Get the free Form 990ez

Get, Create, Make and Sign form 990ez

How to edit form 990ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990ez

How to fill out form 990ez

Who needs form 990ez?

Understanding Form 990-EZ: A Comprehensive Guide for Nonprofits

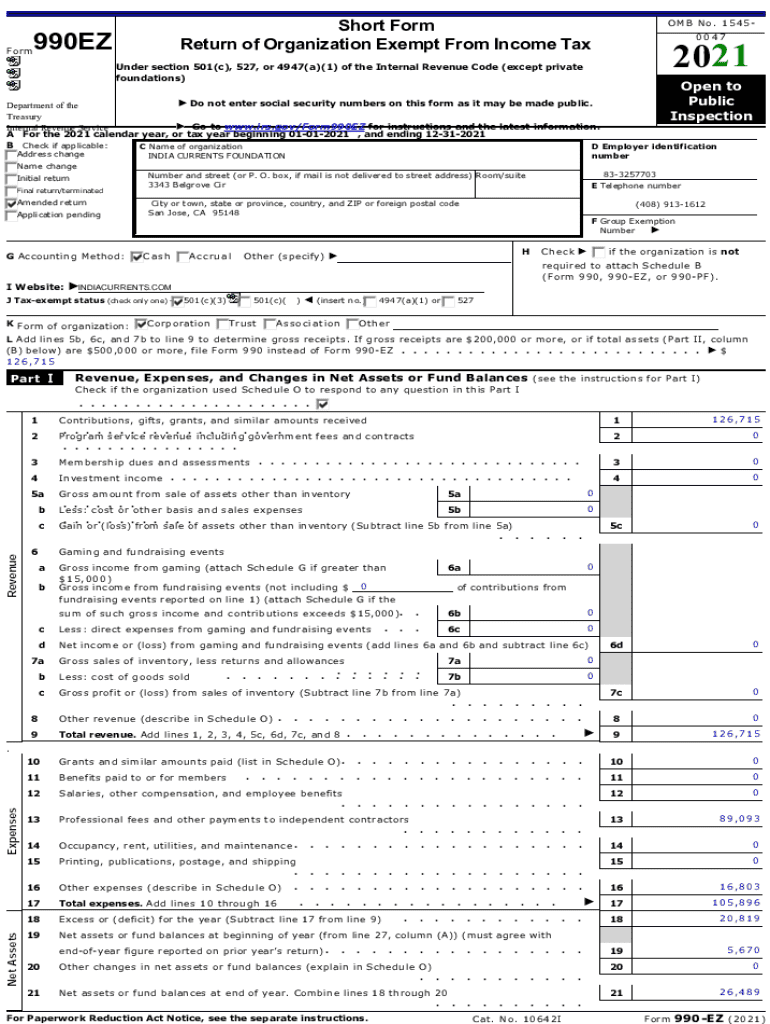

Basic overview of Form 990-EZ

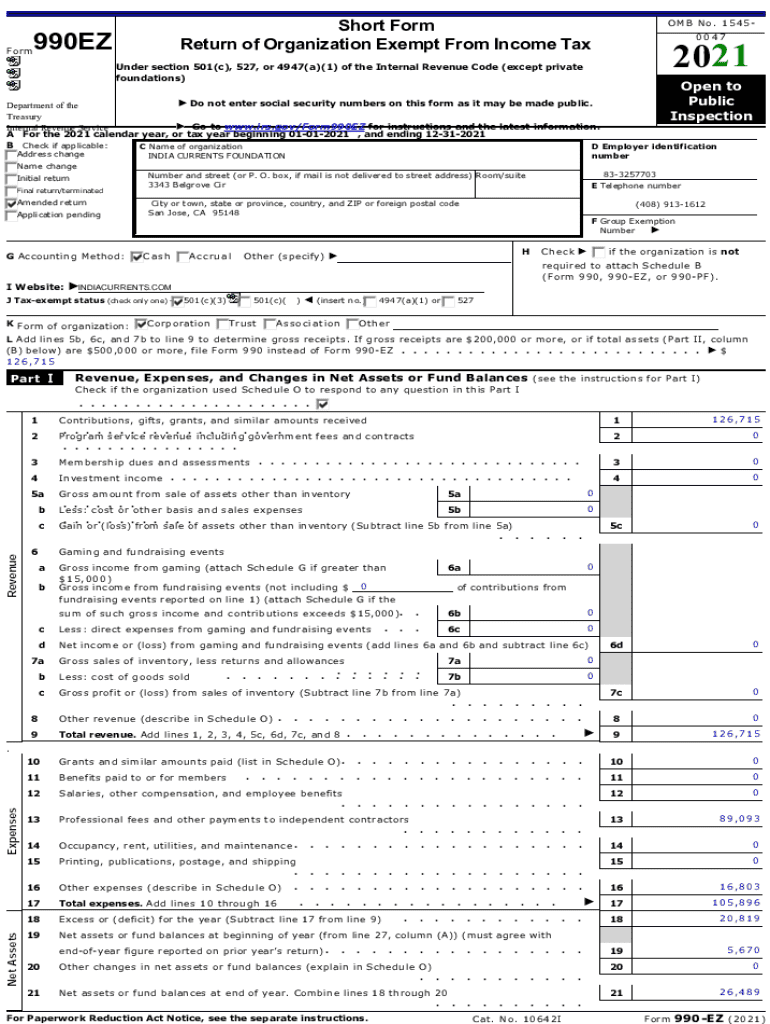

Form 990-EZ is a crucial IRS form designed for tax-exempt organizations, allowing them to report their financial information to the IRS. This streamlined version of the standard Form 990 enables smaller nonprofits to fulfill their reporting requirements without the need for the extensive detail required in the full form. Understanding this form is essential for compliance and for maintaining tax-exempt status.

Organizations that have gross receipts of less than $200,000 and total assets under $500,000 at the end of the year qualify to file Form 990-EZ. This limits the complexity of reporting for smaller entities while still providing necessary financial transparency. Form 990-EZ differs from Form 990 primarily in its simplicity and reduced reporting requirements, making it more accessible for smaller organizations.

Understanding the structure of Form 990-EZ

Understanding how to navigate Form 990-EZ is key for nonprofits aiming to fulfill their reporting obligations effectively. The form consists of several parts, each contributing different elements of information about an organization’s financial status and activities. Deciphering these sections will enable organizations to compile accurate data.

