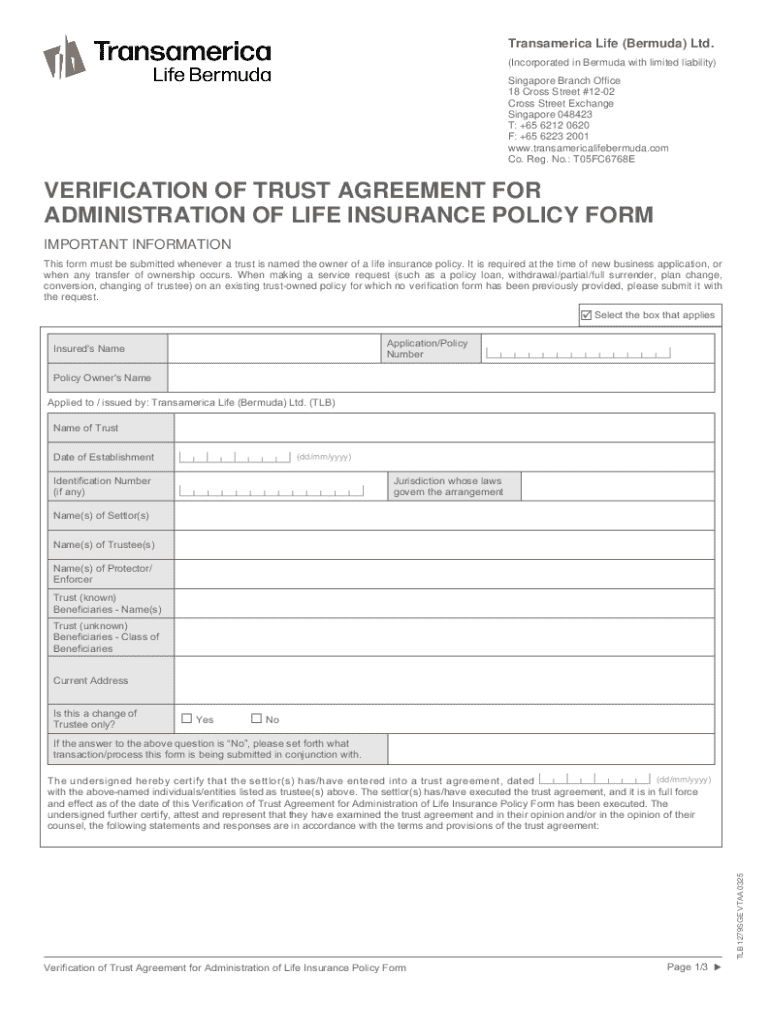

Get the free Verification of Trust Agreement for Administration of Life Insurance Policy Form

Get, Create, Make and Sign verification of trust agreement

Editing verification of trust agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out verification of trust agreement

How to fill out verification of trust agreement

Who needs verification of trust agreement?

Verification of Trust Agreement Form: A How-to Guide

Understanding the trust agreement form

A Trust Agreement Form is a legal document that outlines the terms and conditions under which a trust is established, detailing the assets being placed into the trust and how they are to be managed on behalf of the beneficiaries. This form acts as a foundational piece for estate planning, ensuring that an individual’s wishes regarding asset distribution are codified and legally enforceable.

Verifying the Trust Agreement is crucial for ensuring that the document is valid and serves its intended purpose. A verified trust agreement provides assurance to beneficiaries that they are protected legally and that their rights will be honored. Furthermore, it mitigates the risk of disputes arising among family members or beneficiaries about the trust's terms or its validity.

Steps to verify a trust agreement

Verifying a Trust Agreement involves several important steps, each designed to authenticate the document and ensure it fulfills legal requirements. Below is a comprehensive guide to assist you in this essential process.

Step 1: Gather necessary documentation

Before initiating the verification process, compile all relevant documents. This includes the original Trust Agreement, identification documents of the grantor, trustee, and beneficiaries, as well as any supporting documents that outline the assets of the trust.

Ensure that all documents are complete, accurate, and legible. Any discrepancies may raise questions during verification. Cross-reference details to ensure consistency across all related documents.

Step 2: Understand legal implications

Verification is a legal safeguard, protecting against potential disputes and ensuring that the Trust Agreement adheres to relevant laws. Failing to verify may result in the trust being questioned in a court of law, leading to its possible invalidation. Furthermore, unverified documents can complicate the distribution of assets, leaving beneficiaries vulnerable.

It’s also vital to understand how state laws may affect the verification process; different jurisdictions may have unique requirements regarding trust documentation.

Step 3: Contacting relevant authorities

Once the necessary documents are organized, the next step is to reach out to the relevant authorities for verification. This might include a notary public or an attorney specializing in estate planning. They can provide validation that the Trust Agreement is executed correctly and is compliant with the law.

