Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

Form 990-EZ Form: A Comprehensive How-to Guide

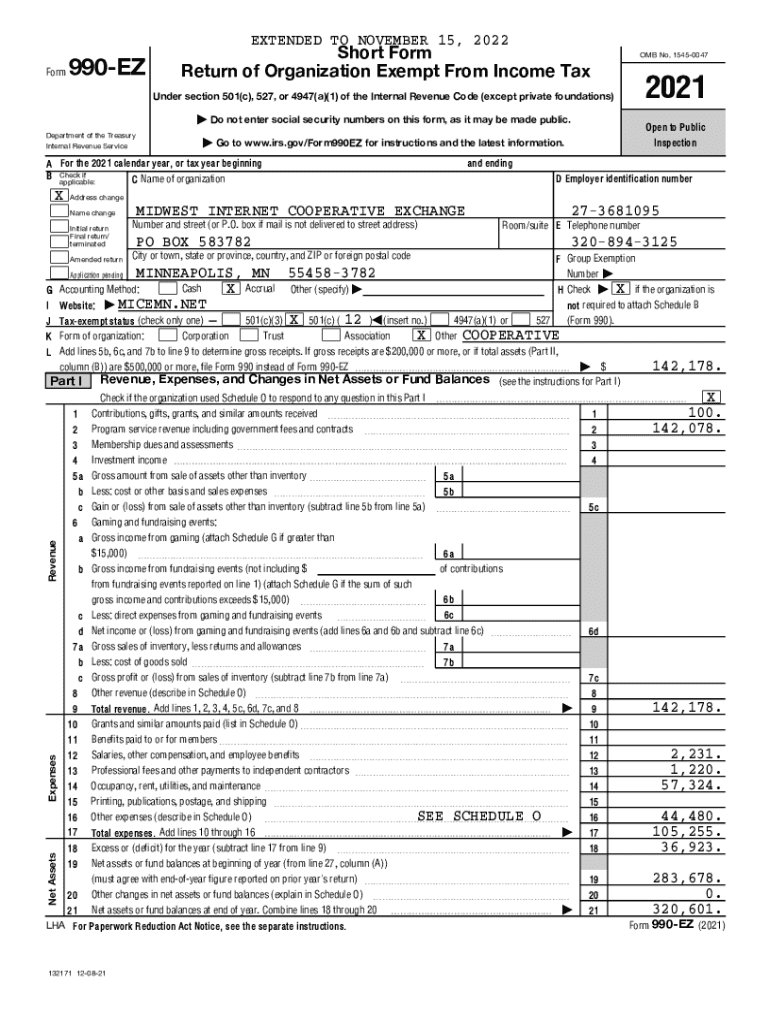

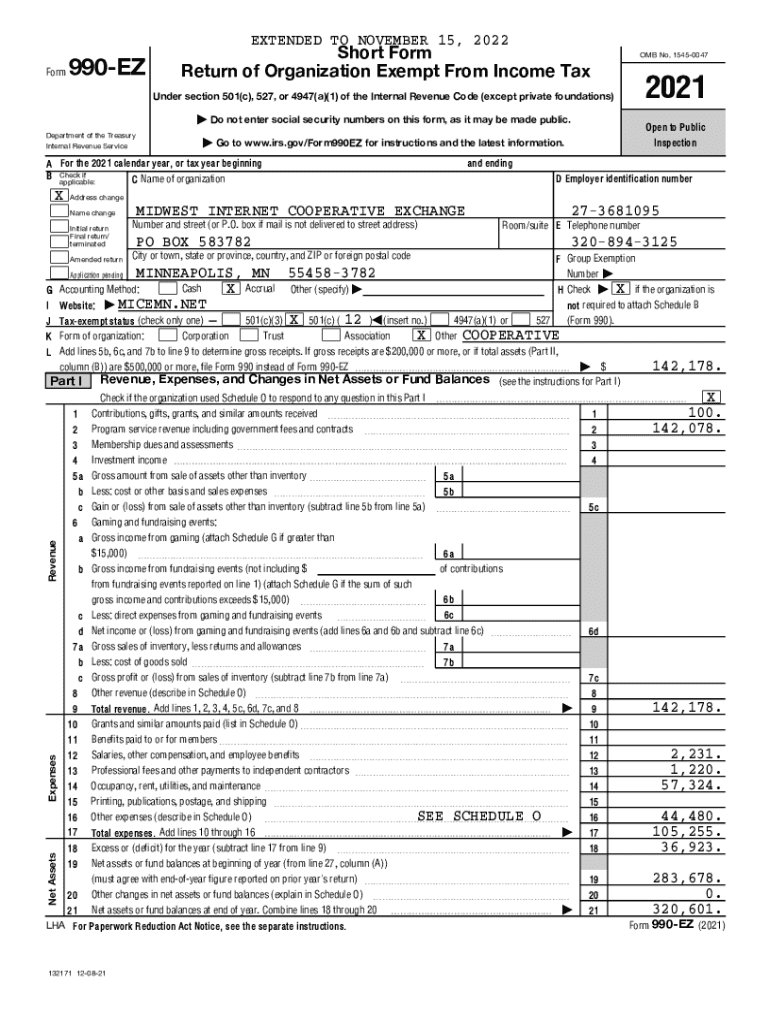

Understanding Form 990-EZ

Form 990-EZ is a streamlined tax document that smaller tax-exempt organizations use to report their financial information to the IRS. Designed with simplicity in mind, this form allows organizations with gross receipts under a certain threshold to maintain compliance without the extensive requirements of Form 990.

The primary distinction between Form 990 and Form 990-EZ lies in the size and complexity of the organizations using them. While Form 990 is intended for larger entities, requiring detailed disclosures and financial statements, Form 990-EZ is structured to fulfill the needs of smaller nonprofits, enabling them to provide essential information without overwhelming paperwork.

The importance of Form 990-EZ cannot be overstated. Filing accurately not only fulfills legal requirements but also enhances transparency and accountability within the nonprofit sector. This form serves as a vital tool for organizations to communicate their financial health and operational effectiveness to stakeholders, funders, and the public.

Who needs to file Form 990-EZ?

Not all tax-exempt organizations are required to file Form 990-EZ. To qualify, an organization must meet specific criteria, including having gross receipts of less than $200,000 and total assets under $500,000 at the end of the year.

Certain entities, like churches, certain governmental units, and organizations that are eligible to file Form 990-N e-Postcard, are exempt from filing Form 990-EZ. Understanding these exceptions is crucial to determine the appropriate form for your organization based on its specific circumstances.

Key deadlines for filing Form 990-EZ

Form 990-EZ must be filed by the 15th day of the 5th month following the end of your organization's accounting period. This means that for organizations operating on a calendar year, the due date would typically be May 15. It's essential to mark this deadline on your calendar to avoid complications.

