Get the free irs

Get, Create, Make and Sign irs form

Editing irs form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out irs form

How to fill out form 990

Who needs form 990?

Form 990: Comprehensive Guide to Understanding and Filing Your Nonprofit's Tax Return

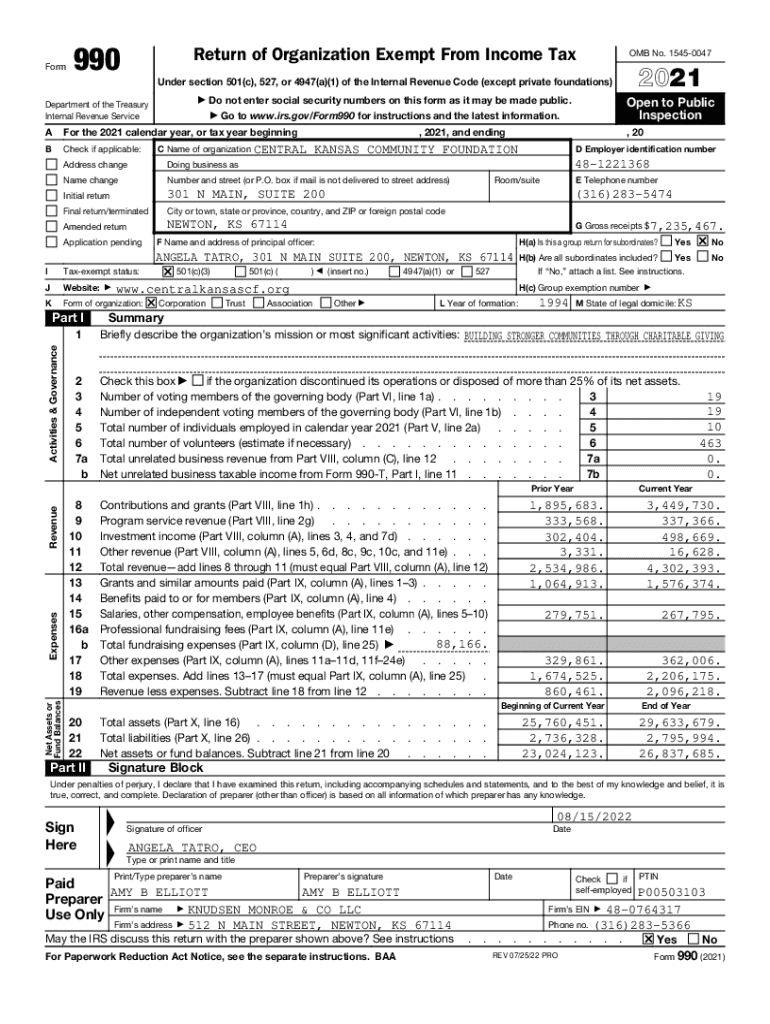

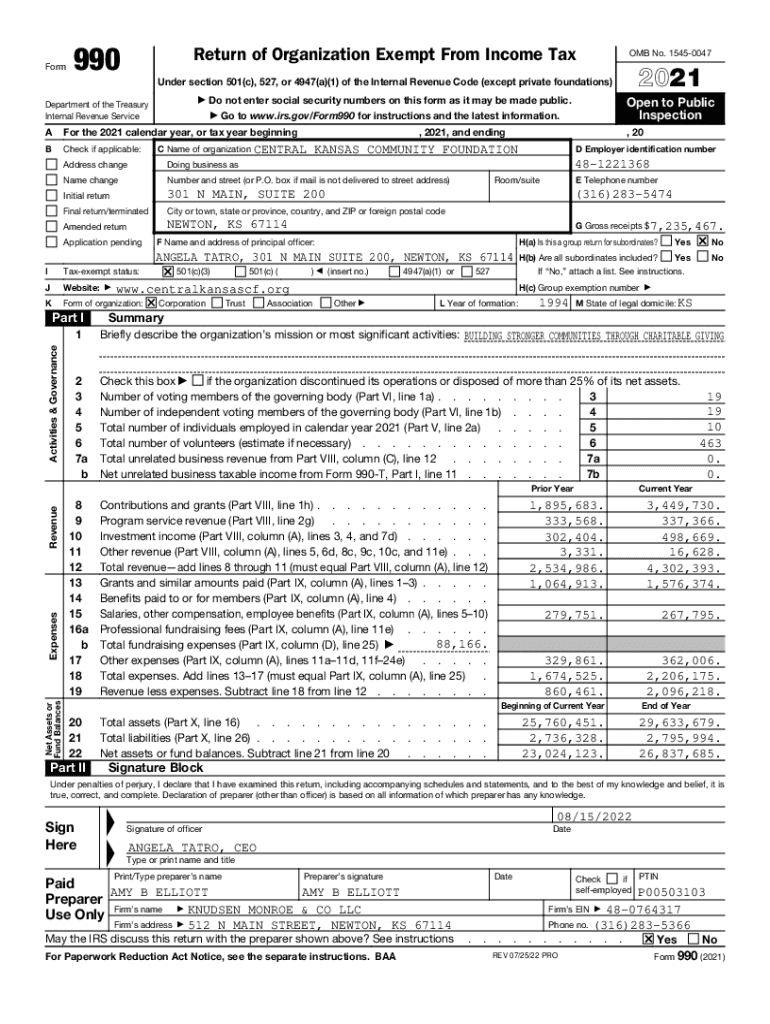

Overview of Form 990

Form 990 is an essential document that nonprofit organizations in the United States must complete annually to provide the IRS with pertinent financial information regarding their operations. This form serves multiple purposes: it helps the Internal Revenue Service assess the organization's compliance with tax-exempt status, enables state agencies to monitor nonprofit activities, and informs the public about the financial health and transparency of nonprofits. Given the reliance on donations, Form 990 plays a critical role in promoting accountability and integrity within the nonprofit sector.

Who needs to file Form 990?

Primarily, organizations classified under section 501(c)(3) of the Internal Revenue Code are required to file Form 990. This category largely encompasses charitable organizations, foundations, and educational institutions. However, not all 501(c)(3) organizations must file the full Form 990; smaller organizations may be subject to reduced reporting requirements under Form 990-EZ or Form 990-N (e-Postcard). Nonprofits classified under other sections, such as 501(c)(4) or 501(c)(6), must also file, with varying guidelines based on their activities and revenue.

Understanding the structure of Form 990

Form 990 is structured to provide a comprehensive snapshot of an organization’s financial status and activities. It contains several key sections, including: Summary (Section A), Mission and Key Activities (Section B), Governance (Section C), and Financial Information (Section D). Each section prompts organizations to disclose essential details such as income, expenses, program services, and governance structure. This structured format allows users to drill down into financial details and assess the organization’s mission and adherence to its stated goals.

Locating and accessing Form 990

Accessing Form 990 is a straightforward process, primarily facilitated through the IRS website, where the latest version is available for download. Start by navigating to the IRS Forms and Publications page and search for Form 990. For organizations that prefer an automated solution, platforms like pdfFiller provide valuable tools to fill out and manage the form efficiently. Utilizing such resources can save time and streamline the filing process, ensuring accuracy and compliance.

Step-by-step instructions for filling out Form 990

Before starting to fill out Form 990, it's crucial to gather all necessary documentation, including your organization’s articles of incorporation and previous Form 990 filings. As you work through the form, you will encounter specific line items that require careful attention. To ensure accuracy and minimize errors, follow a structured approach. First, review the prompts provided for each section; then, make comprehensive disclosures reflecting your organization’s financial activities. Utilizing tools like pdfFiller can facilitate these processes with built-in templates and editing features.

