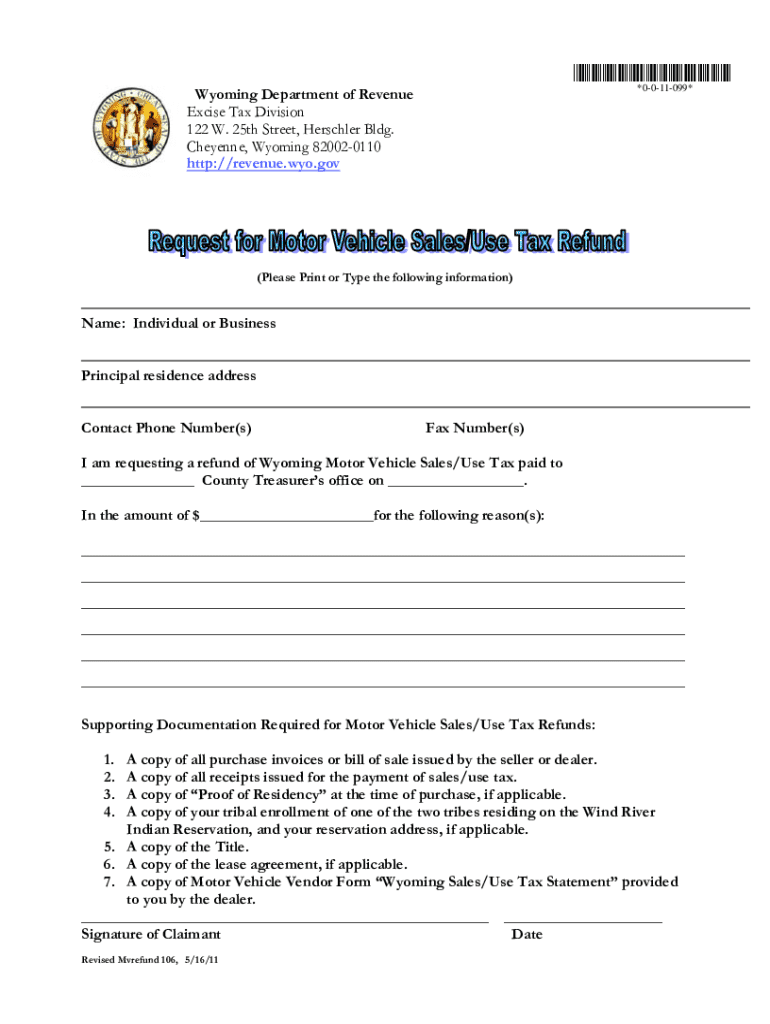

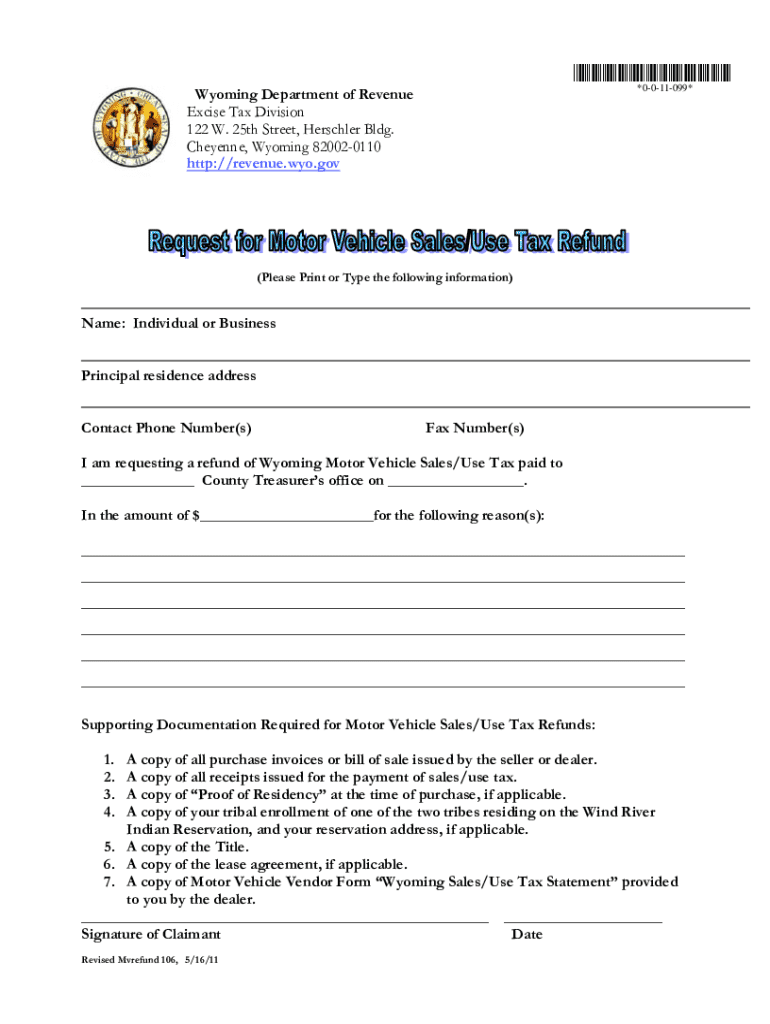

Get the free Motor Vehicle Sales/use Tax Refund Request

Get, Create, Make and Sign motor vehicle salesuse tax

Editing motor vehicle salesuse tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out motor vehicle salesuse tax

How to fill out motor vehicle salesuse tax

Who needs motor vehicle salesuse tax?

Motor Vehicle Sales/Use Tax Form: A Comprehensive How-To Guide

Understanding motor vehicle sales/use tax

Motor vehicle sales/use tax is a critical aspect of buying and owning a vehicle. Essentially, it is a tax levied on the purchase of a motor vehicle, usually imposed by state governments. The principal aim of this tax is to provide revenue for public services while regulating the vehicle market. When you buy a car from a dealership or even a private seller, understanding this tax is essential to ensure compliance with local laws.

The tax can be classified as either a sales tax or a use tax. A sales tax is charged at the point of sale, while a use tax is applied when a vehicle is brought into a state without paying the sales tax. Both types of taxes are similar in their intention, but they can vary significantly in rates and implementation. For vehicle buyers, being informed about the specifics of the motor vehicle sales/use tax form is essential for successful vehicle ownership.

Who is responsible for paying the tax?

Generally, the responsibility of paying motor vehicle sales/use tax falls on the buyer. However, it's essential to differentiate between individual consumers and businesses. For individual buyers, they must ensure that the tax is either included in the purchase price or paid at the time of registration. Businesses, especially those that deal in vehicle sales, are required to handle tax collections and payments on behalf of the state. This relationship can create different obligations depending on the nature of the vehicle transaction.

Sellers also carry certain responsibilities. When selling a vehicle, the seller must provide buyers with the necessary documentation, which often includes a bill of sale indicating the purchase amount — a critical factor that influences the tax due. Both parties must ensure that this transaction adheres to the state’s regulations to avoid potential legal ramifications down the line.

