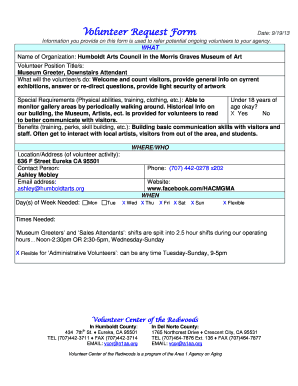

Get the free Aarp Change of Beneficiary Form

Get, Create, Make and Sign aarp change of beneficiary

How to edit aarp change of beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aarp change of beneficiary

How to fill out aarp change of beneficiary

Who needs aarp change of beneficiary?

Understanding the AARP Change of Beneficiary Form: A Comprehensive Guide

Understanding the importance of beneficiary designations

Designating a beneficiary is a crucial component of financial planning. It ensures that your assets are distributed according to your wishes upon your passing. This process can provide peace of mind to individuals, knowing that loved ones are taken care of when they are no longer around. Various life events may prompt a change in beneficiary designations, highlighting why it’s essential to keep this information updated.

Common scenarios prompting a change of beneficiary include marriage, divorce, the birth of a child, or the passing of a previous beneficiary. Each situation requires careful consideration of who should inherit your assets. Legal implications are significant; failure to designate or update beneficiaries correctly can result in unintended distributions, potentially causing family disputes and financial complications.

Overview of the AARP change of beneficiary form

The AARP change of beneficiary form is a document tailored for AARP members, allowing for the straightforward update of beneficiary designations on various insurance policies or retirement accounts. This form streamlines the process, ensuring changes are recorded properly and efficiently.

Its key features include simplicity, a clear layout, and specific sections designed to gather essential information about the current and new beneficiaries. It’s aimed primarily at AARP members but can also be used by anyone needing to modify their beneficiary designations in a straightforward, official manner.

Step-by-step guide to completing the AARP change of beneficiary form

Completing the AARP change of beneficiary form is a straightforward process. Below is a detailed guide to ensure all essential steps are covered.

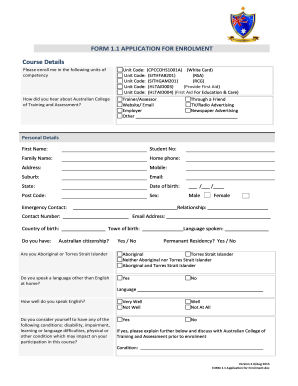

Step 1: Gather necessary information

Before starting the form, gather essential personal information such as your full name, address, and Social Security number. Additionally, you’ll need to identify both your current and new beneficiaries, which may require their full names, relationships to you, and their Social Security numbers or other identifying details if necessary.

Step 2: Accessing the form

The form can be conveniently downloaded from pdfFiller as a PDF file. If you prefer to work with interactive tools, pdfFiller also offers an online version that allows seamless editing directly within your browser.

Step 3: Filling out the form

When filling out the form, pay attention to detail. Start by entering your current beneficiary information and then the new beneficiary details. Ensure that names are spelled correctly and relationships are accurately described. Common mistakes include leaving fields blank or providing incorrect identification details.

Step 4: Reviewing your changes

Once the form is completed, double-check all entries. Cross-verify names, Social Security numbers, and any other personal details to ensure accuracy. It's essential to avoid typos and inaccuracies to prevent any issues during the beneficiary distribution process.

Editing and managing your document

pdfFiller provides rich editing tools that allow you to make changes to your form even after it is completed. You can adjust information, add notes, or make minor edits as needed. Collaborative features facilitate team involvement, enabling multiple users to discuss and edit a document simultaneously, which is especially useful for shared assets.

How to save and organize your documents

After editing, pdfFiller allows users to save documents in various formats, making it easy to organize and store them according to individual preferences. Use folders to categorize your documents, and ensure proper naming conventions for easy retrieval.

Signing and submitting the change of beneficiary form

Once completed, you’ll need to sign the document. pdfFiller offers an eSigning feature, making it easy to apply your signature digitally. This method provides convenience and speeds up the process without compromising security. eSigning is protected by advanced encryption, ensuring that your signature remains secure.

Submission options

After signing, make sure to submit the form to the relevant institution or authority. This can often be done via email, fax, or traditional mail. Keeping a record of your submission ensures you have a verified trail confirming that the changes have been made.

Frequently asked questions (FAQs)

1. How often can I change my beneficiary? You can change your beneficiary as often as necessary, but it's wise to review designations regularly, especially after significant life events.

2. What if my beneficiary is no longer living? If a beneficiary has passed away, it's important to make immediate updates to avoid complications later.

3. Can a minor be designated as a beneficiary? Yes, a minor can be a beneficiary, but consider establishing a trust or appointing a guardian to manage those assets if they are to inherit.

Real-life examples and scenarios

Let's consider a case where an individual updates their beneficiary for retirement accounts after marrying. The previous beneficiary was a sibling, but after marrying, he decides to designate his spouse. In situations like this, ensuring that the new beneficiary designation is updated prevents misunderstandings and ensures the spouse is prioritized in asset distribution.

Similarly, a parent may want to change the beneficiary of a life insurance policy after the birth of a child. Placing the child as a beneficiary ensures that funds are available for their future needs should the unthinkable happen.

Tools and resources for estate planning

Beyond the change of beneficiary form, various other forms may be necessary for comprehensive estate planning. Consider additional documents such as wills, trusts, and powers of attorney, which can help establish your wishes clearly and legally.

Free estate planning tools available through pdfFiller can assist in drafting these essential documents. Utilizing such resources can streamline the planning process and ensure that all relevant information is readily accessible.

Contacting support for assistance

Should you encounter any issues while filling out the AARP change of beneficiary form, pdfFiller provides robust customer support options. You can reach customer support through email or live chat, ensuring you receive timely assistance. Moreover, the resource center offers a wealth of information, including guides and FAQs.

Community forums provide an additional avenue for users to engage and learn from peers. Here, you can find discussions on common challenges others have faced when managing their documents.

Ongoing management of your beneficiary designations

Once you’ve designated your beneficiaries, it’s crucial to manage this information actively. Regularly review your beneficiary designations, especially after significant life changes such as marriage, divorce, or the death of a loved one. This practice ensures that your wishes are accurately reflected at all times.

Integrating beneficiary designation management into your overall estate plan can also be beneficial. Keeping detailed records ensures clarity, minimizes disputes, and focuses on your end-of-life wishes.

Insight into related documents and services

When managing your beneficiary designations, various related forms might be pertinent to your circumstances. pdfFiller offers an array of templates and documents that complement the change of beneficiary form, allowing for comprehensive estate management.

Enhancing your document management skills through interactive pdfFiller tools will empower you to handle future documentation needs more efficiently, whether related to estate planning or other necessary personal forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the aarp change of beneficiary in Chrome?

How do I complete aarp change of beneficiary on an iOS device?

How do I complete aarp change of beneficiary on an Android device?

What is aarp change of beneficiary?

Who is required to file aarp change of beneficiary?

How to fill out aarp change of beneficiary?

What is the purpose of aarp change of beneficiary?

What information must be reported on aarp change of beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.