Get the free Form 990

Get, Create, Make and Sign form 990

Editing form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-to Guide

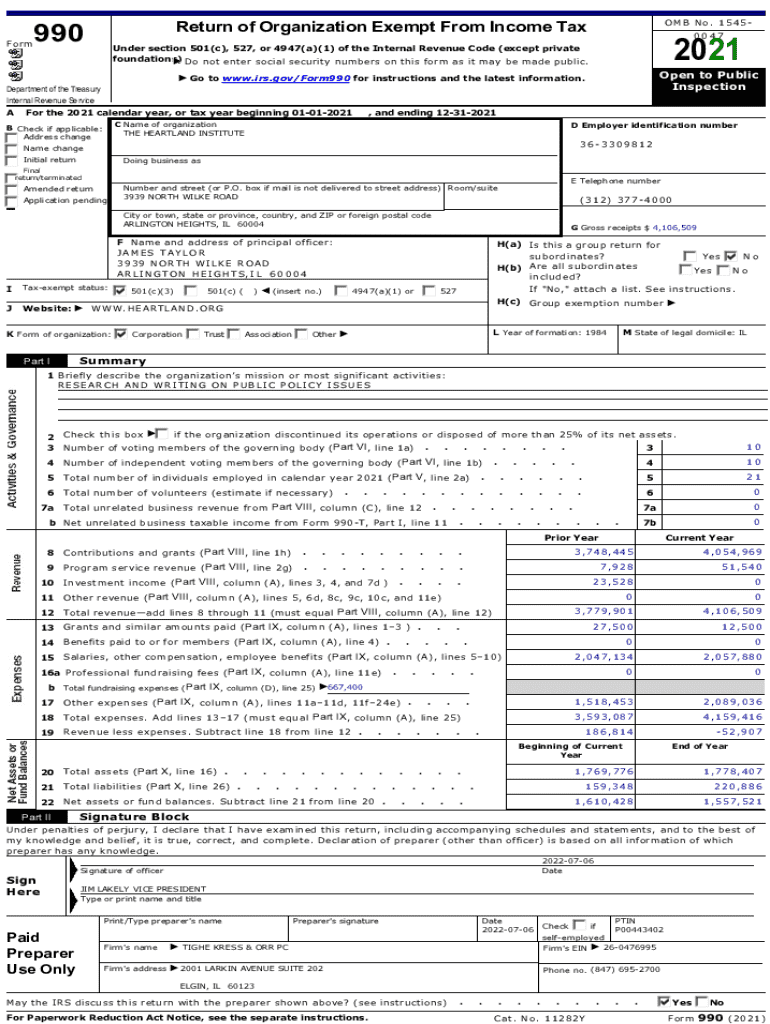

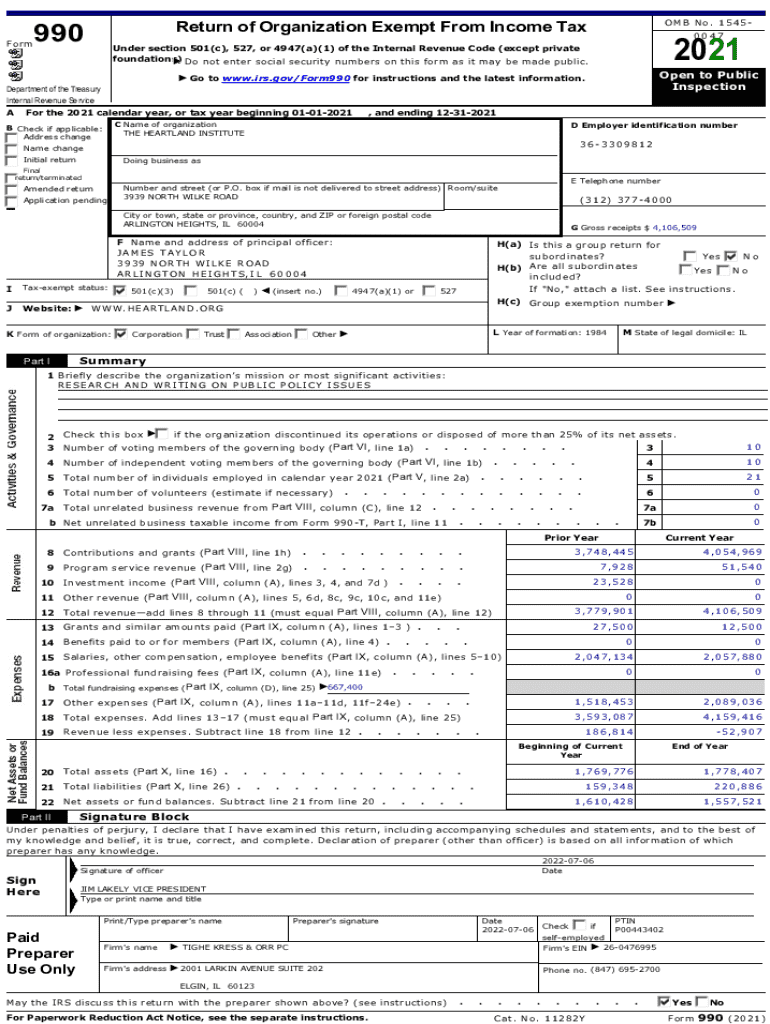

Understanding the Form 990

Form 990 serves as a vital tool for transparency and accountability in the nonprofit sector. It is an informational return that tax-exempt organizations, nonexempt charitable trusts, and Section 527 political organizations are required to file with the IRS. The primary purpose of Form 990 is to provide the IRS and the public with a detailed account of a nonprofit's financial activities, governance, and compliance with tax laws, fostering public trust and ensuring effective oversight.

The significance of Form 990 extends beyond mere compliance; it acts as a platform for nonprofits to communicate their accomplishments, goals, and financial stewardship to donors, stakeholders, and the general public. A well-completed Form 990 can enhance a nonprofit's credibility and help attract funding and support.

Types of organizations required to file

Several types of organizations are mandated to file Form 990, including:

Certain organizations may be exempt from filing Form 990, including churches, certain high schools, and organizations with gross receipts under a specific threshold. Understanding these qualifications is essential for compliance.

Navigating the Form 990

Form 990 comprises various sections and schedules that provide a holistic view of a nonprofit’s financial and operational details. The core sections typically include identification information, governance details, financial statements, and functional expenses. Some significant schedules attached to Form 990 include:

