Get the free Real Estate Investor Protection Program Application

Get, Create, Make and Sign real estate investor protection

How to edit real estate investor protection online

Uncompromising security for your PDF editing and eSignature needs

How to fill out real estate investor protection

How to fill out real estate investor protection

Who needs real estate investor protection?

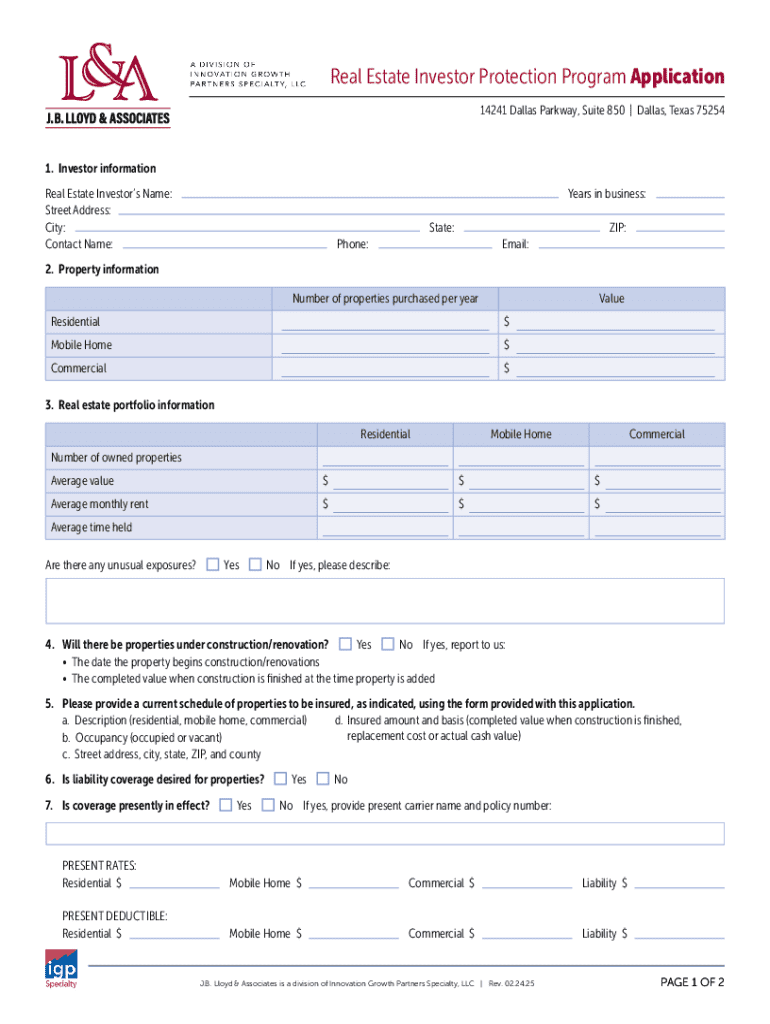

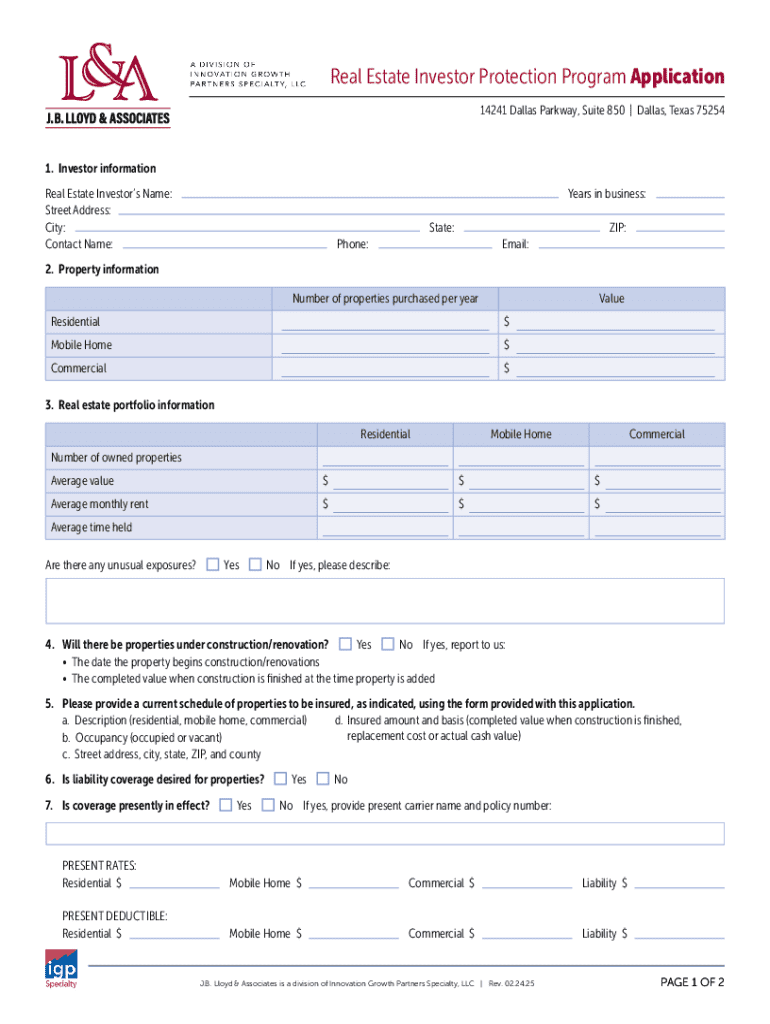

Understanding the Real Estate Investor Protection Form

Understanding the real estate investor protection form

A real estate investor protection form is a document designed to safeguard the interests of individuals or entities involved in real estate transactions. Its primary purpose is to outline the terms and conditions regarding investments, protecting investors from potential risks and liabilities. This form acts as a framework within which parties can establish their rights, responsibilities, and expectations, ultimately creating a safer investment environment.

In real estate, the stakes can be incredibly high, with substantial financial investments on the line. Using a real estate investor protection form is crucial, as it provides a legal basis for the contractual obligations between parties and ensures that there is a formal record of the agreement. This form not only helps to prevent misunderstandings but also offers a pathway for dispute resolution, making it an essential tool for any serious investor.

Key elements of the form

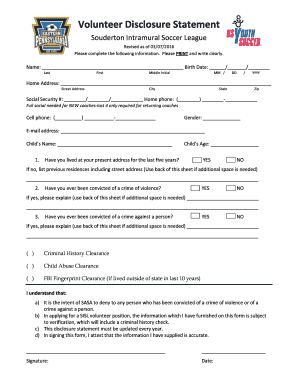

A typical real estate investor protection form consists of several critical sections that must be accurately completed. These include party information, which identifies the investors involved and their roles; asset descriptions detailing the properties or investments in question; and liability waivers that clarify which risks are being assumed by each party. Understanding the legal terminology used within the form is equally important, as terms such as "indemnification" or "default" can have significant implications if disputes arise.

Importance of a real estate investor protection form

The significance of a real estate investor protection form cannot be overstated, particularly when it comes to safeguarding investments. By clearly outlining the terms of an investment, the form mitigates risks and helps prevent financial losses. For example, without proper documentation, an investor might find themselves facing unexpected liabilities from a property's unforeseen defects or disputes over ownership claims. Such situations can lead to substantial losses that could have been avoided had the terms been clearly laid out in the protection form.

In addition to protecting investments, the form also carries legal implications, playing a crucial role in ensuring that all parties comply with relevant laws and regulations. It acts as a reference point should any disagreements arise, paving the way for a more streamlined dispute resolution process. Courts often look favorably on well-documented agreements, which can lead to more favorable outcomes for investors who have taken the time to protect their interests properly.

Preparing to use the real estate investor protection form

Before utilizing the real estate investor protection form, it's essential to assess your protection needs accurately. Take a inventory of your current assets and evaluate potential risks associated with each. A practical approach is to create a checklist to identify various factors such as the nature of the real estate investment, the involved parties, and the financial implications of different scenarios. Doing so will help ensure that all aspects of your investment are accounted for.