Key rates and calculation

Various states have different rates for motor vehicle sales/use tax, typically ranging from 3% to 8% of the purchase price. To accurately calculate the tax owed on a vehicle purchase, you first need to determine the sale price of the vehicle. For example, if you buy a vehicle for $20,000 in a state with a 5% sales tax rate, the calculation would be straightforward: 0.05 x 20,000 = $1,000. Thus, the total amount owed would be the purchase price plus the sales tax.

To further illustrate, here’s a list of scenarios demonstrating how sales/use tax is calculated in different situations: - **New Vehicle Purchase:** A car listed at $30,000 in a 6% tax state nets $1,800 in taxes. - **Used Vehicle Purchase:** Buying a used car for $15,000 in an 8% state will result in $1,200 owed in taxes. - **Gifted Vehicle:** Even when gifted, the fair market value of the vehicle needs to be declared, and the tax paid will be based on that value.

Types of vehicle transactions

The tax implications differ significantly depending on the nature of the transaction. For individuals purchasing from a registered dealer, sales tax is generally included in the purchase price. This means buyers are often shielded from handling the tax payment themselves, streamlining the buying process. These dealers are usually well-versed in tax collection and legal compliance, which simplifies the experience for consumers.

Conversely, private sales can introduce complexities. When buying a vehicle from a private seller, the buyer must ensure that they calculate and remit the appropriate tax amount during the titling process. Gift transactions also pose unique challenges — tax exemptions may apply in certain circumstances, such as gifting a vehicle to a family member. Yet, it's crucial for the recipient to understand whether any tax is owed at the time of title transfer.

Payment procedures for the tax

Paying motor vehicle sales/use tax involves several steps that can vary by state. Typically, the payment occurs at the time of vehicle registration or title transfer. Most states offer online portals where buyers can make their payments conveniently. To complete this process, you will need to gather necessary documents such as proof of purchase, identification, and your completed tax form.