Grasping the structure of Form 990 enables nonprofits to avoid unintended omissions or errors. Each section has unique requirements and implications; thus, thorough understanding is paramount.

Key terminology explained

Filing Form 990 involves a range of terms that can be confusing. Understanding these terms is essential:

Filing requirements

Nonprofit organizations must adhere to specific requirements when filing Form 990. The following groups are generally required to file:

Filing deadlines are critical. Form 990 is typically due on the 15th day of the fifth month after the end of your organization’s fiscal year. For organizations with a fiscal year ending December 31, the deadline is May 15. Extensions can be requested, but it is essential to follow the IRS protocols to avoid penalties.

Late filings can result in penalties, including fines based on the organization’s gross receipts. Understanding these filing requirements ensures compliance and operational stability for nonprofit organizations.

Completing Form 990

Filling out Form 990 can be a meticulous process. Here’s a step-by-step breakdown on how to complete the critical sections of the form effectively:

Paying close attention to IRS guidelines is essential. Misreporting or errors can trigger audits or penalties. Thus, accuracy and thoroughness are critical.

Common pitfalls to avoid

When filling out Form 990, nonprofits often encounter common pitfalls that can jeopardize their compliance status. Key pitfalls include unclear reporting of revenue sources, neglecting detailed expense breakdowns, and incomplete governance data. Each section requires attention to ensure compliance and prevent misunderstandings with the IRS.