If additional time is required, organizations can apply for an extension using Form 8868, which grants an automatic six-month extension. However, it’s important to note that this does not extend the time for payment of taxes due, which remains a critical aspect of compliance.

Preparing to file Form 990-EZ

Preparation is key to ensure that Form 990-EZ is completed accurately and thoroughly. Begin by gathering essential documents, which include your prior year Form 990, financial statements, and records of revenues and expenses. This foundational work will provide a framework for your filing.

Navigating your financial statements can be daunting but is necessary for reporting. Ensure your income, expenses, and assets are accurately presented. It's equally important to compile supporting information such as necessary schedules and additional forms that may be required to substantiate your entries on the form.

Step-by-step guide to completing Form 990-EZ

Completing Form 990-EZ involves several essential steps, streamlined to facilitate a straightforward filing process. Start by entering your organization’s basic information, including its name, address, and Employer Identification Number (EIN). Accurate entry of this information is crucial, as it forms the basis of your tax return.

The next step is to report revenue and expenses. Carefully review all documents, and ensure you categorize income correctly into sources such as gifts, grants, memberships, and program service revenue. Following this, complete the core sections and schedules, focusing on Parts I, II, and III, which include the summary page, revenue and expenses, and balance sheet, respectively.

Amending a previously filed Form 990-EZ

If any errors or omissions necessitate a change after filing, it is possible to amend your Form 990-EZ. This involves filing an amended return, which is designed to rectify inaccuracies. Typically, organizations should file an amendment when they need to change fundamental elements, such as revenue figures and expenses.

The process is straightforward; simply check the box indicating you’re filing an amended return, clearly identify the information being amended, and include any new accurate figures. Additionally, no cost is associated with filing an amendment, which provides organizations peace of mind when correcting their filings.

