Get the free Form 750-d

Get, Create, Make and Sign form 750-d

How to edit form 750-d online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 750-d

How to fill out form 750-d

Who needs form 750-d?

How to Fill Out the Form 750-: A Comprehensive Guide

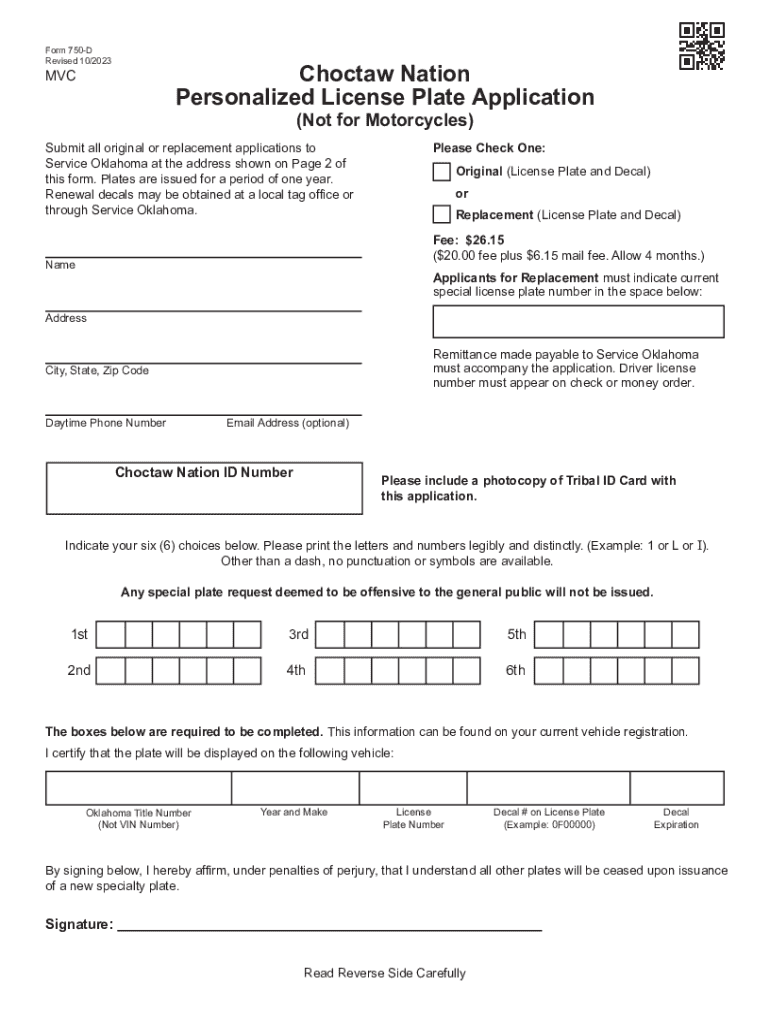

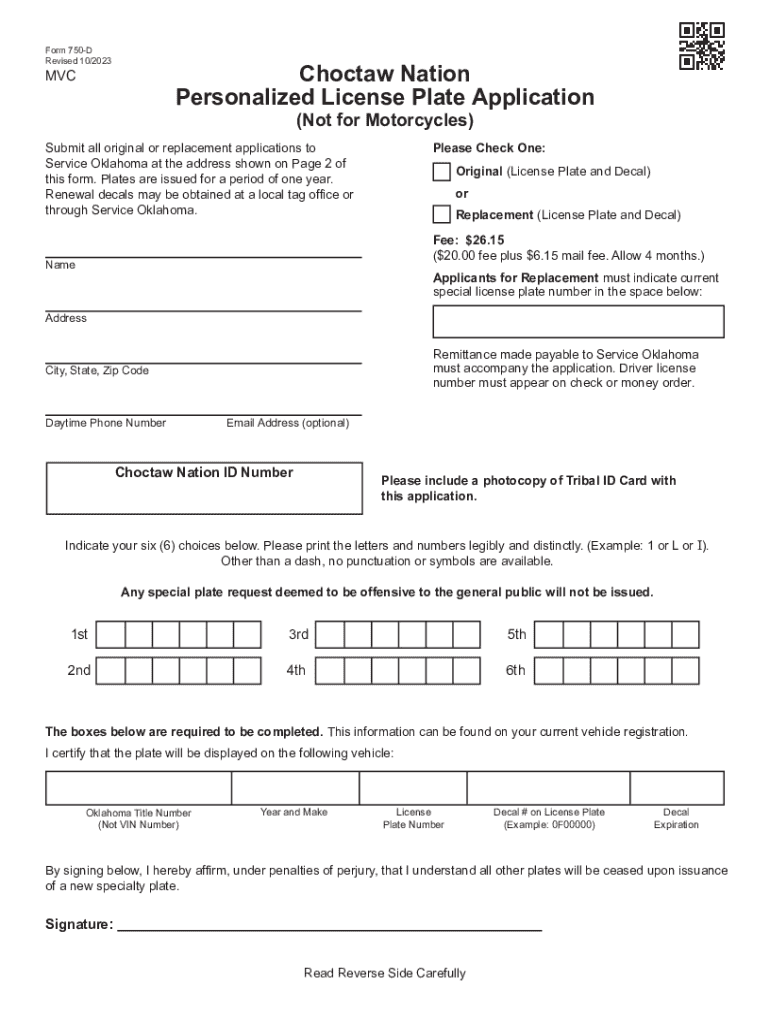

Overview of Form 750-

Form 750-D is a vital document often used in specific regulatory, financial, or administrative contexts. It serves a defined purpose, typically tied to compliance within industries governed by federal or state regulations. Understanding what Form 750-D is, and who it affects, is essential for anyone required to file the document.