Utilizing pdfFiller for seamless completion

Many organizations now turn to pdfFiller to streamline the completion of Form 990. pdfFiller offers features such as real-time editing, collaboration options, and electronic signing capabilities, significantly simplifying the form-filling process. Users can start with an electronic version of Form 990, collaborate seamlessly with their teams, and ensure the most accurate and up-to-date information is included.

Special considerations

Completing Form 990 involves several specialized considerations essential for compliance. One core area is the financial breakdown requirements. Nonprofits must provide detailed reporting of their income streams and expenses, which includes distinguishing between program services, management, and fundraising expenses. Offering detailed insights into these areas not only fulfills regulatory requirements but also enhances the organization’s credibility.

Additionally, compliance with public disclosure regulations mandates that organizations make their Form 990 available upon request. Public inspection obligations emphasize the importance of transparency, allowing the public to access key financial and operational information. Nonprofits must be prepared to respond to public inquiries promptly, maintaining a standard of openness.

Tips for nonprofit fundraising reporting

Nonprofits must also pay careful attention to fundraising reporting. This includes detailing the methods utilized for fundraising, the amount raised versus costs incurred, and the overall return on investment. Fundraising expenses should be reported in various categories to illustrate efficiency and effectiveness in fundraising efforts. By doing so, organizations enhance their credibility and their attraction to potential donors.

Post-filing procedures

Once Form 990 has been filed, appropriate management and storage of the document are crucial. Nonprofits should maintain a reliable system for archiving Form 990 to improve accessibility for internal reviews and potential IRS audits. Storing the document in a cloud-based platform like pdfFiller allows for ease of access while ensuring that all team members can collaborate on and review the file as necessary.

Maintaining transparency post-filing involves understanding how Form 990 impacts charity evaluations. Many watchdog organizations use Form 990 data to assess charities and recommend them to potential donors. The way nonprofits report their operational and financial activities on Form 990 influences public perception and funding opportunities.

Advanced topics

The IRS occasionally implements changes and updates to Form 990 that can impact the filing process. Recent revisions have added more specific questions regarding governance and financial practices, reflecting a broader push for transparency in the nonprofit sector. Organizations must stay updated on these changes to ensure compliance.

Understanding what to expect if your organization gets audited is another critical aspect. An IRS audit typically entails a review of Form 990 alongside various supporting documents, such as financial statements and fundraising records. Being prepared can mitigate stress and ensure that required information is readily available.

Examining case studies showcasing successful nonprofits and their strategies in managing Form 990 could provide additional insights. Successful organizations often showcase meticulous completion of Form 990, highlighting their financial health and operational efficiencies, paving the way for enhanced donor trust and support.

Conclusion: Leveraging pdfFiller for nonprofit success

Leveraging tools like pdfFiller can significantly enhance the experience of preparing and filing Form 990. The platform's features streamline documentation processes and facilitate better organization and compliance tracking. By employing pdfFiller for Form 990, organizations offer real-time collaboration capabilities, improving efficiency in data collection and strategy development.

Implementing best practices for document management within nonprofits ensures ongoing compliance and efficiency. Regular reviews of previous Form 990 filings can provide insights for improvement and ensure accurate record-keeping, establishing a foundation for future success.

Interactive tools and additional features

Interactive tools can facilitate accurate reporting within Form 990. pdfFiller provides templates and calculation tools that simplify financial reporting and ensure accuracy while completing the form. Users can access these resources to optimize their filing processes and provide transparent reporting.

Engaging with a community of filers can also offer valuable insights into best practices and challenges faced during the filing process. Utilizing forums and support features can enhance the knowledge-sharing experience and foster a supportive environment for nonprofit organizations as they navigate the complexities of Form 990.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 990 online?

How do I fill out form 990 using my mobile device?

How do I complete form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.