Filing modalities for Form 990

Organizations can file Form 990 electronically or via paper submission. E-filing is often recommended due to its efficiency and instantaneous confirmation of receipt. Many organizations use IRS-approved software that simplifies the e-filing process. Alternatively, if opting for paper filing, adherence to specific guidelines regarding format and submission addresses is vital to avoid rejections or processing delays. Keep in mind that some states may have their own filing requirements, necessitating awareness of local regulations in addition to federal compliance.

Filing deadlines and extensions

Timely filing of Form 990 is essential to maintain compliance and avoid penalties. Generally, Form 990 is due on the 15th day of the 5th month after the end of the organization's fiscal year. For organizations requiring additional time, it is possible to request a 6-month extension using Form 8868. However, it is crucial to note that this is an extension to file, not an extension to pay any taxes due, which remains due by the original deadline to avoid additional charges.

Common mistakes to avoid when filing

Nonprofits often make several common mistakes when filing Form 990, which can lead to compliance issues or IRS inquiries. One frequent error is providing incomplete or inconsistent financial data, which can trigger audits. Additionally, misreporting expenses or failing to disclose related-party transactions are significant pitfalls that can jeopardize an organization's tax-exempt status. A thorough review of all entries before submission can prevent many of these issues.

Penalties and consequences of non-compliance

Non-compliance with Form 990 filing requirements can result in severe penalties. Organizations that fail to file may incur fines, and repeated non-filing can lead to the loss of tax-exempt status altogether. Additionally, incorrect filings can trigger extensive audits or inquiries from the IRS, which can be costly and time-consuming. Maintaining compliance and ensuring accurate, complete filings is crucial for nonprofits to preserve their operational integrity and community trust.

Using Form 990 for charity evaluation and research

Form 990 is a treasure trove of information that can be invaluable for potential donors and researchers looking to analyze nonprofit organizations. By examining the financial details outlined in Form 990, stakeholders can evaluate the efficiency of an organization’s operations, its fundraising efforts, and its overall impact. Additionally, disclosures around governance practices provide insights into the ethical standing of the nonprofit, helping donors make informed decisions about their contributions.

Collaborating with professionals for filing Form 990

While some organizations may choose to handle Form 990 filings internally, collaborating with financial professionals or tax attorneys can be an advantageous approach. Such experts can provide tailored advice, ensuring that all specifics of the form are thoroughly addressed and that compliance is achieved. Situations that may particularly benefit from professional input include cases with complex financial situations or when significant changes occur in governance or programs. Leveraging professional expertise can reduce errors and enhance the filing process.

Interactive tools and resources on pdfFiller for Form 990

pdfFiller offers users intuitive interactive tools that streamline filling out Form 990. With features like automatic form recognition, electronic signature capabilities, and real-time collaboration, users can efficiently edit and manage their documents from anywhere. Utilizing these tools enhances the overall filing experience, ensures compliance, and minimizes errors. The platform not only makes it easy to fill out the form but also allows users to track versions and maintain organized records.

Related forms and guidance

In addition to Form 990, nonprofits may need to be aware of related forms such as Form 990-EZ and Form 990-N (e-Postcard). Each of these serves different purposes based on the organization's structure and financial activity. Understanding their distinct requirements can further support organizations' compliance efforts. Moreover, being informed about other IRS forms that address nonprofit operations ensures that organizations maintain adherence to annual compliance needs beyond the basic Form 990.

Keeping your organization compliant year-round

Compliance with Form 990 is just one aspect of maintaining a nonprofit's operational integrity. Organizations should also implement strategies for ongoing compliance, which include establishing internal controls, regular financial audits, and staff training on regulatory changes. Staying proactive regarding IRS updates and changes in nonprofit law is essential for avoiding pitfalls and ensuring that the organization's operations remain transparent and accountable to stakeholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in irs form?

Can I create an electronic signature for signing my irs form in Gmail?

How do I edit irs form on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.