The importance of Form 750-D lies in its role in ensuring that regulatory requirements are met efficiently. Depending on your sector, failing to submit this form accurately could lead to compliance issues or financial penalties. Thus, knowing if you need to file this form is critical, particularly for businesses operating in heavily regulated fields.

Key features of Form 750-

Form 750-D comprises several distinct sections, each designed to capture specific information pertinent to regulatory compliance. Common requirements often include personal identification details, relevant financial disclosures, and sometimes even supporting documents outlining previous compliance efforts.

Understanding the nuances of each section can greatly ease the completion process. For example, businesses may have to provide payroll information or revenue figures, whereas individuals might only need to report personal identification and other pertinent details. Real-world scenarios — such as when businesses face audits or individuals seek loans — frequently necessitate the filing of this form.

Step-by-step instructions for filling out Form 750-

Completing Form 750-D efficiently begins with gathering the necessary information. Start by collecting all requisite documents, such as identification proofs and financial statements. Each piece of information plays a critical role in ensuring your submission is accurate.

Gathering necessary information

You will generally need the following documents:

Completing each section of the form

Each section of the form has its specific requirements. Here’s a breakdown:

Section 1 typically includes personal identification information. Make sure the name is spelled correctly and all dates are formatted as required. Follow this process compiling Section 2 and 3 details, where you may report financial information and other disclosures necessary for the specific requirements.

Validating your information

Once the form is completed, validating your information is crucial. Use a detailed checklist to ensure there are no errors. The following common pitfalls can often lead to unnecessary delays or rejections:

Editing and managing Form 750- using pdfFiller

pdfFiller significantly eases the process of managing Form 750-D. The platform provides streamlined tools for uploading, editing, and collaborating on documents. Uploading your form is as simple as drag-and-drop, with support for various file formats.

Uploading the form to pdfFiller

To upload your Form 750-D, follow these steps:

Editing the form easily

With the document uploaded, pdfFiller allows you to utilize a range of editing tools to enhance your Form 750-D. You can easily add text, images, and even signatures, significantly improving your document's responsiveness and clarity.

Collaborative features

pdfFiller also enables real-time collaboration, allowing team members to interact with the document simultaneously. This functionality improves communication and ensures that everyone’s input is reflected before submitting the final form.

Signing the Form 750-

Submitting Form 750-D typically requires signatures, which can now be accomplished electronically. With pdfFiller, users can choose from various e-signature options, ensuring that the signature process is both secure and legally valid.

Guiding signers through the electronic signing process is crucial. You’ll want to provide clear instructions and ensure that every signer understands their responsibility to authenticate the document accurately.

Submitting Form 750-

Understanding submission options is essential for completing the form process efficiently. You have two primary methods for submission — online or mail. The method you choose may depend on regulatory requirements or personal preferences.

Understanding submission options

When opting for online submission, follow any protocol set out by the governing body. For mail submission, ensure the correct address is utilized, as incorrect submissions can lead to delays.

Submission timelines and deadlines

Being aware of deadlines is vital, as missing them can have serious repercussions. It’s advisable to set reminders to submit Form 750-D well ahead of crucial dates to avoid penalties.

Frequently asked questions (FAQ)

Many users encounter repeated questions regarding Form 750-D. Addressing concerns or common confusion can expedite the filing process and ensure smoother submission.

Related forms and documentation

Form 750-D may not exist in isolation. Understanding related forms often filed alongside can assist in meeting compliance effectively. Knowing their intended purpose makes for more seamless documentation.

User testimonials and success stories

Individuals and teams using pdfFiller for Form 750-D have shared success stories that highlight how streamlined the process can be. From avoiding costly mistakes to ensuring timely submissions, these insights can motivate new users to leverage the platform fully.

Case studies show how teams have improved productivity by utilizing pdfFiller’s collaborative features, emphasizing the effectiveness of the platform in achieving faster, more accurate submissions.

Navigating the pdfFiller platform

Users new to pdfFiller will find that creating an account is simple and straightforward. The streamlined interface is designed to enhance user experience, making it easy to access the tools required for filling out Form 750-D efficiently.

Creating an account

Setting up your pdfFiller account is quick. Begin with the following:

Customer support and assistance

Should you require help while navigating pdfFiller, a variety of support options are available. From comprehensive FAQs to direct customer support channels, users can quickly find the answers they need.

About pdfFiller

pdfFiller is an innovative platform designed to empower users to manage their documents more effectively. With a mission to simplify document management, pdfFiller caters to a diverse user base across various sectors.

The commitment to providing tools that enhance user experience underscores the value of the platform, helping individuals and teams succeed with their documentation and compliance needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 750-d for eSignature?

How do I edit form 750-d online?

How do I edit form 750-d on an iOS device?

What is form 750-d?

Who is required to file form 750-d?

How to fill out form 750-d?

What is the purpose of form 750-d?

What information must be reported on form 750-d?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.