The main sections of Form 990-EZ include Part I, which outlines revenue and expenses; Part II, focusing on the balance sheet; Part III, detailing program accomplishments; Part IV, hosting officer and key employee information; Part V, providing additional information; and Part VI, which is specific to 501(c)(3) organizations.

Detailed instructions for completing Form 990-EZ

Completing Form 990-EZ involves understanding specific instructions per section. Starting with Part I, organizations must accurately report their revenue and other income sources, which may include donations, grants, and membership fees. Careful documentation of expenses, like operational costs and program expenses, is also essential to provide a clear picture of changes in net assets.

In Part II, while constructing the balance sheet, organizations must include their total assets, such as cash and property, along with liabilities and fund balances. Mapping out these categories ensures a comprehensive financial statement.

Part III requires organizations to articulate their program service accomplishments succinctly. Highlighting specific achievements, metrics, and community impact will not only fulfill IRS requirements but also enrich the organization's narrative.

For Part IV, it’s critical to provide accurate details of key personnel, including officers and trustees. Ensuring that this section has up-to-date information supports transparency and governance.

Filing requirements and deadlines for Form 990-EZ

Organizations are required to file Form 990-EZ annually, and the filing deadline is traditionally the 15th day of the fifth month after the end of the organization's fiscal year. For many organizations following the calendar year, this means the form is due by May 15. It's crucial for nonprofits to track their fiscal year-end to adhere to the filing schedule.

