Get the free Aer Budget Sheet

Get, Create, Make and Sign aer budget sheet

How to edit aer budget sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out aer budget sheet

How to fill out aer budget sheet

Who needs aer budget sheet?

A comprehensive guide to the AER budget sheet form

Understanding the AER budget sheet form

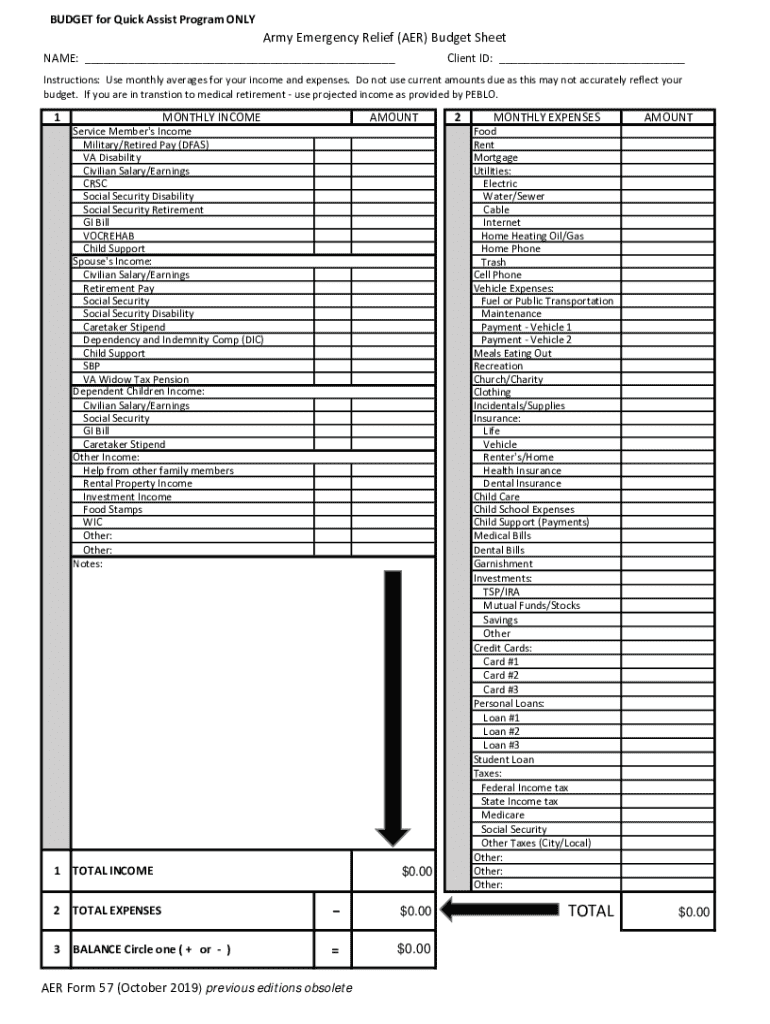

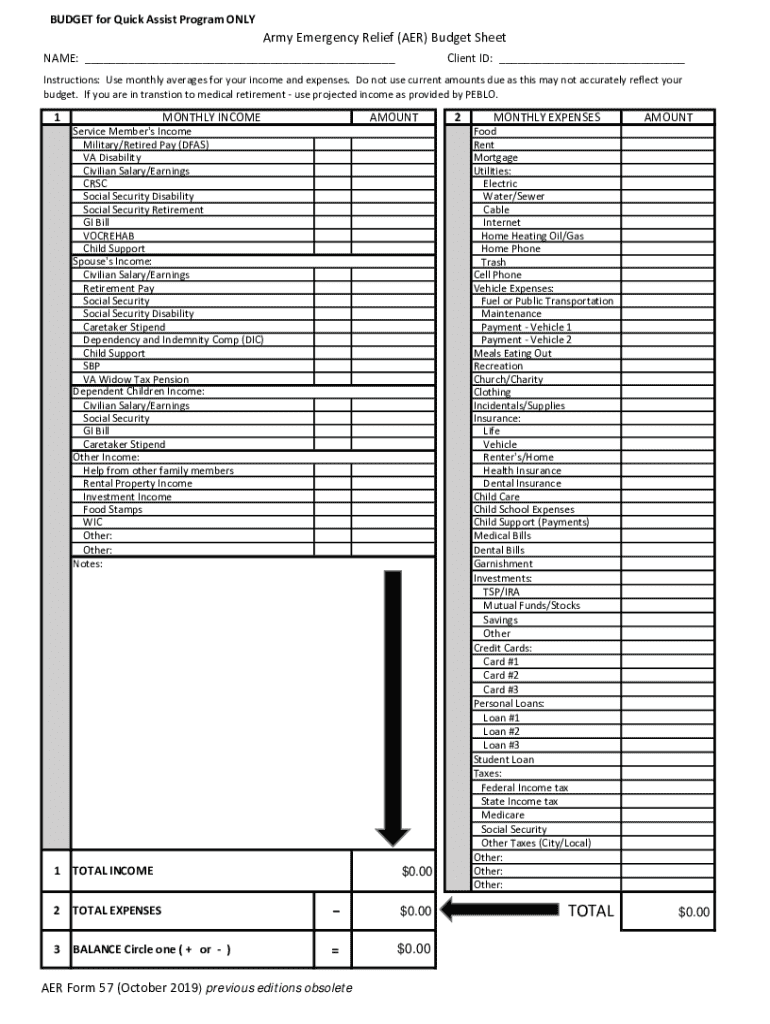

The AER budget sheet form is an essential tool for effective financial management. It offers a structured way to track income, expenses, and savings goals, enabling users to understand their financial status at a glance. The primary purpose of this form is to facilitate budgeting and financial planning by categorizing different aspects of an individual’s or organization’s finances, thus providing a clear overview of where money is allocated and spent.