E-filing Form 990-EZ

E-filing Form 990-EZ offers numerous advantages over traditional paper filing. Not only does it enable quicker processing and acknowledgment by the IRS, but it also minimizes the risk of delays commonly associated with postal submission. Organizations can efficiently manage their documentation in a digital format, enhancing record-keeping.

To file electronically, organizations can use authorized e-file platforms. This process generally requires completing the form online, submitting it through the e-file system, and then storing a confirmation of their submission. Tracking your filing becomes more straightforward, ensuring that organizations maintain compliance with IRS requirements.

Common issues and penalties related to Form 990-EZ

Filing Form 990-EZ incorrectly can lead to various penalties, ranging from monetary fines to loss of tax-exempt status. One common error arises from inaccurately reporting revenues and expenses, which can prompt an IRS audit. Developing a thorough review process can mitigate these risks, ensuring compliance with all requirements.

If organizations receive an IRS notice, it is crucial to address it promptly. Often, these notices contain vital information on discrepancies or issues that need resolution. Failure to respond can exacerbate the situation and potentially result in further penalties or complications.

Resources and tools from pdfFiller for Form 990-EZ

pdfFiller provides exceptional resources for organizations navigating Form 990-EZ. Their interactive tools facilitate filling out the form accurately, allowing users to edit documents seamlessly, ensuring that entries are corrected before submission. This user-friendly platform empowers organizations to manage their documents effectively and efficiently.

Additionally, pdfFiller's features, such as cloud storage and e-signing capabilities, enhance collaboration among teams, making the filing process more manageable. Organizations can work together in real-time, ensuring that all necessary documents and financial data are readily accessible from anywhere.

Frequently asked questions about Form 990-EZ

Many organizations have questions regarding the intricacies of Form 990-EZ. One common area of confusion is the Group Exemption Number (GEN), which is applicable for entities part of a larger association or group. Understanding whether to file in conjunction with other forms, like Form 990-T for unrelated business income tax, is also crucial.

Organizations may also inquire about filing options for situations with multiple income sources or complications stemming from mergers. Having clear guidance and examples can empower organizations to navigate these complexities effectively, ensuring they file accurately and on time.

Case studies: Filing Form 990-EZ successfully

Examining exemplary scenarios offers valuable insight into successful practices. For instance, a small nonprofit organization may have streamlined their filing process through the proactive use of software tools. By consistently maintaining accurate financial records throughout the year, they were able to ease the burden of year-end reporting.

Focusing on best practices such as regular reconciliations, employing a dedicated accounting system, and utilizing e-filing platforms enabled this organization to not only meet its deadlines but also to enhance its transparency with stakeholders. These experiences emphasize the importance of preparation and the effectiveness of leveraging modern tools.

Navigating changes in nonprofit tax regulations

The landscape of nonprofit tax regulations is continually evolving, emphasizing the need for organizations to stay informed. Recent updates may include changes in income thresholds or modified reporting requirements, which can significantly affect which forms organizations are required to file.

Organizations can utilize resources, such as official IRS announcements and nonprofit management seminars, to ensure they remain compliant. Staying updated with these changes will safeguard organizations against potential penalties and help them adapt to new regulatory environments.

Engaging with pdfFiller for your Form 990-EZ needs

pdfFiller stands ready to support organizations looking to simplify their Form 990-EZ filings. Their dedicated customer support team can assist with complex inquiries, providing expert insights and solutions tailored to your specific situation. This level of support helps ensure organizations remain compliant and informed.

Moreover, pdfFiller offers subscription plans uniquely designed for nonprofits, providing access to essential tools and features necessary for effective document management. Investing in such services can enhance organizational capacity and streamline overall processes.

Conclusion and next steps

The streamlined approach that pdfFiller offers for managing Form 990-EZ simplifies the complexities of nonprofit tax compliance. By utilizing their document management tools, organizations can enhance their filing experience and maintain accurate records, facilitating easier audits and reporting.

As your organization prepares for filing, consider leveraging the comprehensive support and interactive resources available through pdfFiller. By taking proactive measures in managing your documentation, you can ensure timely submissions and smooth compliance with all legal requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 990-ez without leaving Google Drive?

Can I sign the form 990-ez electronically in Chrome?

Can I create an eSignature for the form 990-ez in Gmail?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.