Get the free Form 40-17f2

Get, Create, Make and Sign form 40-17f2

Editing form 40-17f2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 40-17f2

How to fill out form 40-17f2

Who needs form 40-17f2?

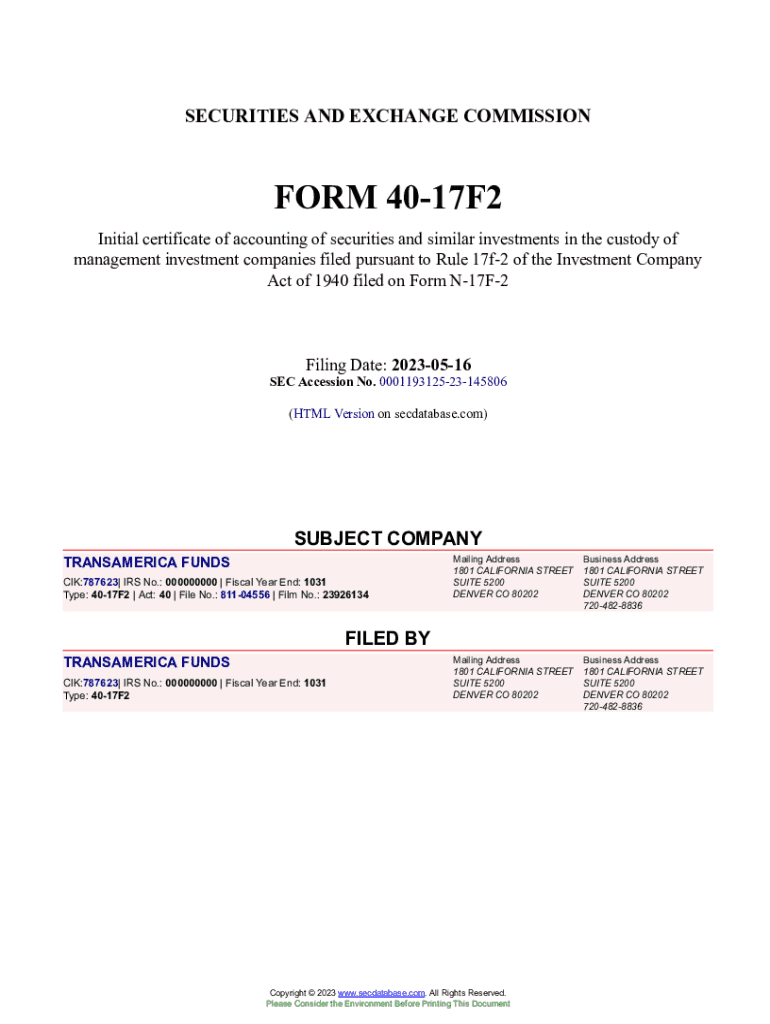

A Comprehensive Guide to Form 40-17F2

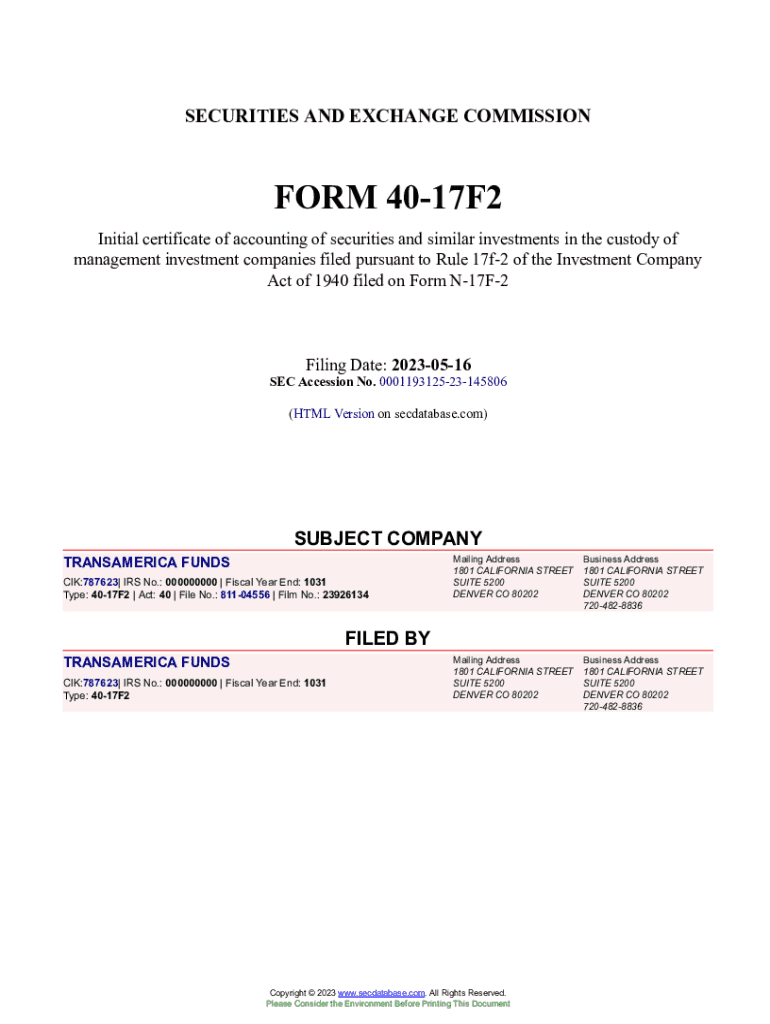

Overview of Form 40-17F2

Form 40-17F2 is a crucial regulatory document that plays an integral role in the financial reporting landscape. It is primarily intended for investment companies and regulated entities, serving as a tool for disclosing significant financial and operational details to the Securities and Exchange Commission (SEC). This form ensures transparency in reporting and helps maintain investor trust in the financial markets, highlighting the importance of compliance with SEC requirements.