Accurate budgeting is crucial because it helps to prevent overspending, promotes saving, and assists in future planning. By using the AER budget sheet form, users can pinpoint trends in their spending habits, identify areas for improvement, and ultimately build a more secure financial future.

Key features of the AER budget sheet form

The AER budget sheet form stands out due to its comprehensive features designed for a variety of users. First and foremost, it categorizes expenses into fixed and variable types, allowing a detailed breakdown of financial obligations. Fixed expenses include monthly bills, while variable expenses cover discretionary spending and unforeseen costs, ensuring that all facets of an individual’s or organization’s expenses are accounted for.

In addition to its categorical features, the form boasts a user-friendly interface on pdfFiller. The design promotes accessibility, making it easy for anyone to navigate through the form. Furthermore, interactive elements enhance usability by allowing users to input data seamlessly, and the cloud-based management capabilities mean that budgets can be accessed and modified from any device, facilitating real-time collaboration, especially for teams.

Step-by-step instructions for filling out the AER budget sheet form

To access and utilize the AER budget sheet form efficiently, begin with obtaining it from pdfFiller. After navigating to the platform, select your desired template that best suits your needs. Once you have the form open, start filling in your personal and financial information. This includes detailed sections for income sources, expenses divided by categories, and any savings goals you may have set.

When gathering the necessary documents, consider including recent bills, bank statements, and pay stubs. To maximize the functionality of the AER budget sheet form, take advantage of its interactive tools. Use built-in calculations and autofill features to save time, and consider incorporating visual elements like charts to provide a clearer representation of your financial data.

Editing and customizing the AER budget sheet form

One of the standout features of the AER budget sheet form on pdfFiller is its editing capabilities. Users can easily modify text and fields to suit their specific budgeting needs. For instance, if you find that certain expense categories are not relevant or need to be expanded, the editing functions allow you to add or remove information effortlessly, ensuring the form is tailored to your financial situation.

Additionally, pdfFiller provides options for legally signing the form electronically. This is particularly beneficial for teams or organizations needing approval or collaboration. After editing, sharing your budget sheet with team members or financial advisors is straightforward, promoting transparency and joint oversight of financial planning.

Common mistakes to avoid when using the AER budget sheet form

While the AER budget sheet form is a powerful tool, users should be mindful of common pitfalls that can undermine effective budgeting. A frequent mistake is overlooking important expense categories, leading to inaccurate budgeting. To avoid this, ensure thorough tracking by reviewing past expenses and factoring in all categories.

Another mistake is neglecting the future financial implications of current spending habits. It’s vital to plan not just for immediate expenses but also future needs like emergencies and savings. Lastly, users often fail to update their budget sheets regularly; setting reminders helps to keep the budget current, refining financial strategies as circumstances change.

Frequently asked questions about the AER budget sheet form

Potential users often have many questions regarding the AER budget sheet form. Common inquiries include the formats available for exporting the completed form; pdfFiller allows exports in PDF, Word, and Excel formats, making it easy to share and analyze data further. Users also express concerns about the security of their sensitive financial information. pdfFiller employs advanced encryption measures to protect user data, ensuring confidentiality during the budgeting process.

Lastly, users wonder about integrating their AER budget sheet with other financial tools. pdfFiller allows integrations with different accounting and finance management software, enabling seamless financial oversight and management without the hassle of transferring data manually.

Case studies: successful budget management using the AER budget sheet form

Examining successful users of the AER budget sheet form highlights its effectiveness. For individuals, many have shared success stories about how the form helped them reduce unnecessary expenses and better allocate their income towards savings and debt reduction. One testimonial noted that after rigorously following their budget for a few months, they were able to save for a vacation and build an emergency fund, showcasing the transformative potential of careful budgeting.

On a larger scale, teams and organizations have also benefited from utilizing the AER budget sheet form. For instance, one non-profit organization found that using the form made tracking group expenditures clearer, leading to more focused fundraising efforts. By identifying and eliminating redundant expenses, they improved overall financial health, which enabled them to increase their outreach efforts.

Final thoughts on the AER budget sheet form

Taking control of one's finances is paramount in today’s economic landscape, and the AER budget sheet form serves as a powerful ally in that journey. By engaging in sound financial practices and keeping an accurate budget, users can manage their resources more effectively and achieve their financial goals. Leveraging pdfFiller’s features enhances this experience further, providing a cloud-based solution that ensures flexibility, collaboration, and ease of use.

In summary, the AER budget sheet form is not just a document; it’s a blueprint for financial success. Whether for personal use or as part of a larger team initiative, its thoughtful design and interactive features can make a significant difference in managing finances efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find aer budget sheet?

Can I sign the aer budget sheet electronically in Chrome?

How do I edit aer budget sheet on an Android device?

What is aer budget sheet?

Who is required to file aer budget sheet?

How to fill out aer budget sheet?

What is the purpose of aer budget sheet?

What information must be reported on aer budget sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.