Get the free Bloom Offering Memorandum

Get, Create, Make and Sign bloom offering memorandum

How to edit bloom offering memorandum online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bloom offering memorandum

How to fill out bloom offering memorandum

Who needs bloom offering memorandum?

Understanding the Bloom Offering Memorandum Form

Understanding the Bloom Offering Memorandum

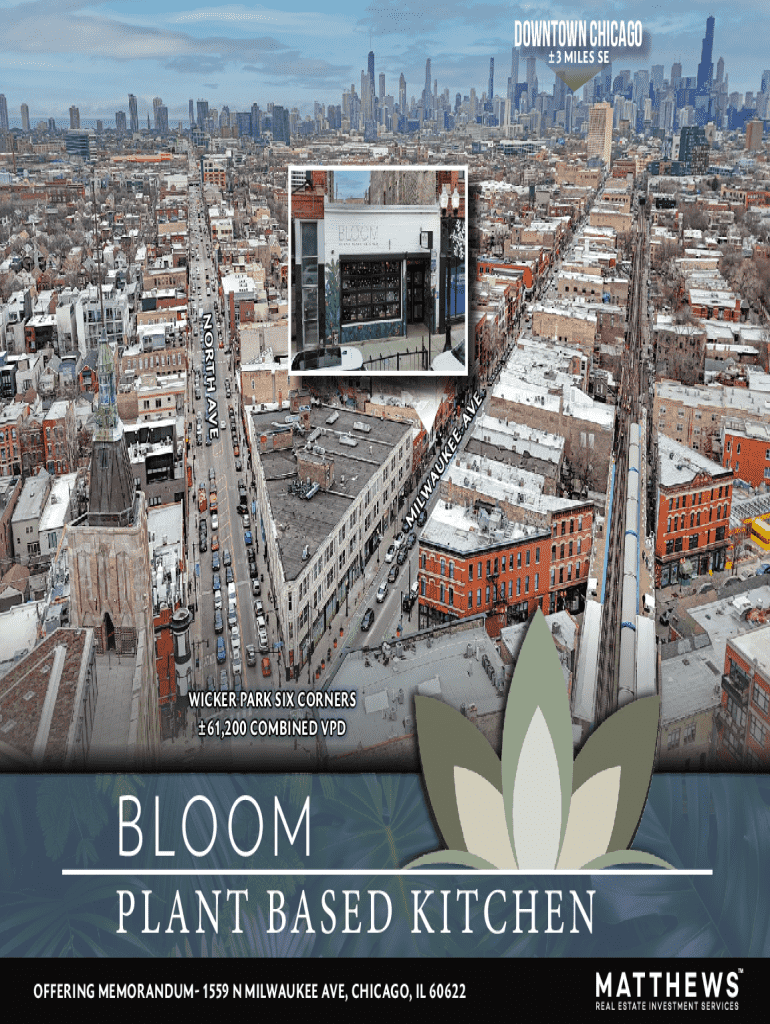

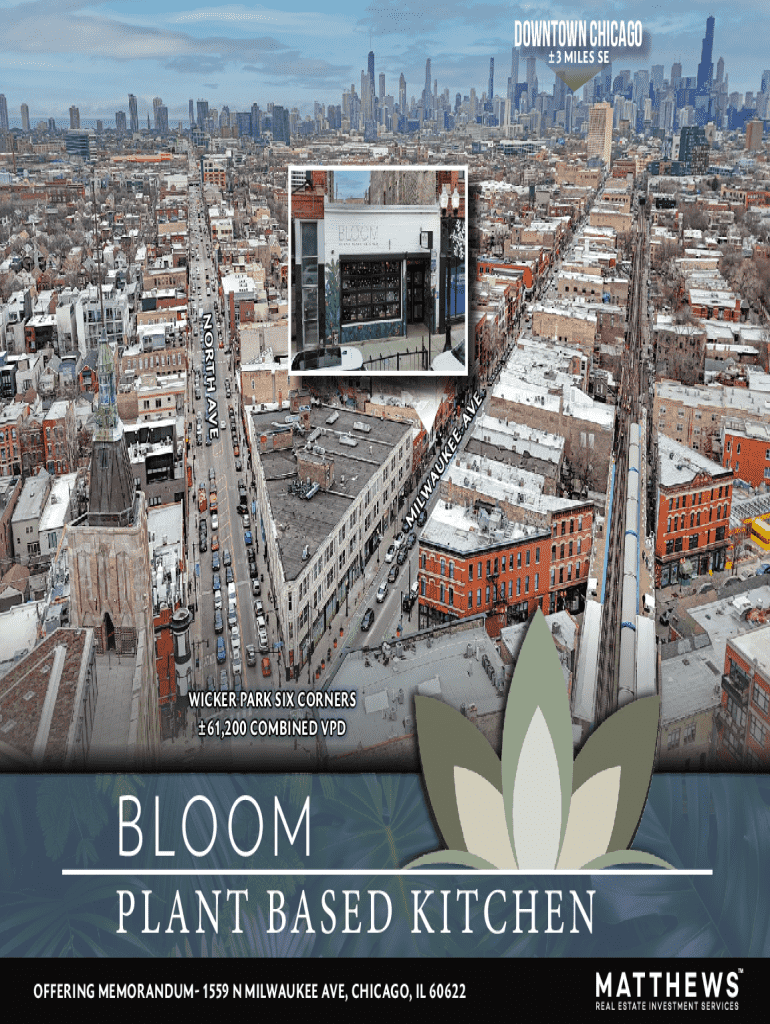

The Bloom Offering Memorandum serves as a crucial document in the investment landscape, designed to provide detailed information about investment opportunities. An Offering Memorandum (OM) is essentially a comprehensive document offering insights into the offerings of a company, including the associated risks and potential returns for investors.

The purpose of the Bloom Offering Memorandum is twofold. First, it aids in soliciting investment from potential backers by presenting a persuasive case for the investment opportunity. Second, it ensures compliance with regulatory disclosure requirements, thereby protecting both the company and the investors.

Key components of a Bloom Offering Memorandum include the Executive Summary, Business Description, Financial Information, and Ownership Structure. Each of these sections plays a pivotal role in providing transparency and guiding investors’ decision-making processes.

Importance of the Bloom Offering Memorandum in investment processes

The Bloom Offering Memorandum holds significant importance in attracting potential investors. By presenting a well-structured and informative OM, companies can capture the attention of investors, compelling them to consider the investment opportunity seriously.

Moreover, the impact of the Bloom Offering Memorandum on investment decisions cannot be overstated. Investors rely on the information presented to assess risks and rewards before parting with their capital. A clear, comprehensive, and professional presentation can tilt the scales in favor of the company seeking investment.

In terms of legal implications, the Bloom Offering Memorandum plays a critical role in investor protection. By ensuring accurate disclosures and compliance with regulations, it safeguards both the company and its investors from potential future disputes or legal challenges.

How to create a Bloom Offering Memorandum

Creating a Bloom Offering Memorandum begins with gathering essential information. This includes comprehensive details about the company such as its background, vision, and mission. Additionally, financial statements and projections must be collected to give potential investors a clear picture of the company's current standing and future expectations.

A thorough market analysis is also crucial, helping to define the company’s competitive position and the overall market opportunity. Once all necessary information is gathered, structuring the memorandum effectively is vital. Recommended layouts typically include distinct sections for the different components, facilitating easier navigation for readers.

Design elements should not be overlooked. A professional appearance, incorporating the company logo and a cohesive color scheme, enhances credibility. This means utilizing appropriate fonts, colors, and graphics that align with the branding of the company.

