Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

Comprehensive Guide to the W-9 Form

Understanding the W-9 form

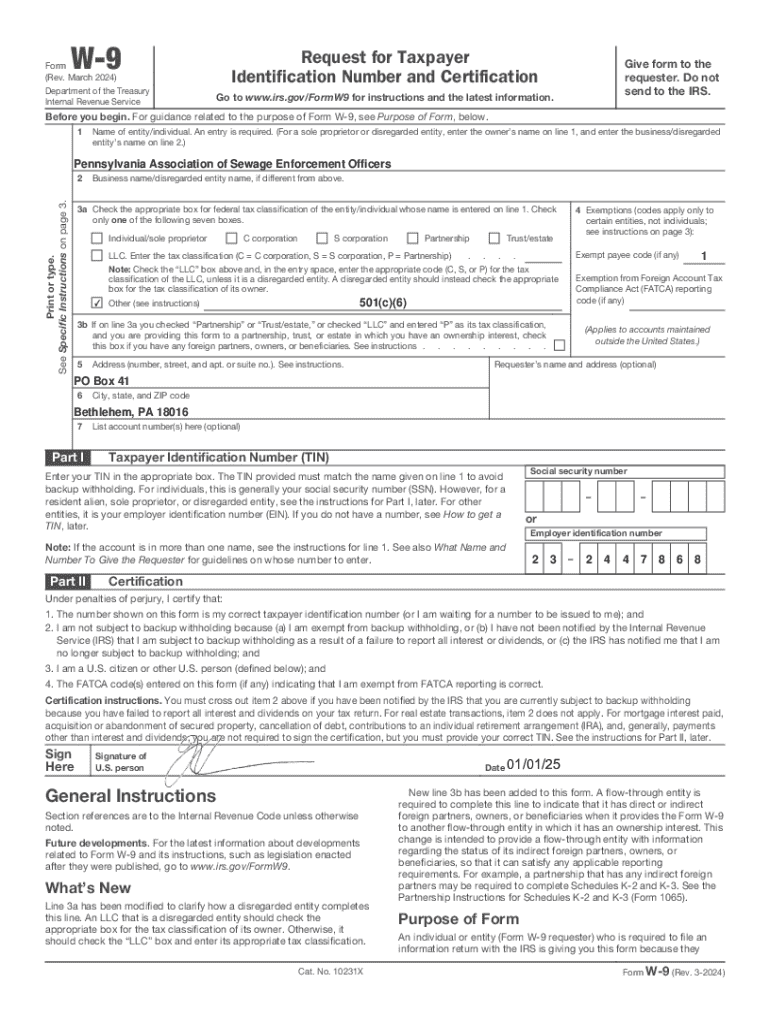

The W-9 form is a crucial document utilized by the Internal Revenue Service (IRS) in the United States, primarily aimed at collecting taxpayer information for various financial transactions. It serves as a request for your Taxpayer Identification Number (TIN), which can be your Social Security Number (SSN) or Employer Identification Number (EIN). The W-9 form is essential for anyone who may be subject to receiving a 1099 form for tax reporting purposes.

Understanding the W-9 is vital not only for freelancers and independent contractors but also for businesses that require accurate taxpayer details for filing taxes and fulfilling their legal obligations. Filling out this form accurately ensures that both parties avoid issues with the IRS, particularly concerning income reporting and withholding taxes.

Use cases for the W-9 form

The W-9 form serves distinct purposes across various professional and transactional contexts. Understanding when to use this form can help streamline communication between payers and payees, ensuring tax compliance and reducing errors during reporting.

