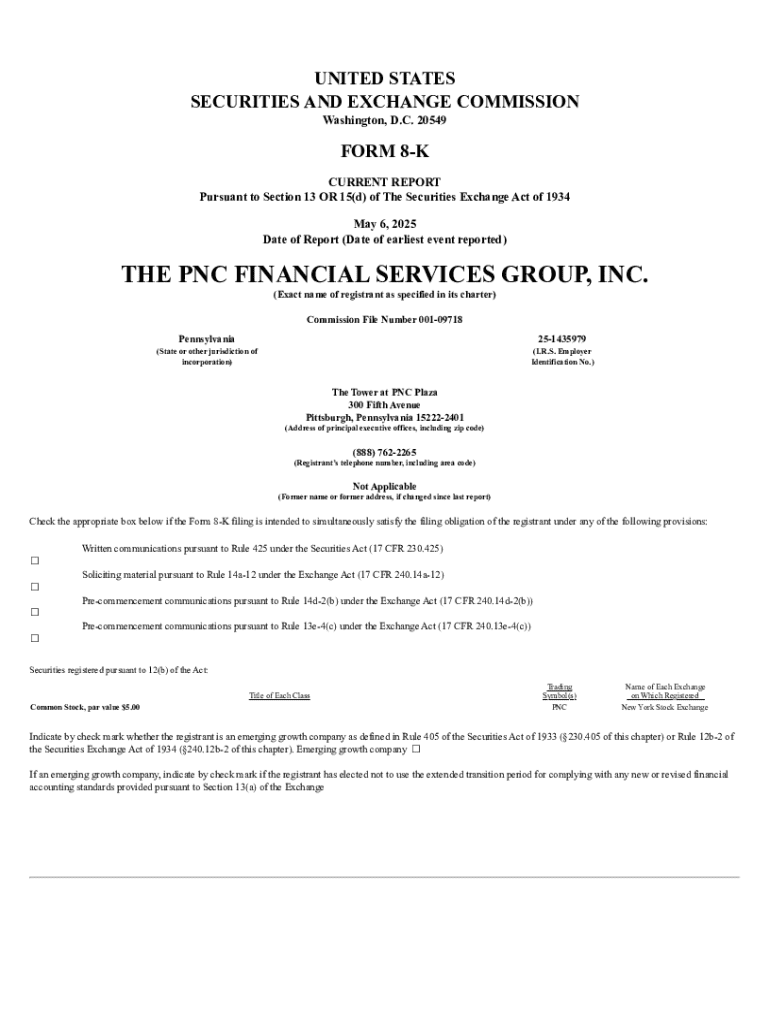

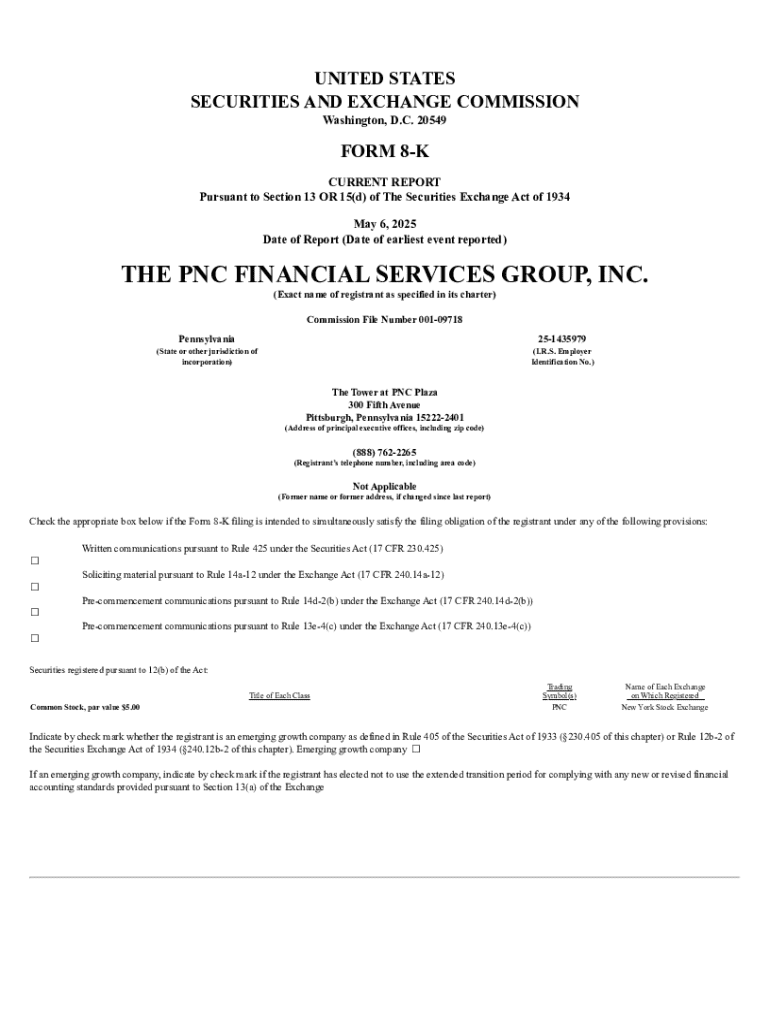

Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Understanding the Form 8-K Form: A Comprehensive Guide

Overview of Form 8-K

Form 8-K is a crucial document that publicly traded companies must file with the Securities and Exchange Commission (SEC) to report major events that shareholders need to know about. Unlike the regular periodic reports such as Form 10-K or Form 10-Q, which provide ongoing financial and operational information, Form 8-K serves as an immediate communication tool designed to disclose specific, significant events.

The purpose of Form 8-K is to ensure transparency and timely information delivery to investors, thus maintaining a fair marketplace. It is imperative for companies to file Form 8-K whenever relevant events occur to safeguard the interests of stakeholders and comply with SEC regulations.

Key aspects of Form 8-K filing

Certain events trigger the necessity for an 8-K filing, ensuring that significant developments are promptly communicated to investors. Some of these events include:

It is essential to adhere to the timeline for filing Form 8-K, as delays can result in penalties or additional scrutiny from the SEC. Typically, companies have four business days from the occurrence of the event to file.

In-depth analysis of Form 8-K sections

Each Form 8-K filed contains several key items that provide insights into the event being reported. The most common items include:

Benefits of filing Form 8-K

Filing Form 8-K has multiple benefits that significantly enhance investor relations and the company’s reputation.

By ensuring that stakeholders are informed of significant events, companies can foster better relationships and trust with their investors.

How to read and interpret an 8-K filing

When reviewing a Form 8-K, it is crucial to focus on specific components that provide the most critical information. Key areas of interest include the nature of disclosed events, involved parties, and any financial implications highlighted in the filing.

Understanding legal jargon often used in these filings can prove challenging, but it's essential. Many terms can be broken down into simpler language, which helps in grasping the overall context of the event. Look for definitions of technical terms in the document and utilize resources to clarify complex clauses.