Here’s an efficient checklist for paying this tax: 1. Verify your purchase price and tax rate. 2. Complete the motor vehicle sales/use tax form. 3. Submit the form and any required documentation through the state’s portal or in-person. 4. Confirm payment through receipt or confirmation message. 5. Register the vehicle after tax payment is processed, ensuring you meet any due dates. Late payments can lead to penalties or accrued interest, making it crucial to adhere to deadlines set by your state.

Titling and registration requirements

To appropriately transfer a vehicle title, specific documents must be presented. These usually include the bill of sale, the motor vehicle sales/use tax form, and proof of identity. Without these documents, the title transfer may be denied, making it imperative to ensure all paperwork is correctly filled out and submitted. Missing even one document can lead to delays and complications.

For name changes on titles, which can occur due to marriage or divorce, the process requires updating the title accordingly. Ensure that your state’s requirements for name changes are met. Typically, you will need to provide legal documentation supporting your name change and may have to reassess any tax obligations if the vehicle’s value has changed due to circumstances surrounding the name change.

Special circumstances

Certain groups, such as active military personnel, may be eligible for tax exemptions related to motor vehicle purchases. Many states offer special provisions allowing military individuals to avoid these taxes while serving. To benefit from this exemption, military personnel usually must provide documentation verifying their status along with the purchase agreement.

When purchasing out-of-state, buyers need to understand that they may be liable for the sales/use tax in the respective state where the vehicle will be registered. This situation can create confusion, especially if the rate in the purchase state is lower than the buyer's home state. Thus, it’s crucial to be diligent and check the tax laws of both states to avoid underpayment or overpayment.

Resources for further assistance

Navigating motor vehicle sales/use tax requirements can be daunting, but numerous resources exist to help. Each state typically has a dedicated tax office website where potential buyers can access critical information about tax rates, forms, deadlines, and payment instructions. Familiarizing oneself with these resources facilitates a smoother transaction process and reduces the risk of missing out on essential steps.

Here are some helpful online resources: - State Department of Revenue websites - Local tax office contacts - FAQs sections on tax-related matters These resources can provide insight into common queries around the motor vehicle sales/use tax — making it easier to address concerns directly related to one’s situation.

Tips for managing your forms and documentation

Using pdfFiller offers a valuable solution for individuals managing their motor vehicle sales/use tax form and related documents. This platform allows users to fill out, edit, and electronically sign necessary forms efficiently, all from a secure cloud-based environment. Accessibility ensures that document management is convenient, whether you are at home or on the go.

To effectively use pdfFiller for your tax documentation: 1. Upload your motor vehicle sales/use tax form directly to pdfFiller. 2. Use editing tools to complete the form accurately, making sure to double-check information. 3. eSign electronically to fast-track the submission process. 4. Collaborate with others, such as family members or advisors, to ensure all perspectives are included. By utilizing pdfFiller, you can streamline your document management and reduce stress during the tax filing process.

Interactive tools for easier tax management

pdfFiller provides interactive templates that improve the organization of your tax documents. These templates offer step-by-step guidance to complete the motor vehicle sales/use tax forms with precision. Utilizing these tools simplifies the process, minimizes errors, and helps individuals feel confident about their submissions.

Potential features include: - Form preview options to review your entries before submitting. - Built-in checks for common mistakes to ensure accuracy. - Simple navigation aids to assist users in finding and filling out required documents quickly. Employing these interactive tools makes the entire document management process more efficient and less intimidating.

Additional insights

Being aware of potential changes in tax regulations can prepare buyers for future transactions. Legislative shifts may impact motor vehicle sales/use tax rates or filing requirements, so staying informed helps avoid surprises. Participating in community discussions or forums focused on local vehicle ownership can be a great resource for ongoing updates.

Transparency in tax data is crucial for informed compliance. Efforts to access open data tools that provide insights into tax trends and legislative impacts can empower users to make educated decisions regarding vehicle purchases. Incorporating this information effectively supports individuals and businesses in staying ahead in their tax planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my motor vehicle salesuse tax in Gmail?

How do I complete motor vehicle salesuse tax online?

How do I edit motor vehicle salesuse tax online?

What is motor vehicle salesuse tax?

Who is required to file motor vehicle salesuse tax?

How to fill out motor vehicle salesuse tax?

What is the purpose of motor vehicle salesuse tax?

What information must be reported on motor vehicle salesuse tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.