Gathering necessary information

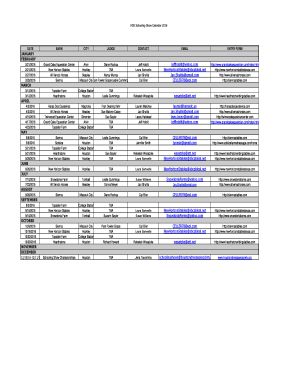

As part of the preparation process, you'll need to gather necessary information, including details about the assets involved, ownership structures, and the individuals or entities participating in the investment. Accurate data collection is vital, and tools like pdfFiller can greatly assist in this process. Start by documenting key information such as property addresses, purchase prices, and appraisals to ensure completeness.

Step-by-step guide to completing the real estate investor protection form

Accessing the form via pdfFiller

To get started with your real estate investor protection form, log onto pdfFiller, an intuitive platform designed to streamline the document creation process. Simply navigate to the forms section and search for the specific real estate investor protection form. Navigating the platform is user-friendly, and you can access a library of interactive tools to assist in form completion.

Filling out the form

When you begin to fill out the form, you’ll encounter several sections. Understanding how to complete each one will greatly aid in ensuring the form's effectiveness.

While filling out the form, it’s essential to avoid common pitfalls such as providing incomplete information or using unclear language. Such mistakes can lead to misunderstandings, rendering the document less effective in protecting your interests.

Editing and customizing the form

Once your initial draft is complete, utilizing pdfFiller’s editing tools is crucial for customizing the protection form to your specific investment needs. Tailoring the template can accommodate unique situations like specific legal stipulations relevant to your location or the nature of your investment. Proper customization helps ensure the document aligns with your particular requirements and enhances its applicability in protecting your assets.

Signing and finalizing your real estate investor protection form

eSigning the form

To finalize your form, you can use the eSigning feature available on pdfFiller. Electronic signatures are not only easy to use but also hold legal validity in most jurisdictions, making the signing process efficient and dependable. Ensure that all parties involved receive and sign the document promptly to move forward with the investment.

Reviewing and finalizing

Before submitting your form, thorough proofreading is critical. Check for completeness, accuracy, and that all necessary parties have signed. Best practices also include making a backup copy in a secure format. This step ensures that you have a reliable reference in case any issues arise later in the investment process.

Managing your real estate investor protection form

Storing your document securely

Once your real estate investor protection form has been completed and signed, it's vital to store the document securely. Using cloud storage solutions, like those offered by pdfFiller, provides an accessible and safe way to manage your sensitive documents. This approach allows for easy retrieval and sharing with stakeholders while ensuring that confidential information remains protected.

Updating your form as circumstances change

The real estate landscape is dynamic, and situations may arise necessitating changes to your protection form. Common scenarios include altering ownership stakes or updating asset valuations. It’s important to keep the document current, as an outdated form may not accurately reflect your investment situation. Regularly review and revise the document as needed, ensuring that each version is appropriately saved to maintain a complete history of your records.

Additional considerations for real estate investors

Legal compliance and regulations

Investing in real estate also means navigating a complex web of local, state, and federal laws. Understanding legal compliance is crucial for safeguarding your interests, as these regulations can profoundly impact your investments. It’s advisable to stay informed on changes in real estate laws that may affect investor protection, whether through personal research or participation in relevant training programs.

Networking and community support

Engaging with real estate investment communities can yield invaluable insights and support. Networking with other investors exposes you to best practices, risk management strategies, and legal compliance tips that can enhance your asset protection efforts. Participating in workshops or discussion forums will also allow you to share experiences and learn from the successes or failures of others.

Conclusion: Taking control of your real estate investments

In conclusion, the real estate investor protection form plays a pivotal role in managing investment risks effectively. By clearly establishing terms and conditions, it empowers investors to protect their assets and navigate the complexities of real estate transactions. Embracing proactive asset management, from using appropriate documentation to staying informed about changing regulations, is essential for securing your investments and ensuring long-term success in the real estate market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute real estate investor protection online?

How do I fill out the real estate investor protection form on my smartphone?

How can I fill out real estate investor protection on an iOS device?

What is real estate investor protection?

Who is required to file real estate investor protection?

How to fill out real estate investor protection?

What is the purpose of real estate investor protection?

What information must be reported on real estate investor protection?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.