Filing Form 40-17F2 is not merely an administrative task; it reflects an organization’s commitment to regulatory compliance. Inaccuracies in this submission can lead to a series of consequences, including financial penalties and reputational damage. Conversely, adhering to the requirements not only mitigates regulatory risks but also establishes the entity as a responsible player within the investment community.

Who needs to file Form 40-17F2?

Filing Form 40-17F2 is critical for a variety of entities, particularly investment companies and other corporations that fall under SEC jurisdiction. This includes mutual funds, closed-end funds, and unit investment trusts that engage in significant investment activities. Understanding which entities need to file is vital, as non-compliance can lead to serious repercussions, including regulatory scrutiny.

Eligibility criteria for filing Form 40-17F2 generally depend on the size of the entity and the nature of its investment activities. Companies that manage assets above a certain threshold or meet specific financial metrics may be required to submit this form. Ensuring that you fall within these criteria is essential to avoid unnecessary legal complications.

Step-by-step guide to filling out Form 40-17F2

Before diving into filling out Form 40-17F2, adequate preparation is crucial. Start by gathering all necessary documentation, including financial statements, previous filings, and any other relevant data that showcases your investment strategies and operational metrics. Additionally, utilizing tools like pdfFiller can streamline the document preparation process. With its versatile editing features, filling out the form becomes a far less daunting task.

The form consists of several sections, each demanding specific information.

Special care should be taken in Section 4, where signatures and dates are crucial. Missing or incorrect signatures can invalidate your submission, leading to administrative delays and potential penalties.

Tools for completing Form 40-17F2

Using interactive tools like pdfFiller can significantly enhance the filing experience for Form 40-17F2. With features designed specifically for document editing, users can easily navigate through the form, input necessary data, and take advantage of the eSign capabilities for secure submissions. Each tool is tailored for accuracy and efficiency, allowing teams to collaborate seamlessly on document preparation.

Collaboration becomes effortless with pdfFiller. Teams can share the document, provide feedback, and make real-time edits, which is essential for larger organizations that require multiple stakeholders to review and approve the filing. This collaborative option not only saves time but also reduces the likelihood of errors.

Common mistakes to avoid when filing Form 40-17F2

Filing errors can be costly, both financially and reputationally. Common mistakes when submitting Form 40-17F2 include misreporting data, failing to meet submission deadlines, and overlooking specific requirements set out by the SEC. Since the stakes can be high, it’s crucial to approach this task methodically.

To avoid such pitfalls, consider using a checklist that covers all necessary points. Here’s a brief overview of what to double-check before sending in your data:

FAQs about Form 40-17F2 filing process

Navigating the complexities of Form 40-17F2 can bring up several questions. For instance, what happens if you realize there's a mistake after submission? It’s essential to act quickly; the SEC allows amendments to be filed, provided that you follow the specified protocols. Similarly, tracking the status of your filing can be done via the SEC’s EDGAR system, where you can monitor your submission for processing updates.

Another common query is whether Form 40-17F2 can be amended after submission. Yes, amendments can be filed if significant changes occur, ensuring that the information remains current and compliant. Properly managing these updates reflects a company's commitment to transparency and responsible reporting.

Additional resources and tools

For those looking to gain further insights into the filing process of Form 40-17F2, numerous resources are available. Websites like the SEC’s official page provide detailed instructions and links to related forms. Additionally, external regulatory bodies often have guidelines that may prove beneficial during the filing process.

Video tutorials available on platforms such as pdfFiller can guide users through visual step-by-step processes for filling out Form 40-17F2. These resources can break down complex sections into manageable tasks, ensuring that users have access to information that meets their specific needs.

Advanced tips for efficient filing

Effective document management can enhance the experience significantly when handling filing requirements like Form 40-17F2. One key best practice is organizing digital files systematically, which allows for quick retrieval of relevant documents when needed. Utilizing cloud storage solutions for keeping your files organized ensures that your necessary documents are always at your fingertips, regardless of location.

Leveraging pdfFiller offers additional enhancements for document management. The platform provides automated filling options that can save a considerable amount of time when completing repetitive tasks. Its integration with various cloud storage systems also ensures seamless access to documents while optimizing the filing process.

User stories and case studies

Real-world examples illustrate the value of effectively navigating the Form 40-17F2 filing process. Many users have shared positive experiences with pdfFiller, highlighting how the platform simplified their document management and ensured compliance with SEC regulations. These testimonials reflect how understanding and using the right tools can transform what often feels like an overwhelming process into a manageable task.

However, the journey isn't without challenges. Common difficulties include adapting to the requirements of the form and ensuring that all necessary stakeholders review the document comprehensively. Testimonials often highlight how pdfFiller’s collaborative features helped teams overcome these challenges and achieve successful filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 40-17f2 directly from Gmail?

Where do I find form 40-17f2?

How can I edit form 40-17f2 on a smartphone?

What is form 40-17f2?

Who is required to file form 40-17f2?

How to fill out form 40-17f2?

What is the purpose of form 40-17f2?

What information must be reported on form 40-17f2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.