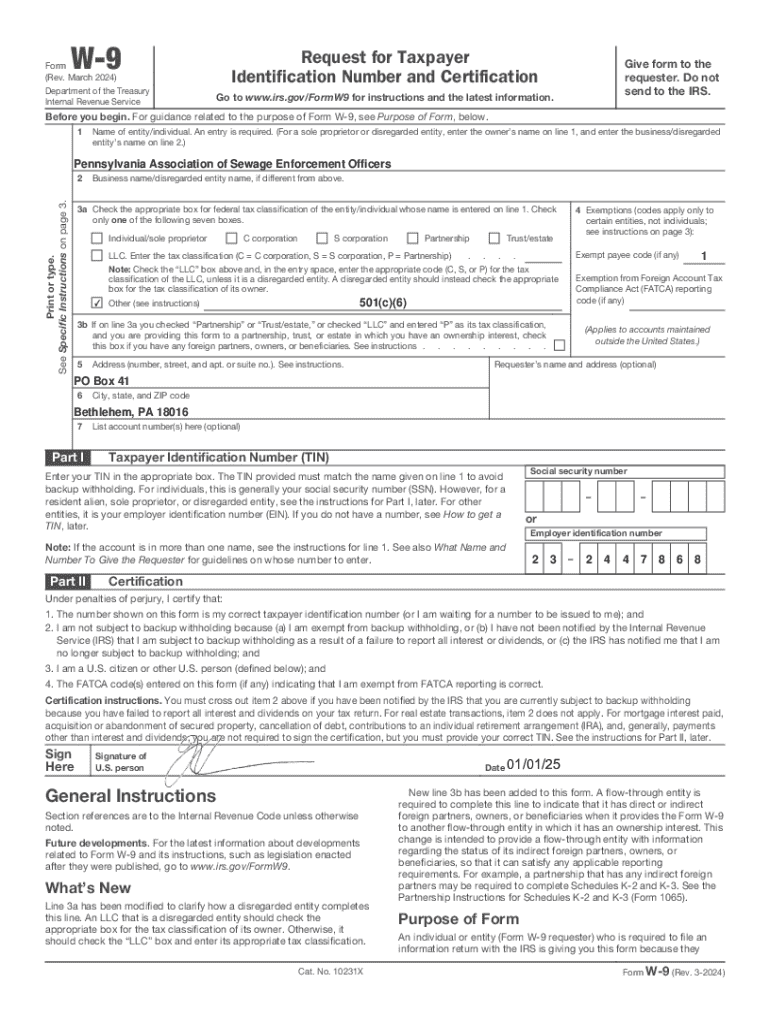

How to fill out the W-9 form

Filling out the W-9 form correctly is crucial for ensuring accurate tax information submission. Here’s a step-by-step guide on how to accomplish it with ease:

Step 1: Personal Identification

Start the process by providing your full name. If you are operating under a different business name, include that next to 'Business name/ disregarded entity name', if applicable.

Step 2: Tax Classification

Select the appropriate tax classification from the options provided: Individual/Sole Proprietor, C Corporation, S Corporation, Partnership, Trust/estate, Limited Liability Company, or Other. Make sure you fully understand the implications of each classification for tax purposes.

Step 3: Address Information

You need to provide both your physical address and, if different, your mailing address. This ensures that you receive any important tax documentation without issues.

Step 4: Taxpayer Identification Number (TIN)

Here, you’ll input your TIN. If you are a sole proprietor, this will typically be your SSN. If you operate a business, you should provide your EIN instead. Always double-check to avoid errors, as incorrect information can lead to backup withholding.

Step 5: Certification Signatures

Finally, sign and date the form to certify that the information provided is accurate and complete. Keep in mind that electronic signatures are valid as long as they comply with IRS guidelines.

Digital tools for W-9 management

pdfFiller provides a seamless digital solution for managing your W-9 forms. Here’s how to make the most out of the platform:

Using pdfFiller for electronically completing the W-9

With pdfFiller, users can easily upload their W-9 forms, edit them, and save the changes effortlessly. Here’s a step-by-step guide:

The benefits of utilizing digital signing and document management through pdfFiller include immediate access to your documents from anywhere, enhanced security, and a reduced risk of paperwork mishaps.

Moreover, if you are part of a team, pdfFiller provides collaborative features, allowing multiple users to work on a document or provide input without a hassle.

Filing and submission of the W-9 form

Once the W-9 form is completed, submitting it correctly becomes crucial for compliance. The process can vary depending on the specific arrangement between parties involved.

Typically, the W-9 is not submitted to the IRS directly. Instead, it is given to the requesting party—usually an employer or a company paying you for services.

Deadlines and timelines

Understanding the deadlines associated with the W-9 form can significantly influence your financial reporting and planning. Generally, there are a few important timelines to be aware of:

Common mistakes to avoid

Filling out the W-9 form comes with its own set of common pitfalls. Being aware of these can save you from issues later, particularly involving tax compliance.

Special considerations

Certain situations require additional caution when submitting your W-9 form. By being aware of these special considerations, you can navigate your tax obligations more effectively.

Avoiding backup withholding

Backup withholding may occur if the IRS notifies the payer to withhold taxes due to invalid TINs or if you fail to provide the requested form altogether. This means your payments will have a percentage withheld, often 24%.

Financial institution-customer arrangements

When dealing with financial institutions, be aware that they may require W-9 forms for prospective clients or the opening of accounts. Failing to provide a valid W-9 could impact your ability to complete essential banking transactions.

Integration with other forms

The W-9 form is closely associated with the 1099 form, often creating confusion for those managing their tax documents. Understanding this relationship is vital for successful tax compliance and accurate income reporting.

Quick reference

Here’s a brief summary of key points regarding the W-9 form to keep in mind:

For additional tools and resources related to W-9 and other forms, you can navigate through pdfFiller's offerings to maximize efficiency in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my w-9 in Gmail?

How can I edit w-9 on a smartphone?

How can I fill out w-9 on an iOS device?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.