Should an organization find itself needing more time, it can file for an extension using Form 8868. This extension allows an additional six months to submit Form 990-EZ, but it’s imperative to understand that this does not extend the time to pay any due taxes or penalties, if applicable.

Failure to file Form 990-EZ on time can result in significant penalties. Organizations may face a fine of $20 per day, capped at $10,000 for large organizations. It's essential to prioritize compliance to avoid these financial consequences.

How to file Form 990-EZ electronically

Filing Form 990-EZ electronically has become a common practice due to its efficiency and ease of access. By opting for e-filing, organizations can expedite their submission, reduce errors, and receive immediate confirmation of receipt from the IRS. E-filing also simplifies the populous process of calculating totals correctly, as most software solutions utilize automated systems.

To file electronically, organizations need to choose an IRS-approved e-filing solution, which should guide them through completing Form 990-EZ accurately. The steps generally include selecting the appropriate form, filling out financial details, and submitting securely while retaining a copy for their records.

When selecting e-filing software, consider features such as user-friendliness, support options, and integration with other accounting software, which can streamline the entire process. Popular platforms include pdfFiller, TurboTax, and H&R Block offering specific tools for nonprofits.

Frequently asked questions (FAQs) about Form 990-EZ

Navigating the intricacies of Form 990-EZ can raise various questions among nonprofit organizations. One common inquiry is about the Group Exemption Number (GEN), which is crucial for organizations operating under a larger umbrella organization. Understanding how to utilize this number can affect filing processes.

Amending Form 990-EZ is straightforward; organizations can file a new Form 990-EZ indicating it’s an amended return, clearly stating the changes made. Key considerations include noting reasons for amendments and understanding the implications of submitting late. Specifically, late filings can result in penalties that could seriously impact an organization’s credibility.

Additional resources for nonprofits

For organizations seeking comprehensive assistance, several resources can enhance understanding and compliance with Form 990-EZ. These include supported schedules such as the Schedule A for public charities or Schedule B for contributors, providing additional guidance on reporting relevant information.

Additionally, links to related forms like Form 990 for larger organizations and Form 990-T for unrelated business income tax can create a holistic view of nonprofit reporting requirements. Engaging with knowledge bases and attending webinars can also be helpful, as they often provide insights into best practices for filings, compliance strategies, and updates on tax laws.

Tips for best practices in filing Form 990-EZ

Utilizing digital tools can significantly ease the process of filling out Form 990-EZ. Platforms like pdfFiller offer essential features for editing and signing documents, allowing organizations to fill out the form accurately and quickly. Its collaborative options allow multiple stakeholders to contribute, ensuring no detail is missed during completion.

Consider using templates available on pdfFiller for a structured approach, which can guide users through filling in data correctly. These templates are designed to reduce the time spent navigating through the complexities of the form while ensuring compliance. Furthermore, leveraging the e-signature feature available in pdfFiller streamlines submission, allowing for swift approvals from necessary parties.

Always double-check submissions before filing; meticulous reviews can prevent costly mistakes. Tracking deadlines using project management tools can help keep filing on time and reduce the risk of late fines.

Testimonials and success stories

Nonprofits have shared their success stories about using pdfFiller to navigate the filing of Form 990-EZ with ease. Organizations report that the platform helps clarify complicated sections, and the ease of use has empowered their teams to complete submissions confidently and accurately. Such feedback underscores how integrated document management can significantly improve the filing experience.

Case studies reveal that organizations using pdfFiller to manage their Form 990-EZ filings have reduced the time spent on submissions, allowing staff to focus more on their core mission activities. Users often highlight features like real-time collaboration and e-signature functionalities as integral in achieving a smooth filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 990ez to be eSigned by others?

Can I create an electronic signature for the form 990ez in Chrome?

How can I edit form 990ez on a smartphone?

What is form 990ez?

Who is required to file form 990ez?

How to fill out form 990ez?

What is the purpose of form 990ez?

What information must be reported on form 990ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.