Filing process for Form 8-K

Filing Form 8-K requires careful attention to detail to ensure compliance and accuracy. Here’s a step-by-step guide to effectively prepare and submit this form:

Filing accurately and on time helps avoid penalties and maintains the company’s credibility.

Historical context of Form 8-K

Form 8-K has evolved significantly since its inception, reflecting a growing emphasis on transparency and investor protection. Originally introduced in the 1930s, the SEC has updated its guidelines several times to address emerging issues and enhance the filing process. Most notably, regulations in the 2000s aimed to improve the timeliness of disclosures, mandating immediate reporting of significant events.

Over the years, trends in SEC enforcement related to Form 8-K have shifted, emphasizing stricter compliance and faster reporting. As companies face higher scrutiny from regulators, understanding Form 8-K and its implications has become increasingly crucial for corporate governance.

Frequently asked questions about Form 8-K

Navigating the complexities of Form 8-K may lead to questions. Here are some common concerns and clarifications:

Interactive tools and resources

Using document management solutions such as pdfFiller simplifies the process of creating, editing, and managing Form 8-K filings. Here are some beneficial features to consider:

These tools enhance efficiency and help maintain compliance with SEC regulations throughout the filing process.

Additional support for Form 8-K users

Many resources and support tools are available for individuals and teams navigating Form 8-K filings. Tutorials and video guides can provide visual aids for improved understanding and insight.

Additionally, customer support and consultation services are invaluable for addressing questions throughout the filing process, ensuring that companies can effectively manage their disclosure obligations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 8-k online?

Can I edit form 8-k on an iOS device?

How do I edit form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.