When contacting legal professionals or financial institutions, be clear about your intent and be prepared to provide any required documentation for review.

Step 4: Performing an independent review

Conducting your review of the Trust Agreement is an essential part of the verification process. Use a detailed checklist to ensure all components are present and accurate. Look for key indicators of authenticity, such as signatures, notarization, and date stamps.

Tools and resources for verification

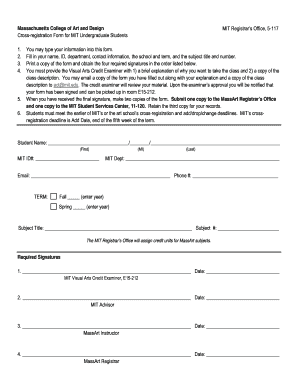

In an increasingly digital landscape, utilizing online tools can streamline the verification process for a Trust Agreement. pdfFiller offers an effective solution, allowing you to manage, edit, and verify important documents seamlessly.

Utilizing pdfFiller for document verification

pdfFiller supports users by providing interactive features that enhance document management. To get started, you simply upload your Trust Agreement form to the platform.

Once uploaded, you can easily edit the document for accuracy or add any additional information. The platform also allows for e-signatures, which is a crucial step in the verification process. Users can follow these steps:

Other digital tools and platforms

While pdfFiller stands out as a convenient choice for Trust Agreement verification, there are various other platforms available. A comparison of features, such as ease of use, cost, and customer support, can help you decide the best fit for your needs.

Cloud-based platforms typically offer enhanced security and accessibility, enabling users to manage their documents from anywhere, ensuring they are always up to date.

Common issues in trust agreement verification

Verification may bring to light several common challenges that can complicate the process. Being aware of these issues can help navigate the verification landscape more effectively.

Misleading information: Recognizing red flags in a trust agreement

One potential issue is the presence of misleading information within the Trust Agreement. Red flags include vague language, undisclosed changes, or missing essential signatures. Notation that looks inconsistent or altered is also a significant indicator that the trust may not be valid.

Dealing with discrepancies: What to do if your verification raises questions

If your review uncovers discrepancies, take immediate action. Consult with your attorney or a financial advisor to assess your options. It may be necessary to amend the Trust Agreement or in more serious cases, completely redo the document, which could have legal implications for asset distribution.

Updating an existing trust agreement: Steps to modify or correct documents

Updating a Trust Agreement is essential when circumstances change, such as a change in beneficiaries, asset ownership, or significant life events like marriage or divorce. To update your document effectively:

Frequently asked questions (FAQs) about verification

When navigating the verification process, you may have several questions about what it entails and the implications involved. Here are some frequently asked questions to clarify your concerns.

Tips for maintaining trust agreements

Once your Trust Agreement is verified, it's crucial to maintain it to ensure it remains relevant and functional. Regular updates and diligent record-keeping go a long way in managing your trust effectively.

Regular updates: Importance of revisiting and revising trust agreements

Regularly revisit your Trust Agreement to accommodate changes in your life circumstances or to comply with new laws. Consulting with your legal advisor is recommended to ensure ongoing relevance.

Keeping records: Best practices for document management and organization

Implement an effective document management system for your Trust Agreement and related documents. Digital storage solutions like pdfFiller allow you to organize and access your documents easily while ensuring they remain secure.

Utilizing pdfFiller for ongoing management of trust agreements

With pdfFiller, users can manage their Trust Agreements effortlessly by using features that allow for easy editing, sharing, and signing. This platform not only facilitates verification but also helps in the continuous management of your trust-related documents.

Related forms and templates

In addition to the Trust Agreement, several other legal documents are essential for effective estate planning. Familiarizing yourself with these documents can help ensure comprehensive management of your estate.

For quick access, pdfFiller offers direct links to various popular forms, making it easier to connect with all your estate planning needs.

User testimonials and case studies

Understanding how others have successfully navigated the verification process can provide valuable insights. Read through some real-life scenarios of individuals using pdfFiller to verify their Trust Agreements.

User feedback from pdfFiller clients has shown high satisfaction rates, with many customers appreciating the platform's ease of use and comprehensive features that facilitate document verification and management.

Feedback and experience sharing

For those who have undergone the Trust Agreement verification process, sharing your experiences can be beneficial to others. Consider offering your insights on what worked for you and any challenges you faced during the process.

As part of the pdfFiller community, you are invited to rate your document management solutions and share your stories. Your feedback can help guide others through their verification journeys.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit verification of trust agreement from Google Drive?

How can I send verification of trust agreement for eSignature?

Can I sign the verification of trust agreement electronically in Chrome?

What is verification of trust agreement?

Who is required to file verification of trust agreement?

How to fill out verification of trust agreement?

What is the purpose of verification of trust agreement?

What information must be reported on verification of trust agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.