Step-by-step guide to filling out the Bloom Offering Memorandum form

Filling out the Bloom Offering Memorandum form involves a structured approach. First, access the form via pdfFiller, a platform known for its user-friendly document solutions. Setting up an account might be necessary, allowing you to save and edit your documents seamlessly.

When diving into the form, begin by filling out basic company information. This foundational data ensures investors understand who they are dealing with. Subsequently, input financial data, including balance sheets and income statements, to provide a clear picture of the company's financial health.

Special attention should be given to legal disclosures, as omitting crucial information can lead to compliance issues. After completing the form, upload any supporting documents needed for substantiation. Finally, review the contents for accuracy to prevent any potential mishaps that might arise from inaccurate information.

Editing and reviewing the Bloom Offering Memorandum

Editing the Bloom Offering Memorandum is essential to ensure that it meets the highest standards. Utilizing pdfFiller’s editing tools provides ease in making text edits and adding annotations. These features allow for refined presentations and can help clarify key points for potential investors.

Collaborating with team members is a practical approach to enhance the memorandum further. Share the document for review and leverage real-time collaboration features. Feedback is invaluable; integrating it can significantly improve the final product.

Professional advice can be crucial at this stage. Consulting with legal or financial experts can help validate the information provided, ensuring that it holds up to scrutiny before being presented to potential investors.

Signing and finalizing the Bloom Offering Memorandum

Once the Bloom Offering Memorandum is ready, integrating eSignature options is a seamless way to finalize the document. Explore the various eSignature solutions available on pdfFiller to ensure compliance with e-signature laws. This allows for efficient signing without the hassle of physical paperwork.

The final review process is critical. Conduct last-minute checks to ensure everything is accurate and comprehensive. Having a clear copy for your records is equally important, as it protects your interests and provides a reference for future discussions with investors.

Managing and storing the Bloom Offering Memorandum

Managing and storing the Bloom Offering Memorandum in pdfFiller’s Cloud Storage provides a reliable way to keep your documents organized. Utilizing effective organization methods makes it easy to retrieve documents when needed, minimizing time lost searching for files.

When it's time to share the memorandum with investors, pdfFiller offers secure sharing options. This ensures that sensitive information is protected while still allowing investors to access the documents they need. Additionally, tracking document views and actions provides insights into investor engagement.

Frequently asked questions (FAQs)

The Bloom Offering Memorandum often raises several common inquiries. Many users wonder about the typical length and depth of detail required in the document and if there are specific formats to adhere to. Others might be concerned regarding the legal implications of their disclosures.

Addressing these concerns is crucial for ensuring that users feel confident about their documentation process. Providing troubleshooting resources and examples can further demystify the process and clarify the purpose of various sections within the memorandum.

Success stories and case studies

Exploring success stories and case studies where the Bloom Offering Memorandum was utilized effectively can provide valuable insights. Many companies have leveraged well-crafted offering documents to secure significant investments, showcasing the potential impact of a meticulously prepared OM.

These examples underscore the importance of conveying clear value propositions and addressing investor concerns, leading to improved investment outcomes. Analyzing the strategies these successful companies used can yield best practices and inspire new users to create thorough and persuasive offering memoranda.

Additional interactive tools available on pdfFiller

pdfFiller offers various interactive tools and resources that can enhance the document creation experience. Users can access other relevant templates and forms that can support different facets of their business operations, allowing for a cohesive documentation process.

Furthermore, the support resources available on pdfFiller can guide users through potential challenges they may encounter while creating their Bloom Offering Memorandum. Community insights and user-generated content can also provide additional perspectives, enriching the user's overall experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find bloom offering memorandum?

How do I complete bloom offering memorandum online?

How do I fill out bloom offering memorandum using my mobile device?

What is bloom offering memorandum?

Who is required to file bloom offering memorandum?

How to fill out bloom offering memorandum?

What is the purpose of bloom offering memorandum?

What information must be reported on bloom offering memorandum?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.